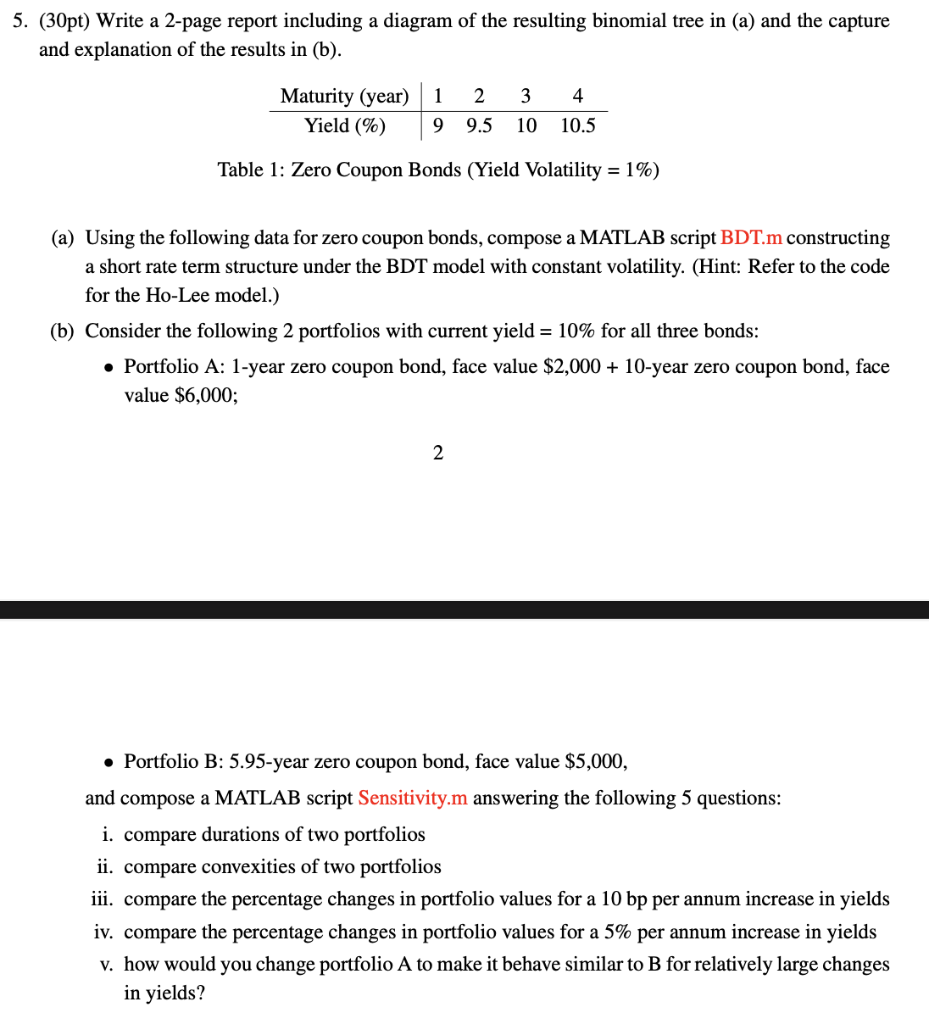

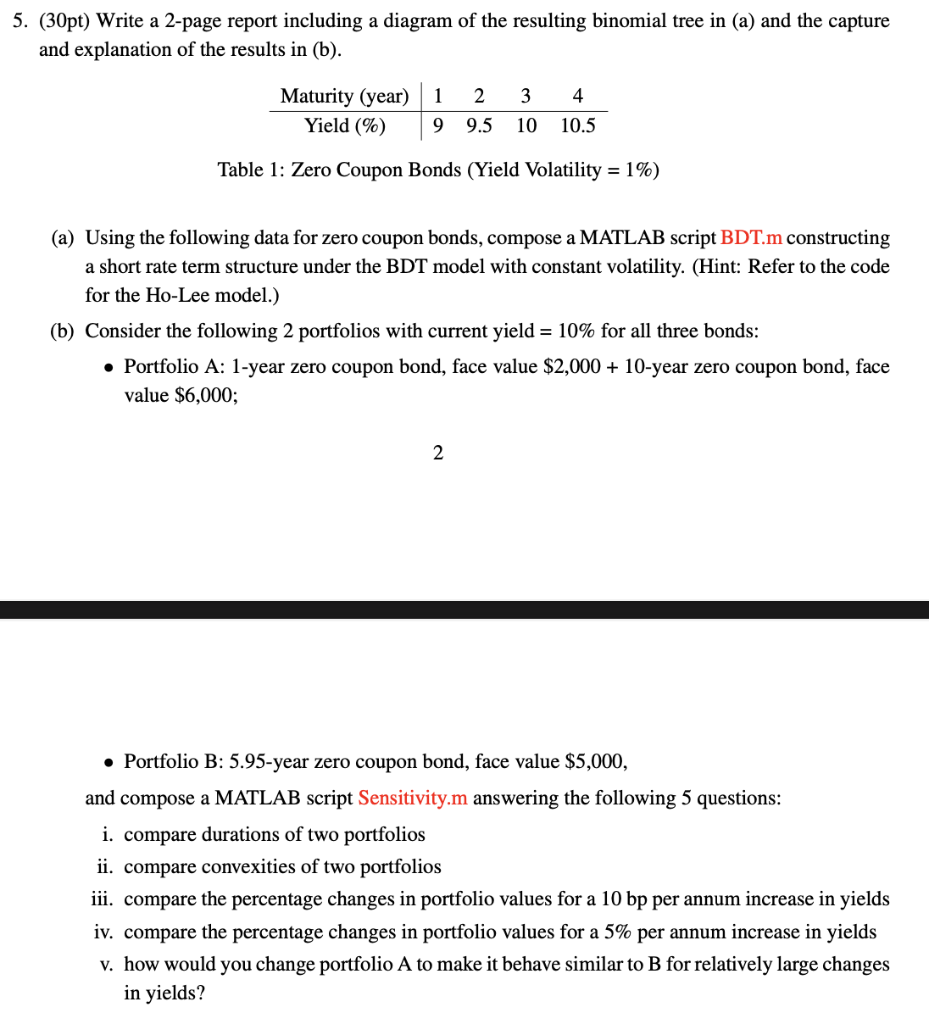

5. (30pt) Write a 2-page report including a diagram of the resulting binomial tree in (a) and the capture and explanation of the results in (b). 1 3 4 Maturity (year) Yield (%) 2 9.5 9 10 10.5 Table 1: Zero Coupon Bonds (Yield Volatility = 1%) (a) Using the following data for zero coupon bonds, compose a MATLAB script BDT.m constructing a short rate term structure under the BDT model with constant volatility. (Hint: Refer to the code for the Ho-Lee model.) (b) Consider the following 2 portfolios with current yield = 10% for all three bonds: Portfolio A: 1-year zero coupon bond, face value $2,000 + 10-year zero coupon bond, face value $6,000; 2 Portfolio B: 5.95-year zero coupon bond, face value $5,000, and compose a MATLAB script Sensitivity.m answering the following 5 questions: i. compare durations of two portfolios ii. compare convexities of two portfolios iii. compare the percentage changes in portfolio values for a 10 bp per annum increase in yields iv. compare the percentage changes in portfolio values for a 5% per annum increase in yields v. how would you change portfolio A to make it behave similar to B for relatively large changes in yields? 5. (30pt) Write a 2-page report including a diagram of the resulting binomial tree in (a) and the capture and explanation of the results in (b). 1 3 4 Maturity (year) Yield (%) 2 9.5 9 10 10.5 Table 1: Zero Coupon Bonds (Yield Volatility = 1%) (a) Using the following data for zero coupon bonds, compose a MATLAB script BDT.m constructing a short rate term structure under the BDT model with constant volatility. (Hint: Refer to the code for the Ho-Lee model.) (b) Consider the following 2 portfolios with current yield = 10% for all three bonds: Portfolio A: 1-year zero coupon bond, face value $2,000 + 10-year zero coupon bond, face value $6,000; 2 Portfolio B: 5.95-year zero coupon bond, face value $5,000, and compose a MATLAB script Sensitivity.m answering the following 5 questions: i. compare durations of two portfolios ii. compare convexities of two portfolios iii. compare the percentage changes in portfolio values for a 10 bp per annum increase in yields iv. compare the percentage changes in portfolio values for a 5% per annum increase in yields v. how would you change portfolio A to make it behave similar to B for relatively large changes in yields