Answered step by step

Verified Expert Solution

Question

1 Approved Answer

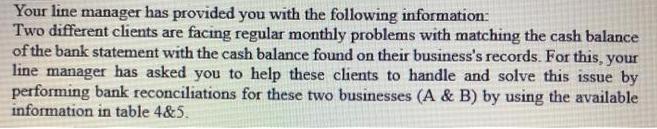

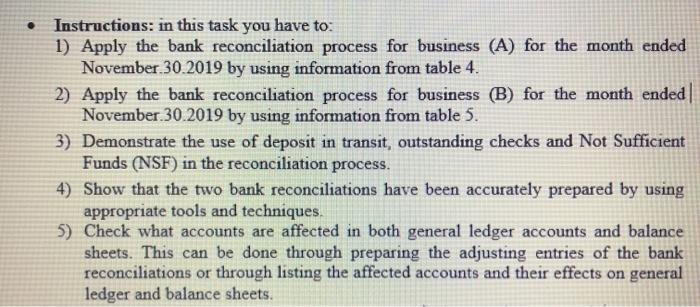

Your line manager has provided you with the following information: Two different clients are facing regular monthly problems with matching the cash balance of

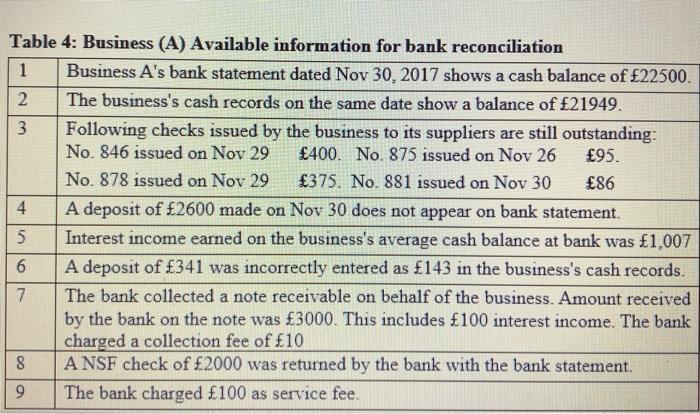

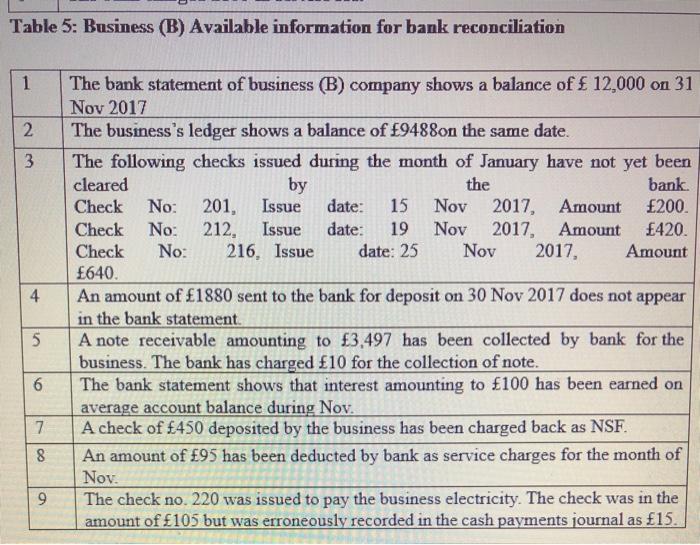

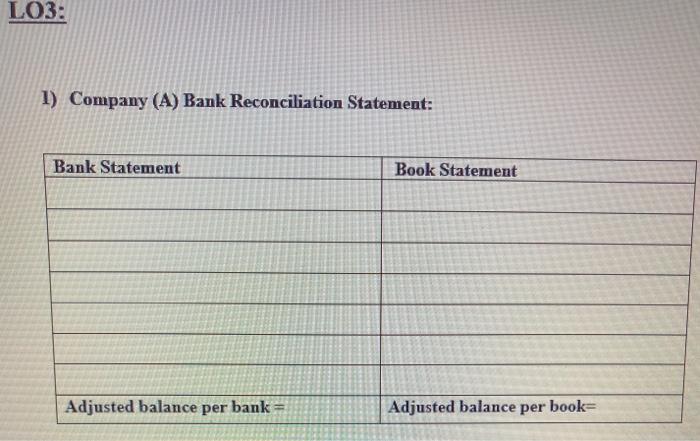

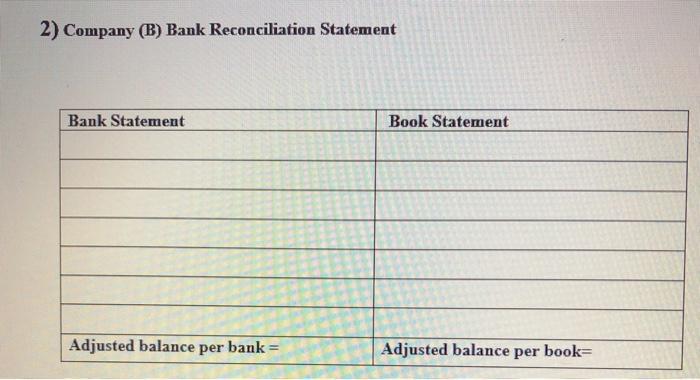

Your line manager has provided you with the following information: Two different clients are facing regular monthly problems with matching the cash balance of the bank statement with the cash balance found on their business's records. For this, your line manager has asked you to help these clients to handle and solve this issue by performing bank reconciliations for these two businesses (A & B) by using the available information in table 4&5. Instructions: in this task you have to: 1) Apply the bank reconciliation process for business (A) for the month ended November 30.2019 by using information from table 4. 2) Apply the bank reconciliation process for business (B) for the month ended November 30.2019 by using information from table 5. 3) Demonstrate the use of deposit in transit, outstanding checks and Not Sufficient Funds (NSF) in the reconciliation process. 4) Show that the two bank reconciliations have been accurately prepared by using appropriate tools and techniques. 5) Check what accounts are affected in both general ledger accounts and balance sheets. This can be done through preparing the adjusting entries of the bank reconciliations or through listing the affected accounts and their effects on general ledger and balance sheets. Table 4: Business (A) Available information for bank reconciliation 1 Business A's bank statement dated Nov 30, 2017 shows a cash balance of 22500. The business's cash records on the same date show a balance of 21949. 2 3 Following checks issued by the business to its suppliers are still outstanding: No. 846 issued on Nov 29 400. No. 875 issued on Nov 26 95. No. 878 issued on Nov 29 375. No. 881 issued on Nov 30 86 4 5 6 7 8 9 A deposit of 2600 made on Nov 30 does not appear on bank statement. Interest income earned on the business's average cash balance at bank was 1,007 A deposit of 341 was incorrectly entered as 143 in the business's cash records. The bank collected a note receivable on behalf of the business. Amount received by the bank on the note was 3000. This includes 100 interest income. The bank charged a collection fee of 10 ANSF check of 2000 was returned by the bank with the bank statement. The bank charged 100 as service fee. Table 5: Business (B) Available information for bank reconciliation 1 The bank statement of business (B) company shows a balance of 12,000 on 31 Nov 2017 The business's ledger shows a balance of 9488on the same date. 2 3 4 5 6 7 8 9 The following checks issued during the month of January have not yet been cleared by the bank. 200. 420. Check No: 201, Issue date: 15 Nov 2017, Check No: 212, Issue date: 19 Nov 2017, Check No: 216, Issue 640. date: 25 Nov 2017, Amount An amount of 1880 sent to the bank for deposit on 30 Nov 2017 does not appear in the bank statement. Amount Amount A note receivable amounting to 3,497 has been collected by bank for the business. The bank has charged 10 for the collection of note. The bank statement shows that interest amounting to 100 has been earned on average account balance during Nov. A check of 450 deposited by the business has been charged back as NSF. An amount of 95 has been deducted by bank as service charges for the month of Nov. The check no. 220 was issued to pay the business electricity. The check was in the amount of 105 but was erroneously recorded in the cash payments journal as 15. LO3: 1) Company (A) Bank Reconciliation Statement: Bank Statement Adjusted balance per bank Book Statement Adjusted balance per book- 2) Company (B) Bank Reconciliation Statement Bank Statement Adjusted balance per bank = Book Statement Adjusted balance per book- 3) Demonstrate the use of deposit in transit, outstanding checks and Not Sufficient Funds (NSF) in the reconciliation process. 