Question: [ 4 pts. A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it

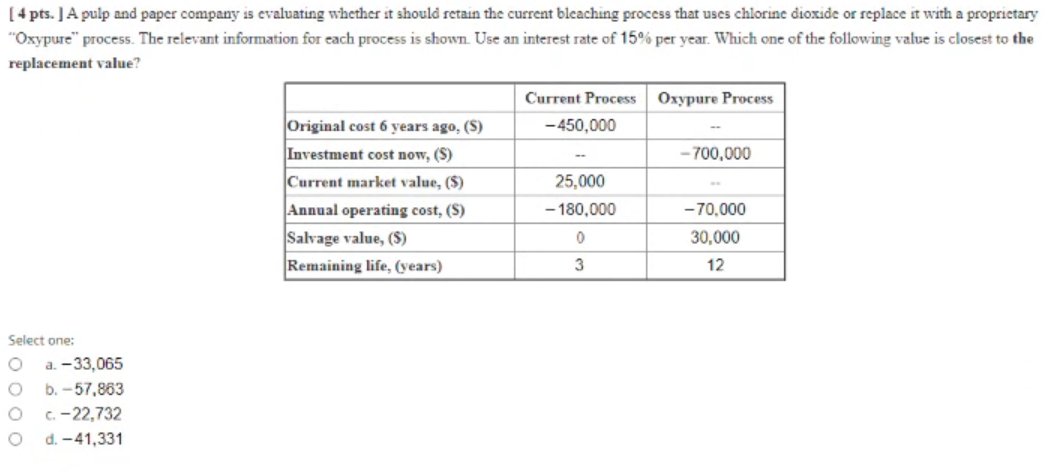

[ 4 pts. A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprietary "Oxypure" process. The relevant information for each process is shown. Use an interest rate of 15% per year. Which one of the following value is closest to the replacement value? Oxypure Process Current Process -450,000 - 700,000 Original cost 6 years ago, (S) Investment cost now, (S) Current market value, ($) Annual operating cost, (S) Salvage value, (S) Remaining life, (years) 25,000 - 180,000 0 3 - 70.000 30,000 12 Select one: a.-33,065 b.-57,863 C.-22,732 d. -41,331 [ 4 pts. A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprietary "Oxypure" process. The relevant information for each process is shown. Use an interest rate of 15% per year. Which one of the following value is closest to the replacement value? Oxypure Process Current Process -450,000 - 700,000 Original cost 6 years ago, (S) Investment cost now, (S) Current market value, ($) Annual operating cost, (S) Salvage value, (S) Remaining life, (years) 25,000 - 180,000 0 3 - 70.000 30,000 12 Select one: a.-33,065 b.-57,863 C.-22,732 d. -41,331

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts