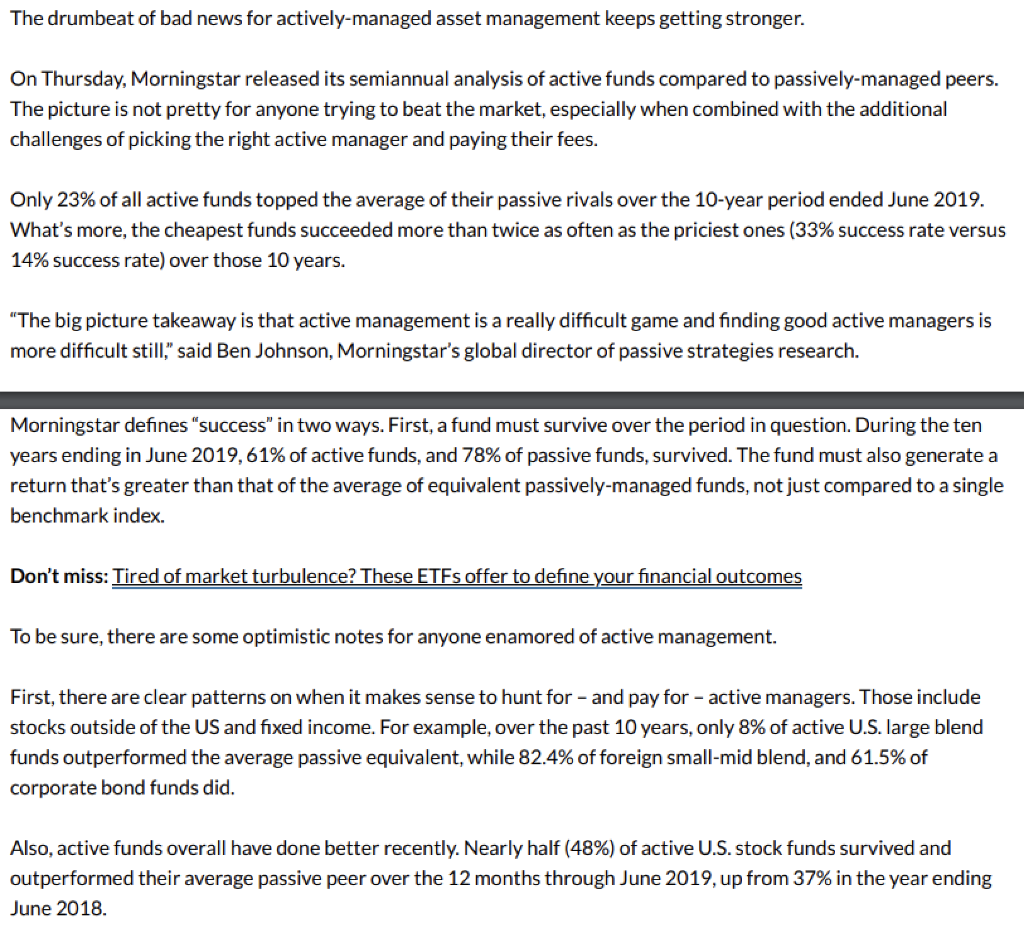

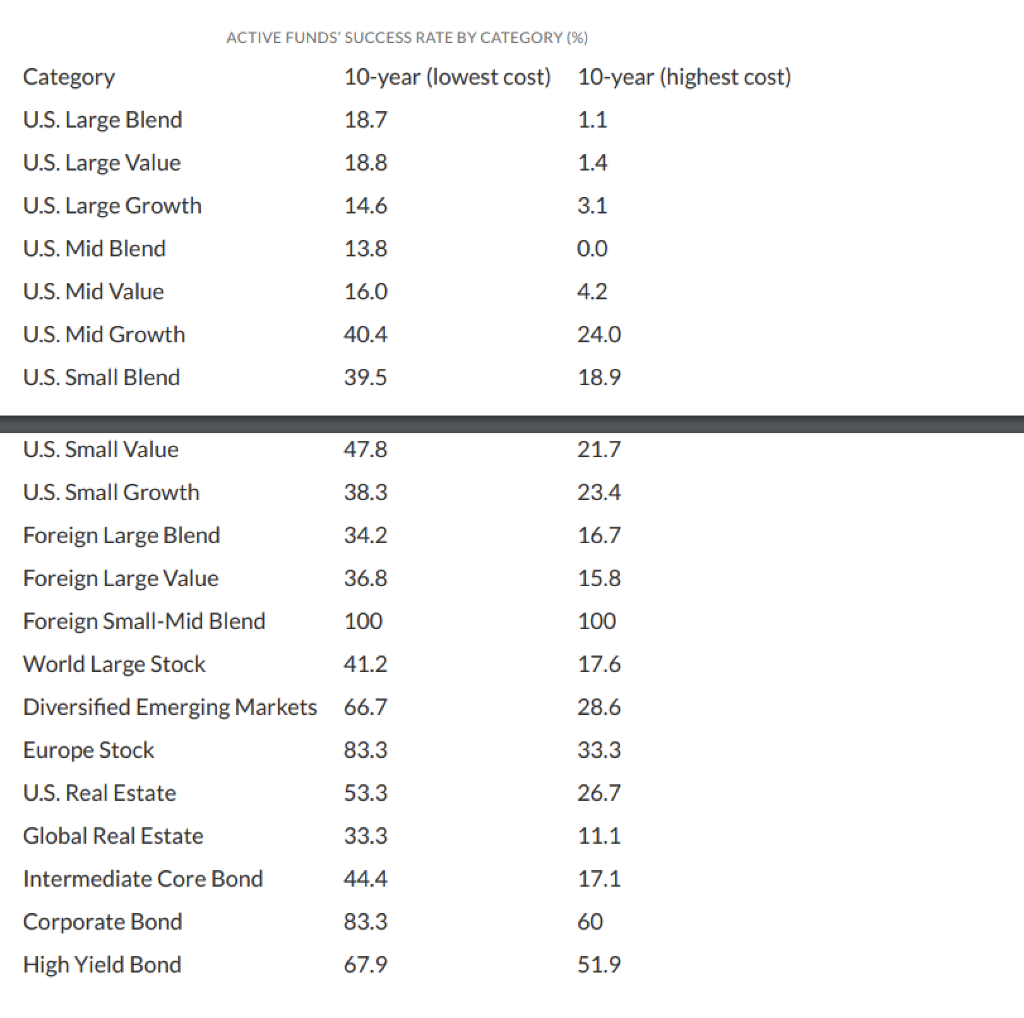

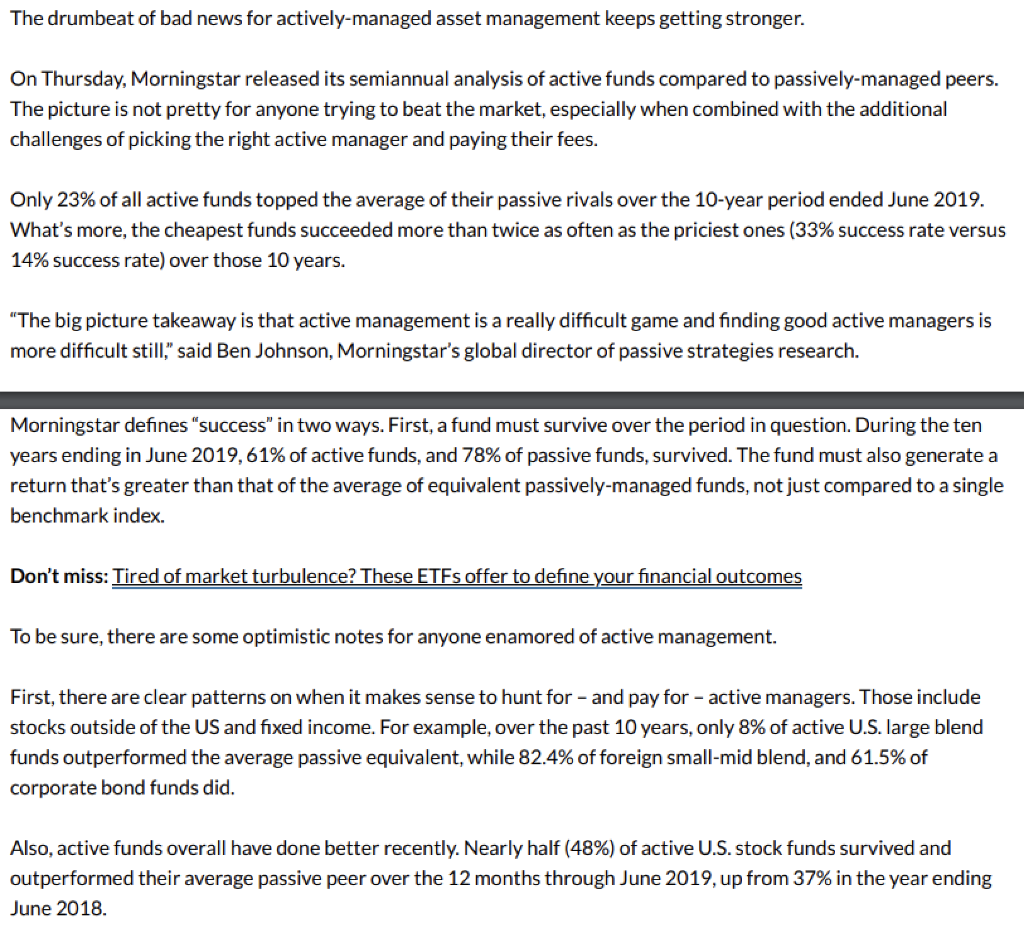

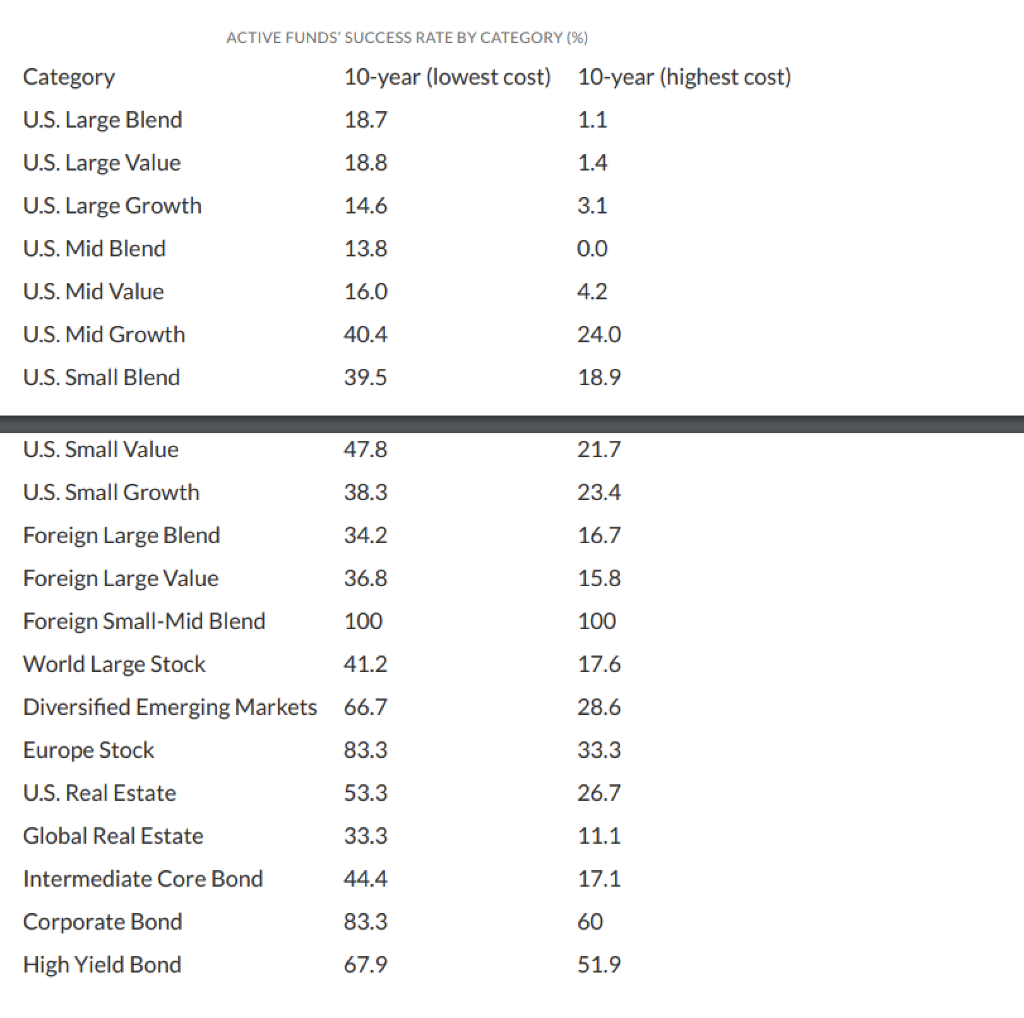

According to the Morningstar Article there are certain types of funds that might be better suited to active management. Can you provide insights on why certain fund categories might be better suited for active management than others? The drumbeat of bad news for actively-managed asset management keeps getting stronger. On Thursday, Morningstar released its semiannual analysis of active funds compared to passively-managed peers. The picture is not pretty for anyone trying to beat the market, especially when combined with the additional challenges of picking the right active manager and paying their fees. Only 23% of all active funds topped the average of their passive rivals over the 10-year period ended June 2019. What's more, the cheapest funds succeeded more than twice as often as the priciest ones (33% success rate versus 14% success rate) over those 10 years. "The big picture takeaway is that active management is a really difficult game and finding good active managers is more difficult still," said Ben Johnson, Morningstar's global director of passive strategies research. Morningstar defines "success" in two ways. First, a fund must survive over the period in question. During the ten years ending in June 2019,61% of active funds, and 78% of passive funds, survived. The