Question

A full set of financial statements, and notes for Dollarama Inc., a Canadian chain of dollar stores has been provided above. Use the attached financial

A full set of financial statements, and notes for Dollarama Inc., a Canadian chain of dollar stores has been provided above.

Use the attached financial statements and notes to answer the questions.

Show all formulas and calculations.

Answer all of the questions in complete sentences.

Questions:

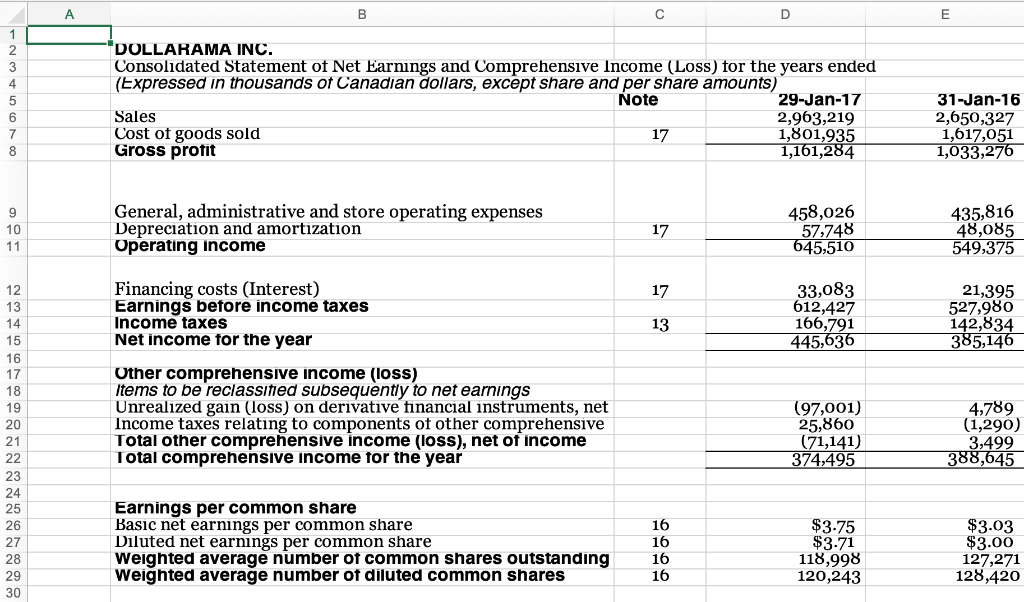

10. If a user of the financial statements was interested in how efficiently a company was using its assets to make profit, what ratio would they use? Calculate for both years.

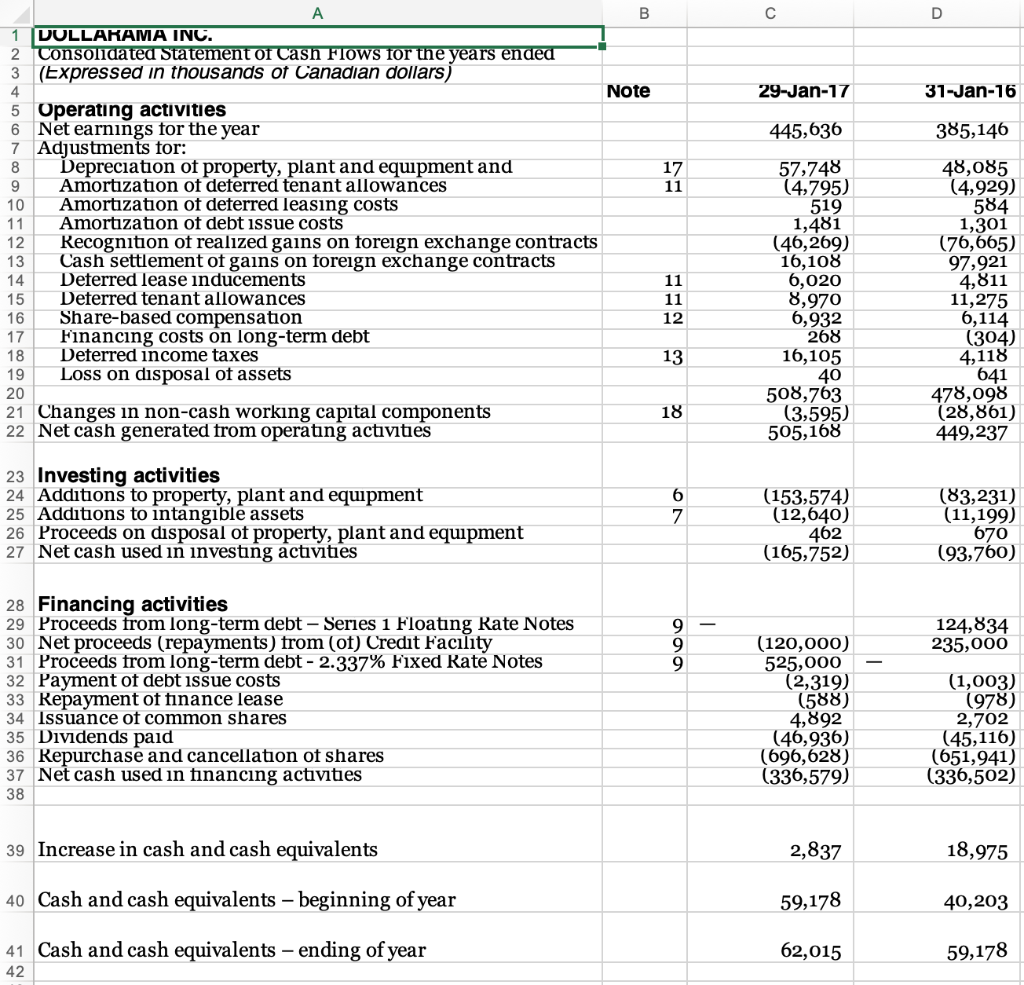

11. What was the free cash flow for 2017? What does this number mean or represent to a user of the financial statements?

12. What method of depreciation does Dollarama use? What is the estimated useful life for their computer equipment?

13. What kind of employee future liabilities does Dollarama have?

---------

So, this question that was posted is the same question I'm stuck on. However, the one's I'm stuck on are Questions 10-13. Specifically #11. If this isn't good for a question, please let me know. I'll get the information in but I am stumped.

