Answered step by step

Verified Expert Solution

Question

1 Approved Answer

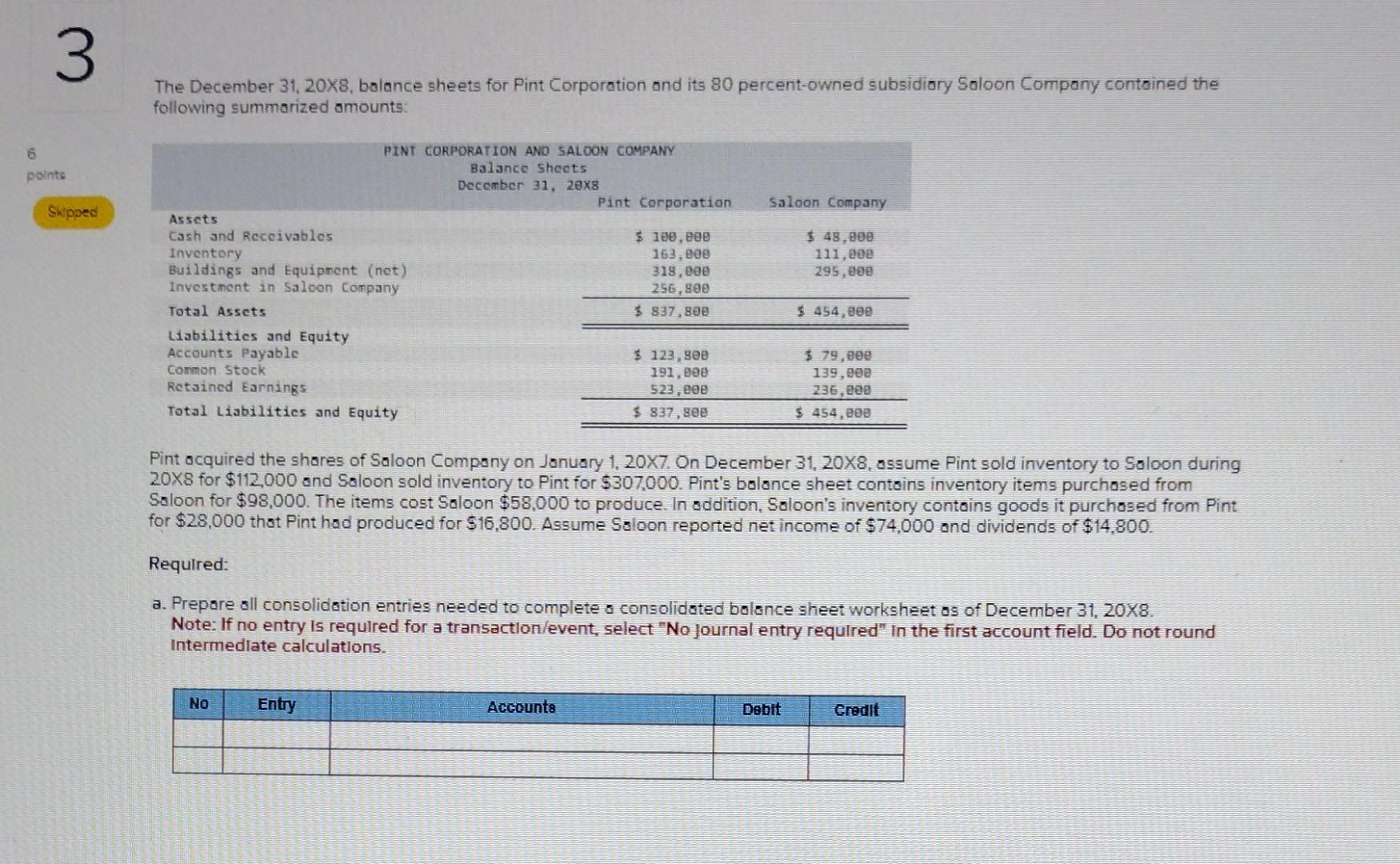

#3 this is all one question please do both parts The December 31, 20X8, bolance sheets for Pint Corporation and its 80 percent-owned subsidiary Soloon