fund must also generate a return that's greater than that of the average of equivalent passively-managed funds, not just compared to a single benchmark index. Don't miss: Tired of market turbulence? These ETFs offer to define your financial outcomes To be sure, there are some optimistic notes for anyone enamored of active management. First, there are clear patterns on when it makes sense to hunt for and pay for - active managers. Those include stocks outside of the US and fixed income. For example, over the past 10 years, only 8% of active U.S. large blend funds outperformed the average passive equivalent, while 82.4% of foreign small-mid blend, and 61.5% of corporate bond funds did. Also, active funds overall have done better recently. Nearly half (48%) of active U.S. stock funds survived and outperformed their average passive peer over the 12 months through June 2019, up from 37% in the year ending June 2018. Still, "nearly half" isn't the same thing as "all," "most," or even just half. That means success may come down to looking for the best bang for the buck. Related: There's a 'bubble' in passive investing, says investor made famous by 'Big Short' "If there's any guidepost that investors can use, it's fees," Johnson told MarketWatch. "The lowest cost funds in any given categories had above average odds of beating their index." The table below illustrates what he means. Over the past ten years, it's hard to find categories in which it made sense to pay for active management. Then again, as some in the industry might say, past performance is no guarantee of future results. ACTIVE FUNDS' SUCCESS RATE BY CATEGORY (%) Category 10-year (lowest cost) 10-year (highest cost) 18.7 1.1 18.8 1.4 U.S. Large Blend U.S. Large Value U.S. Large Growth U.S. Mid Blend 14.6 3.1 13.8 0.0 U.S. Mid Value 16.0 4.2 U.S. Mid Growth 40.4 24.0 U.S. Small Blend 39.5 18.9 U.S. Small Value 47.8 21.7 U.S. Small Growth 38.3 23.4 34.2 16.7 36.8 15.8 100 100 Foreign Large Blend Foreign Large Value Foreign Small-Mid Blend World Large Stock Diversified Emerging Markets Europe Stock 41.2 17.6 66.7 28.6 83.3 33.3 U.S. Real Estate 53.3 26.7 Global Real Estate 33.3 11.1 Intermediate Core Bond 44.4 17.1 Corporate Bond 83.3 60 High Yield Bond 67.9 51.9 According to the Morningstar Article there are certain types of funds that might be better suited to active management. Can you provide insights on why certain fund categories might be better suited for active management than others? The drumbeat of bad news for actively-managed asset management keeps getting stronger. On Thursday, Morningstar released its semiannual analysis of active funds compared to passively-managed peers. The picture is not pretty for anyone trying to beat the market, especially when combined with the additional challenges of picking the right active manager and paying their fees. Only 23% of all active funds