Answered step by step

Verified Expert Solution

Question

1 Approved Answer

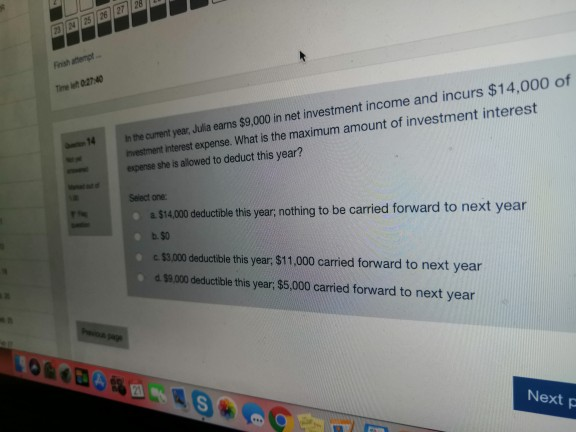

2528 14 in the current year, Julia earns $9,000 in net investment income and incurs $14,000 of vestment interest expense. What is the maximum amount

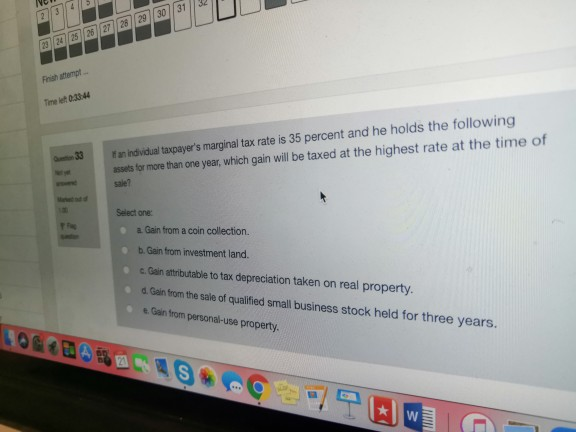

2528 14 in the current year, Julia earns $9,000 in net investment income and incurs $14,000 of vestment interest expense. What is the maximum amount of investment interest expense she is allowed to deduct this year? Select one $14,000 deductible this year, nothing to be carried forward to next year b. $0 e $3.000 deductible this year: $11,000 carried forward to next year $9.000 deductible this year, $5,000 carried forward to next year Next 26 27 24/25 Timele 0:21:44 I an individual taxpayer's marginal tax rate is 35 percent and he holds the following sets for more than one year, which gain will be taxed at the highest rate at the time of Select one: a Gain from a coin collection b. Gain from investment land. Gain attributable to tax depreciation taken on real property. a. Gain trom the sale of qualified small business stock held for three years. t. Gain from personal use property. e 108 * $ % *18 - 1 * W

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started