Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Algo Rhythm Ltd (ARL) receives fixed rate income of 4% p.a. paid semi-annually, but has borrowed by issuing floating rate notes with a total

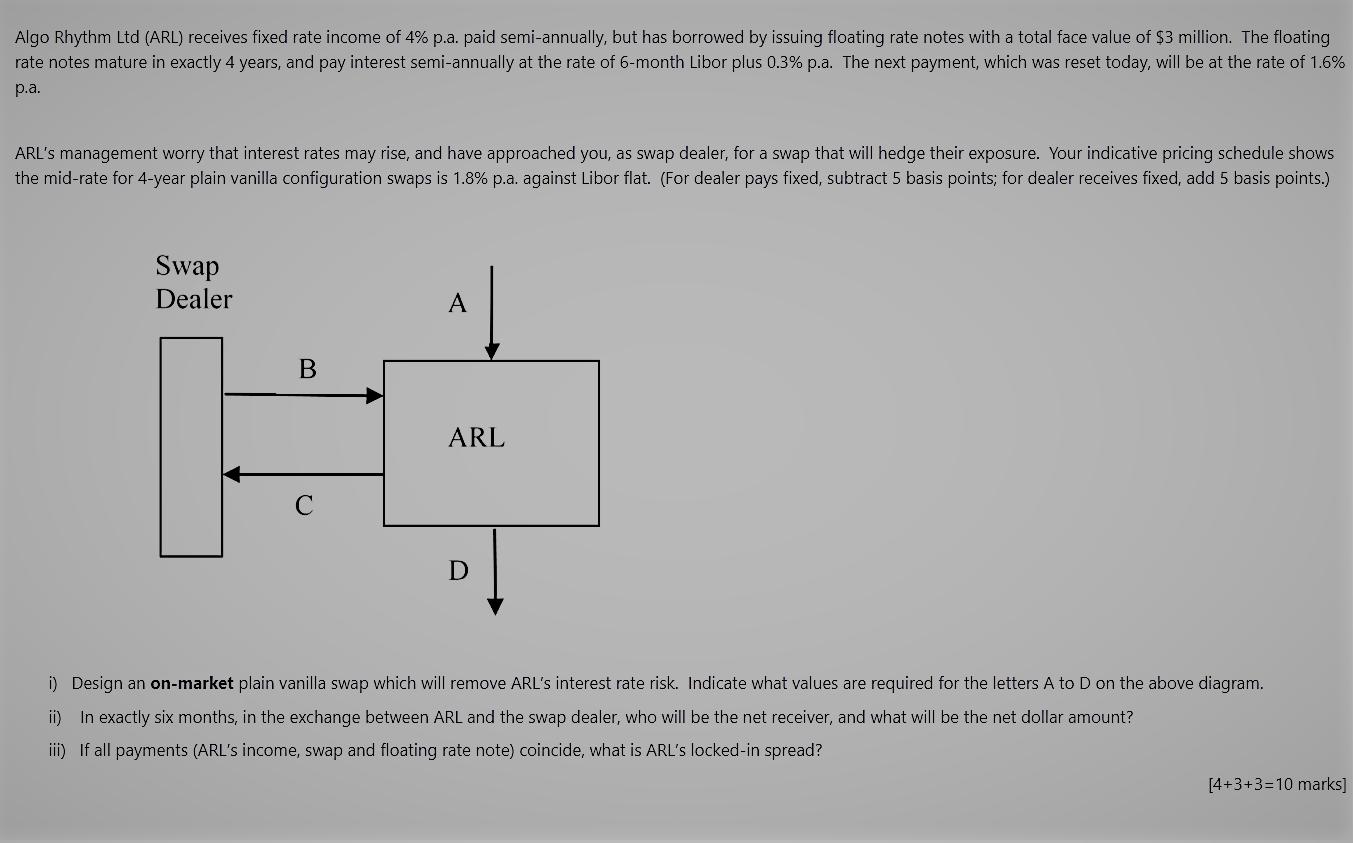

Algo Rhythm Ltd (ARL) receives fixed rate income of 4% p.a. paid semi-annually, but has borrowed by issuing floating rate notes with a total face value of $3 million. The floating rate notes mature in exactly 4 years, and pay interest semi-annually at the rate of 6-month Libor plus 0.3% p.a. The next payment, which was reset today, will be at the rate of 1.6% p.a. ARL's management worry that interest rates may rise, and have approached you, as swap dealer, for a swap that will hedge their exposure. Your indicative pricing schedule shows the mid-rate for 4-year plain vanilla configuration swaps is 1.8% p.a. against Libor flat. (For dealer pays fixed, subtract 5 basis points; for dealer receives fixed, add 5 basis points.) Swap Dealer B C A ARL D i) Design an on-market plain vanilla swap which will remove ARL's interest rate risk. Indicate what values are required for the letters A to D on the above diagram. ii) In exactly six months, in the exchange between ARL and the swap dealer, who will be the net receiver, and what will be the net dollar amount? iii) If all payments (ARL's income, swap and floating rate note) coincide, what is ARL's locked-in spread? [4+3+3=10 marks]

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

i Design an onmarket plain vanilla swap which will remove ARLs interest rate risk Indicate what valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started