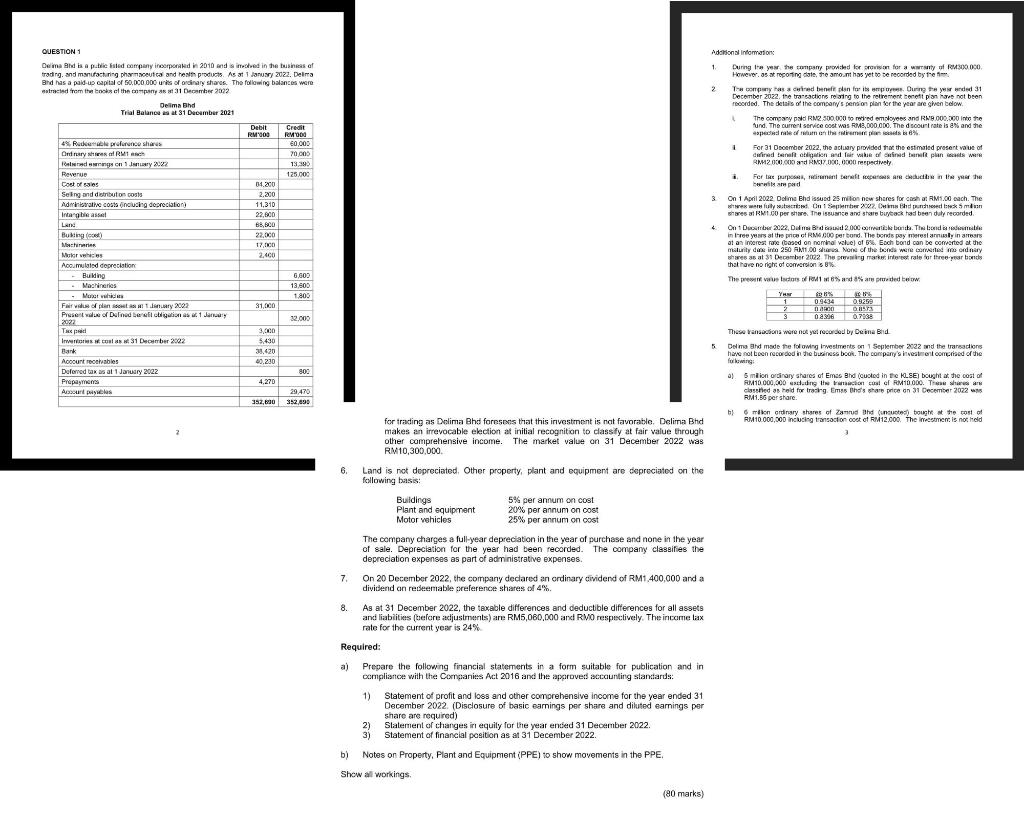

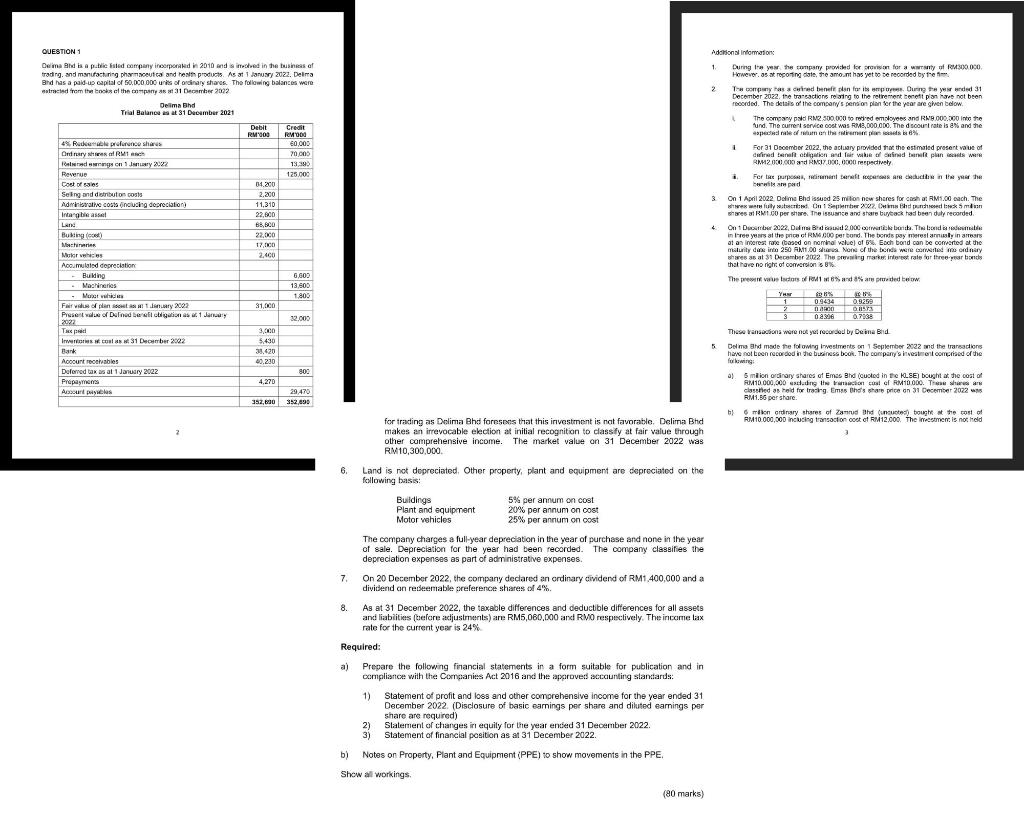

6. Land is not dopreciated. Other property, plant and ecuipment are teppreciatod on the following basis: BuldingsPlantandequiprentMotorwahicles5%perannumoncost20%perannumoncost25%perannumoncost The company charges a fullyear deprecition in the year of purchase and none in the year of sgle. Depreciation for the yesr hed been recorded. The compary classifies the depreciation expenses as part of administrative expenses. 7. On 20 December 2022 , she compary dechared an ardinary cividend of RM1,400,000 and a dividend on redeemable areferencee shares of 4m. 8. As at 31 December 2022 , the taxgle differences and deductble diffenences for all assets and liabiticas (cuefore iedjustroerts) are RM5, 060,000 and RM0 respesctively. The incarme lax rate foe the current year is 24% Required: a) Prepare the following financial statements in a form suitable for publication and in compliance with the Companies Act 2016 and the approved accounting standards: 1) Statement of profit and loss and other comprehensive income for the year ended 31 December 2022. (Disclosure of basic earnings per share and diluted earnings per share are required) 2) Slatement of thanges ir equily for the year ended 31 December 2022. 