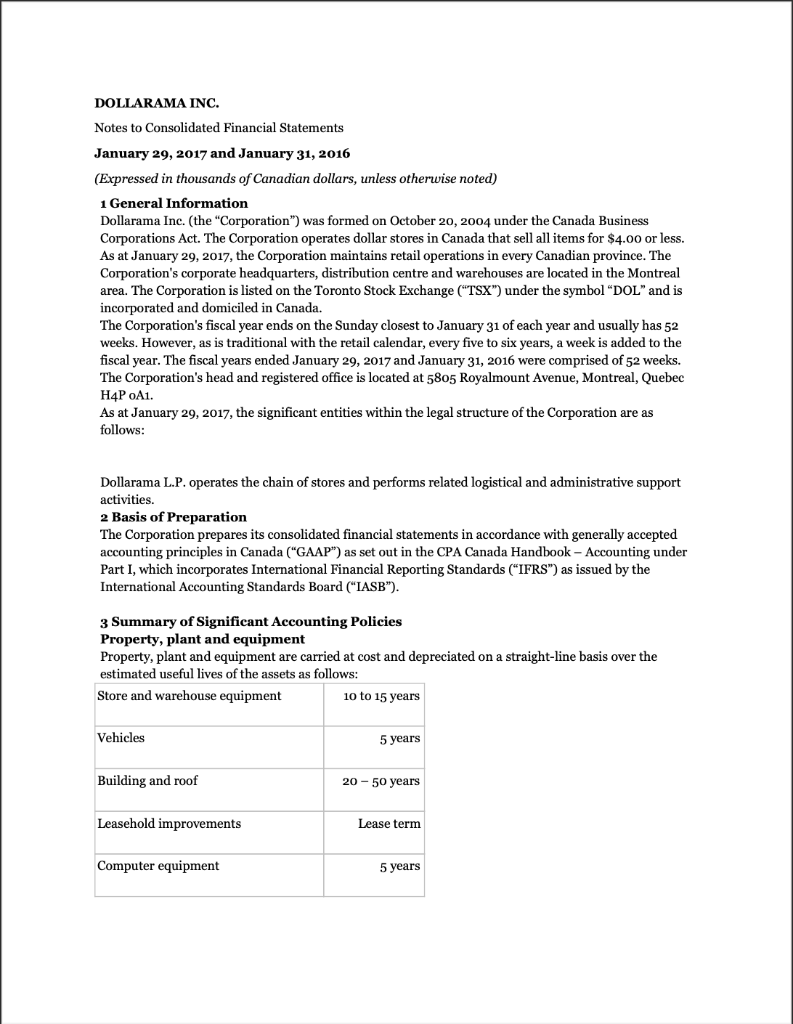

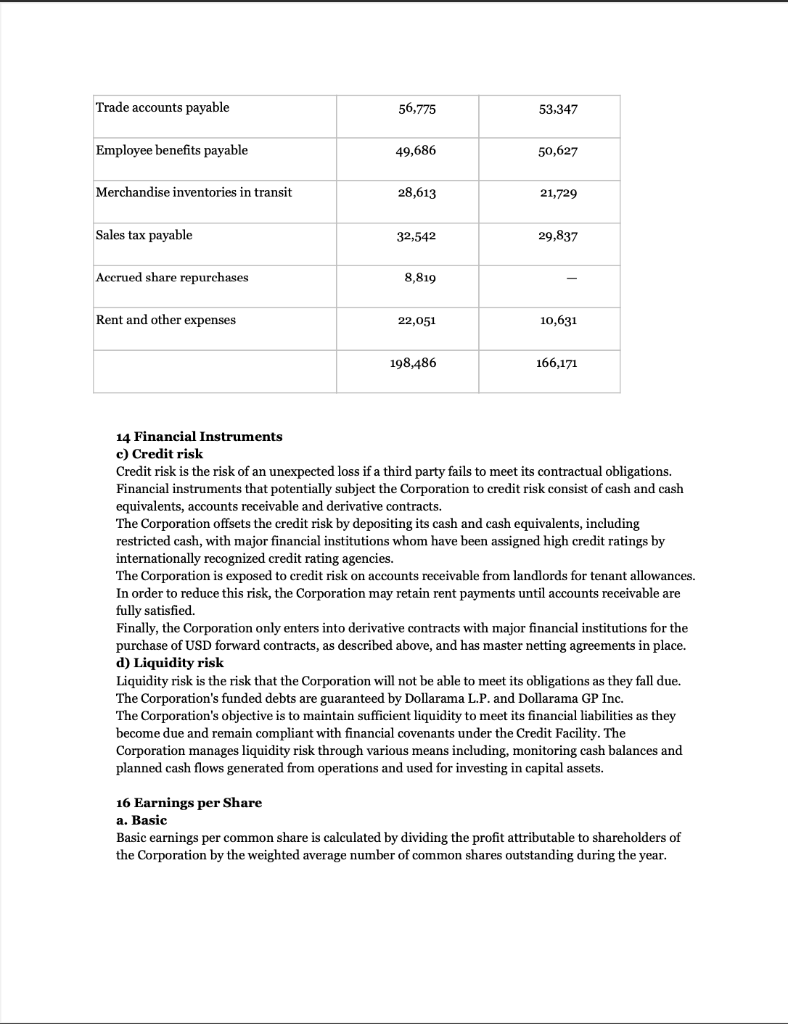

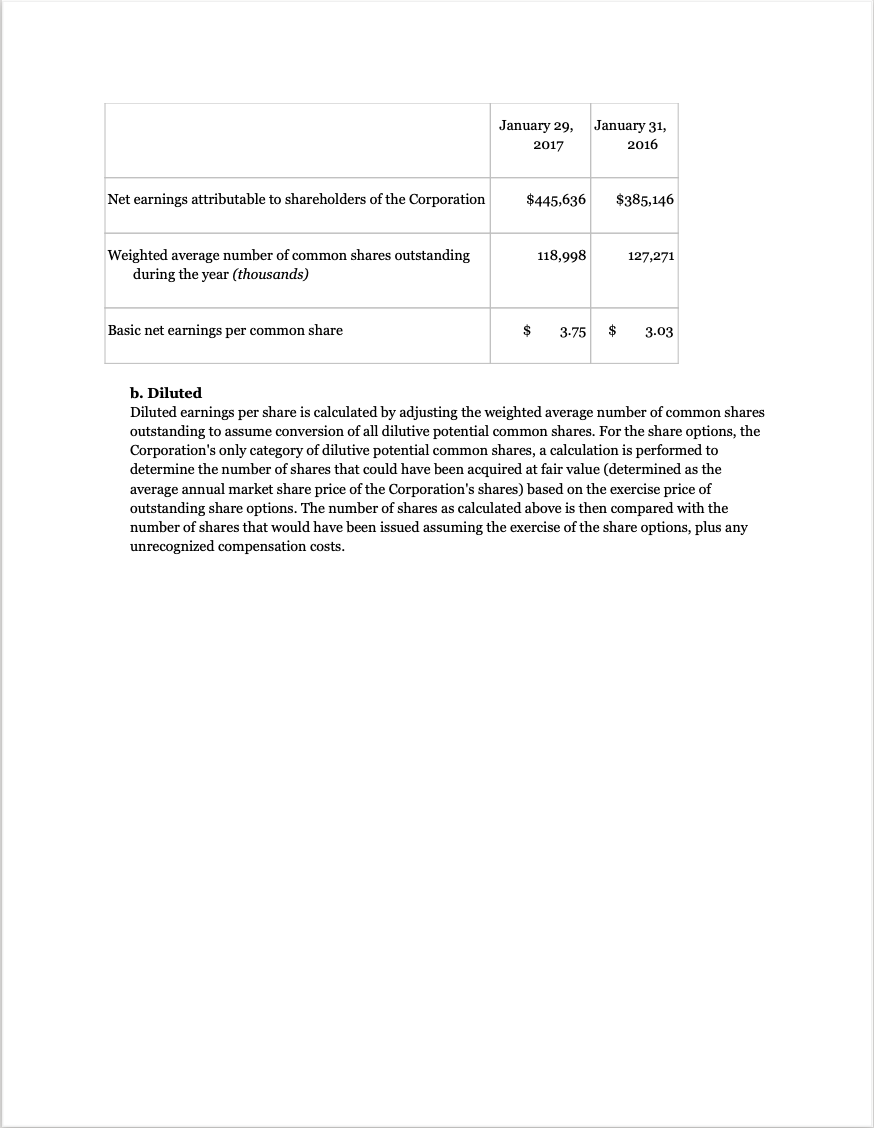

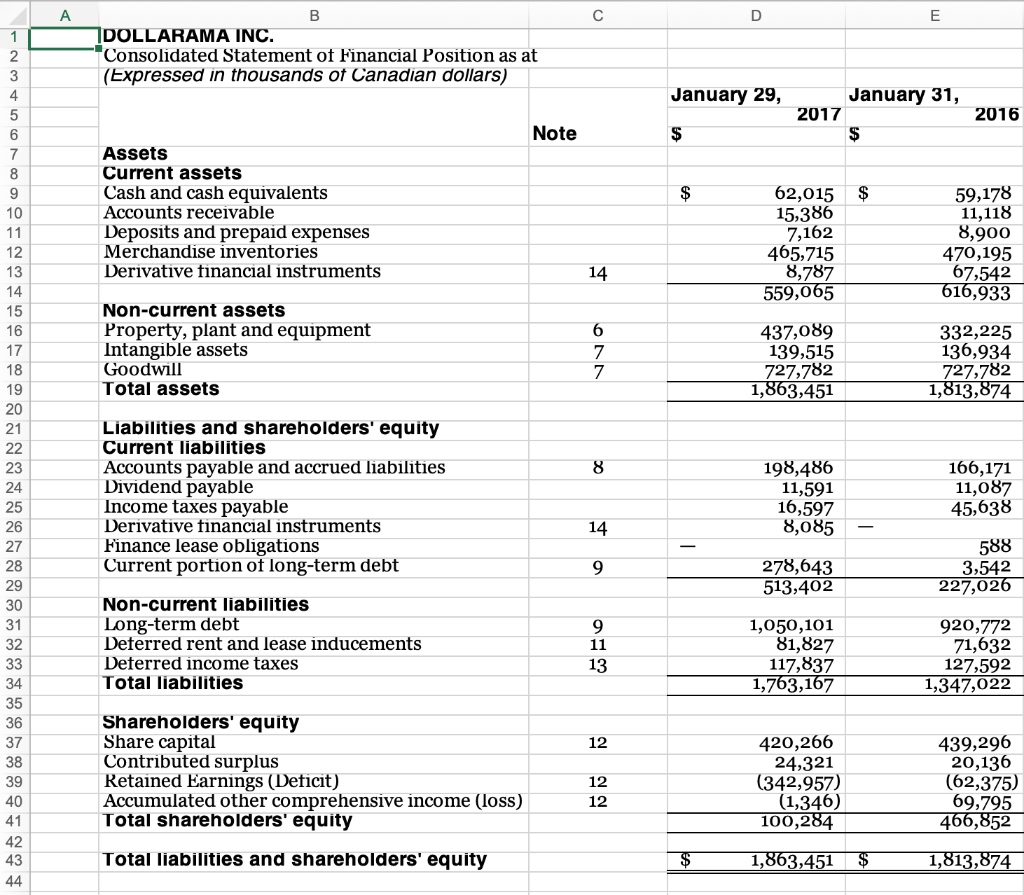

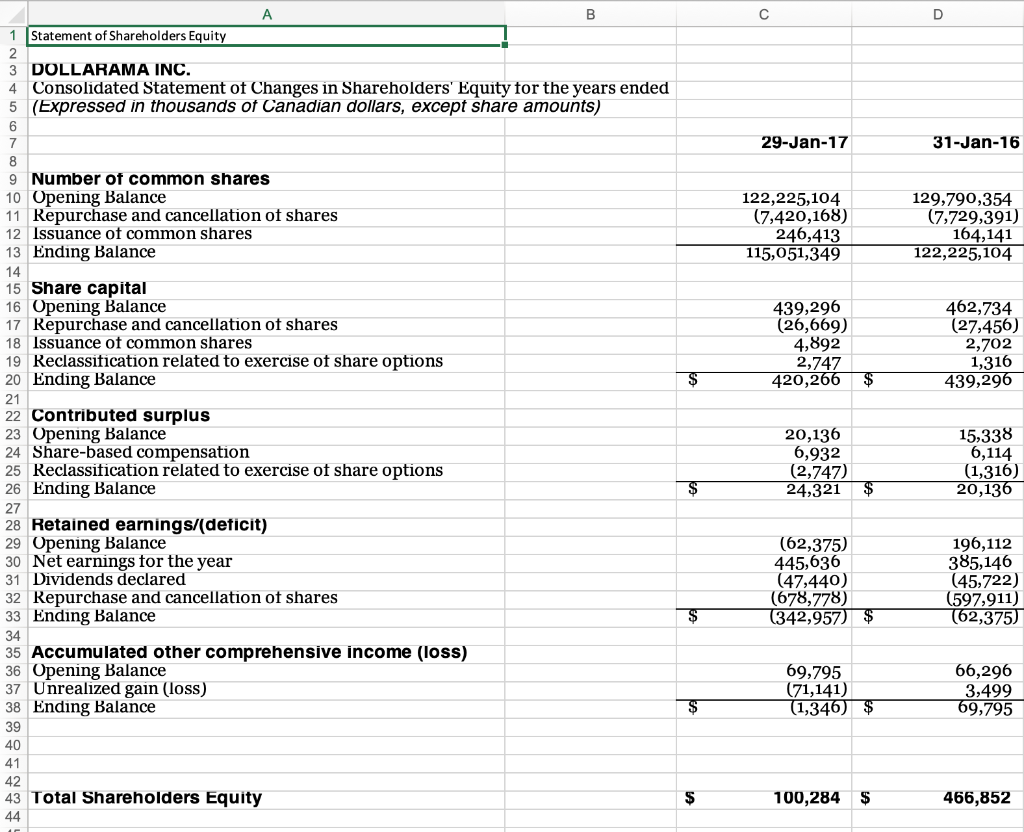

Independent Auditor's Report To the Shareholders of Dollarama Inc. We have audited the accompanying consolidated financial statements of Dollarama Inc. and its subsidiaries, which comprise the consolidated statements of financial position as at January 29, 2017 and January 31, 2016 and the consolidated statements of changes in shareholder's equity, net earnings and comprehensive income (loss) and cash flows for the years then ended, and the related notes, which comprise a summary of significant accounting policies and other explanatory information. Management's responsibility for the consolidated financial statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor's responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards require that we con with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained in our audits is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of Dollarama Inc. and its subsidiaries as at January 29, 2017 and January 31, 2016 and their financial performance and their cash flows for the years then ended in accordance with International Financial Reporting Standards. DOLLARAMA INC. Notes to Consolidated Financial Statements January 29, 2017 and January 31, 2016 (Expressed in thousands of Canadian dollars, unless otherwise noted) 1 General Information Dollarama Inc. (the "Corporation") was formed on October 20, 2004 under the Canada Business Corporations Act. The Corporation operates dollar stores in Canada that sell all items for $4.00 or less. As at January 29, 2017, the Corporation maintains retail operations in every Canadian province. The Corporation's corporate headquarters, distribution centre and warehouses are located in the Montreal area. The Corporation is listed on the Toronto Stock Exchange ("TSX") under the symbol DOL" and is incorporated and domiciled in Canada. The Corporation's fiscal year ends on the Sunday closest to January 31 of each year and usually has 52 weeks. However, as is traditional with the retail calendar, every five to six years, a week is added to the fiscal year. The fiscal years ended January 29, 2017 and January 31, 2016 were comprised of 52 weeks. The Corporation's head and registered office is located at 5805 Royalmount Avenue, Montreal, Quebec H4P A1. As at January 29, 2017, the significant entities within the legal structure of the Corporation are as follows: Dollarama L.P. operates the chain of stores and performs related logistical and administrative support activities. Basis of Preparation The Corporation prepares its consolidated financial statements in accordance with generally accepted accounting principles in Canada ("GAAP") as set out in the CPA Canada Handbook - Accounting under Part I, which incorporates International Financial Reporting Standards (IFRS") as issued by the International Accounting Standards Board ("IASB"). 3 Summary of Significant Accounting Policies Property, plant and equipment Property, plant and equipment are carried at cost and depreciated on a straight-line basis over the estimated useful lives of the assets as follows: Store and warehouse equipment 10 to 15 years Vehicles 5 years Building and roof 20-50 years Leasehold improvements Lease term Computer equipment 5 years The Corporation recognizes in the carrying amount of property, plant and equipment the full purchase price of assets acquired or constructed as well as the costs incurred that are directly incremental as a result of the construction of a specific asset, when they relate to bringing the asset into working condition. The Corporation also capitalizes the cost of replacing parts of an item when that cost is incurred, if it is probable that the future economic benefits embodied within the item will flow to the Corporation and the cost of the item can be measured reliably. The carrying amount of the replaced part is derecognized. Estimates of useful lives, residual values and methods of depreciation are reviewed annually. Any changes are accounted for prospectively as a change in accounting estimate. If the expected residual value of an asset is equal to or greater than its carrying value, depreciation on that asset is ceased. Depreciation is resumed when the expected residual value falls below the asset's carrying value. Gains and losses on disposal of an item of property, plant and equipment are determined by comparing the proceeds from disposal with the carrying amount of the item and are recognize directly in the consolidated statement of net earnings and comprehensive income (loss). Goodwill and intangible assets The Corporation classifies intangible assets into three categories: (1) intangible assets with finite lives subject to amortization, (2) intangible assets with indefinite lives not subject to amortization and (3) goodwill. Intangible assets with finite lives subject to amortization The Corporation determines the useful lives of identifiable intangible assets based on the specific facts and circumstances related to each intangible asset. Finite life intangibles are carried at cost and depreciated on a straight-line basis over the estimated useful lives of the assets as follows: Computer software 5 years Deferred leasing costs Lease term The Corporation recognizes in the carrying amount of intangible assets with finite lives subject to amortization the full purchase price of the intangible assets developed or acquired as well as other costs incurred that are directly incremental as a result of the development of a specific intangible asset, when they relate to bringing the asset into working condition. Intangible assets with indefinite lives not subject to amortization The trade name is the Corporation's only intangible asset with indefinite life not subject to amortization. The trade name is recorded at cost and is not subject to amortization, having an indefinite life. It is tested for impairment annually, as of the statement of financial position date, or more frequently if events or circumstances indicate that it may be impaired. An impairment loss is recognized for the amount by which the asset's carrying amount exceeds its recoverable amount. The recoverable amount is the higher of an asset's fair value less costs of disposal and value in use. As the trade name does not generate cash flows that are independent from other assets or individual cash-generating units ("CGUs" or "CGU"), trade name is allocated to one group of CGUs that is expected to benefit from the business combination, and which represents the lowest level within the Corporation at which trade name is monitored for internal management purposes. Goodwill Goodwill arises on the acquisition of subsidiaries and associates, and represents the excess of the consideration transferred over the share of the net identifiable assets acquired of the acquiree and the fair value of the non-controlling interest in the acquiree. Goodwill is subsequently measured at cost less any accumulated impairment losses. Goodwill is tested for impairment annually, as at the statement of financial position date, or more frequently if events or circumstances indicate that it may be impaired. For the purposes of annual impairment testing, goodwill is allocated to one group of CGUs that is expected to benefit from the business combination, and which represents the lowest level within the Corporation at which goodwill is monitored for internal management purposes. Impairment of non-financial assets Assets that are subject to amortization are periodically reviewed for indicators of impairment. Whenever events or changes in circumstances indicate that the carrying amount may not be recoverable, the asset or CGU is tested for impairment. To the extent that the asset or CGU's carrying amount exceeds its recoverable amount, an impairment loss is recognized in the consolidated statement of net earnings and comprehensive income (loss). The recoverable amount of an asset or a CGU is the higher of its fair value less costs of disposal and its value in use. Value in use is the present value of the future cash flows expected to be derived from an asset or