Answer the questions below. Thank you

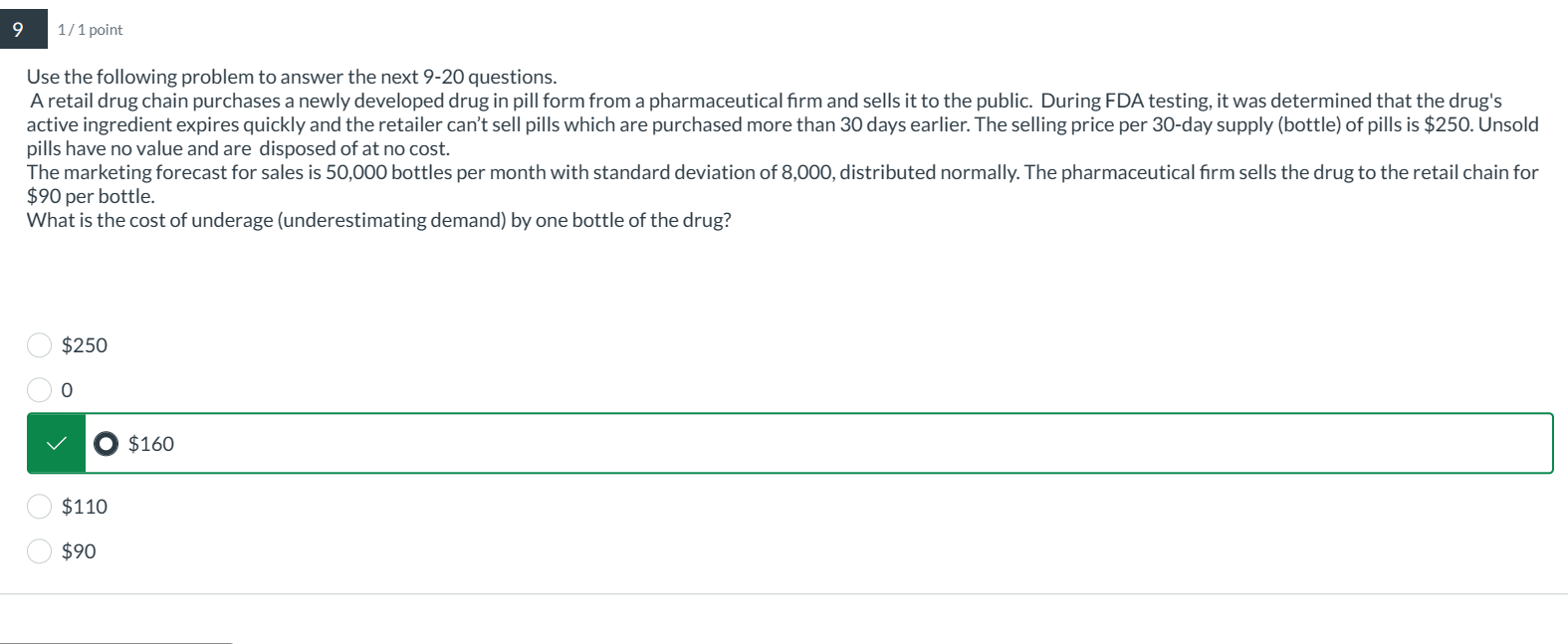

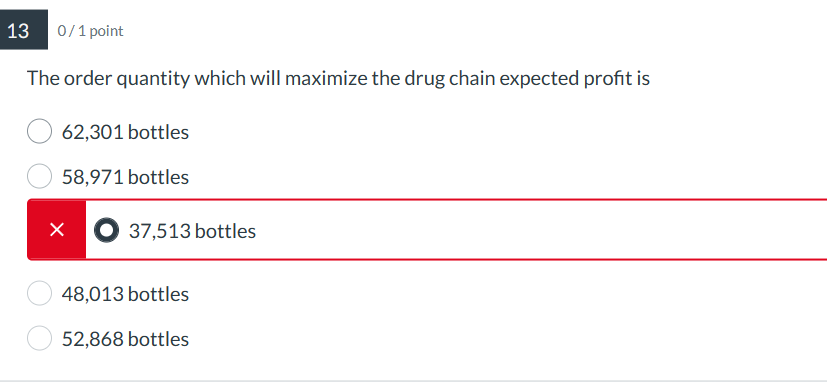

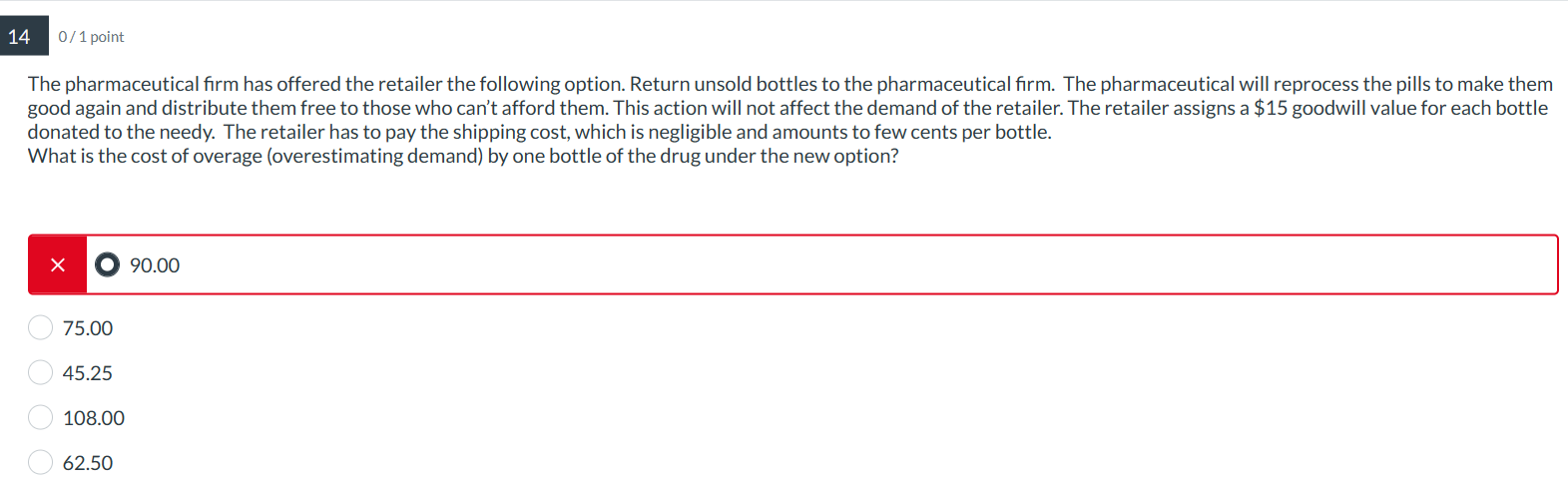

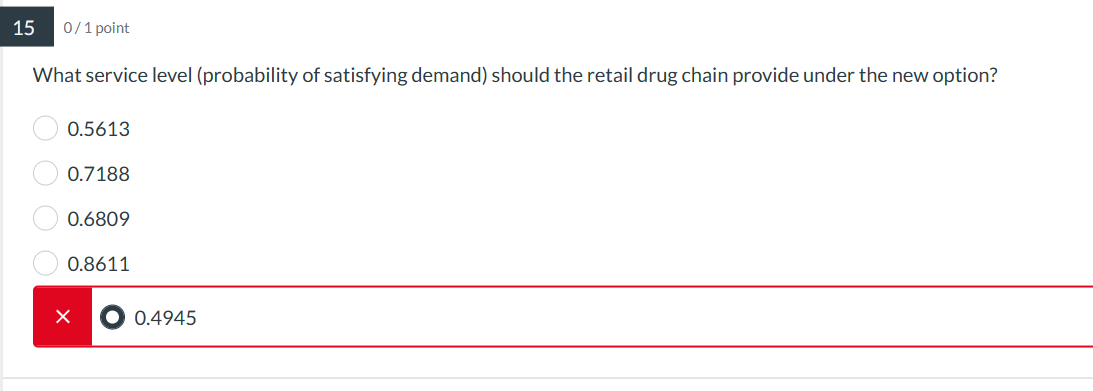

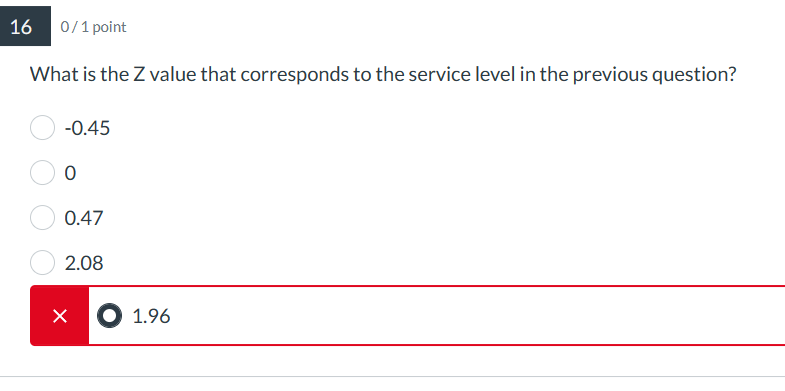

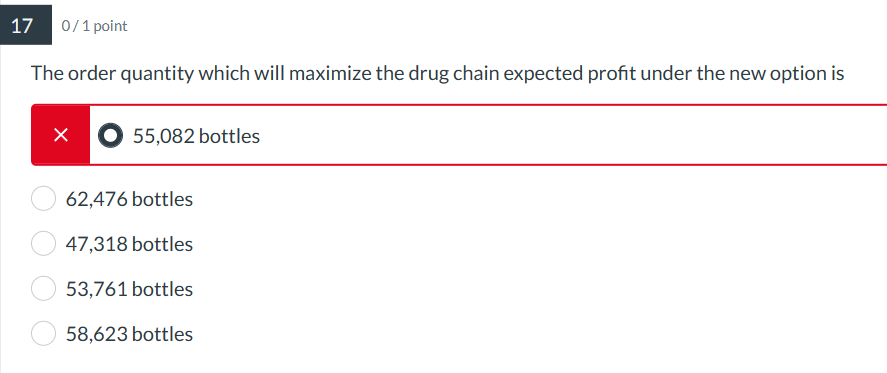

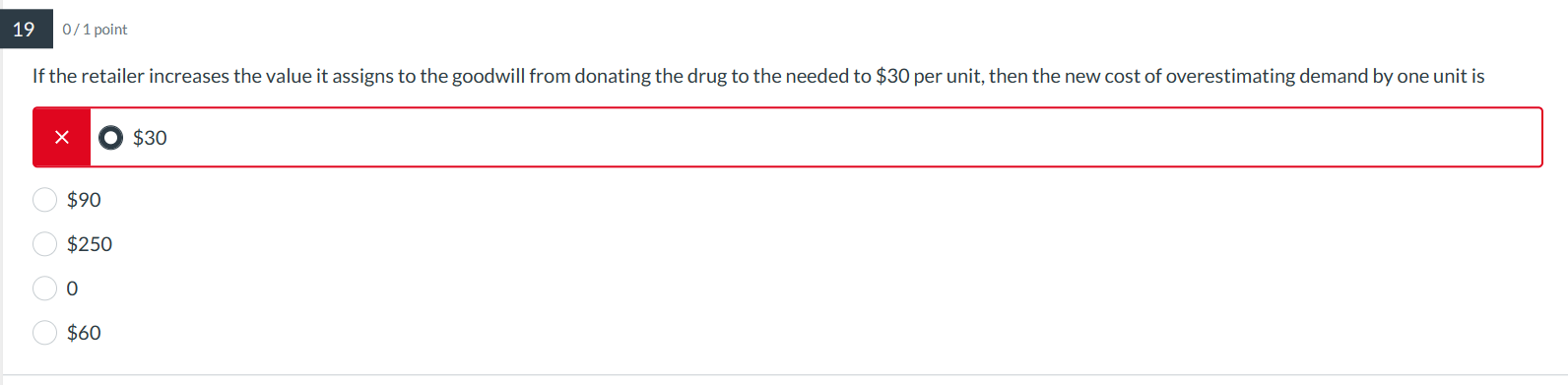

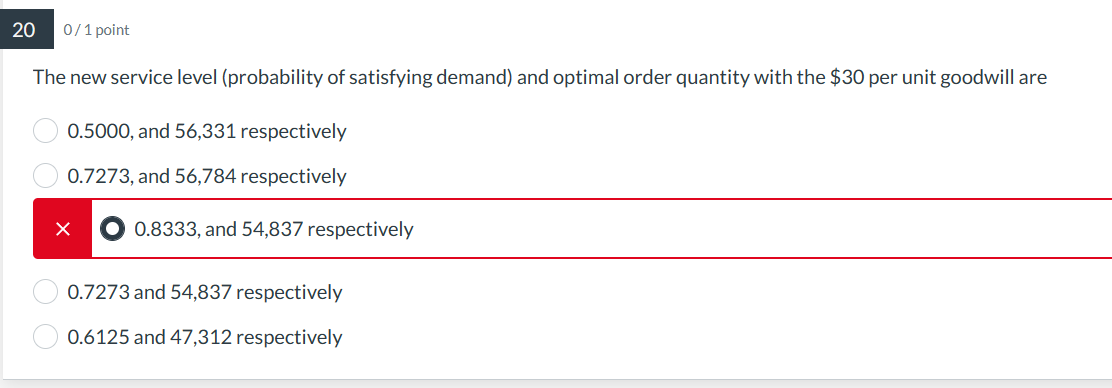

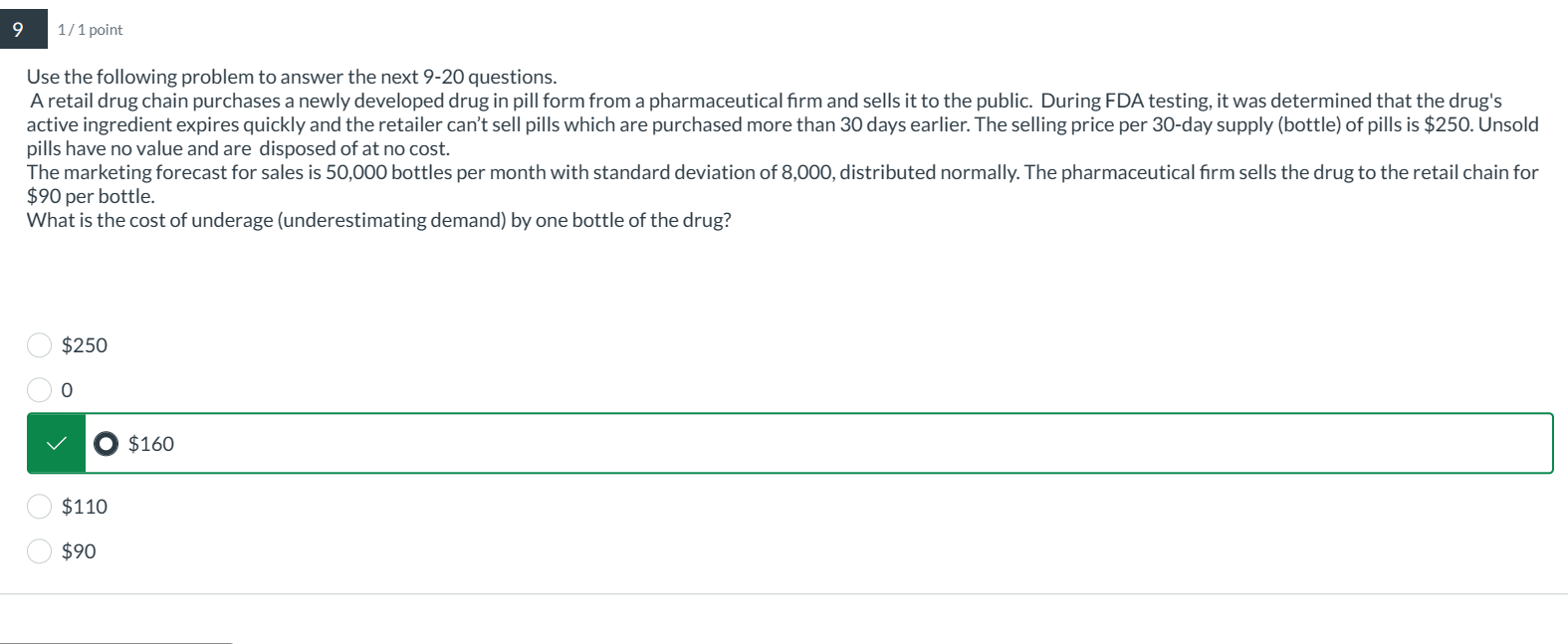

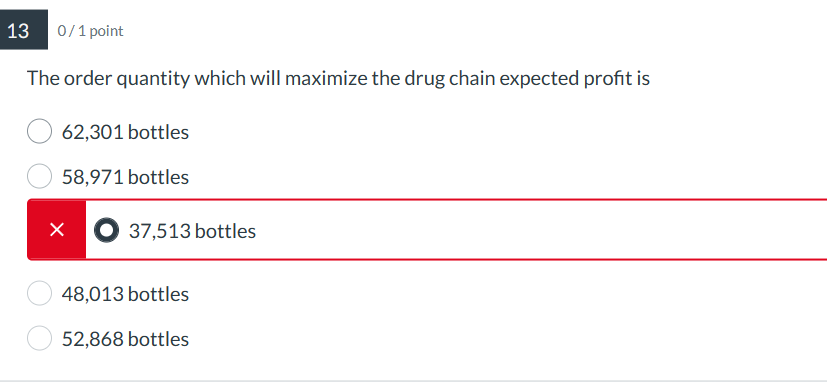

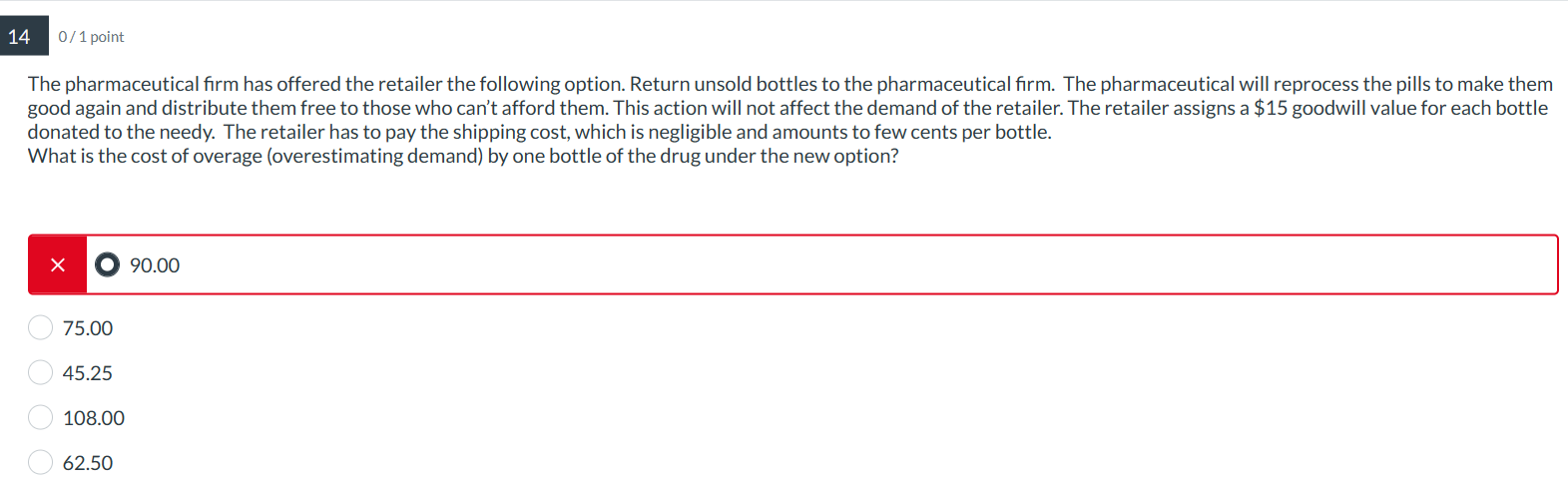

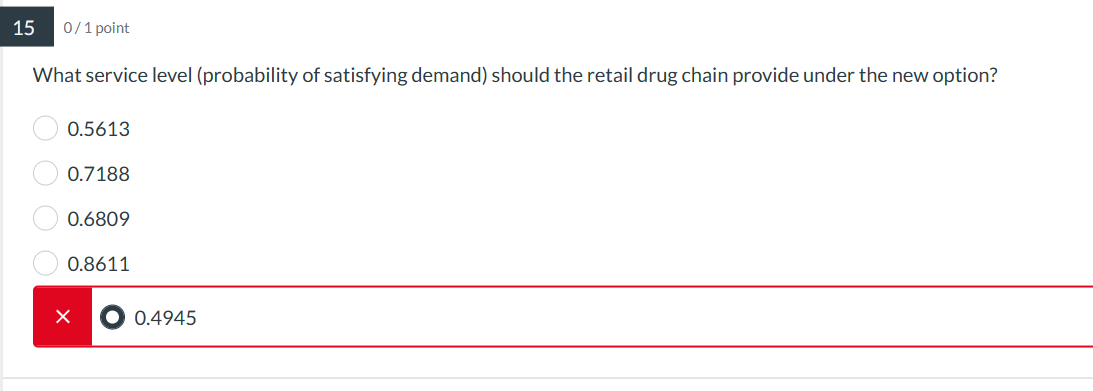

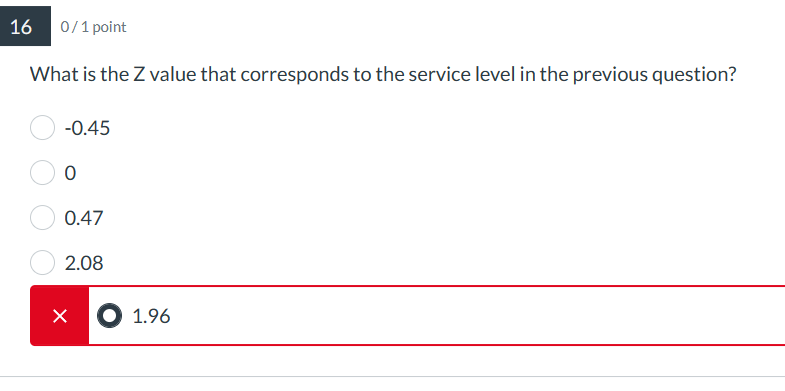

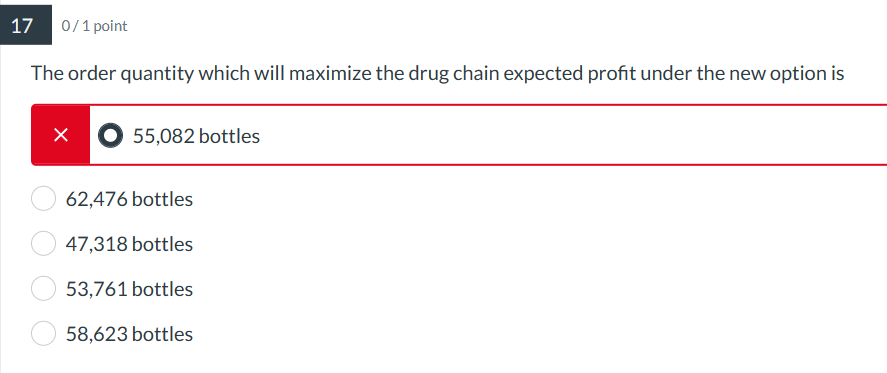

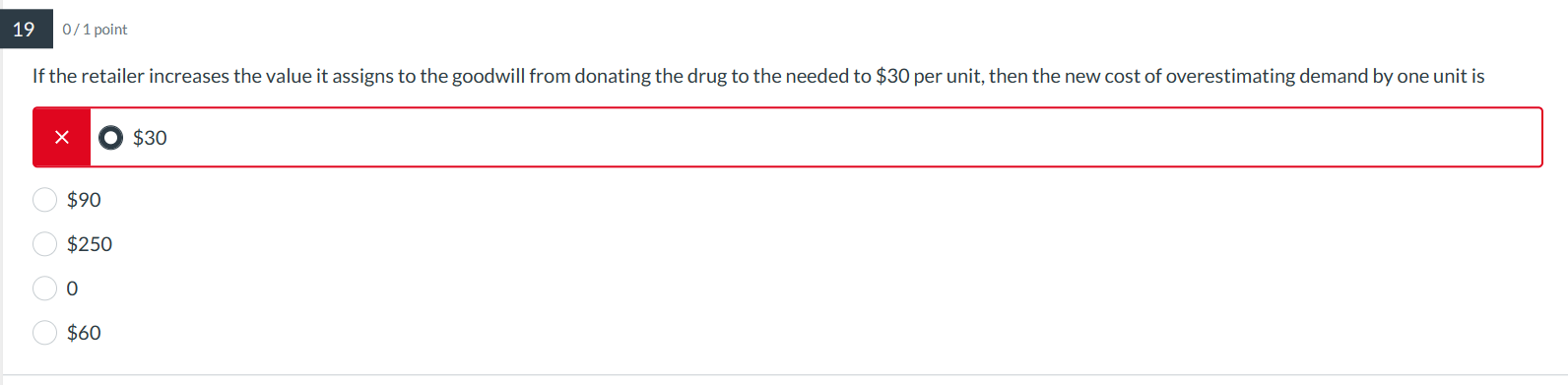

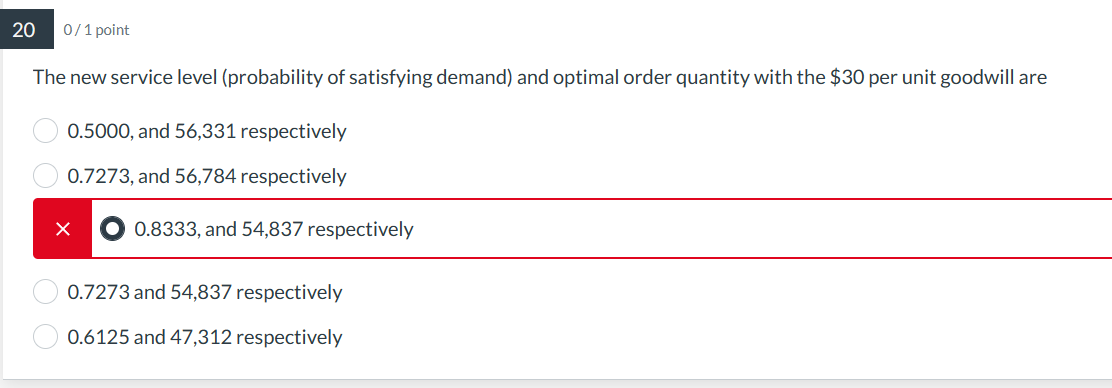