#3 this is all one question please do both parts

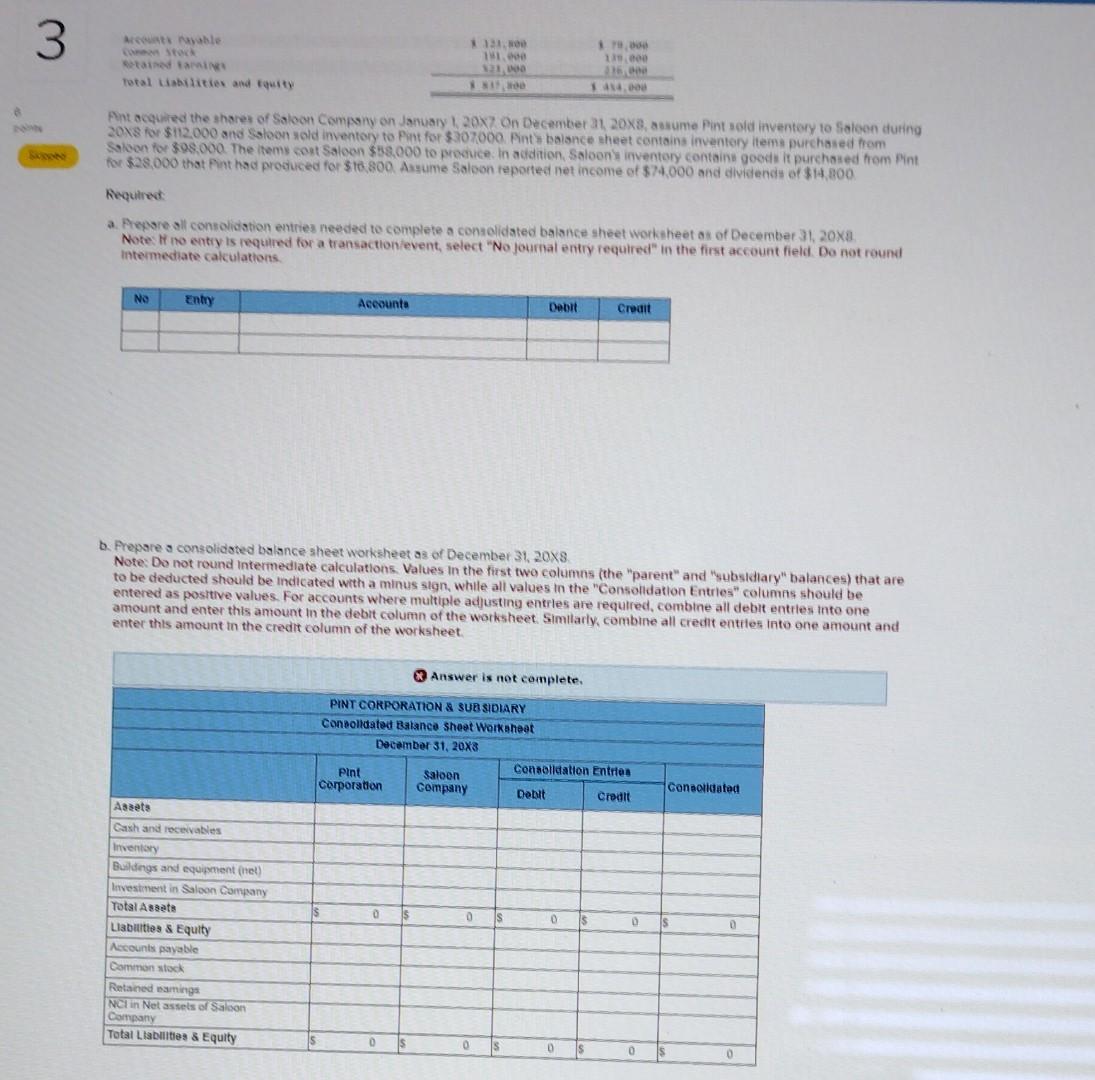

The December 31, 20X8, bolance sheets for Pint Corporation and its 80 percent-owned subsidiary Soloon Compony contoined the following summarized amounts: Pint acquired the shares of Saloon Compony on January 1, 20X7. On December 31, 20X8, assume Pint sold inventory to Saloon during 208 for $112,000 and Soloon sold inventory to Pint for $307,000. Pint's balance sheet contoins inventory items purchased from Soloon for $98,000. The items cost Saloon $58,000 to produce. In sddition, Saloon's inventory contoins goods it purchased from Pint for $28,000 that Pint had produced for $16,800. Assume Soloon reported net income of $74,000 and dividends of $14,800. Required: a. Prepare all consolidation entries needed to complete a consolidated balance sheet worksheet as of December 31,208. Note: If no entry Is required for a transactlon/event, select "No journal entry required" In the first account field. Do not round Intermediate calculatlons. 203 for $112,000 and Sotoon sold inventory to Pint for $307000. Ant in baisnce sheet contains inventory liem purchased fiom Soloon for 395.000. The items cort Saloon \$5.000 to precice. In adidion, Saloon) inventery contains good it purchated fiom Pint for \$28,000 that Pint had prodiced for $10800 Asyume Saloon teported net income of $74,000 and dividendis of \$14, 800 Aequitred: a. Arepse all consolidation entries needed to complete a consolidated balsnce sheet worksheet as of December 31, 20xa. Note if no entiy is required for a transactionievent, select "No journal entry required" in the first account field. Do not round intermediate cakculations. b. Prepare s consolidoted balance sheet worksheet as of December 31,208. Note: Do not round intermediate calculations. Values in the first two columns (the "parent" and "yubsidiary" balances) that are to be deducted should be indicated with a minus sign, whille all values in the "Consolldation Entries" columns should be entered as positive values. For accounts where multiple adjusting entrles are required, combine all debit entiles into one amount and enter this amount in the debit column of the wotksheet. Similarly, combine all credit entites into one amount and enter this amount in the credit column of the worksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started