CGU. The fair value is the price that could be received for an asset or CGU in an orderly transaction between market participants at the measurement date, less costs of disposal. For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash flows (CGUs - these are individual stores). Management undertakes an assessment of relevant market data, which includes the current publicly quoted market capitalization of the Corporation. Cash and cash equivalents Cash and cash equivalents include highly liquid investments with original maturities from the date of purchase of three months or less. Merchandise inventories Merchandise inventories at the distribution centre, warehouses and stores are measured at the lower of cost and net realizable value. Cost is determined on a weighted average cost basis and is assigned to store inventories using the retail inventory method. Costs of inventories include amounts paid to suppliers, duties and freight into the warehouses as well as costs directly associated with warehousing and distribution. Net realizable value is the estimated selling price in the ordinary course of business, less applicable variable selling expenses. Accounts payable and accrued liabilities Accounts payable and accrued liabilities are obligations to pay for goods acquired from suppliers or services rendered by employees and service providers in the ordinary course of business. Accounts payable and accrued liabilities are classified as current liabilities if payment is due or expected within one year or less. Otherwise, they are presented as non-current liabilities. Accounts payable and accrued liabilities are recognized initially at fair value and subsequently measured at amortized cost. Provisions A provision is recognized if, as a result of a past event, the Corporation has a present legal or constructive obligation that can be estimated reliably, and if it is probable that an constructive obligation that can be estimated reliably, and if it is probable that an outflow of economic benefits will be required to settle the obligation. Provisions are not recognized for future operating losses. If the effect of time value of money is material, provisions are measured at the present value of cash flows expected to be required to settle the obligation using a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the obligation. The increase in the provision due to the passage of time is recognized as accretion expense under financing costs in the consolidated statement of net earnings and comprehensive income (loss). Share capital Common shares are classified as shareholders' equity. Incremental costs directly attributable to the issue of shares or options are shown in shareholders' equity as a deduction, net of tax, from the proceeds of issuance. When the Corporation repurchases common shares under its normal course issuer bid, the portion of the price paid for the common shares that corresponds to the book value of those shares is recognized as a reduction of share capital. The portion of the price paid that is in excess of the book value is recognized as a reduction of retained earnings. Dividends declared Dividend distributions to the Corporation's shareholders are recognized as a liability in the Corporation's consolidated financial statements in the period in which the dividends are declared by the board of directors. Employee future benefits A defined contribution plan is a post-employment benefit plan under which the Corporation pays fixed contributions into a separate legal entity as well as state plans administered by the provincial and federal governments and will have no legal or constructive obligation to pay further amounts. Obligations for contributions to defined contribution retirement plans are recognized as an expense in earnings when they are due. The Corporation offers a defined contribution pension plan to eligible employees whereby it matches an employee's contributions up to 5% of the employee's salary, subject to a maximum of 50% of RRSP annual contribution limit. Short-term employee benefits Liabilities for bonus plans are recognized based on a formula that takes into consideration individual performance and contributions to the profitability of the Corporation. Termination benefits Termination benefits are generally payable when employment is terminated before the normal retirement date or whenever an employee accepts voluntary redundancy in exchange for these benefits. The Corporation recognizes termination benefits when it is demonstrably committed to providing termination benefits as a result of an offer made. Income taxes The income tax expense for the year comprises current and deferred tax. Tax is recognized in earnings, except to the extent that it relates to items recognized in other comprehensive income or directly in shareholders' equity. In this case, tax is recognized in other comprehensive income or directly in shareholders' equity, respectively. The current income tax charge is calculated on the basis of the tax laws enacted or substantively enacted at the statement of financial position date and any adjustment to tax payable in respect of previous years. Deferred income tax is recognized using the liability method on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the consolidated financial statements. However, deferred income tax liabilities are not recognized if they arise from initial recognition of goodwill or if they arise from initial recognition of an asset or liability in a transaction other than a business combination that at the time of the transaction affects neither accounting nor taxable profit or loss. Deferred income tax is determined using tax rates and laws that have been enacted or substantively enacted by the statement of financial position date and are expected to apply when the related deferred income tax asset is realized or the deferred income tax liability is settled. Deferred income tax assets are recognized only to the extent that it is probable that future taxable profits will be available against which the temporary differences can be utilized. Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities and when the deferred income tax assets and liabilities relate to income tax levied by the same taxation authority on either the same taxable entity or different taxable entities where there is an intention to settle the balances on a net basis. Revenue recognition The Corporation recognizes revenue from the sale of products or the rendering of services when they are earned, specifically when all the following conditions are met: (1) the significant risks and rewards of ownership are transferred to customers and the Corporation retains neither continuing managerial involvement nor effective control; (2) there is clear evidence that an arrangement exists; (3) the amount of revenues and related costs can be measured reliably; and (4) it is probable that the economic benefits associated with the transaction will flow to the Corporation. The recognition of revenue at the store occurs at the time a customer tenders payment for and takes possession of the merchandise. All sales are final. Revenue is shown net of sales tax and discounts. Gift cards sold are recorded as a liability, and revenue is recognized when gift cards are redeemed. Gross versus net The Corporation may enter into arrangements with third parties for the sale of products to customers. When the Corporation acts as the principal in these arrangements, it recognizes revenues based on the amounts billed to customers. Otherwise, the Corporation recognizes the net amount that it retains as revenues. Cost of sales Cost of sales includes the cost of merchandise inventories, outbound transportation costs, warehousing and distribution costs, store, warehouse and distribution centre occupancy costs, as well as the transfer from accumulated other comprehensive income of any gains (losses) on qualifying cash flow hedges related to the purchase of merchandise inventories. Vendor rebates The Corporation records vendor rebates, consisting of volume purchase rebates, when it is probable that they will be received and the amounts are reasonably estimable. The rebates are recorded as a reduction of inventory purchases and are reflected as a reduction of