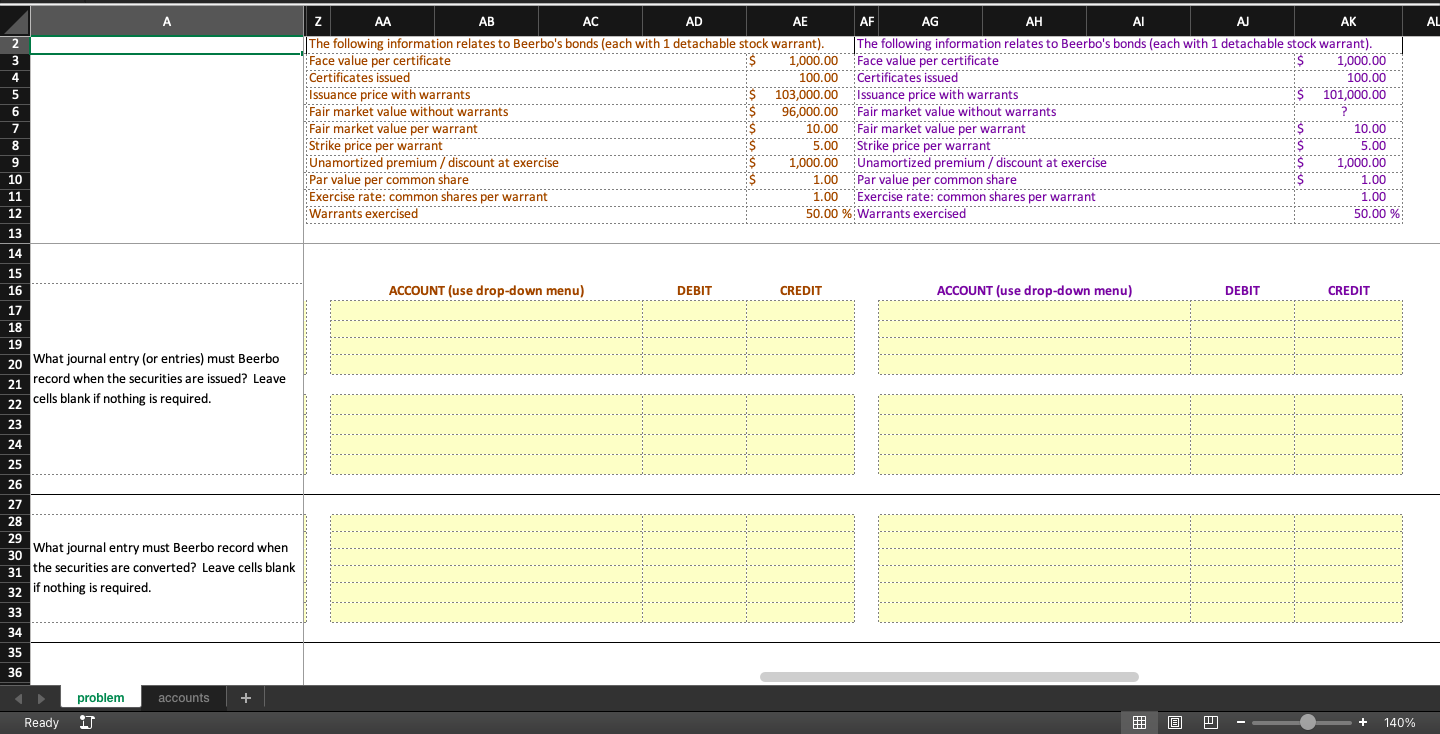

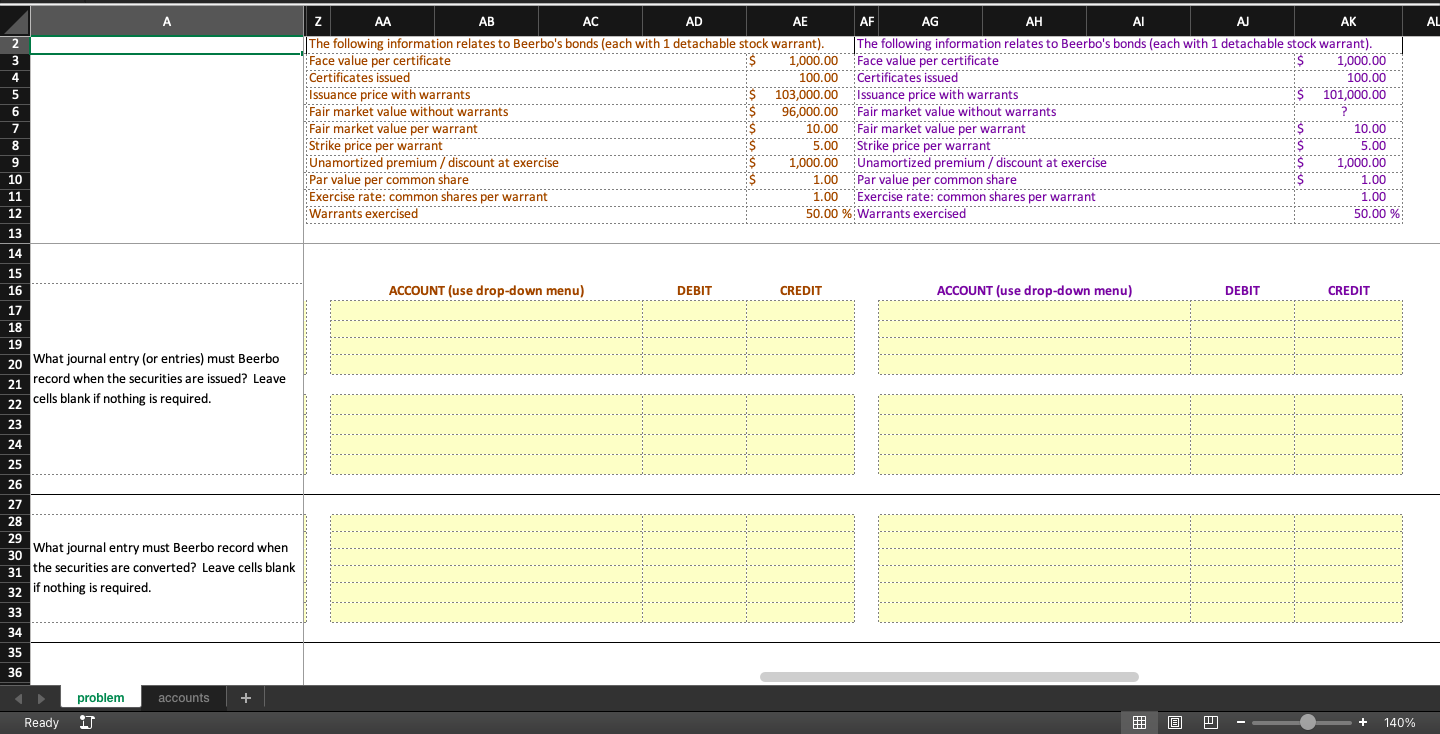

A Z AA AB AC AD AE AF AG AH AJ AK AL 2 3 4 5 6 The following information relates to Beerbo's bonds (each with 1 detachable stock warrant). The following information relates to Beerbo's bonds (each with 1 detachable stock warrant). Face value per certificate S 1,000.00 Face value per certificate 1,000.00 Certificates issued 100.00 Certificates issued 100.00 Issuance price with warrants $ 103,000.00 Issuance price with warrants $ 101,000.00 Fair market value without warrants ES 96,000.00 Fair market value without warrants Fair market value per warrant $ 10.00 Fair market value per warrant S 10.00 Strike price per warrant $ Strike price per warrant Unamortized premium / discount at exercise $ 1,000.00 Unamortized premium / discount at exercise 1,000.00 Par value per common share $ Par value per common share 1.00 Exercise rate: common shares per warrant 1.00 Exercise rate: common shares per warrant 1.00 Warrants exercised 50.00 % Warrants exercised 50.00 % 7 8 5.00 5.00 9 10 1.00 11 12 --- 13 14 15 16 ACCOUNT (use drop-down menu) DEBIT CREDIT ACCOUNT (use drop-down menu) DEBIT DEBIT CREDIT ............ ---- 17 18 19 20 What journal entry (or entries) must Beerbo record when the securities are issued? Leave 22 cells blank if nothing is required. 21 23 24 25 26 27 28 29 30 What journal entry must Beerbo record when 31 the securities are converted? Leave cells blank 32 if nothing is required. 