Use the following problem to answer the next 9-20 questions. A retail drug chain purchases a newly developed drug in pill form from a pharmaceutical firm and sells it to the public. During FDA testing, it was determined that the drug's active ingredient expires quickly and the retailer can't sell pills which are purchased more than 30 days earlier. The selling price per 30 -day supply (bottle) of pills is $250. Unsold pills have no value and are disposed of at no cost. The marketing forecast for sales is 50,000 bottles per month with standard deviation of 8,000 , distributed normally. The pharmaceutical firm sells the drug to the retail chain for $90 per bottle. What is the cost of underage (underestimating demand) by one bottle of the drug? $250 0 $160 $110 $90 The order quantity which will maximize the drug chain expected profit is 62,301 bottles 58,971 bottles ( 37,513 bottles 48,013 bottles 52,868 bottles The pharmaceutical firm has offered the retailer the following option. Return unsold bottles to the pharmaceutical firm. The pharmaceutical will reprocess the pills to make them good again and distribute them free to those who can't afford them. This action will not affect the demand of the retailer. The retailer assigns a $15 goodwill value for each bottle donated to the needy. The retailer has to pay the shipping cost, which is negligible and amounts to few cents per bottle. What is the cost of overage (overestimating demand) by one bottle of the drug under the new option? 9.00 75.00 45.25 108.00 62.50 What service level (probability of satisfying demand) should the retail drug chain provide under the new option? 0.56130.71880.68090.8611 What is the Z value that corresponds to the service level in the previous question? 0.4500.472.08 The order quantity which will maximize the drug chain expected profit under the new option is 55,082 bottles 62,476 bottles 47,318 bottles 53,761 bottles 58,623 bottles If the retailer increases the value it assigns to the goodwill from donating the drug to the needed to $30 per unit, then