cost of sales in the consolidated statement of net earnings and comprehensive income (loss). General, administrative and store operating expenses The Corporation includes store and head office salaries and benefits, repairs and maintenance, professional fees, store supplies and other related expenses in general, administrative and store operating expenses. Earnings per common share Earnings per common share is determined using the weighted average number of common shares outstanding during the year. Diluted earnings per common share is determined using the treasury share method to evaluate the dilutive effect of share options. Under this method, instruments with a dilutive effect are considered to have been exercised at the beginning of the year, or at the time of issuance, if later, and the proceeds received are considered to have been used to redeem common shares at the average market price during the year. Leases Finance leases Assets held under leases which result in the Corporation receiving substantially all the risks and rewards of ownership of the asset ("finance leases") are capitalized at the lower of the fair value of the property and equipment or the estimated present value of the minimum lease payments. The corresponding finance lease obligation is included within interest bearing liabilities. The interest element is amortized using the effective interest rate method. Operating leases The Corporation leases stores, five warehouses, a distribution centre and corporate headquarters. Leases in which a significant portion of the risks and rewards of ownership are retained by the lessor are classified as operating leases. The Corporation recognizes rental expense incurred and inducements received from landlords on a straight-line basis over the term of the lease. Any difference between the calculated expense and the amounts actually paid is reflected as deferred lease inducements in the Corporation's consolidated statement of financial position. Contingent rental expense is recognized when the achievement of specified sales targets is considered probable. Deferred leasing costs and deferred tenant allowances are recorded on the consolidated statement of financial position and amortized using the straight-line method over the term of the respective lease. Share-based compensation The Corporation recognizes a compensation expense for options granted based on the fair value of the options at the grant date, using the Black-Scholes option pricing model. The options granted by the Corporation vest in tranches (graded vesting); accordingly, the expense is recognized in vesting tranches. The total amount to be expensed is determined by reference to the fair value of the options granted. The impact of any service and non-market performance vesting conditions (for example, profitability, sales growth targets and retaining an employee of the entity over a specified time period) are excluded from the fair value calculation. Non-market performance vesting conditions are included in assumptions about the number of options that are expected to vest. The total expense is recognized over the vesting period, which is the period over which all of the specified vesting conditions are to be satisfied. At the end of each reporting period, the Corporation revises its estimates of the number of options that are expected to vest based on the non-market performance vesting conditions. The Corporation recognizes the impact of the revision to original estimates, if any, in the consolidated statement of net earnings and comprehensive income (loss), with a corresponding adjustment to contributed surplus. The option holders have the right to exercise their options on a cash or cashless basis. The cash paid for the shares issued when the options are exercised is credited, together with the related compensation costs, to share capital (nominal value), net of any directly attributable transaction costs. 5 Critical Accounting Judgments and Estimates The preparation of financial statements requires management to make estimates and assumptions using judgment that affect the application of accounting policies and the reported amounts of assets and liabilities, income and expenses during the reporting period. Estimates and other judgments are continually evaluated and are based on management's experience and other factors, including expectations about future events that are believed to be reasonable under the circumstances. Actual results may differ from those estimates. The following discusses the most significant accounting judgments and estimates that the Corporation made in the preparation of the consolidated financial statements. Income taxes Judgment - Judgment is required in determining income taxes. There are transactions and calculations for which the ultimate tax determination is uncertain. The Corporation recognizes liabilities for anticipated tax audit issues based on estimates of whether additional taxes will be due. Where the final tax outcome of these matters differs from the amounts that were initially recorded, such differences will impact the current and deferred income tax assets and liabilities in the period in which such determination is made. Property, plant and equipment Estimate - Estimates of useful lives, residual values and methods of depreciation are reviewed annually. Any changes, based on additional available information, are accounted for prospectively as a change in accounting estimate. Valuation of merchandise inventories Estimate-Store merchandise inventories are valued at the lower of cost and net realizable value, with cost being determined by the retail inventory method. Under the retail inventory method, merchandise inventories are converted to a cost basis by applying an average cost-to-sell ratio. Merchandise inventories that are at the distribution centre or warehouses and inventories that are in transit from suppliers are measured at the lower of cost and net realizable value, with cost determined on a weighted average cost basis. Merchandise inventories include items that have been marked down to management's best estimate of their net realizable value and are included in cost of sales in the period in which the markdown is determined. The Corporation estimates its inventory provisions based on the consideration of a variety of factors, including quantities of slow-moving or carryover seasonal merchandise on hand, historical markdown statistics, future merchandising plans and inventory shrinkage. The accuracy of the Corporation's estimates can be affected by many factors, some of which are beyond its control, including changes in economic conditions and consumer buying trends. Historically, the Corporation has not experienced significant differences in its estimates of markdowns compared with actual results. Changes to the inventory provisions can have a material impact on the results of the Corporation. Impairment of goodwill and trade name Estimate - Goodwill and trade name are not subject to amortization and are tested for impairment annually or more frequently if events or circumstances indicate that the assets might be impaired. Impairment is identified by comparing the recoverable amount of the CGU to its carrying value. To the extent the CGU's carrying amount exceeds its recoverable amount, an impairment loss is recognized in the consolidated statement of net earnings and comprehensive income (loss). The recoverable amount of the CGU is based on the fair value less costs of disposal. The fair value is the price that could be received for an asset or CGU in an orderly transaction between market participants at the measurement date, less costs of disposal. Management undertakes an assessment of relevant market data, which includes the current publicly quoted market capitalization of the Corporation. As at January 29, 2017 and January 31, 2016, impairment reviews were performed by comparing the carrying value of goodwill and the trade name with the recoverable amount of the CGU to which goodwill and the trade name have been allocated. Management determined that there has been no impairment. 1) Indefinite life intangibles are not subject to amortization. 