4) Show that the two bank reconciliations have been accurately prepared by using appropriate tools and techniques. 5) Check what accounts are affected in both general ledger accounts and balance sheets. This can be done through preparing the adjusting entries of the bank reconciliations or through listing the affected accounts and their effects on general ledger and balance sheets. Your line manager has provided you with the following information: Two different clients are facing regular monthly problems with matching the cash balance of the bank statement with the cash balance found on their business's records. For this, your line manager has asked you to help these clients to handle and solve this issue by performing bank reconciliations for these two businesses (A & B) by using the available information in table 4&5. Instructions: in this task you have to: 1) Apply the bank reconciliation process for business (A) for the month ended November 30.2019 by using information from table 4. 2) Apply the bank reconciliation process for business (B) for the month ended November 30.2019 by using information from table 5. 3) Demonstrate the use of deposit in transit, outstanding checks and Not Sufficient Funds (NSF) in the reconciliation process. 4) Show that the two bank reconciliations have been accurately prepared by using appropriate tools and techniques. 5) Check what accounts are affected in both general ledger accounts and balance sheets. This can be done through preparing the adjusting entries of the bank reconciliations or through listing the affected accounts and their effects on general ledger and balance sheets. Table 4: Business (A) Available information for bank reconciliation 1 Business A's bank statement dated Nov 30, 2017 shows a cash balance of 22500. The business's cash records on the same date show a balance of 21949. 2 3 Following checks issued by the business to its suppliers are still outstanding: No. 846 issued on Nov 29 400. No. 875 issued on Nov 26 95. No. 878 issued on Nov 29 375. No. 881 issued on Nov 30 86 4 5 6 7 8 9 A deposit of 2600 made on Nov 30 does not appear on bank statement. Interest income earned on the business's average cash balance at bank was 1,007 A deposit of 341 was incorrectly entered as 143 in the business's cash records. The bank collected a note receivable on behalf of the business. Amount received by the bank on the note was 3000. This includes 100 interest income. The bank charged a collection fee of 10 ANSF check of 2000 was returned by the bank with the bank statement. The bank charged 100 as service fee. Table 5: Business (B) Available information for bank reconciliation 1 The bank statement of business (B) company shows a balance of 12,000 on 31 Nov 2017 The business's ledger shows a balance of 9488on the same date. 2 3 4 5 6 7 8 9 The following checks issued during the month of January have not yet been cleared by the bank. Check No: 201, Issue date: 15 Nov 2017, 200. 420. Check No: 212, Issue Check No: 216, Issue 640. date: 19 Nov 2017, date: 25 Nov 2017, Amount An amount of 1880 sent to the bank for deposit on 30 Nov 2017 does not appear in the bank statement. Amount Amount A note receivable amounting to 3,497 has been collected by bank for the business. The bank has charged 10 for the collection of note. The bank statement shows that interest amounting to 100 has been earned on average account balance during Nov. A check of 450 deposited by the business has been charged back as NSF. An amount of 95 has been deducted by bank as service charges for the month of Nov. The check no. 220 was issued to pay the business electricity. The check was in the amount of 105 but was erroneously recorded in the cash payments journal as 15. LO3: 1) Company (A) Bank Reconciliation Statement: Bank Statement Adjusted balance per bank Book Statement Adjusted balance per book- 2) Company (B) Bank Reconciliation Statement Bank Statement Adjusted balance per bank = Book Statement Adjusted balance per book- 3) Demonstrate the use of deposit in transit, outstanding checks and Not Sufficient Funds (NSF) in the reconciliation process. 4) Show that the two bank reconciliations have been accurately prepared by using appropriate tools and techniques. 