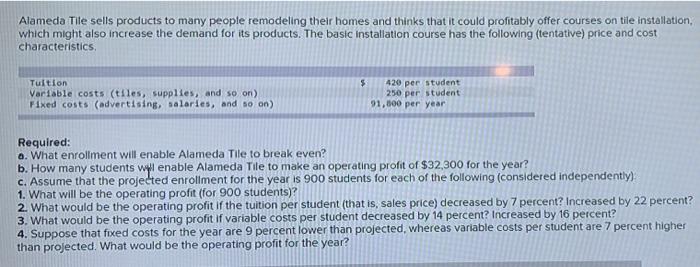

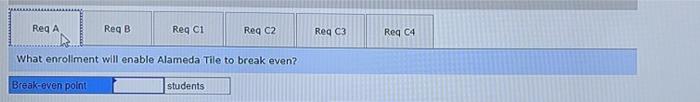

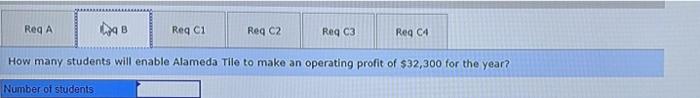

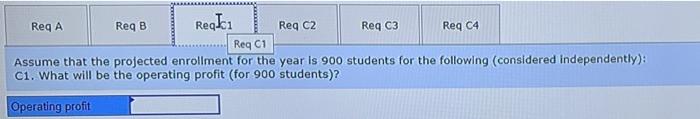

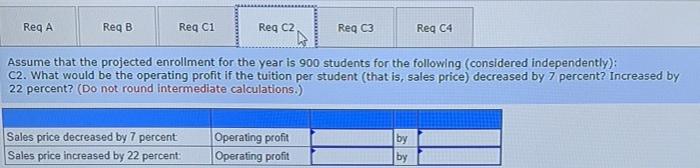

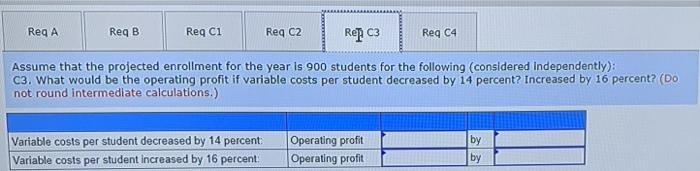

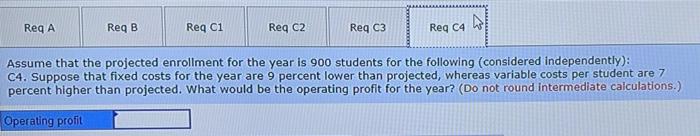

Alameda Tile sells products to many people remodeling their homes and thinks that it could profitably offer courses on tile installation, which might also increase the demand for its products. The basic installation course has the following (tentative) price and cost characteristics $ Tultion Variable costs (tiles, supplies, and so on) Fixed costs (advertising, salaries, and so on) 420 per student 250 per student 91,000 per year Required: a. What enrollment will enable Alameda Tile to break even? b. How many students will enable Alameda Tile to make an operating profit of $32,300 for the year? c. Assume that the projected enrollment for the year is 900 students for each of the following considered independently) 1. What will be the operating profit (for 900 students)? 2. What would be the operating profit if the tuition per student (that is, sales price) decreased by 7 percent? Increased by 22 percent? 3. What would be the operating profit if variable costs per student decreased by 14 percent? Increased by 16 percent? 4. Suppose that fixed costs for the year are percent lower than projected, whereas variable costs per student are 7 percent higher than projected. What would be the operating profit for the year? Reg A ReqB Reg Ci Req C2 Reg C3 Reg C4 What enrollment will enable Alameda Tile to break even? Break-even point students Reg A 19B Reg C1 Reg C2 Reg C3 Reg C4 How many students will enable Alameda Tile to make an operating profit of $32,300 for the year? Number of students Req A Reg B Reakci Reg C2 Req C3 Req C4 ReqC1 Assume that the projected enrollment for the year is 900 students for the following considered independently): C1. What will be the operating profit (for 900 students)? Operating profit Req A Reg B Req c1 Reg C2 Reg C3 Reg C4 Assume that the projected enrollment for the year is 900 students for the following considered independently): C2. What would be the operating profit if the tuition per student (that is, sales price) decreased by 7 percent? Increased by 22 percent? (Do not round intermediate calculations.) by Sales price decreased by 7 percent Sales price increased by 22 percent: Operating profit Operating profit by Reg A ReqB Req ci Reg C2 Rep C3 Req C4 Assume that the projected enrollment for the year is 900 students for the following considered Independently): C3. What would be the operating profit if variable costs per student decreased by 14 percent? Increased by 16 percent? (DO not round intermediate calculations.) Variable costs per student decreased by 14 percent Variable costs per student increased by 16 percent Operating profit Operating profit by by Req A ReqB Req C1 Reg C2 Reg C3 Reg C4 Assume that the projected enrollment for the year is 900 students for the following (considered independently): C4. Suppose that fixed costs for the year are 9 percent lower than projected, whereas variable costs per student are 7 percent higher than projected. What would be the operating profit for the year? (Do not round intermediate calculations.) Operating profit