8 Accounts Payable and Accrued Liabilities January 29, 2017 January 31, 2016 $ Trade accounts payable 56,775 53,347 Employee benefits payable 49,686 50,627 Merchandise inventories in transit 28,613 21,729 Sales tax payable 32,542 29,837 Accrued share repurchases 8,819 Rent and other expenses 22,051 10,631 198,486 166,171 14 Financial Instruments c) Credit risk Credit risk is the risk of an unexpected loss if a third party fails to meet its contractual obligations. Financial instruments that potentially subject the Corporation to credit risk consist of cash and cash equivalents, accounts receivable and derivative contracts. The Corporation offsets the credit risk by depositing its cash and cash equivalents, including restricted cash, with major financial institutions whom have been assigned high credit ratings by internationally recognized credit rating agencies. The Corporation is exposed to credit risk on accounts receivable from landlords for tenant allowances. In order to reduce this risk, the Corporation may retain rent payments until accounts receivable are fully satisfied. Finally, the Corporation only enters into derivative contracts with major financial institutions for the purchase of USD forward contracts, as described above, and has master netting agreements in place. d) Liquidity risk Liquidity risk is the risk that the Corporation will not be able to meet its obligations as they fall due. The Corporation's funded debts are guaranteed by Dollarama L.P. and Dollarama GP Inc. The Corporation's objective is to maintain sufficient liquidity to meet its financial liabilities as they become due and remain compliant with financial covenants under the Credit Facility. The Corporation manages liquidity risk through various means including, monitoring cash balances and planned cash flows generated from operations and used for investing in capital assets. 16 Earnings per Share a. Basic Basic earnings per common share is calculated by dividing the profit attributable to shareholders of the Corporation by the weighted average number of common shares outstanding during the year. January 29, 2017 January 31, 2016 Net earnings attributable to shareholders of the Corporation $445,636 $385,146 118,998 127,271 Weighted average number of common shares outstanding during the year (thousands) Basic net earnings per common share $ 3.75 $ 3.03 b. Diluted Diluted earnings per share is calculated by adjusting the weighted average number of common shares outstanding to assume conversion of all dilutive potential common shares. For the share options, the Corporation's only category of dilutive potential common shares, a calculation is performed to determine the number of shares that could have been acquired at fair value (determined as the average annual market share price of the Corporation's shares) based on the exercise price of outstanding share options. The number of shares as calculated above is then compared with the number of shares that would have been issued assuming the exercise of the share options, plus any unrecognized compensation costs. A D E 1 2 B DOLLARAMA INC. Consolidated Statement of Financial Position as at (Expressed in thousands of Canadian dollars) 3 4 5 6 January 29, January 31, 2017 $ 2016 Note $ $ Assets Current assets Cash and cash equivalents Accounts receivable Deposits and prepaid expenses Merchandise inventories Derivative financial instruments 59,178 11,118 62,015 $ 15,386 7,162 465,715 8,787 559,065 8,900 470,195 67,542 616,933 14 Non-current assets Property, plant and equipment Intangible assets Goodwill Total assets 6 7 7 437,089 139,515 727,782 1,863,451 332,225 136,934 727,782 1,813,874 8 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Liabilities and shareholders' equity Current liabilities Accounts payable and accrued liabilities Dividend payable Income taxes payable Derivative financial instruments Finance lease obligations Current portion of long-term debt 198,486 11,591 16,597 8,085 166,171 11,087 45,638 14 9 278,643 513,402 588 3,542 227,026 Non-current liabilities Long-term debt Deferred rent and lease inducements Deferred income taxes Total liabilities 9 11 13 1,050,101 81,827 117,837 1,763,167 920,772 71,632 127,592 1,347,022 12 Shareholders' equity Share capital Contributed surplus Retained Earnings (Deficit) Accumulated other comprehensive income (loss) Total shareholders' equity 12 12 420,266 24,321 (342,957) (1,346) 100,284 439,296 20,136 (62,375) 69,795 466,852 Total liabilities and shareholders' equity $ 1,863,451 $ 1,813,874 B D 1 Statement of Shareholders Equity 29-Jan-17 31-Jan-16 122,225,104 (7,420,168) 246,413 115,051,349 129,790,354 (7,729,391) 164,141 122,225,104 439,296 (26,669) 4,892 2,747 420,266 462,734 (27,456) 2,702 1,316 439,296 $ 3 DOLLARAMA INC. 4 Consolidated Statement of Changes in Shareholders' Equity for the years ended 5 (Expressed in thousands of Canadian dollars, except share amounts) 6 7 8 9 Number of common shares 10 Opening Balance 11 Repurchase and cancellation of shares 12 Issuance of common shares 13 Ending Balance 14 15 Share capital 16 Opening Balance 17 Repurchase and cancellation of shares 18 Issuance of common shares 19 Reclassification related to exercise of share options 20 Ending Balance $ 21 22 Contributed surplus 23 Opening Balance 24 Share-based compensation 25 Reclassification related to exercise of share options 26 Ending Balance $ 27 28 Retained earnings/(deficit) 29 Opening Balance 30 Net earnings for the year 31 Dividends declared 32 Repurchase and cancellation of shares 33 Ending Balance 34 35 Accumulated other comprehensive income (loss) 36 Opening Balance 37 Unrealized gain (loss) 38 Ending Balance $ 39 40 41 42 43 Total Shareholders Equity $ 44 20,136 6,932 (2,747) 24,321 $ 15,338 6,114 (1,316) 20,136 (62,375) 445,636 (47,440) (678,778) (342,957) $ 196,112 385,146 (45,722) (597,911) (62,375) 69,795 (71,141) (1,346) $ 66,296 3,499 69,795 100,284 $ 466,852 A B D 5 6 7 8 DOLLARAMA INC. Consolidated Statement of Net Earnings and Comprehensive Income (Loss) for the years ended (Expressed in thousands of Canadian dollars, except share and per share amounts) Note 29-Jan-17 Sales 2,963,219 Cost of goods sold 17 1,801,935 Gross profit 1,161,284 31-Jan-16 2,650,327 1,617,051 1,033,276 9 10 11 General, administrative and store operating expenses Depreciation and amortization Operating income 17 458,026 57,748 645,510 435,816 48,085 549,375 17 Financing costs (Interest) Earnings before income taxes Income taxes Net income for the year 33,083 612,427 166,791 445,636 21,395 527,980 142,834 385,146 13 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Other comprehensive income (loss) Items to be reclassified subsequently to net earnings Unrealized gain (loss) on derivative financial instruments, net Income taxes relating to components of other comprehensive Total other comprehensive income (loss), net of income Total comprehensive income for the year (97,001) 25,860 (71,141) 374,495 4,789 (1,290) 3,499 388,645 Earnings per common share Basic net earnings per common share Diluted net earnings per common share Weighted average number of common shares outstanding Weighted average number of diluted common shares 16 16 16 16 $3.75 $3.71 118,998 120,243 $3.03 $3.00 127,271 128,420 D 29-Jan-17 31-Jan-16 445,636 385,146 17 11 A B 1 DOLLARAMA INC. 2 Consolidated Statement of Cash FIOWS for the years ended 3 (Expressed in thousands of Canadian dollars) 4 Note 5 Operating activities 6 Net earnings for the year 7 Adjustments for: 8 Depreciation of property, plant and equipment and 9 Amortization of deterred tenant allowances 10 Amortization of deferred leasing costs 11 Amortization of debt issue costs 12 Recognition of realized gains on foreign exchange contracts 13 Cash settlement of gains on foreign exchange contracts 14 Deferred lease inducements 15 Deterred tenant allowances 16 Share-based compensation 17 Financing costs on long-term debt 18 Deferred income taxes 19 Loss on disposal of assets 20 21 Changes in non-cash working capital components 22 Net cash generated from operating activities 11 11 12 57,748 (4,795) 519 1,481 (46,269) 16,108 6,020 8,970 6,932 268 16,105 40 508,763 (3,595) 505,168 48,085 (4,929) 584 1,301 (76,665) 97,921 4,811 11,275 6,114 (304) 4,118 641 478,098 (28,861) 449,237 13 18 23 Investing activities 24 Additions to property, plant and equipment 25 Additions