topped the average of their passive rivals over the 10-year period ended June 2019. What's more, the cheapest funds succeeded more than twice as often as the priciest ones (33% success rate versus 14% success rate) over those 10 years. "The big picture takeaway is that active management is a really difficult game and finding good active managers is more difficult still," said Ben Johnson, Morningstar's global director of passive strategies research. Morningstar defines "success" in two ways. First, a fund must survive over the period in question. During the ten years ending in June 2019,61% of active funds, and 78% of passive funds, survived. The fund must also generate a return that's greater than that of the average of equivalent passively-managed funds, not just compared to a single benchmark index. Don't miss: Tired of market turbulence? These ETFs offer to define your financial outcomes To be sure, there are some optimistic notes for anyone enamored of active management. First, there are clear patterns on when it makes sense to hunt for and pay for - active managers. Those include stocks outside of the US and fixed income. For example, over the past 10 years, only 8% of active U.S. large blend funds outperformed the average passive equivalent, while 82.4% of foreign small-mid blend, and 61.5% of corporate bond funds did. Also, active funds overall have done better recently. Nearly half (48%) of active U.S. stock funds survived and outperformed their average passive peer over the 12 months through June 2019, up from 37% in the year ending June 2018. Still, "nearly half" isn't the same thing as "all," "most," or even just half. That means success may come down to looking for the best bang for the buck. Related: There's a 'bubble' in passive investing, says investor made famous by 'Big Short' "If there's any guidepost that investors can use, it's fees," Johnson told MarketWatch. "The lowest cost funds in any given categories had above average odds of beating their index." The table below illustrates what he means. Over the past ten years, it's hard to find categories in which it made sense to pay for active management. Then again, as some in the industry might say, past performance is no guarantee of future results. ACTIVE FUNDS' SUCCESS RATE BY CATEGORY (%) Category 10-year (lowest cost) 10-year (highest cost) 18.7 1.1 18.8 1.4 U.S. Large Blend U.S. Large Value U.S. Large Growth U.S. Mid Blend 14.6 3.1 13.8 0.0 U.S. Mid Value 16.0 4.2 U.S. Mid Growth 40.4 24.0 U.S. Small Blend 39.5 18.9 U.S. Small Value 47.8 21.7 U.S. Small Growth 38.3 23.4 34.2 16.7 36.8 15.8 100 100 Foreign Large Blend Foreign Large Value Foreign Small-Mid Blend World Large Stock Diversified Emerging Markets Europe Stock 41.2 17.6 66.7 28.6 83.3 33.3 U.S. Real Estate 53.3 26.7 Global Real Estate 33.3 11.1 Intermediate Core Bond 44.4 17.1 Corporate Bond 83.3 60 High Yield Bond 67.9 51.9