Answered step by step

Verified Expert Solution

Question

1 Approved Answer

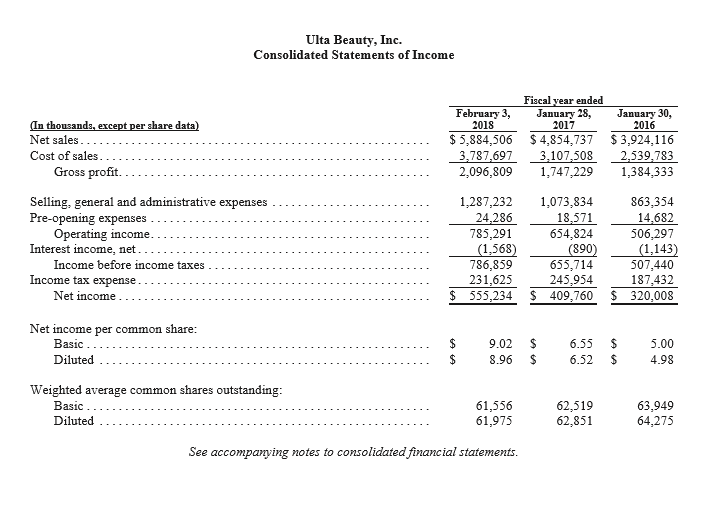

?a. Which method, single-step or multipe step is used in this statement? c. Calculate the gross profit ratio for each of the years reported. Briefly

?a. Which method, single-step or multipe step is used in this statement?

c. Calculate the gross profit ratio for each of the years reported. Briefly evaluate the trend of these results.

d. Is operating income increasing or decreasing for the years reported?

e. Does the company reportany unusual or infrequently ocurring items? If so, what are the effects of these items on net income and earnings per share.

Ulta Beauty, Inc. Consolidated Statements of Income Fiscal year ended January 28, February 3, 2018 January 30, 2016 thousand share data) 2017 $5,884,506 $4,854,737 $3,924,116 3.787,697 3,107508 2,539,783 2,096,8091,747,229 1,384,333 Net sales Cost of sales Gross profit. Selling, general and administrative expenses .. Pre-opening expenses 1,287,232 1,073,834 18,571 654,824 890 655,714 231625245.959 863,354 14,682 506,297 1,143 507,440 187,432 24,286 Operating income 785,291 65 1,568 786,859 Interest income, net Income before income taxes Income tax expense Net income $ 555,234 409,760 320,008 Net income per common s hare Basic Diluted $ 9.02 S 8.96 $ 6.55 6.52 4.98 5.00 Weighted average common shares outstanding Basic Diluted 61,556 61,975 62,519 62,851 63,949 64,275 See accompanying notes to consolidated financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started