5) Check what accounts are affected in both general ledger accounts and balance sheets. This can be done through preparing the adjusting entries of the bank reconciliations or through listing the affected accounts and their effects on general ledger and balance sheets. Your line manager has provided you with the following information: Two different clients are facing regular monthly problems with matching the cash balance of the bank statement with the cash balance found on their business's records. For this, your line manager has asked you to help these clients to handle and solve this issue by performing bank reconciliations for these two businesses (A & B) by using the available information in table 4&5. Instructions: in this task you have to: 1) Apply the bank reconciliation process for business (A) for the month ended November 30.2019 by using information from table 4. 2) Apply the bank reconciliation process for business (B) for the month ended November 30.2019 by using information from table 5. 3) Demonstrate the use of deposit in transit, outstanding checks and Not Sufficient Funds (NSF) in the reconciliation process. 4) Show that the two bank reconciliations have been accurately prepared by using appropriate tools and techniques. 5) Check what accounts are affected in both general ledger accounts and balance sheets. This can be done through preparing the adjusting entries of the bank reconciliations or through listing the affected accounts and their effects on general ledger and balance sheets. Table 4: Business (A) Available information for bank reconciliation 1 Business A's bank statement dated Nov 30, 2017 shows a cash balance of 22500. The business's cash records on the same date show a balance of 21949. 2 3 Following checks issued by the business to its suppliers are still outstanding: No. 846 issued on Nov 29 400. No. 875 issued on Nov 26 95. No. 878 issued on Nov 29 375. No. 881 issued on Nov 30 86 4 5 6 7 8 9 A deposit of 2600 made on Nov 30 does not appear on bank statement. Interest income earned on the business's average cash balance at bank was 1,007 A deposit of 341 was incorrectly entered as 143 in the business's cash records. The bank collected a note receivable on behalf of the business. Amount received by the bank on the note was 3000. This includes 100 interest income. The bank charged a collection fee of 10 ANSF check of 2000 was returned by the bank with the bank statement. The bank charged 100 as service fee. Table 5: Business (B) Available information for bank reconciliation 1 The bank statement of business (B) company shows a balance of 12,000 on 31 Nov 2017 The business's ledger shows a balance of 9488on the same date. 2 3 4 5 6 7 8 9 The following checks issued during the month of January have not yet been cleared by the bank. Check No: 201, Issue date: 15 Nov 2017, 200. 420. Check No: 212, Issue Check No: 216, Issue 640. date: 19 Nov 2017, date: 25 Nov 2017, Amount An amount of 1880 sent to the bank for deposit on 30 Nov 2017 does not appear in the bank statement. Amount Amount A note receivable amounting to 3,497 has been collected by bank for the business. The bank has charged 10 for the collection of note. The bank statement shows that interest amounting to 100 has been earned on average account balance during Nov. A check of 450 deposited by the business has been charged back as NSF. An amount of 95 has been deducted by bank as service charges for the month of Nov. The check no. 220 was issued to pay the business electricity. The check was in the amount of 105 but was erroneously recorded in the cash payments journal as 15. LO3: 1) Company (A) Bank Reconciliation Statement: Bank Statement Adjusted balance per bank Book Statement Adjusted balance per book- 2) Company (B) Bank Reconciliation Statement Bank Statement Adjusted balance per bank = Book Statement Adjusted balance per book- 3) Demonstrate the use of deposit in transit, outstanding checks and Not Sufficient Funds (NSF) in the reconciliation process. 4) Show that the two bank reconciliations have been accurately prepared by using appropriate tools and techniques. 