Answered step by step

Verified Expert Solution

Question

1 Approved Answer

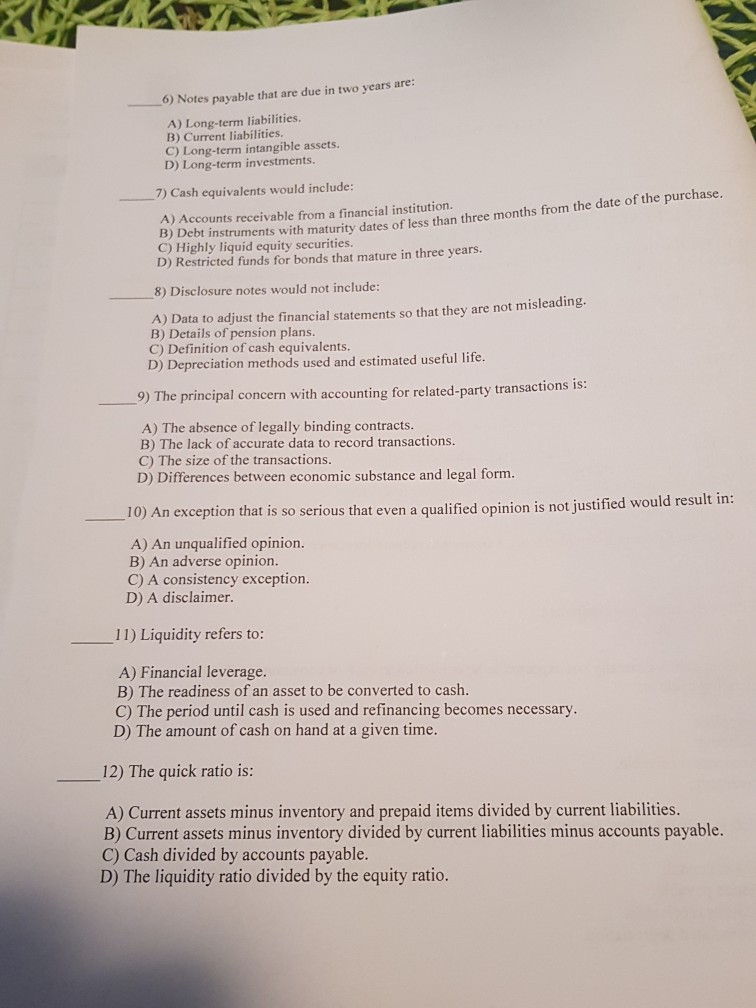

6) Notes payable that are due in two years are A) Long-term liabilities B) Current liabilities. C) Long-term intangible assets. D) Long-term investments. 7) Cash

6) Notes payable that are due in two years are A) Long-term liabilities B) Current liabilities. C) Long-term intangible assets. D) Long-term investments. 7) Cash equivalents would include A) Accounts receivable from a financial institution. B) Debt instruments with maturity dates of less than three months from the date of the purchase. C) Highly liquid equity securities. D) Restricted funds for bonds that mature in three years. 8) Disclosure notes would not include: A) Data to adjust the financial statements so that they are not misleading. B) Details of pension plans. C) Definition of cash equivalents. D) Depreciation methods used and estimated useful life. 9) The principal concern with accounting for related-party transactions is: A) The absence of legally binding contracts. B) The lack of accurate data to record transactions C) The size of the transactions D) Differences between economic substance and legal form. 10) An exception that is so serious that even a qualified opinion is not justified would result in A) An unqualified opinion. B) An adverse opinion. C) A consistency exception. D) A disclaimer 11) Liquidity refers to: A) Financial leverage. B) The readiness of an asset to be converted to cash C) The period until cash is used and refinancing becomes necessary. D) The amount of cash on hand at a given time. 12) The quick ratio is: A) Current assets minus inventory and prepaid items divided by current liabilities. B) Current assets minus inventory divided by current liabilities minus accounts payable C) Cash divided by accounts payable. D) The liquidity ratio divided by the equity ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started