3) Statement of financial position as at 31 December 2022. b) Notes on Property, Plant and Equipment (PPE) to show movements in the PPE, Shcw al workings. (80 marks) 6. Land is not dopreciated. Other property, plant and ecuipment are teppreciatod on the following basis: BuldingsPlantandequiprentMotorwahicles5%perannumoncost20%perannumoncost25%perannumoncost The company charges a fullyear deprecition in the year of purchase and none in the year of sgle. Depreciation for the yesr hed been recorded. The compary classifies the depreciation expenses as part of administrative expenses. 7. On 20 December 2022 , she compary dechared an ardinary cividend of RM1,400,000 and a dividend on redeemable areferencee shares of 4m. 8. As at 31 December 2022 , the taxgle differences and deductble diffenences for all assets and liabiticas (cuefore iedjustroerts) are RM5, 060,000 and RM0 respesctively. The incarme lax rate foe the current year is 24% Required: a) Prepare the following financial statements in a form suitable for publication and in compliance with the Companies Act 2016 and the approved accounting standards: 1) Statement of profit and loss and other comprehensive income for the year ended 31 December 2022. (Disclosure of basic earnings per share and diluted earnings per share are required) 2) Slatement of thanges ir equily for the year ended 31 December 2022. 3) Statement of financial position as at 31 December 2022. b) Notes on Property, Plant and Equipment (PPE) to show movements in the PPE, Shcw al workings. (80 marks)