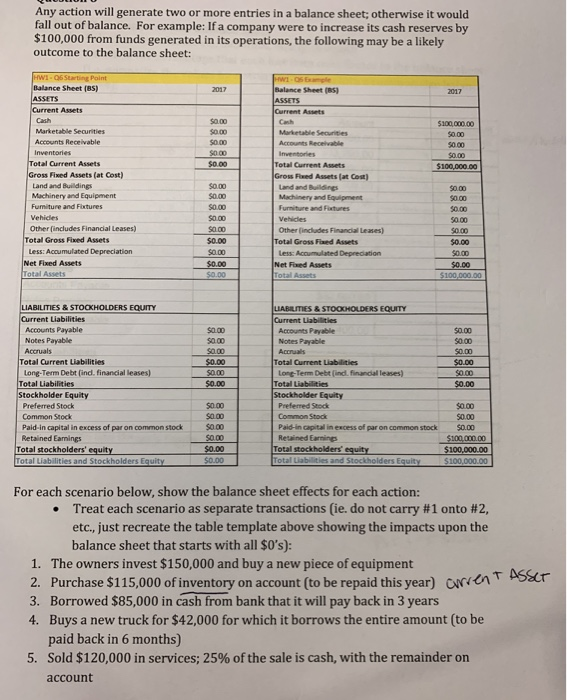

Any action will generate two or more entries in a balance sheet; otherwise it would fall out of balance. For example: If a company were to increase its cash reserves by $100,000 from funds generated in its operations, the following may be a likely outcome to the balance sheet: HWI-Q6 Starting Paint Balance Sheet (BS) ASSETS Current Assets W 05 Example Balance Sheet (B5) ASSETS Current Assets 2017 2017 Cash sa.00 S0.00 Cash $100000.00 Marketable Securities Marketable Securities S0.00 Accounts Receivable s0.00 S000 Accounts Receivable 5000 Inventories Inventories S0.00 Total Current Assets Total Current Assets Gross Fixed Assets (at Cost) s0.00 $100,000.00 Gross Fixed Assets (at Cost) Land and Buildings Machinery and Equipment S0.00 Land and Buildings Machinery and Equipment S000 s0.00 S0.00 Fumiture and Fixtures S0.00 Furniture and Fixtures 50.00 Vehides S0.00 Vehicles 50.00 Other (includes Financial Leases) S0.00 Other (includes Financial Leases) Total Gross Fiaxed Assets s0.00 Total Gross Fixed Assets So.00 S0.00 Less: Accumulated Depreciation S0.00 Less: Accumulated Deprediations Net Fixed Assets Total Assets S0.00 Net Fixed Assets Total Assets $0.00 $0.00 S0.00 $100,000.00 LIABILITIES & STOCKHOLDERS EQUITY Current Liabilities Accounts Payable LIABILITIES & STOOKHOLDERS EQUITY Current Liabilities Accounts Payable S0.00 S0.00 Notes Payable Accruals Total Current Liabilities Long-Term Debt (ind. financial leases) Total Liabilities Stockholder Equity S0.00 Notes Payable 50.00 S0.00 $0.00 Accruals Total Current Liabilities $0.00 S0.00 $0.00 Long-Term Debt (indl. financal leases) Total Liabilities Stockholder Equity $0.00 $0.00 $0.00 Preferred Stock $0.00 Prefered Stock s0.00 50.00 Common Stock Paid-in capital in excess of par on common stock S0.00 Common Stock Paid-in capital in excess of par on common stock S0.00 S0.00 $0.00 Retained Earnings Total stockholders equity Total Liabilities and Stockholders Equity Retained Eamings Total stockholders' equity Total Liabilities and Stockholders Equity $100,000.00 $100,000.00 $0.00 $0.00 $100,000.00 For each scenario below, show the balance sheet effects for each action: Treat each scenario as separate transactions (ie. do not carry #1 onto # 2, etc., just recreate the table template above showing the impacts upon the balance sheet that starts with all $0's): 1. The owners invest $150,000 and buy a new piece of equipment 2. Purchase $115,000 of inventory on account (to be repaid this year) Orren 3. Borrowed $85,000 in cash from bank that it will pay back in 3 years 4. Buys a new truck for $42,000 for which it borrows the entire amount (to be paid back in 6 months) 5. Sold $120,000 in services; 25% of the sale is cash, with the remainder on account