Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Advanced Assignments Intra-entity sales and bonds I. Parent and its 60%, owned subsidiary. Sub, conducted the following transactions with each other: Sale of inventory During

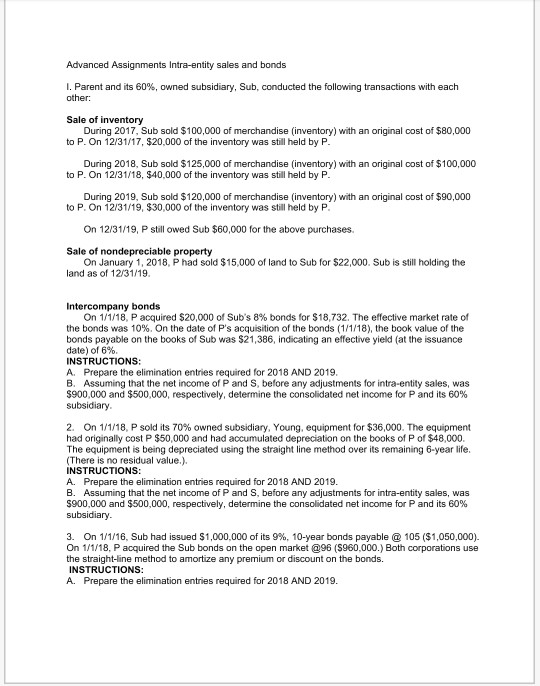

Advanced Assignments Intra-entity sales and bonds I. Parent and its 60%, owned subsidiary. Sub, conducted the following transactions with each other: Sale of inventory During 2017, Sub sold $100,000 of merchandise (inventory) with an original cost of $80,000 During 2018, Sub sold $125,000 of merchandise (inventory) with an original cost of $100,000 During 2019, Sub sold $120,000 of merchandise (inventory) with an original cost of $90,000 On 12/31/19, P still owed Sub $60,000 for the above purchases. to P. On 12/31/17, $20,000 of the inventory was still held by P to P. On 12/31/18, $40,000 of the inventory was still held by P to P. On 12/31/19, $30,000 of the inventory was still held by P Sale of nondepreciable property On January 1, 2018, P had sold $15,000 of land to Sub for $22,000. Sub is still holding the land as of 12/31/19. Intercompany bonds On 1/1/18, P acquired $20,000 of Sub's 896 bonds for $18,732. The effective market rate of the bonds was 10%. On the date of P's acquisition of the bonds (1/1/18), the book value of the bonds payable on the books of Sub was $21,386, indicating an effective yield (at the issuance date) of 6%. INSTRUCTIONS A. Prepare the elimination entries required for 2018 AND 2019 B. Assuming that the net income of P and S, before any adjustments for intra-entity sales, was S900,000 and $500,000, respectively, determine the subsidiary net income for P and its 60% 2. On 1/1/18, P sold its 70% owned subsidiary, Young, equipment for $36,000. The equipment had originally cost P $50,000 and had accumulated depreciation on the books of P of $48,000 The equipment is being depreciated using the straight line method over its remaining 6-year life. (There is no residual value.) INSTRUCTIONS: A. Prepare the elimination entries required for 2018 AND 2019 B. Assuming that the net income of P and S, before any adjustments for intra-entity sales, was $900,000 and $500,000, respectively, determine the subsidiary net income for P and its 60% 3. On 1/1/16. Sub had issued $1,000.000 of its 9%. 10-year bonds payable @ 105 ($1.050,000). On 1/1/18, P acquired the Sub bonds on the open market @96 (S960,000.) Both corporations use the straight-line method to a INSTRUCTIONS: A. Prepare the elimination entries required for 2018 AND 2019 any premium or discount on the bonds. Advanced Assignments Intra-entity sales and bonds I. Parent and its 60%, owned subsidiary. Sub, conducted the following transactions with each other: Sale of inventory During 2017, Sub sold $100,000 of merchandise (inventory) with an original cost of $80,000 During 2018, Sub sold $125,000 of merchandise (inventory) with an original cost of $100,000 During 2019, Sub sold $120,000 of merchandise (inventory) with an original cost of $90,000 On 12/31/19, P still owed Sub $60,000 for the above purchases. to P. On 12/31/17, $20,000 of the inventory was still held by P to P. On 12/31/18, $40,000 of the inventory was still held by P to P. On 12/31/19, $30,000 of the inventory was still held by P Sale of nondepreciable property On January 1, 2018, P had sold $15,000 of land to Sub for $22,000. Sub is still holding the land as of 12/31/19. Intercompany bonds On 1/1/18, P acquired $20,000 of Sub's 896 bonds for $18,732. The effective market rate of the bonds was 10%. On the date of P's acquisition of the bonds (1/1/18), the book value of the bonds payable on the books of Sub was $21,386, indicating an effective yield (at the issuance date) of 6%. INSTRUCTIONS A. Prepare the elimination entries required for 2018 AND 2019 B. Assuming that the net income of P and S, before any adjustments for intra-entity sales, was S900,000 and $500,000, respectively, determine the subsidiary net income for P and its 60% 2. On 1/1/18, P sold its 70% owned subsidiary, Young, equipment for $36,000. The equipment had originally cost P $50,000 and had accumulated depreciation on the books of P of $48,000 The equipment is being depreciated using the straight line method over its remaining 6-year life. (There is no residual value.) INSTRUCTIONS: A. Prepare the elimination entries required for 2018 AND 2019 B. Assuming that the net income of P and S, before any adjustments for intra-entity sales, was $900,000 and $500,000, respectively, determine the subsidiary net income for P and its 60% 3. On 1/1/16. Sub had issued $1,000.000 of its 9%. 10-year bonds payable @ 105 ($1.050,000). On 1/1/18, P acquired the Sub bonds on the open market @96 (S960,000.) Both corporations use the straight-line method to a INSTRUCTIONS: A. Prepare the elimination entries required for 2018 AND 2019 any premium or discount on the bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started