33 34 35 36 problem accounts + Ready 17 + 140% A Z AA AB AC AD AE AF AG AH AJ AK AL 2 3 4 5 6 The following information relates to Beerbo's bonds (each with 1 detachable stock warrant). The following information relates to Beerbo's bonds (each with 1 detachable stock warrant). Face value per certificate S 1,000.00 Face value per certificate 1,000.00 Certificates issued 100.00 Certificates issued 100.00 Issuance price with warrants $ 103,000.00 Issuance price with warrants $ 101,000.00 Fair market value without warrants ES 96,000.00 Fair market value without warrants Fair market value per warrant $ 10.00 Fair market value per warrant S 10.00 Strike price per warrant $ Strike price per warrant Unamortized premium / discount at exercise $ 1,000.00 Unamortized premium / discount at exercise 1,000.00 Par value per common share $ Par value per common share 1.00 Exercise rate: common shares per warrant 1.00 Exercise rate: common shares per warrant 1.00 Warrants exercised 50.00 % Warrants exercised 50.00 % 7 8 5.00 5.00 9 10 1.00 11 12 --- 13 14 15 16 ACCOUNT (use drop-down menu) DEBIT CREDIT ACCOUNT (use drop-down menu) DEBIT DEBIT CREDIT ............ ---- 17 18 19 20 What journal entry (or entries) must Beerbo record when the securities are issued? Leave 22 cells blank if nothing is required. 21 23 24 25 26 27 28 29 30 What journal entry must Beerbo record when 31 the securities are converted? Leave cells blank 32 if nothing is required. 33 34 35 36 problem accounts + Ready 17 + 140%