the new cost of overestimating demand by one unit is $30 $90 $250 0 $60 The new service level (probability of satisfying demand) and optimal order quantity with the $30 per unit goodwill are 0.5000 , and 56,331 respectively 0.7273 , and 56,784 respectively ( 0.8333 , and 54,837 respectively 0.7273 and 54,837 respectively 0.6125 and 47,312 respectively Use the following problem to answer the next 9-20 questions. A retail drug chain purchases a newly developed drug in pill form from a pharmaceutical firm and sells it to the public. During FDA testing, it was determined that the drug's active ingredient expires quickly and the retailer can't sell pills which are purchased more than 30 days earlier. The selling price per 30 -day supply (bottle) of pills is $250. Unsold pills have no value and are disposed of at no cost. The marketing forecast for sales is 50,000 bottles per month with standard deviation of 8,000 , distributed normally. The pharmaceutical firm sells the drug to the retail chain for $90 per bottle. What is the cost of underage (underestimating demand) by one bottle of the drug? $250 0 $160 $110 $90 The order quantity which will maximize the drug chain expected profit is 62,301 bottles 58,971 bottles ( 37,513 bottles 48,013 bottles 52,868 bottles The pharmaceutical firm has offered the retailer the following option. Return unsold bottles to the pharmaceutical firm. The pharmaceutical will reprocess the pills to make them good again and distribute them free to those who can't afford them. This action will not affect the demand of the retailer. The retailer assigns a $15 goodwill value for each bottle donated to the needy. The retailer has to pay the shipping cost, which is negligible and amounts to few cents per bottle. What is the cost of overage (overestimating demand) by one bottle of the drug under the new option? 9.00 75.00 45.25 108.00 62.50 What service level (probability of satisfying demand) should the retail drug chain provide under the new option? 0.56130.71880.68090.8611 What is the Z value that corresponds to the service level in the previous question? 0.4500.472.08 The order quantity which will maximize the drug chain expected profit under the new option is 55,082 bottles 62,476 bottles 47,318 bottles 53,761 bottles 58,623 bottles If the retailer increases the value it assigns to the goodwill from donating the drug to the needed to $30 per unit, then the new cost of overestimating demand by one unit is $30 $90 $250 0 $60 The new service level (probability of satisfying demand) and optimal order quantity with the $30 per unit goodwill are 0.5000 , and 56,331 respectively 0.7273 , and 56,784 respectively ( 0.8333 , and 54,837 respectively 0.7273 and 54,837 respectively 0.6125 and 47,312 respectively