. Answer the following questions fully.

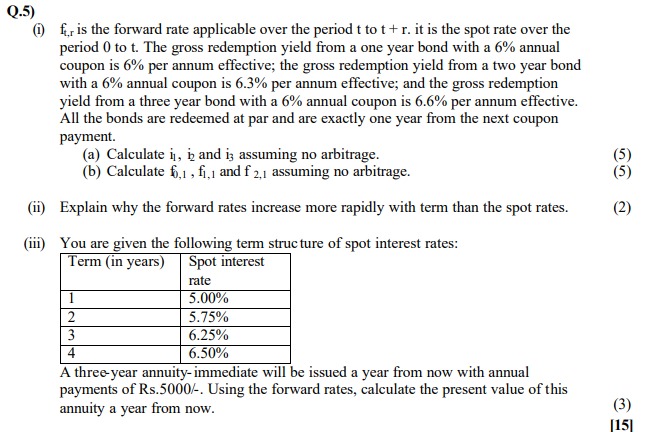

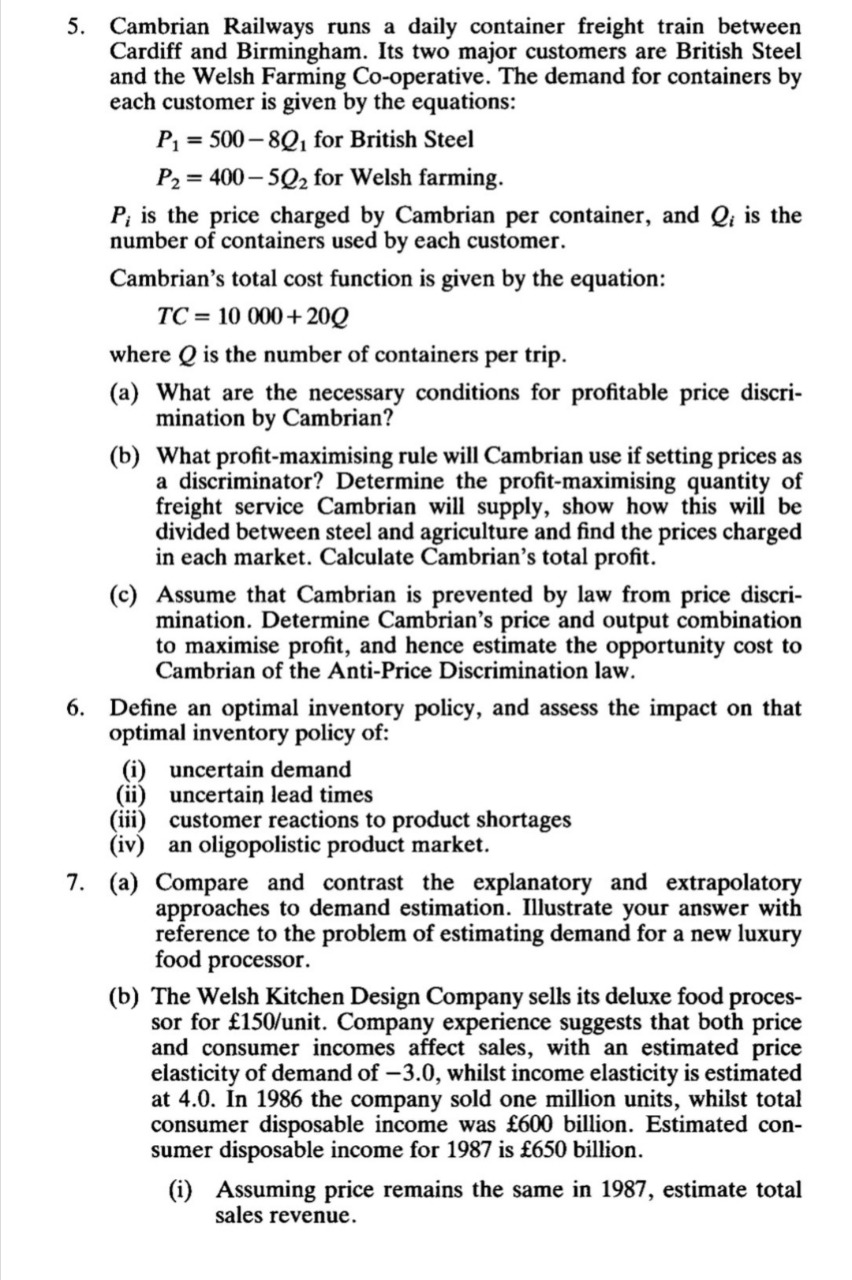

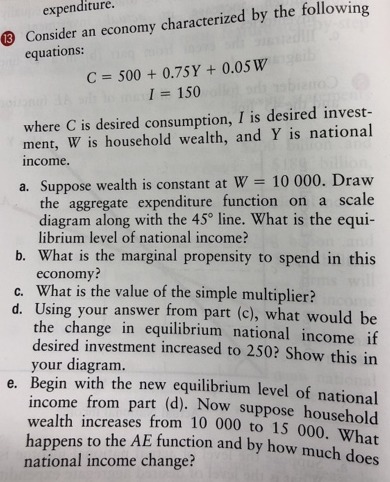

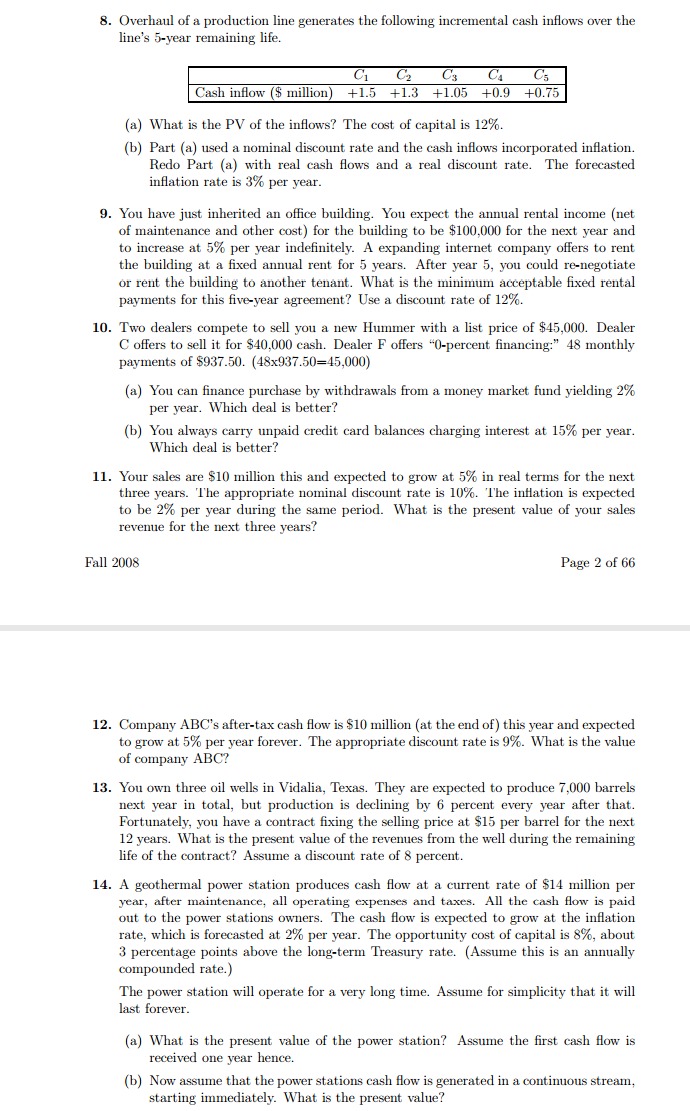

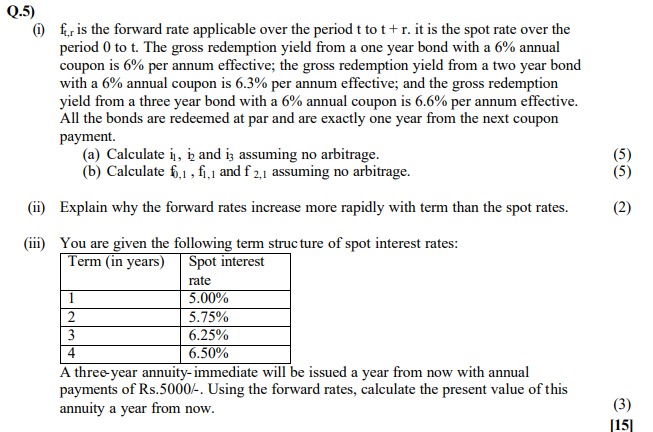

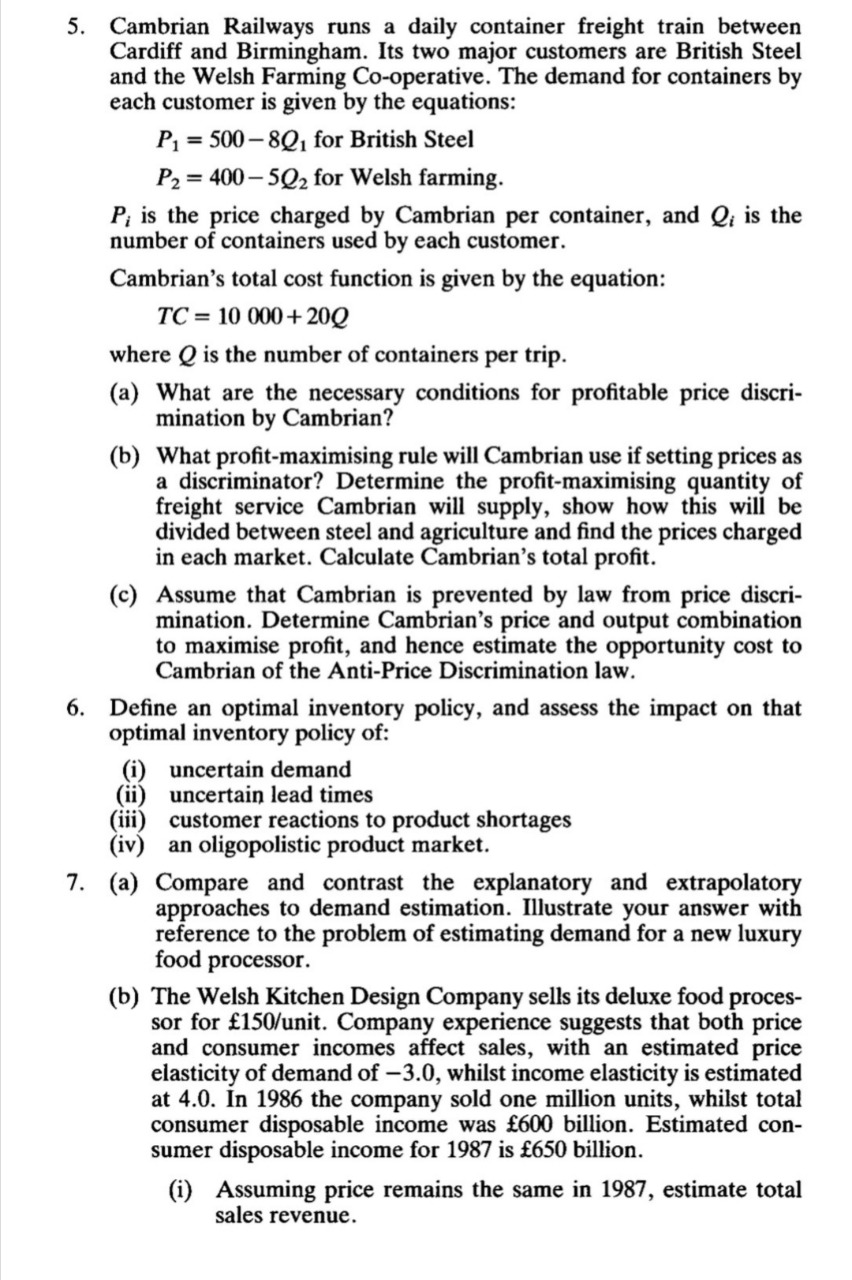

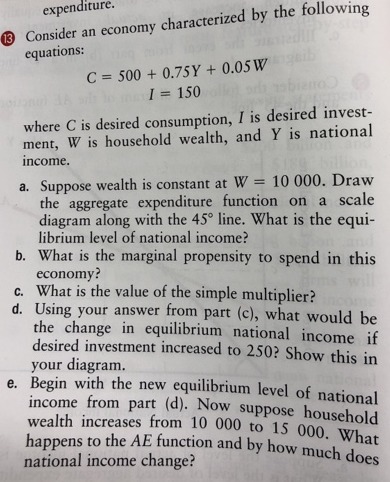

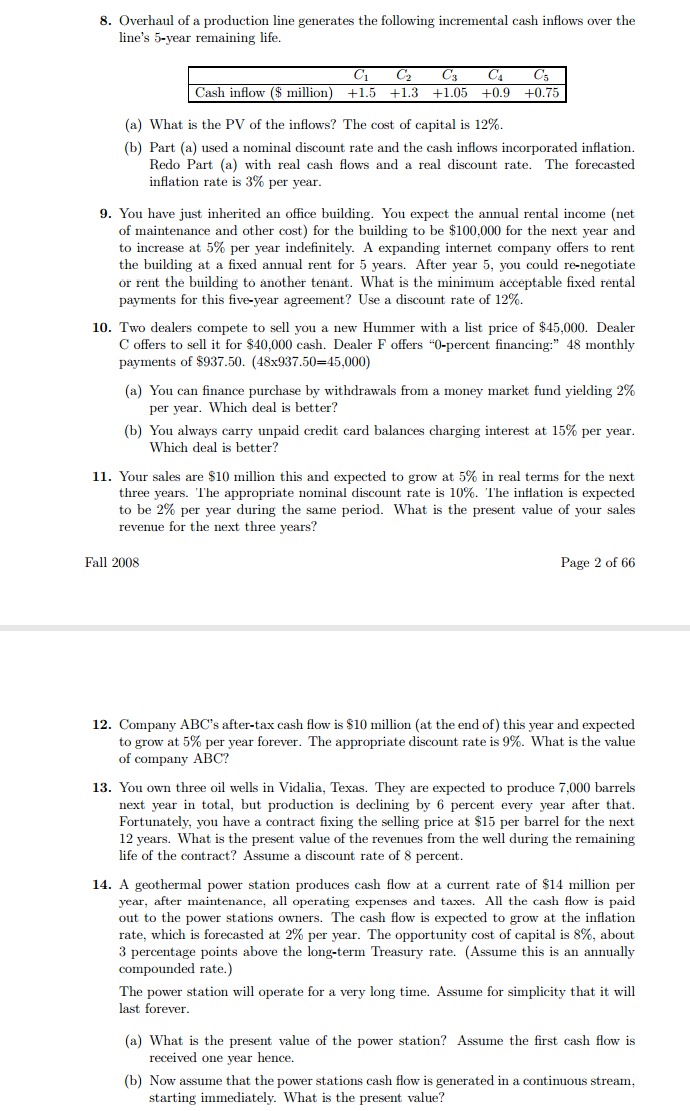

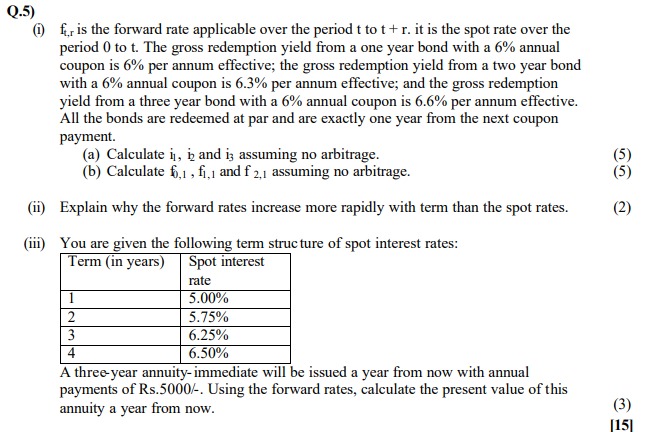

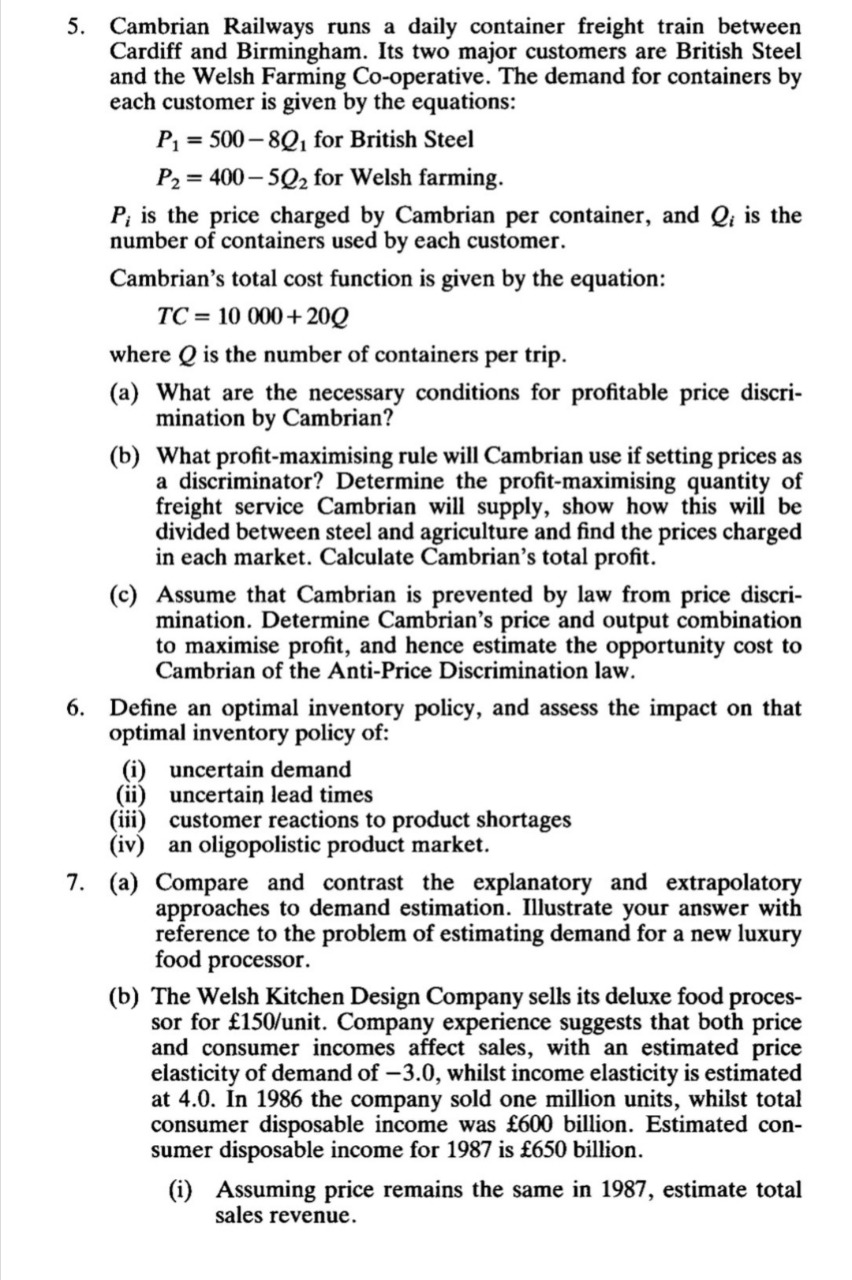

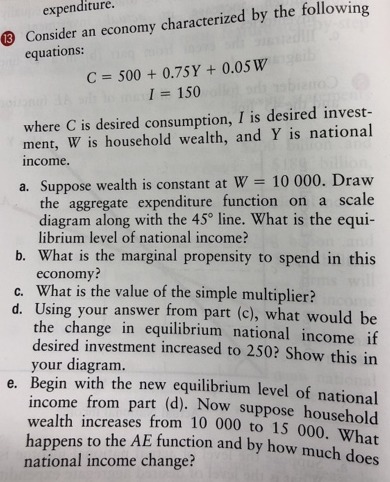

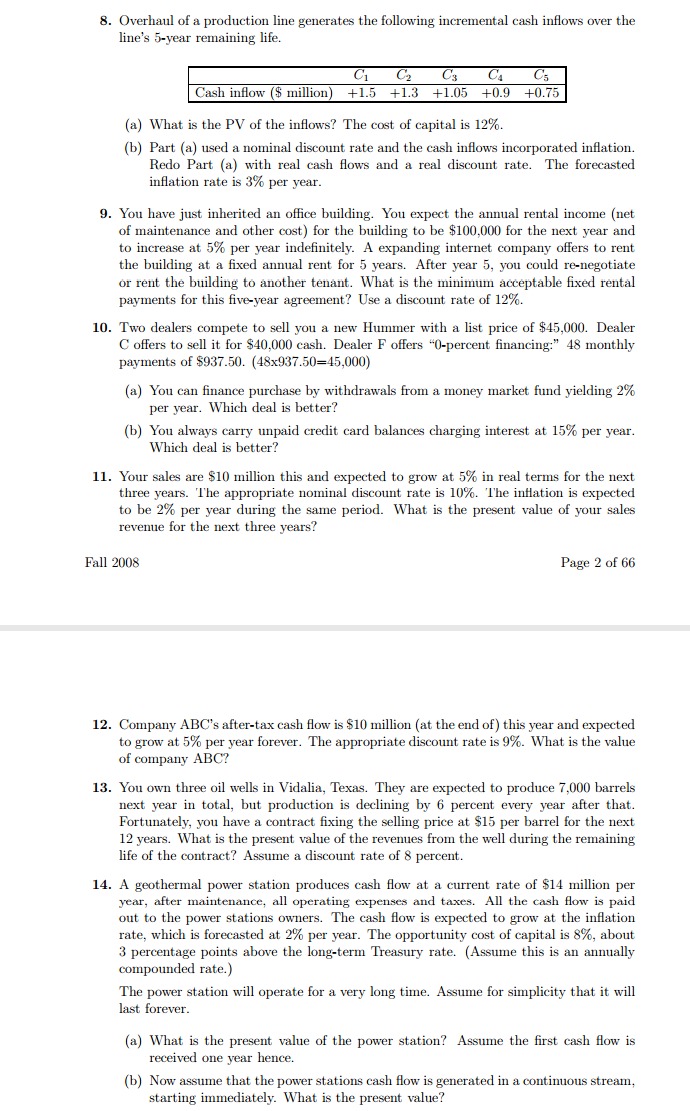

(.5) (i) for is the forward rate applicable over the period t to t + r. it is the spot rate over the period 0 to t. The gross redemption yield from a one year bond with a 6% annual coupon is 6% per annum effective; the gross redemption yield from a two year bond with a 6% annual coupon is 6.3% per annum effective; and the gross redemption yield from a three year bond with a 6% annual coupon is 6.6% per annum effective. All the bonds are redeemed at par and are exactly one year from the next coupon payment. (a) Calculate i, i and i; assuming