to intangible assets 26 Proceeds on disposal of property, plant and equipment 27 Net cash used in investing activities 6 7 (153,574) (12,640) 462 (165,752) (83,231) (11,199) 670 (93,760) 9 124,834 235,000 9 28 Financing activities 29 Proceeds from long-term debt - Series 1 Floating Rate Notes 30 Net proceeds (repayments) from (of) Credit Facility 31 Proceeds from long-term debt - 2.337% Fixed Rate Notes 32 Payment of debt issue costs 33 Repayment of finance lease 34 Issuance of common shares 35 Dividends paid 36 Repurchase and cancellation of shares 37 Net cash used in financing activities 38 (120,000) 525,000 (2,319) (588) 4,892 (46,936) (696,628) (336,579) (1,003) (978) 2,702 (45,116) (651,941) (336,502) 39 Increase in cash and cash equivalents 2,837 18,975 40 Cash and cash equivalents - beginning of year 59,178 40,203 41 Cash and cash equivalents ending of year 62,015 59,178 42 Independent Auditor's Report To the Shareholders of Dollarama Inc. We have audited the accompanying consolidated financial statements of Dollarama Inc. and its subsidiaries, which comprise the consolidated statements of financial position as at January 29, 2017 and January 31, 2016 and the consolidated statements of changes in shareholder's equity, net earnings and comprehensive income (loss) and cash flows for the years then ended, and the related notes, which comprise a summary of significant accounting policies and other explanatory information. Management's responsibility for the consolidated financial statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor's responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards require that we con with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained in our audits is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of Dollarama Inc. and its subsidiaries as at January 29, 2017 and January 31, 2016 and their financial performance and their cash flows for the years then ended in accordance with International Financial Reporting Standards. DOLLARAMA INC. Notes to Consolidated Financial Statements January 29, 2017 and January 31, 2016 (Expressed in thousands of Canadian dollars, unless otherwise noted) 1 General Information Dollarama Inc. (the "Corporation") was formed on October 20, 2004 under the Canada Business Corporations Act. The Corporation operates dollar stores in Canada that sell all items for $4.00 or less. As at January 29, 2017, the Corporation maintains retail operations in every Canadian province. The Corporation's corporate headquarters, distribution centre and warehouses are located in the Montreal area. The Corporation is listed on the Toronto Stock Exchange ("TSX") under the symbol DOL" and is incorporated and domiciled in Canada. The Corporation's fiscal year ends on the Sunday closest to January 31 of each year and usually has 52 weeks. However, as is traditional with the retail calendar, every five to six years, a week is added to the fiscal year. The fiscal years ended January 29, 2017 and January 31, 2016 were comprised of 52 weeks. The Corporation's head and registered office is located at 5805 Royalmount Avenue, Montreal, Quebec H4P A1. As at January 29, 2017, the significant entities within the legal structure of the Corporation are as follows: Dollarama L.P. operates the chain of stores and performs related logistical and administrative support activities. Basis of Preparation The Corporation prepares its consolidated financial statements in accordance with generally accepted accounting principles in Canada ("GAAP") as set out in the CPA Canada Handbook - Accounting under Part I, which incorporates International Financial Reporting Standards (IFRS") as issued by the International Accounting Standards Board ("IASB"). 3 Summary of Significant Accounting Policies Property, plant and equipment Property, plant and equipment are carried at cost and depreciated on a straight-line basis over the estimated useful lives of the assets as follows: Store and warehouse equipment 10 to 15 years Vehicles 5 years Building and roof 20-50 years Leasehold improvements Lease term Computer equipment 5 years The Corporation recognizes in the carrying amount of property, plant and equipment the full purchase price of assets acquired or constructed as well as the costs incurred that are directly incremental as a result of the construction of a specific asset, when they relate to bringing the asset into working condition. The Corporation also capitalizes the cost of replacing parts of an item when that cost is incurred, if it is probable that the future economic benefits embodied within the item will flow to the Corporation and the cost of the item can be measured reliably. The carrying amount of the replaced part is derecognized. Estimates of useful lives, residual values and methods of depreciation are reviewed annually. Any changes are accounted for prospectively as a change in accounting estimate. If the expected residual value of an asset is equal to or greater than its carrying value, depreciation on that asset is ceased. Depreciation is resumed when the expected residual value falls below the asset's carrying value. Gains and losses on disposal of an item of property, plant and equipment are determined by comparing the proceeds from disposal with the carrying amount of the item and are recognize directly in the consolidated statement of net earnings and comprehensive income (loss). Goodwill and intangible assets The Corporation classifies intangible assets into three categories: (1) intangible assets with finite lives subject to amortization, (2) intangible assets with indefinite lives not subject to amortization and (3) goodwill. Intangible assets with finite lives subject to amortization The Corporation determines the useful lives of identifiable intangible assets based on the specific facts and circumstances related to each intangible asset. Finite life intangibles are carried at cost and depreciated on a straight-line basis over the estimated useful lives of the assets as follows: Computer software 5 years Deferred leasing costs Lease term The Corporation recognizes in the carrying amount of intangible assets with finite lives subject to amortization the full purchase price of the intangible assets developed or acquired as well as other costs incurred that are directly incremental as a result of the development of a specific intangible asset, when they relate to bringing the asset into working condition. Intangible assets with indefinite lives not subject to amortization The trade name is the Corporation's only intangible asset with indefinite life not subject to amortization. The trade name is recorded at cost and is not subject to amortization, having an indefinite life. It is tested for impairment annually, as of the statement of financial position date, or more frequently if events or circumstances indicate that it may be impaired. An impairment loss is recognized for the amount by which the asset's carrying amount exceeds its recoverable amount. The recoverable amount is the higher of an asset's fair value less costs of disposal and value in use. As the trade name does not generate cash flows that are independent from other assets or individual cash-generating units ("CGUs" or "CGU"), trade name is allocated to one group of CGUs that is expected to benefit from the business combination, and which represents the lowest level within the Corporation at which trade name is monitored for internal management purposes. Goodwill Goodwill arises on the acquisition of subsidiaries and associates, and represents the excess of the consideration transferred over the share of the net identifiable assets acquired of the acquiree and the fair value of the non-controlling interest in the acquiree. Goodwill is subsequently measured at cost less any accumulated impairment losses. Goodwill is tested for impairment annually, as at the statement of financial position date, or more frequently if events or circumstances indicate that it may be impaired. For the purposes of annual impairment testing, goodwill is allocated to one group of CGUs that is expected to benefit from the business combination, and which represents the lowest level within the Corporation at which goodwill is monitored for internal management purposes. Impairment