Answered step by step

Verified Expert Solution

Question

1 Approved Answer

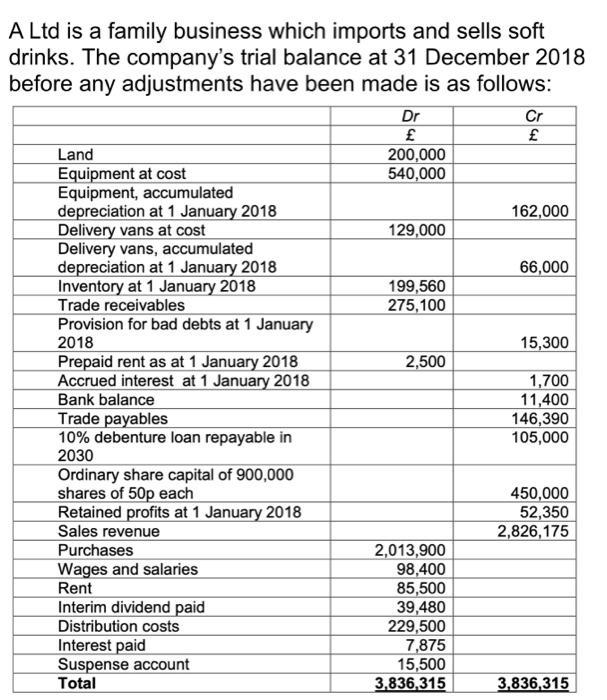

A Ltd is a family business which imports and sells soft drinks. The company's trial balance at 31 December 2018 before any adjustments have

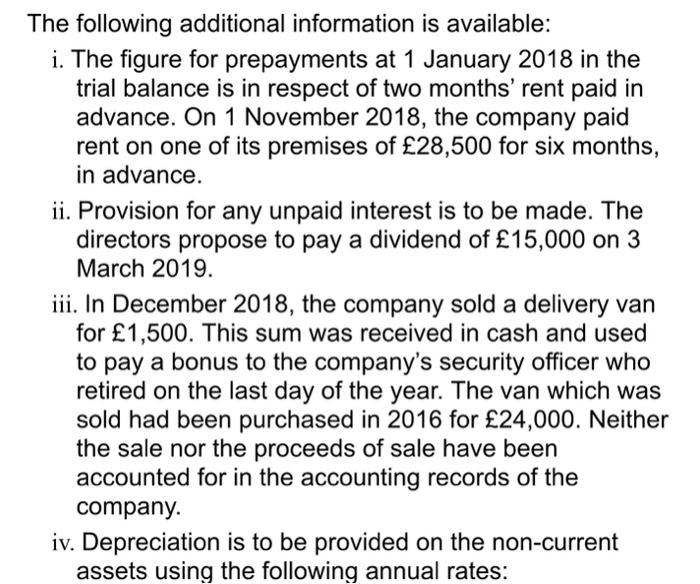

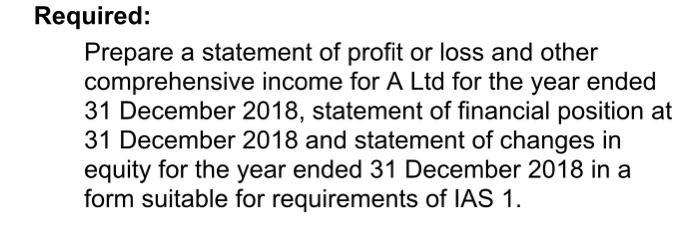

A Ltd is a family business which imports and sells soft drinks. The company's trial balance at 31 December 2018 before any adjustments have been made is as follows: Land Equipment at cost Equipment, accumulated depreciation at 1 January 2018 Delivery vans at cost Delivery vans, accumulated depreciation at 1 January 2018 Inventory at 1 January 2018 Trade receivables Provision for bad debts at 1 January 2018 Prepaid rent as at 1 January 2018 Accrued interest at 1 January 2018 Bank balance Trade payables 10% debenture loan repayable in 2030 Ordinary share capital of 900,000 shares of 50p each Retained profits at 1 January 2018 Sales revenue Purchases Wages and salaries Rent Interim dividend paid Distribution costs Interest paid Suspense account Total Dr 200,000 540,000 129,000 199,560 275,100 2,500 2,013,900 98,400 85,500 39,480 229,500 7,875 15,500 3,836,315 Cr 162,000 66,000 15,300 1,700 11,400 146,390 105,000 450,000 52,350 2,826,175 3,836,315 The following additional information is available: i. The figure for prepayments at 1 January 2018 in the trial balance is in respect of two months' rent paid in advance. On 1 November 2018, the company paid rent on one of its premises of 28,500 for six months, in advance. ii. Provision for any unpaid interest is to be made. The directors propose to pay a dividend of 15,000 on 3 March 2019. iii. In December 2018, the company sold a delivery van for 1,500. This sum was received in cash and used to pay a bonus to the company's security officer who retired on the last day of the year. The van which was sold had been purchased in 2016 for 24,000. Neither the sale nor the proceeds of sale have been accounted for in the accounting records of the company. iv. Depreciation is to be provided on the non-current assets using the following annual rates: Land nil Equipment 10% per year on a straight line basis Delivery vans 20% per year on a reducing balance basis A full year's depreciation is provided in the year of acquisition and no depreciation is provided in the year of disposal. v. The inventory was counted on 31 December 2018 and valued, at cost, at 219,000. Included in this were some crates of soft drinks which cost 6,000, which were damaged and it is believed these goods could be sold for 1,500. vi. A customer owing 9,600 has recently been declared bankrupt. The company does not expect to recover any of this. A provision for bad debts of 3% of remaining trade receivables is to be provided. vii. Corporation tax for the year ended 31 December 2018 is estimated to be 62,000 and is to be paid on 1 October 2019. viii. The company's bookkeeper is new to the job and is not sure how to deal with the following items: (i) A one-off payment of 10,000 was received on 30 June 2018 as consideration for the company agreeing to carry an advertisement for a leading brand of soft drinks on two of its delivery vans for the year ended 30 June 2019. All the cost of respraying the vans was borne by the advertiser. (ii) The company's corporation tax liability for the year ended 31 December 2017 had been estimated as 65,800. However, the UK tax authority (known as HMRC) disputed this figure and the final liability was agreed and paid by the Company on 1 October 2018 as 91,300. She has therefore credited and debited respectively the balances relating to these two items (i) and (ii) to a suspense account in the trial balance. Required: Prepare a statement of profit or loss and other comprehensive income for A Ltd for the year ended 31 December 2018, statement of financial position at 31 December 2018 and statement of changes in equity for the year ended 31 December 2018 in a form suitable for requirements of IAS 1.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the financial statements for A Ltd in accordance with the requirements of IAS 1 we will start by analyzing the given information and making the necessary adjustments Then we will present th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started