Answered step by step

Verified Expert Solution

Question

1 Approved Answer

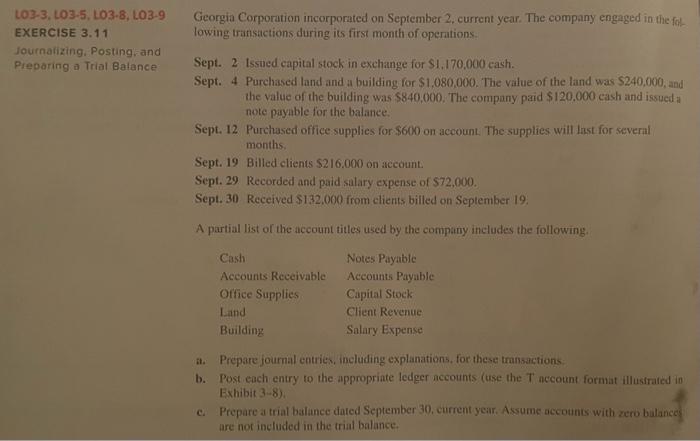

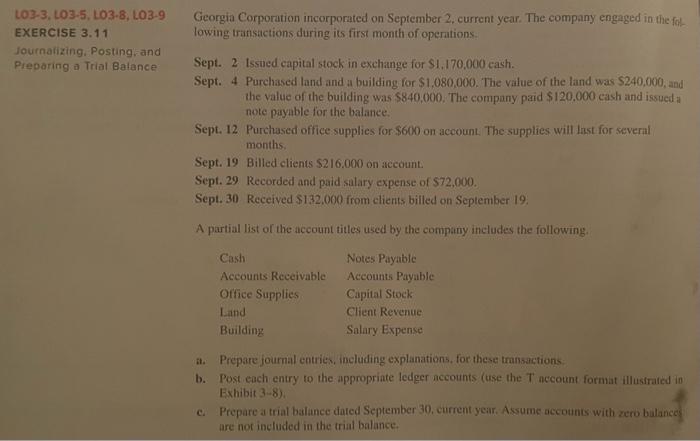

Accounting 101 L03-3, L03-5, L03-8, L03-9 Georgia Corporation incorporated on September 2, current year. The company engaged in the fol EXERCISE 3.11 lowing transactions during

Accounting 101

L03-3, L03-5, L03-8, L03-9 Georgia Corporation incorporated on September 2, current year. The company engaged in the fol EXERCISE 3.11 lowing transactions during its first month of operations. Journarizing. Posting. and Preparing a Trial Balance Sept. 2 tssicd capital stock in exchange for $1,170.000 cash. Sept. 4 Purchased land and a building for $1,080,000. The value of the land was $240,000, and the value of the building was $840,000. The company paid $120.000cash and issued in note payable for the balance. Sept. 12 Purchased office supplies for $600 on account. The supplies will last for several months. Sept. 19 Billed clients $216.000 on account. Sept. 29 Recorded and paid salary expense of $72,000. Sept. 30 Received $132.000 from clients billed on September 19. A partial list of the account titles used by the company includes the following: th. Prepare journal entrick, including explanations, for these transactions b. Post each entry to the appropriate ledger accounts (use the T account format illusirared in Exhibit 3-8). c. Prepare a trial balance dated September 30, current year. Assume accounts with zero balances are not included in the trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started