of non-financial assets Assets that are subject to amortization are periodically reviewed for indicators of impairment. Whenever events or changes in circumstances indicate that the carrying amount may not be recoverable, the asset or CGU is tested for impairment. To the extent that the asset or CGU's carrying amount exceeds its recoverable amount, an impairment loss is recognized in the consolidated statement of net earnings and comprehensive income (loss). The recoverable amount of an asset or a CGU is the higher of its fair value less costs of disposal and its value in use. Value in use is the present value of the future cash flows expected to be derived from an asset or CGU. The fair value is the price that could be received for an asset or CGU in an orderly transaction between market participants at the measurement date, less costs of disposal. For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash flows (CGUs - these are individual stores). Management undertakes an assessment of relevant market data, which includes the current publicly quoted market capitalization of the Corporation. Cash and cash equivalents Cash and cash equivalents include highly liquid investments with original maturities from the date of purchase of three months or less. Merchandise inventories Merchandise inventories at the distribution centre, warehouses and stores are measured at the lower of cost and net realizable value. Cost is determined on a weighted average cost basis and is assigned to store inventories using the retail inventory method. Costs of inventories include amounts paid to suppliers, duties and freight into the warehouses as well as costs directly associated with warehousing and distribution. Net realizable value is the estimated selling price in the ordinary course of business, less applicable variable selling expenses. Accounts payable and accrued liabilities Accounts payable and accrued liabilities are obligations to pay for goods acquired from suppliers or services rendered by employees and service providers in the ordinary course of business. Accounts payable and accrued liabilities are classified as current liabilities if payment is due or expected within one year or less. Otherwise, they are presented as non-current liabilities. Accounts payable and accrued liabilities are recognized initially at fair value and subsequently measured at amortized cost. Provisions A provision is recognized if, as a result of a past event, the Corporation has a present legal or constructive obligation that can be estimated reliably, and if it is probable that an constructive obligation that can be estimated reliably, and if it is probable that an outflow of economic benefits will be required to settle the obligation. Provisions are not recognized for future operating losses. If the effect of time value of money is material, provisions are measured at the present value of cash flows expected to be required to settle the obligation using a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the obligation. The increase in the provision due to the passage of time is recognized as accretion expense under financing costs in the consolidated statement of net earnings and comprehensive income (loss). Share capital Common shares are classified as shareholders' equity. Incremental costs directly attributable to the issue of shares or options are shown in shareholders' equity as a deduction, net of tax, from the proceeds of issuance. When the Corporation repurchases common shares under its normal course issuer bid, the portion of the price paid for the common shares that corresponds to the book value of those shares is recognized as a reduction of share capital. The portion of the price paid that is in excess of the book value is recognized as a reduction of retained earnings. Dividends declared Dividend distributions to the Corporation's shareholders are recognized as a liability in the Corporation's consolidated financial statements in the period in which the dividends are declared by the board of directors. Employee future benefits A defined contribution plan is a post-employment benefit plan under which the Corporation pays fixed contributions into a separate legal entity as well as state plans administered by the provincial and federal governments and will have no legal or constructive obligation to pay further amounts. Obligations for contributions to defined contribution retirement plans are recognized as an expense in earnings when they are due. The Corporation offers a defined contribution pension plan to eligible employees whereby it matches an employee's contributions up to 5% of the employee's salary, subject to a maximum of 50% of RRSP annual contribution limit. Short-term employee benefits Liabilities for bonus plans are recognized based on a formula that takes into consideration individual performance and contributions to the profitability of the Corporation. Termination benefits Termination benefits are generally payable when employment is terminated before the normal retirement date or whenever an employee accepts voluntary redundancy in exchange for these benefits. The Corporation recognizes termination benefits when it is demonstrably committed to providing termination benefits as a result of an offer made. Income taxes The income tax expense for the year comprises current and deferred tax. Tax is recognized in earnings, except to the extent that it relates to items recognized in other comprehensive income or directly in shareholders' equity. In this case, tax is recognized in other comprehensive income or directly in shareholders' equity, respectively. The current income tax charge is calculated on the basis of the tax laws enacted or substantively enacted at the statement of financial position date and any adjustment to tax payable in respect of previous years. Deferred income tax is recognized using the liability method on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the consolidated financial statements. However, deferred income tax liabilities are not recognized if they arise from initial recognition of goodwill or if they arise from initial recognition of an asset or liability in a transaction other than a business combination that at the time of the transaction affects neither accounting nor taxable profit or loss. Deferred income tax is determined using tax rates and laws that have been enacted or substantively enacted by the statement of financial position date and are expected to apply when the related deferred income tax asset is realized or the deferred income tax liability is settled. Deferred income tax assets are recognized only to the extent that it is probable that future taxable profits will be available against which the temporary differences can be utilized. Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities and when the deferred income tax assets and liabilities relate to income tax levied by the same taxation authority on either the same taxable entity or different taxable entities where there is an intention to settle the balances on a net basis. Revenue recognition The Corporation recognizes revenue from the sale of products or the rendering of services when they are earned, specifically when all the following conditions are met: (1) the significant risks and rewards of ownership are transferred to customers and the Corporation retains neither continuing managerial involvement nor effective control; (2) there is clear evidence that an arrangement exists; (3) the amount of revenues and related costs can be measured reliably; and (4) it is probable that the economic benefits associated with the transaction will flow to the Corporation. The recognition of revenue at the store occurs at the time a customer tenders payment for and takes possession of the merchandise. All sales are final. Revenue is shown net of sales tax and discounts. Gift cards sold are recorded as a liability, and revenue is recognized when gift cards are redeemed. Gross versus net The Corporation may enter into arrangements with third parties for the sale of products to customers. When the Corporation acts as the principal in these arrangements, it recognizes revenues based on the amounts billed to customers. Otherwise, the Corporation recognizes the net amount