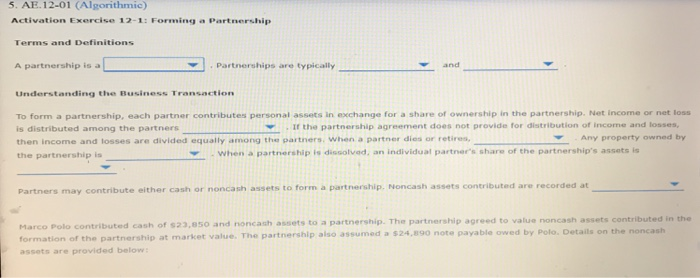

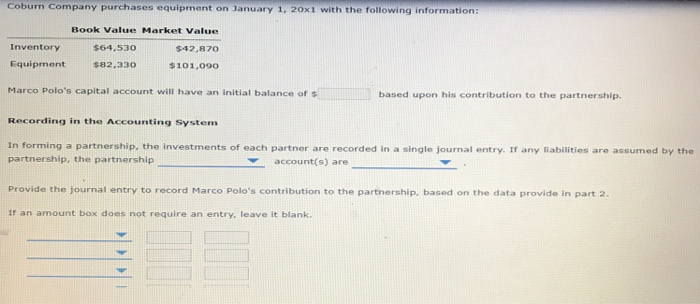

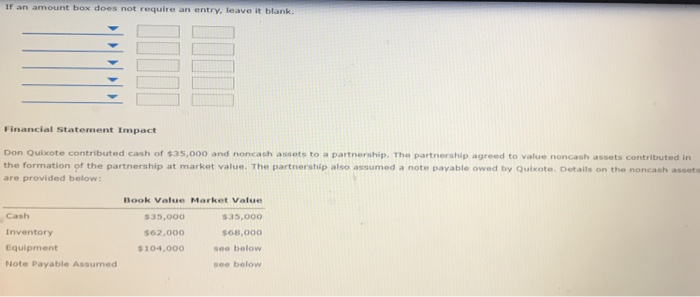

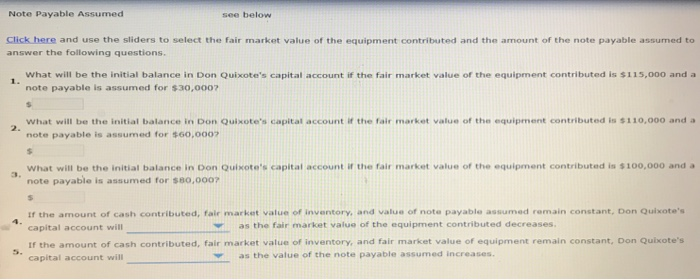

5. AE. 12-01 (Algorithmic) Activation Exercise 12-1: Forming a Partnership Terms and Definitions A partnership is a , partnerships are typically and iness Transaction To form a partnership, each partner contributes personal assets in exchange for a share of ownership in the partnership. Net income or net loss is distributed among the partners then income and losses are divided equaly among the partners. When a partner dies or retires, the partnership is , if the partnership agreement does not provide for distribution of income and losses. Any property owned by When a partnership is dissolvad, an individual partner's share of the partnership's assets is Partners may contribute either cash or noncash assets to form a partnership. Noncash assets contributed are recorded at Marco Polo contributed cash of s23.850 and noncash assets to a partnership. The partnership agreed to value noncash assets contributed in the formation of the partnership at market value. The part assets are provided below nership also assumed a $24,890 note payable owed by Poto. Details on the noncash Coburn Company purchases equipment on January 1, 20x1 with the following information: Book Value Market Value $42,870 $101,090 Inventory Equipment Marco Polo's capital account will have an initial balance of s $64.530 $82,330 based upon his contribution to the partnership. Recording in the Accounting System In forming a partnership, the investments of each partner are recorded in a single journal entry. If any liabilities are assumed by the partnership, the partnership account(s) are Provide the journal entry to record Marco Polo's contribution to the partnership, based on the data provide in part 2 If an amount box does not require an entry, leave it blank. If an amount box does not require an entry, leave it blank Financial Statement Impact Don Quixote contributed cash of S 35,000 and noncash atusets to a partnership. Partnership agreed to value noncash assets contributed in the formation of the partnership at market value. The partnership also assumed a note payable owed by Quixote. Details on the noncash assets are provided below: Book Value Market Value 35,000 $68,000 Cash $35,00o Inventory Equipment Note Payable Assumed $62,000 $104,000e below see below Note Payable Assumed see below Click here and use the sliders to select the fair market value of the equipment contributed and the amount of the note payable assumed to answer the following questions. What will be the initial balance in Don Quixote's capital account if the fair market value of the equipment contributed is $115,000 and a note payable is assumed for $30,0007 1. What will be the initial balance in Don Quixote's capital account if the fair market value of the equipment contributed is s 110,000 and a note payable is assumed for 60,000? 2. what will be the initial balance in Don Quixoto's capital account i, the fair market value o, the equipment contributed is nooooo and . note payable is assumed for s80,0007 3. If the amount of cash contributed, fair market value of inventory, and value of note payable assumed remain constant, Don Quixote's capital account will If the amount of cash contributed, fair market value of inventory, and fair market value of equipment remain constant, Don Quixote's capital account will as the fair market value of the equipment contributed decreases S. as the value of the note payable assumed increases