no arbitrage. (5) (b) Calculate 6,1 , fi,1 and f 2, 1 assuming no arbitrage. (5) (ii) Explain why the forward rates increase more rapidly with term than the spot rates. (2) (iii) You are given the following term structure of spot interest rates: Term (in years) Spot interest rate 5.00% 2 5.75% 6.25% 6.50% A three-year annuity- immediate will be issued a year from now with annual payments of Rs.5000/-. Using the forward rates, calculate the present value of this annuity a year from now. (3) [15]5. Cambrian Railways runs a daily container freight train between Cardiff and Birmingham. Its two major customers are British Steel and the Welsh Farming Co-operative. The demand for containers by each customer is given by the equations: P; I Sill-a 8Q; for British Steel P2 = 400 5Q; for Welsh farming. P; is the price charged by Cambrian per container, and Q; is the number of containers used by each customer. Cambrian's total cost function is given by the equation: TC = 10 [IIH 20Q where Q is the number of containers per trip. (a) What are the necessary conditions for protable price discri- urination by Cambrian? (b) What prot-maximising rule will Cambrian use if setting prices as a discriminator? Determine the prot-maximising quantity of freight service Cambrian will supply, show how this will be divided between steel and agriculture and nd the prices charged in each market. Calculate Cambrian's total prot. (c) Assume that Cambrian is prevented by law from price discri- mination. Determine Cambrian's price and output combination to maximise prot, and hence estimate the opportunity cost to Cambrian of the Anti-Price Discrimination law. 6. Dene an optimal inventory policy, and assess the impact on that optimal inventory policy of: (i) uncertain demand (ii) uncertain lead times (iii) customer reactions to product shortages (iv) an oligopolistic product market. 7. (a) Compare and contrast the explanatory and extrapolatory approaches to demand estimation. Illustrate your answer with reference to the problem of estimating demand for a new luxury food processor. (b) The Welsh Kitchen Design Company sells its deluxe food proces- sor for 150Iunit. Company experience