Answered step by step

Verified Expert Solution

Question

1 Approved Answer

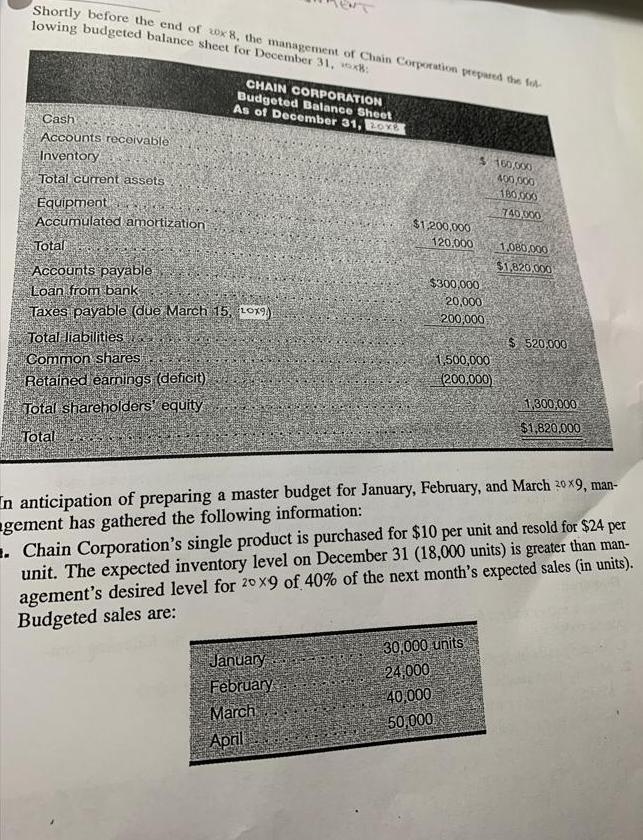

Shortly before the end of 20x8, the management of Chain Corporation prepared the fol lowing budgeted balance sheet for December 31, 8: Cash Accounts

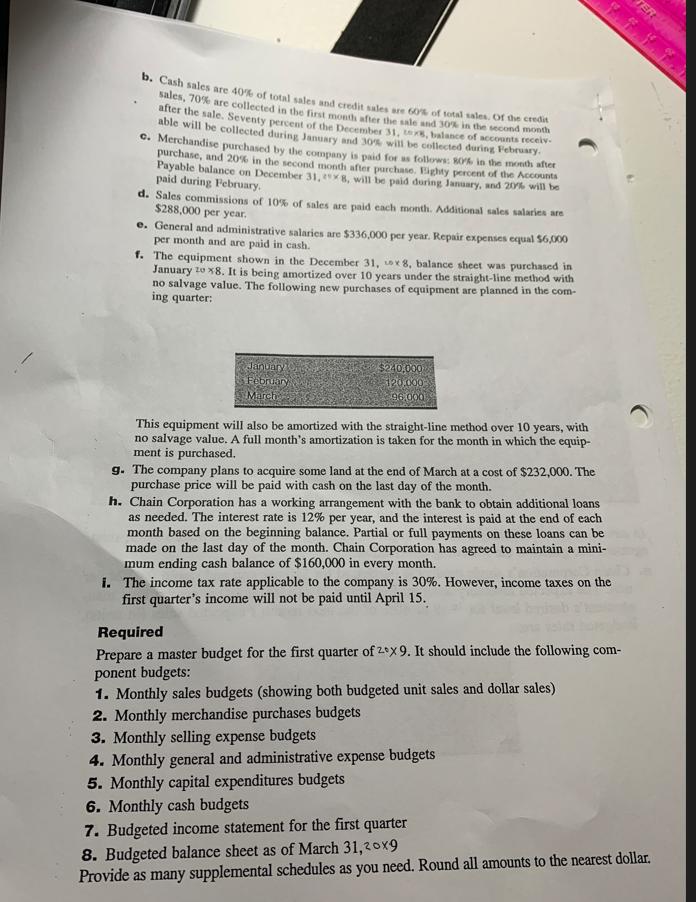

Shortly before the end of 20x8, the management of Chain Corporation prepared the fol lowing budgeted balance sheet for December 31, 8: Cash Accounts receivable Inventory Total current assets. Equipment Accumulated amortization CHAIN CORPORATION Budgeted Balance Sheet As of December 31, 20x8 Total Accounts payable Loan from bank Taxes payable (due March 15, 10x9) Total liabilities Common shares Retained earnings (deficit) Total shareholders' equity Total $1,200,000 120,000 January February $300,000 20,000 200,000 March April 1,500,000 (200,000) 160,000 400,000 180,000 740.000 1,080,000 $1,820.000 In anticipation of preparing a master budget for January, February, and March 209, man- gement has gathered the following information: 30,000 units 24,000 40,000 50,000 $ 520,000 . Chain Corporation's single product is purchased for $10 per unit and resold for $24 per unit. The expected inventory level on December 31 (18,000 units) is greater than man- agement's desired level for 20x9 of 40% of the next month's expected sales (in units). Budgeted sales are: 1,300,000 $1,820,000 b. Cash sales are 40% of total sales and credit sales are 60% of total sales. Of the credit sales, 70% are collected in the first month after the sale and 30% in the second month after the sale. Seventy percent of the December 31, tox, balance of accounts receiv able will be collected during January and 30% will be collected during February. c. Merchandise purchased by the company is paid for as follows: 80% in the month after purchase, and 20% in the second month after purchase. Eighty percent of the Accounts Payable balance on December 31, x8, will be paid during January, and 20% will be paid during February. d. Sales commissions of 10% of sales are paid each month. Additional sales salaries are $288,000 per year. e. General and administrative salaries are $336,000 per year. Repair expenses equal $6,000 per month and are paid in cash. f. The equipment shown in the December 31, x 8, balance sheet was purchased in January 20 x8. It is being amortized over 10 years under the straight-line method with no salvage value. The following new purchases of equipment are planned in the com- ing quarter: January February March $240,000 $120.000 96,000 This equipment will also be amortized with the straight-line method over 10 years, with no salvage value. A full month's amortization is taken for the month in which the equip- ment is purchased. g. The company plans to acquire some land at the end of March at a cost of $232,000. The purchase price will be paid with cash on the last day of the month. h. Chain Corporation has a working arrangement with the bank to obtain additional loans as needed. The interest rate is 12% per year, and the interest is paid at the end of each month based on the beginning balance. Partial or full payments on these loans can be made on the last day of the month. Chain Corporation has agreed to maintain a mini- mum ending cash balance of $160,000 in every month. i. The income tax rate applicable to the company is 30%. However, income taxes on the first quarter's income will not be paid until April 15. Required Prepare a master budget for the first quarter of 2x 9. It should include the following com- ponent budgets: 1. Monthly sales budgets (showing both budgeted unit sales and dollar sales) 2. Monthly merchandise purchases budgets 3. Monthly selling expense budgets 4. Monthly general and administrative expense budgets 5. Monthly capital expenditures budgets 6. Monthly cash budgets TER 7. Budgeted income statement for the first quarter 8. Budgeted balance sheet as of March 31,20x9 Provide as many supplemental schedules as you need. Round all amounts to the nearest dollar.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Monthly Sales Budget January Units 30000 Dollar Sales 720000 February Units 24000 Dollar Sales 576000 March Units 40000 Dollar Sales 960000 April Un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started