Answered step by step

Verified Expert Solution

Question

1 Approved Answer

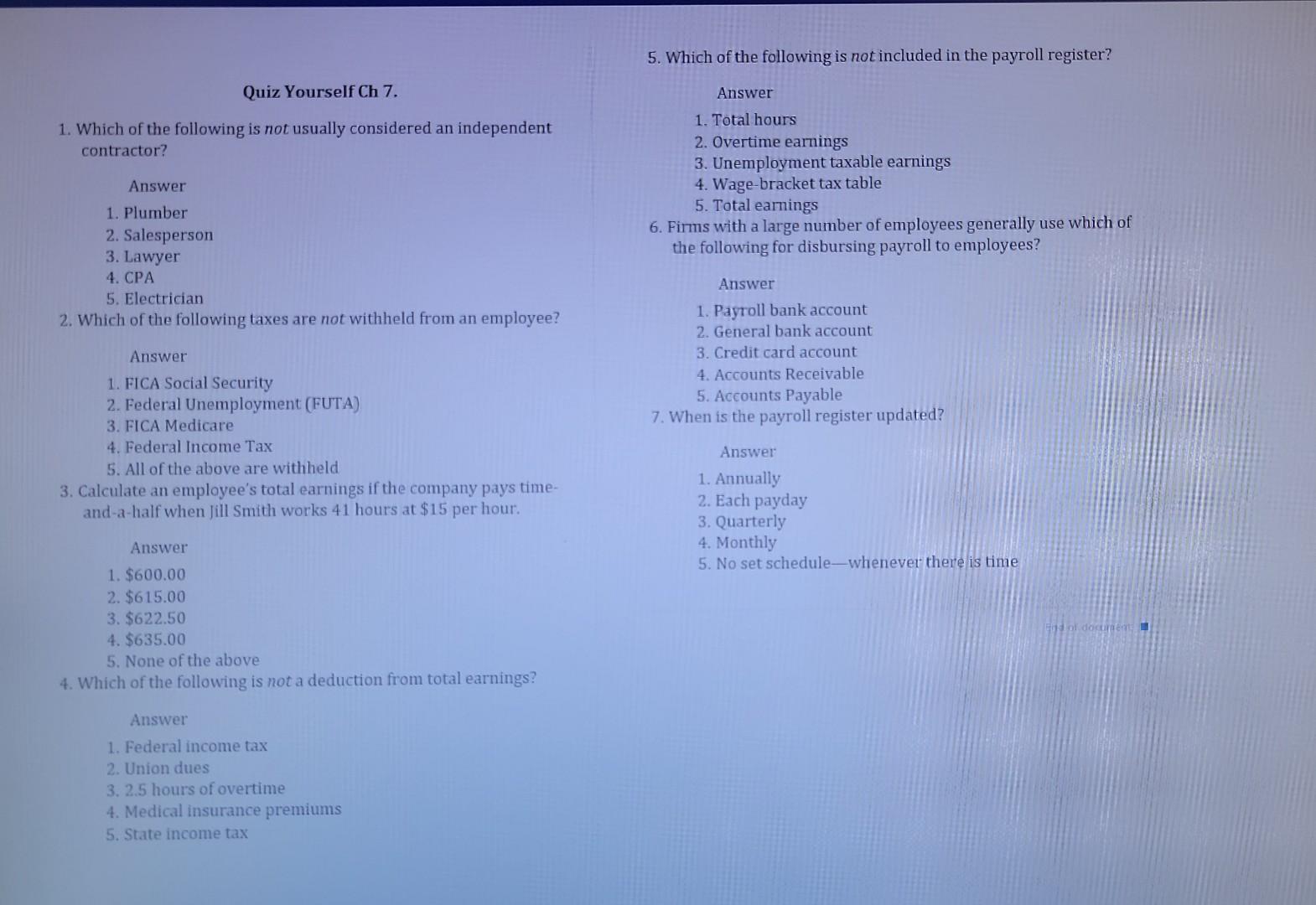

5. Which of the following is not included in the payroll register? Quiz Yourself Ch 7. Answer 1. Which of the following is not usually

5. Which of the following is not included in the payroll register? Quiz Yourself Ch 7. Answer 1. Which of the following is not usually considered an independent 1. Total hours contractor? 2. Overtime earnings 3. Unemployment taxable earnings Answer 1. Plumber 4. Wage-bracket tax table 2. Salesperson 5. Total earnings 3. Lawyer 6. Firms with a large number of employees generally use which of 4. CPA the following for disbursing payroll to employees? 5. Electrician 2. Which of the following taxes are not wit Answer 1. FICA Social Security 2. Federal Unemployment (FUTA) Answer 3. FICA Medicare 4. Federal Income Tax 7. When is the pay Answer 1. Annually 5. All of the above are withheld 1. Payroll bank account 2. General bank account 3. Credit card account 4. Accounts Receivable 5. Accounts Payable is is the payroll register updated? 3. Calculate an employee's total earnings if the company pays time- 2. Each payday and-a-half when Jill Smith works 41 hours at $15 per hour. 3. Quarterly Answer 4. Monthly 5. No set schedule - whenever there is time 1. $600.00 2. $615.00 3. $622.50 4. $635.00 5. None of the above 4. Which of the following is not a deduction from total earnings? Answer 1. Federal income tax 2. Union dues 3. 2.5 hours of overtime 4. Medical insurance premiums 5. State income tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started