suggests that both price and consumer incomes affect sales, with an estimated price elasticity of demand of 3.0, whilst income elasticity is estimated at 4.0. In 1986 the company sold one million units, whilst total consumer disposable income was $6\") billion. Estimated con sumer disposable income for 198? is 650 billion. (i) Assuming price remains the same in 1987, estimate total sales revenue. expenditure. Consider an economy characterized by the following 13 equations: ng61b C = 500 + 0.75Y + 0.05W I = 150 where C is desired consumption, I is desired invest- ment, W is household wealth, and Y is national income. a. Suppose wealth is constant at W = 10 000. Draw the aggregate expenditure function on a scale diagram along with the 45 line. What is the equi- librium level of national income? b. What is the marginal propensity to spend in this economy? c. What is the value of the simple multiplier? d. Using your answer from part (c), what would be the change in equilibrium national income if desired investment increased to 250? Show this in your diagram. e. Begin with the new equilibrium level of national income from part (d). Now suppose household wealth increases from 10 000 to 15 000. What happens to the AE function and by how much does national income change?8. Overhaul of a production line generates the following incremental cash inflows over the line's 5-year remaining life. C1 C2 C's CA C's Cash inflow ($ million) +1.5 +1.3 +1.05 +0.9 +0.75 (a) What is the PV of the inflows? The cost of capital is 12%. (b) Part (a) used a nominal discount rate and the cash inflows incorporated inflation. Redo Part (a) with real cash flows and a real discount rate. The forecasted inflation rate is 3% per year. 9. You have just inherited an office building. You expect the annual rental income (net of maintenance and other cost) for the building to be $100,000 for the next year and to increase at 5% per year indefinitely. A expanding internet company offers to rent the building at a fixed annual rent for 5 years. After year 5, you could re-negotiate or rent the building to another tenant. What is the minimum acceptable fixed rental payments for this five-year agreement? Use a discount rate of 12%. 