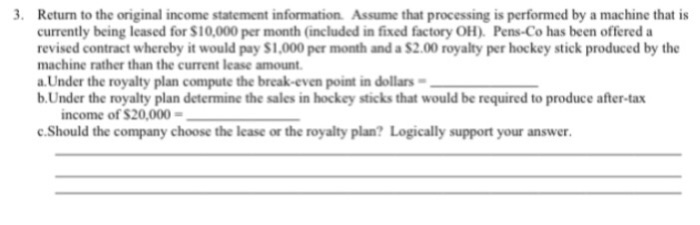

answers for part 3

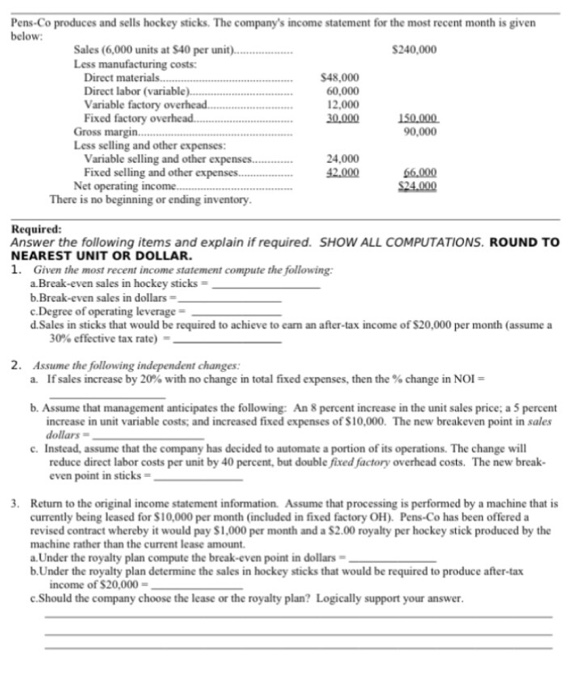

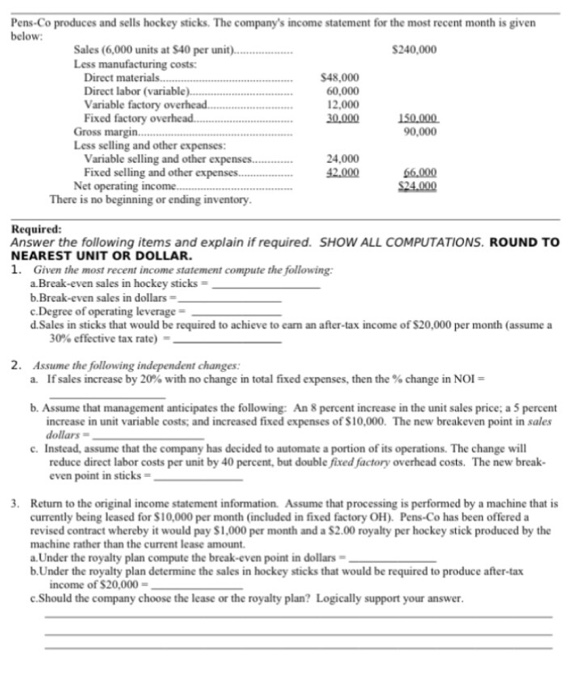

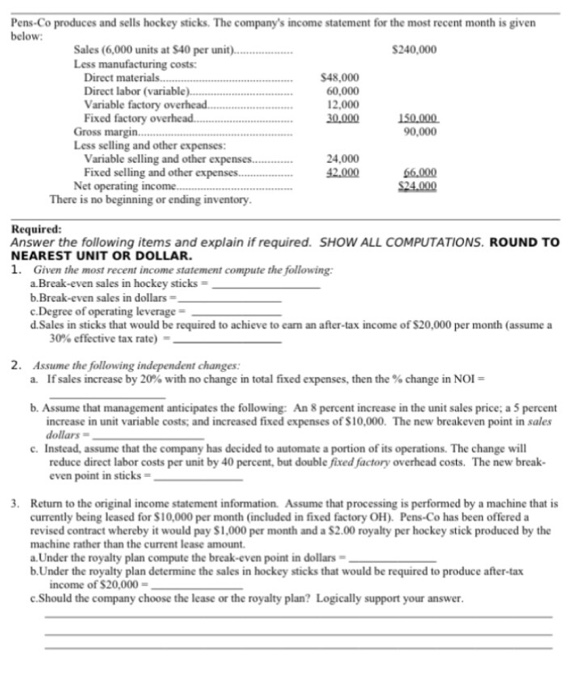

Pens-Co produces and sells hockey sticks. The company's income statement for the most recent month is given below Sales (6,000 units at $40 per unit) Less manufacturing costs: $240,000 $48,000 Direct labor (variable) Variable factory Fixed factory 60,000 12,000 30.000 50.000 90,000 Gross Less selling and other expenses: Variable selling and other Fixed selling and other 24.000 42000 $24000 66.000 Net operating There is no beginning or ending inventory Required: Answer the following items and explain if required. SHOW ALL COMPUTATIONS. ROUND TO NEAREST UNIT OR DOLLAR. 1. Given the most recent income statement compute the following a. Break-even sales in hockey sticks b. Break-even sales in dollars = c.Degree of operating leverage d.Sales in sticks that would be required to achieve to earm an after-tax income of $20,000 per month (assume a 30% effective tax rate)- 2. Assume the following independent changes: a. If sales increase by 20% with no change in total fixed expenses, then the % change in NOI = b. Assume that management anticipates the following: An 8 percent increase in the unit sales price; a 5 percent increase in unit variable costs; and increased fixed expenses of $10,000. The new breakeven point in sales dollars c. Instead, assume that the company has decided to automate a portion of its operations. The change will reduce direct labor costs per unit by 40 percent, but double fixed factory overhead costs. The new break- even point in sticks Return to the original income statement information Assume that processing is performed by a machine that is currently being leased for $10,000 per month (included in fixed factory OH). Pens-Co has been offered a revised contract whereby it would pay $1,000 per month and a $2.00 royalty per hockey stick produced by the machine rather than the current lease amount. a Under the royalty plan compute the break-even point in dollars b.Under the royalty plan determine the sales in hockey sticks that would be required to produce after-tax income of $20,000- c.Should the company choose the lease or the royalty plan? Logically support your answer 3. Return to the original income statement information Assume that processing is performed by a machine that is currently being leased for $10,000 per month (included in fixed factory OH) Pens-Co has been offered a revised contract whereby it would pay $1,000 per month and a $2.00 royalty per hockey stick produced by the machine rather than the current lease amount a Under the royalty plan compute the break-even point in dollars b.Under the royalty plan determine the sales in hockey sticks that would be required to produce after-tax income of $20,000- c.Should the company choose the lease or the royalty plan? Logically support your