Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor buys a $1,000 par value, 10.0% coupon bond with 9 years until maturity for The investor holds the bond for 3 years and

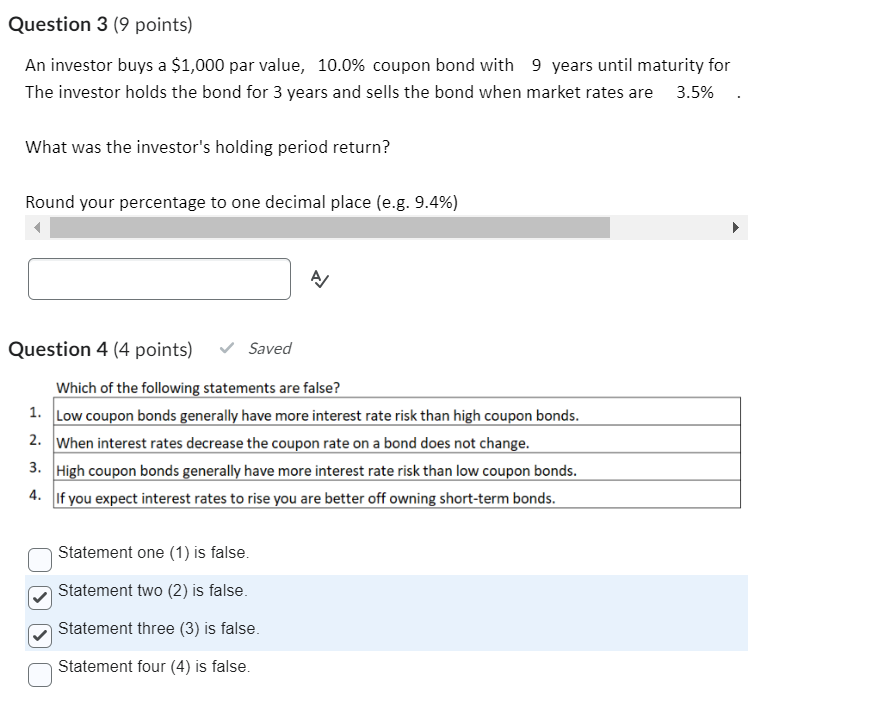

An investor buys a $1,000 par value, 10.0% coupon bond with 9 years until maturity for The investor holds the bond for 3 years and sells the bond when market rates are 3.5%. What was the investor's holding period return? Round your percentage to one decimal place (e.g. 9.4\%) A Question 4 (4 points) Which of the following statements are false? 1. Low coupon bonds generally have more interest rate risk than high coupon bonds. 2. When interest rates decrease the coupon rate on a bond does not change. 3. High coupon bonds generally have more interest rate risk than low coupon bonds. 4. If you expect interest rates to rise you are better off owning short-term bonds. Statement one (1) is false. Statement two (2) is false. Statement three (3) is false. Statement four (4) is false

An investor buys a $1,000 par value, 10.0% coupon bond with 9 years until maturity for The investor holds the bond for 3 years and sells the bond when market rates are 3.5%. What was the investor's holding period return? Round your percentage to one decimal place (e.g. 9.4\%) A Question 4 (4 points) Which of the following statements are false? 1. Low coupon bonds generally have more interest rate risk than high coupon bonds. 2. When interest rates decrease the coupon rate on a bond does not change. 3. High coupon bonds generally have more interest rate risk than low coupon bonds. 4. If you expect interest rates to rise you are better off owning short-term bonds. Statement one (1) is false. Statement two (2) is false. Statement three (3) is false. Statement four (4) is false Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started