10. Two dealers compete to sell you a new Hummer with a list price of $45,000. Dealer C offers to sell it for $40,000 cash. Dealer F offers "(-percent financing:" 48 monthly payments of $937.50. (48x937.50=45,000) (a) You can finance purchase by withdrawals from a money market fund yielding 2% per year. Which deal is better? (b) You always carry unpaid credit card balances charging interest at 15% per year. Which deal is better? 11. Your sales are $10 million this and expected to grow at 5% in real terms for the next three years. The appropriate nominal discount rate is 10%. The inflation is expected to be 2% per year during the same period. What is the present value of your sales revenue for the next three years? Fall 2008 Page 2 of 66 12. Company ABC's after-tax cash flow is $10 million (at the end of ) this year and expected to grow at 5% per year forever. The appropriate discount rate is 9%. What is the value of company ABC? 13. You own three oil wells in Vidalia, Texas. They are expected to produce 7,000 barrels next year in total, but production is declining by 6 percent every year after that. Fortunately, you have a contract fixing the selling price at $15 per barrel for the next 12 years. What is the present value of the revenues from the well during the remaining life of the contract? Assume a discount rate of 8 percent. 14. A geothermal power station produces cash flow at a current rate of $14 million per year, after maintenance, all operating expenses and taxes. All the cash flow is paid out to the power stations owners. The cash flow is expected to grow at the inflation rate, which is forecasted at 2% per year. The opportunity cost of capital is 8%, about 3 percentage points above the long-term Treasury rate. (Assume this is an annually compounded rate.) The power station will operate for a very long time. Assume for simplicity that it will last forever. (a) What is the present value of the power station? Assume the first cash flow is received one year hence (b) Now assume that the power stations cash flow is generated in a continuous stream, starting immediately. What is the present value