Answered step by step

Verified Expert Solution

Question

1 Approved Answer

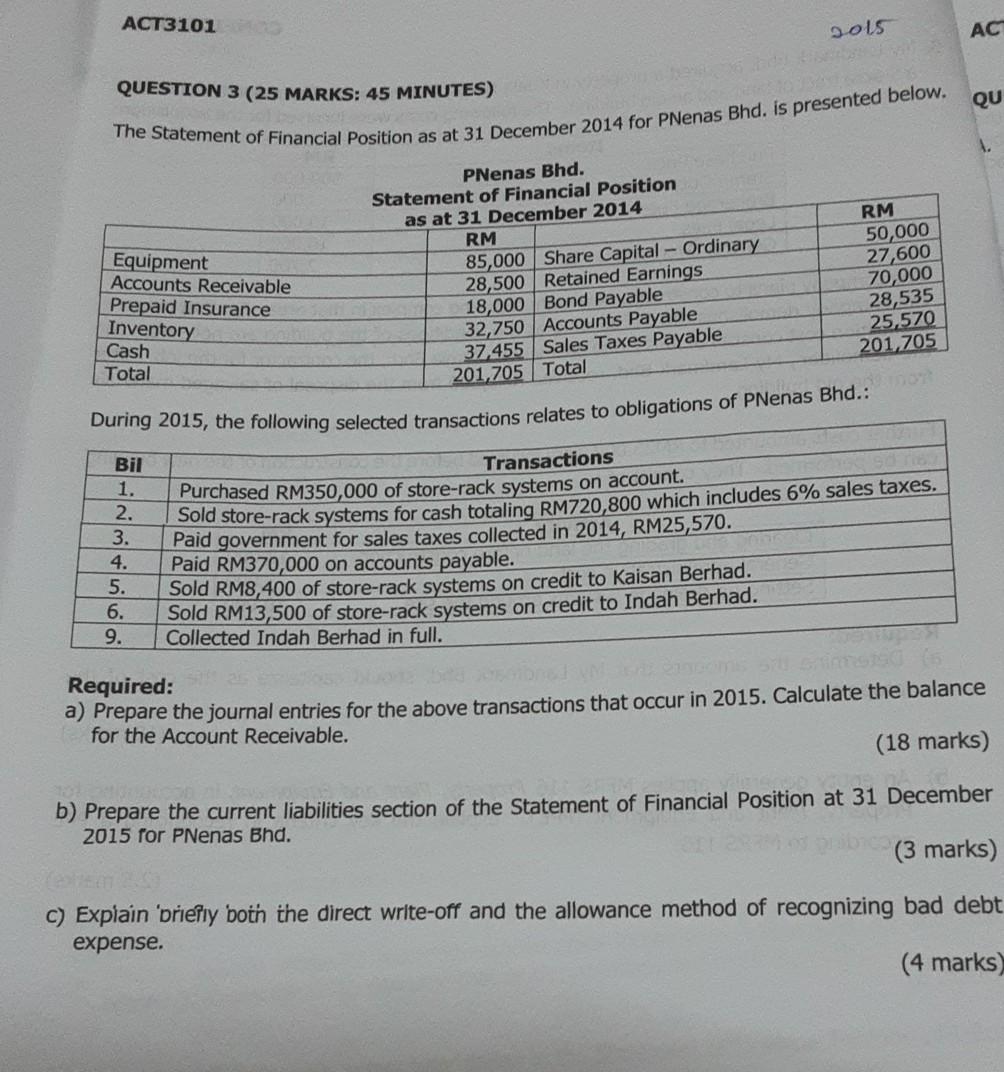

ACT3101 sols AC QUESTION 3 (25 MARKS: 45 MINUTES) QU The Statement of Financial Position as at 31 December 2014 for PNenas Bhd. is presented

ACT3101 sols AC QUESTION 3 (25 MARKS: 45 MINUTES) QU The Statement of Financial Position as at 31 December 2014 for PNenas Bhd. is presented below. Equipment Accounts Receivable Prepaid Insurance Inventory Cash Total PNenas Bhd. Statement of Financial Position as at 31 December 2014 RM 85,000 Share Capital - Ordinary 28,500 Retained Earnings 18,000 Bond Payable 32,750 Accounts Payable 37,455 Sales Taxes Payable 201.705 Total RM 50,000 27,600 70,000 28,535 25,570 201,705 During 2015, the following selected transactions relates to obligations of PNenas Bhd.: Bil 1. 2. 3. 4. 5. 6. 9. Transactions Purchased RM350,000 of store-rack systems on account. Sold store-rack systems for cash totaling RM720,800 which includes 6% sales taxes. Paid government for sales taxes collected in 2014, RM25,570. Paid RM370,000 on accounts payable. Sold RM8,400 of store-rack systems on credit to Kaisan Berhad. Sold RM13,500 of store-rack systems on credit to Indah Berhad. Collected Indah Berhad in full. Required: a) Prepare the journal entries for the above transactions that occur in 2015. Calculate the balance for the Account Receivable. (18 marks) b) Prepare the current liabilities section of the Statement of Financial Position at 31 December 2015 for PNenas Bhd. (3 marks) C) Explain 'briefly both the direct write-off and the allowance method of recognizing bad debt expense. (4 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started