that it retains as revenues. Cost of sales Cost of sales includes the cost of merchandise inventories, outbound transportation costs, warehousing and distribution costs, store, warehouse and distribution centre occupancy costs, as well as the transfer from accumulated other comprehensive income of any gains (losses) on qualifying cash flow hedges related to the purchase of merchandise inventories. Vendor rebates The Corporation records vendor rebates, consisting of volume purchase rebates, when it is probable that they will be received and the amounts are reasonably estimable. The rebates are recorded as a reduction of inventory purchases and are reflected as a reduction of cost of sales in the consolidated statement of net earnings and comprehensive income (loss). General, administrative and store operating expenses The Corporation includes store and head office salaries and benefits, repairs and maintenance, professional fees, store supplies and other related expenses in general, administrative and store operating expenses. Earnings per common share Earnings per common share is determined using the weighted average number of common shares outstanding during the year. Diluted earnings per common share is determined using the treasury share method to evaluate the dilutive effect of share options. Under this method, instruments with a dilutive effect are considered to have been exercised at the beginning of the year, or at the time of issuance, if later, and the proceeds received are considered to have been used to redeem common shares at the average market price during the year. Leases Finance leases Assets held under leases which result in the Corporation receiving substantially all the risks and rewards of ownership of the asset ("finance leases") are capitalized at the lower of the fair value of the property and equipment or the estimated present value of the minimum lease payments. The corresponding finance lease obligation is included within interest bearing liabilities. The interest element is amortized using the effective interest rate method. Operating leases The Corporation leases stores, five warehouses, a distribution centre and corporate headquarters. Leases in which a significant portion of the risks and rewards of ownership are retained by the lessor are classified as operating leases. The Corporation recognizes rental expense incurred and inducements received from landlords on a straight-line basis over the term of the lease. Any difference between the calculated expense and the amounts actually paid is reflected as deferred lease inducements in the Corporation's consolidated statement of financial position. Contingent rental expense is recognized when the achievement of specified sales targets is considered probable. Deferred leasing costs and deferred tenant allowances are recorded on the consolidated statement of financial position and amortized using the straight-line method over the term of the respective lease. Share-based compensation The Corporation recognizes a compensation expense for options granted based on the fair value of the options at the grant date, using the Black-Scholes option pricing model. The options granted by the Corporation vest in tranches (graded vesting); accordingly, the expense is recognized in vesting tranches. The total amount to be expensed is determined by reference to the fair value of the options granted. The impact of any service and non-market performance vesting conditions (for example, profitability, sales growth targets and retaining an employee of the entity over a specified time period) are excluded from the fair value calculation. Non-market performance vesting conditions are included in assumptions about the number of options that are expected to vest. The total expense is recognized over the vesting period, which is the period over which all of the specified vesting conditions are to be satisfied. At the end of each reporting period, the Corporation revises its estimates of the number of options that are expected to vest based on the non-market performance vesting conditions. The Corporation recognizes the impact of the revision to original estimates, if any, in the consolidated statement of net earnings and comprehensive income (loss), with a corresponding adjustment to contributed surplus. The option holders have the right to exercise their options on a cash or cashless basis. The cash paid for the shares issued when the options are exercised is credited, together with the related compensation costs, to share capital (nominal value), net of any directly attributable transaction costs. 5 Critical Accounting Judgments and Estimates The preparation of financial statements requires management to make estimates and assumptions using judgment that affect the application of accounting policies and the reported amounts of assets and liabilities, income and expenses during the reporting period. Estimates and other judgments are continually evaluated and are based on management's experience and other factors, including expectations about future events that are believed to be reasonable under the circumstances. Actual results may differ from those estimates. The following discusses the most significant accounting judgments and estimates that the Corporation made in the preparation of the consolidated financial statements. Income taxes Judgment - Judgment is required in determining income taxes. There are transactions and calculations for which the ultimate tax determination is uncertain. The Corporation recognizes liabilities for anticipated tax audit issues based on estimates of whether additional taxes will be due. Where the final tax outcome of these matters differs from the amounts that were initially recorded, such differences will impact the current and deferred income tax assets and liabilities in the period in which such determination is made. Property, plant and equipment Estimate - Estimates of useful lives, residual values and methods of depreciation are reviewed annually. Any changes, based on additional available information, are accounted for prospectively as a change in accounting estimate. Valuation of merchandise inventories Estimate-Store merchandise inventories are valued at the lower of cost and net realizable value, with cost being determined by the retail inventory method. Under the retail inventory method, merchandise inventories are converted to a cost basis by applying an average cost-to-sell ratio. Merchandise inventories that are at the distribution centre or warehouses and inventories that are in transit from suppliers are measured at the lower of cost and net realizable value, with cost determined on a weighted average cost basis. Merchandise inventories include items that have been marked down to management's best estimate of their net realizable value and are included in cost of sales in the period in which the markdown is determined. The Corporation estimates its inventory provisions based on the consideration of a variety of factors, including quantities of slow-moving or carryover seasonal merchandise on hand, historical markdown statistics, future merchandising plans and inventory shrinkage. The accuracy of the Corporation's estimates can be affected by many factors, some of which are beyond its control, including changes in economic conditions and consumer buying trends. Historically, the Corporation has not experienced significant differences in its estimates of markdowns compared with actual results. Changes to the inventory provisions can have a material impact on the results of the Corporation. Impairment of goodwill and trade name Estimate - Goodwill and trade name are not subject to amortization and are tested for impairment annually or more frequently if events or circumstances indicate that the assets might be impaired. Impairment is identified by comparing the recoverable amount of the CGU to its carrying value. To the extent the CGU's carrying amount exceeds its recoverable amount, an impairment loss is recognized in the consolidated statement of net earnings and comprehensive income (loss). The recoverable amount of the CGU is based on the fair value less costs of disposal. The fair value is the price tStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started