5) Check what accounts are affected in both general ledger accounts and balance sheets. This can be done through preparing the adjusting entries of the bank reconciliations or through listing the affected accounts and their effects on general ledger and balance sheets. Your line manager has provided you with the following information: Two different clients are facing regular monthly problems with matching the cash balance of the bank statement with the cash balance found on their business's records. For this, your line manager has asked you to help these clients to handle and solve this issue by performing bank reconciliations for these two businesses (A & B) by using the available information in table 4&5. Instructions: in this task you have to: 1) Apply the bank reconciliation process for business (A) for the month ended November 30.2019 by using information from table 4. 2) Apply the bank reconciliation process for business (B) for the month ended November 30.2019 by using information from table 5. 3) Demonstrate the use of deposit in transit, outstanding checks and Not Sufficient Funds (NSF) in the reconciliation process. 4) Show that the two bank reconciliations have been accurately prepared by using appropriate tools and techniques. 5) Check what accounts are affected in both general ledger accounts and balance sheets. This can be done through preparing the adjusting entries of the bank reconciliations or through listing the affected accounts and their effects on general ledger and balance sheets. Table 4: Business (A) Available information for bank reconciliation 1 Business A's bank statement dated Nov 30, 2017 shows a cash balance of 22500. The business's cash records on the same date show a balance of 21949. 2 3 Following checks issued by the business to its suppliers are still outstanding: No. 846 issued on Nov 29 400. No. 875 issued on Nov 26 95. No. 878 issued on Nov 29 375. No. 881 issued on Nov 30 86 4 5 6 7 8 9 A deposit of 2600 made on Nov 30 does not appear on bank statement. Interest income earned on the business's average cash balance at bank was 1,007 A deposit of 341 was incorrectly entered as 143 in the business's cash records. The bank collected a note receivable on behalf of the business. Amount received by the bank on the note was 3000. This includes 100 interest income. The bank charged a collection fee of 10 ANSF check of 2000 was returned by the bank with the bank statement. The bank charged 100 as service fee. Table 5: Business (B) Available information for bank reconciliation 1 The bank statement of business (B) company shows a balance of 12,000 on 31 Nov 2017 The business's ledger shows a balance of 9488on the same date. 2 3 4 5 6 7 8 9 The following checks issued during the month of January have not yet been cleared by the bank. Check No: 201, Issue date: 15 Nov 2017, 200. 420. Check No: 212, Issue Check No: 216, Issue 640. date: 19 Nov 2017, date: 25 Nov 2017, Amount An amount of 1880 sent to the bank for deposit on 30 Nov 2017 does not appear in the bank statement. Amount Amount A note receivable amounting to 3,497 has been collected by bank for the business. The bank has charged 10 for the collection of note. The bank statement shows that interest amounting to 100 has been earned on average account balance during Nov. A check of 450 deposited by the business has been charged back as NSF. An amount of 95 has been deducted by bank as service charges for the month of Nov. The check no. 220 was issued to pay the business electricity. The check was in the amount of 105 but was erroneously recorded in the cash payments journal as 15. LO3: 1) Company (A) Bank Reconciliation Statement: Bank Statement Adjusted balance per bank Book Statement Adjusted balance per book- 2) Company (B) Bank Reconciliation Statement Bank Statement Adjusted balance per bank = Book Statement Adjusted balance per book- 3) Demonstrate the use of deposit in transit, outstanding checks and Not Sufficient Funds (NSF) in the reconciliation process. 4) Show that the two bank reconciliations have been accurately prepared by using appropriate tools and techniques. 5) Check what accounts are affected in both general ledger accounts and balance sheets. This can be done through preparing the adjusting entries of the bank reconciliations or through listing the affected accounts and their effects on general ledger and balance sheets. Your line manager has provided you with the following information: Two different clients are facing regular monthly problems with matching the cash balance of the bank statement with the cash balance found on their business's records. For this, your line manager has asked you to help these clients to handle and solve this issue by performing bank reconciliations for these two businesses (A & B) by using the available information in table 4&5. Instructions: in this task you have to: 1) Apply the bank reconciliation process for business (A) for the month ended November 30.2019 by using information from table 4. 2) Apply the bank reconciliation process for business (B) for the month ended November 30.2019 by using information from table 5. 3) Demonstrate the use of deposit in transit, outstanding checks and Not Sufficient Funds (NSF) in the reconciliation process. 4) Show that the two bank reconciliations have been accurately prepared by using appropriate tools and techniques. 5) Check what accounts are affected in both general ledger accounts and balance sheets. This can be done through preparing the adjusting entries of the bank reconciliations or through listing the affected accounts and their effects on general ledger and balance sheets. Table 4: Business (A) Available information for bank reconciliation 1 Business A's bank statement dated Nov 30, 2017 shows a cash balance of 22500. The business's cash records on the same date show a balance of 21949. 2 3 Following checks issued by the business to its suppliers are still outstanding: No. 846 issued on Nov 29 400. No. 875 issued on Nov 26 95. No. 878 issued on Nov 29 375. No. 881 issued on Nov 30 86 4 5 6 7 8 9 A deposit of 2600 made on Nov 30 does not appear on bank statement. Interest income earned on the business's average cash balance at bank was 1,007 A deposit of 341 was incorrectly entered as 143 in the business's cash records. The bank collected a note receivable on behalf of the business. Amount received by the bank on the note was 3000. This includes 100 interest income. The bank charged a collection fee of 10 ANSF check of 2000 was returned by the bank with the bank statement. The bank charged 100 as service fee. Table 5: Business (B) Available information for bank reconciliation 1 The bank statement of business (B) company shows a balance of 12,000 on 31 Nov 2017 The business's ledger shows a balance of 9488on the same date. 2 3 4 5 6 7 8 9 The following checks issued during the month of January have not yet been cleared by the bank. Check No: 201, Issue date: 15 Nov 2017, 200. 420. Check No: 212, Issue Check No: 216, Issue 640. date: 19 Nov 2017, date: 25 Nov 2017, Amount An amount of 1880 sent to the bank for deposit on 30 Nov 2017 does not appear in the bank statement. Amount Amount A note receivable amounting to 3,497 has been collected by bank for the business. The bank has charged 10 for the collection of note. The bank statement shows that interest amounting to 100 has been earned on average account balance during Nov. A check of 450 deposited by the business has been charged back as NSF. An amount of 95 has been deducted by bank as service charges for the month of Nov. The check no. 220 was issued to pay the business electricity. The check was in the amount of 105 but was erroneously recorded in the cash payments journal as 15. LO3: 1) Company (A) Bank Reconciliation Statement: Bank Statement Adjusted balance per bank Book Statement Adjusted balance per book- 2) Company (B) Bank Reconciliation Statement Bank Statement Adjusted balance per bank = Book Statement Adjusted balance per book- 3) Demonstrate the use of deposit in transit, outstanding checks and Not Sufficient Funds (NSF) in the reconciliation process. 4) Show that the two bank reconciliations have been accurately prepared by using appropriate tools and techniques. 5) Check what accounts are affected in both general ledger accounts and balance sheets. This can be done through preparing the adjusting entries of the bank reconciliations or through listing the affected accounts and their effects on general ledger and balance sheets.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Company A Bank Reconciliation Statement Items Unadjusted B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started