Question

Arkin Corporation acquired 75% of the outstanding shares of Sharp Company on January 2, 2016 for a consideration transferred of 4,320,000. The price paid includes

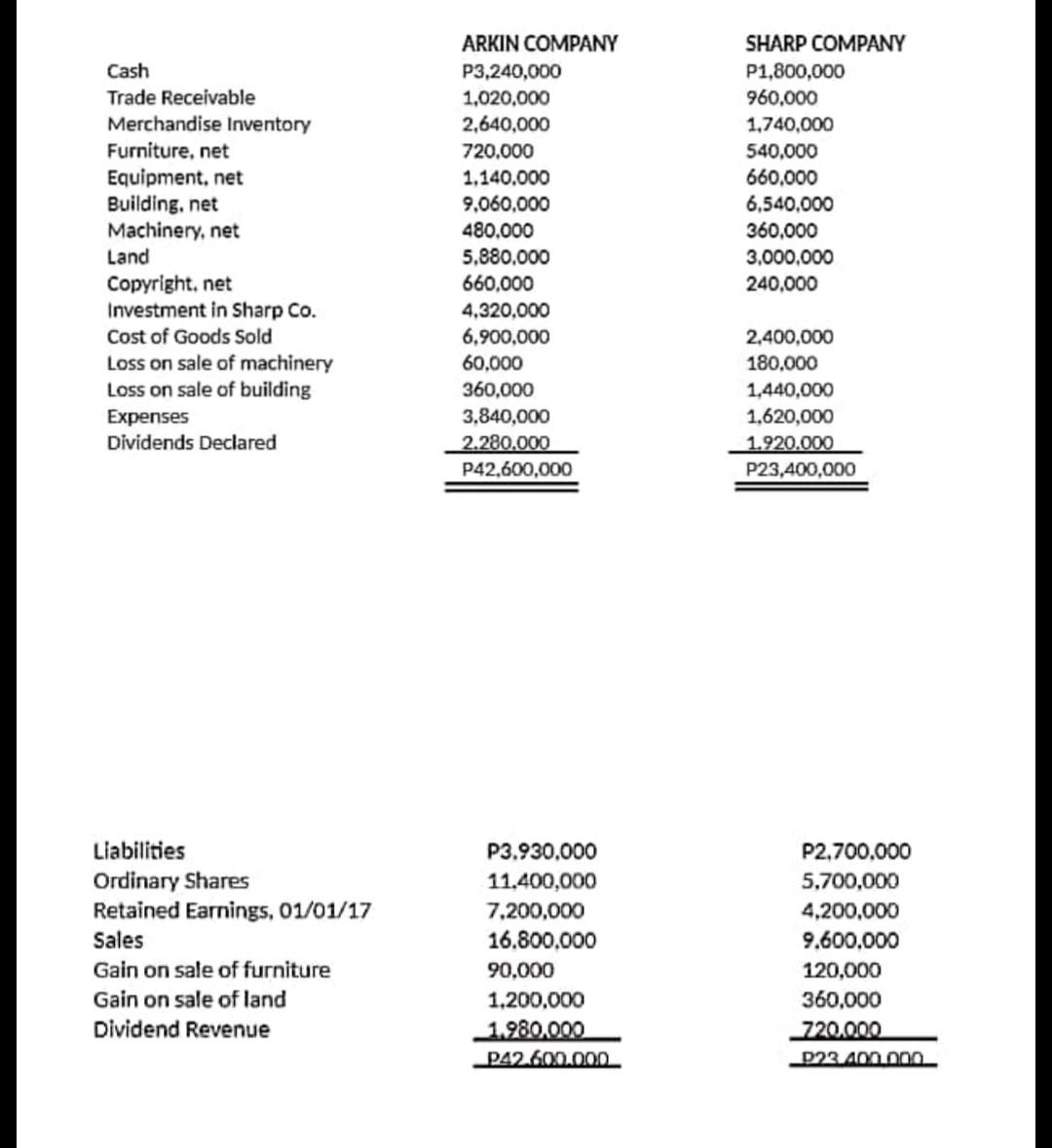

Arkin Corporation acquired 75% of the outstanding shares of Sharp Company on January 2, 2016 for a consideration transferred of 4,320,000. The price paid includes a control premium amounting to 120,000. On the date of acquisition, the related cost of business combination amounted to 80,000. On January 2, 2016, Sharp companys shareholders equity accounts were: Ordinary Shares 5,700,000 Retained Earnings 1,860,000 An examination of the acquired companys assets and liabilities on the DOA revealed that there were assets with books values different from the FMV. The inventory is overstated by 180,000; the land is undervalued by 900,000; the equipment is overstated by 720,000 and a copyright is understated by 540,000. Inventories were all sold in 2016. The equipment had a remaining life of 8 years while copyright had a remaining life of 5 years. During 2016, intercompany sale of merchandise on account amounted to 1,980,000 of which 126,000 is from upstream sales. Likewise, the December 31, 2016 inventory includes 144,000 from downstream sales. The Arkin corporations mark-up was 20% of sales while Sharp Companys selling price is 120% of cost. On the first day of the second month of the second quarter of 2017, there was an upstream sale of land for 2,700,000 costing 2,340,000. On the first day of the last month of the third quarter of 2017 there was a downstream sale of furniture for 300,000 having a net cost of 210,000 which has a remaining useful life of 5 years from the date of sale. On the first day of the last month of 2017, there was an upstream sale of building for 6,720,000 having a net cost of 8,160,000 which has a useful life of 8 years from the date of sale. During 2017 intercompany sale of merchandise on account amounted to 3,240,000 of which 360,000 is from upstream sales. Likewise, the 12/31/2017 inventory includes 270,000 from downstream sales. The acquirer corporation uses the cost method. Unconsolidated statement of financial position as of 12/31/2017 follows:

For 2017 compute for the following items in the consolidated financial statement: 1. Gross Profit A. 17,164,200 B. 20,275,800 C. 17,035,800 D. 17,100,000 2. Expenses A. 5,460,000 B. 5,487,000 C. 5,433,000 D. 5,469,000 3. Non-controlling Interest in Profit A. 1,542,000 B. 1,582,500 C. 1,546,500 D. 1,536,750 4. Net Income A. 11,986,800 B. 14,968,800 C. 12,988,800 D. 13,528,800 5. Non-controlling Interest on Net Assets A. 3,626,250 B. 3,707,250 C. 3,712,500 D. 3,716,250 6. Retained Earnings Attributable to Parents shareholders Equity A. 16,906,800 B. 18,767,550 C. 20,493,750 D. 18,738,750

Cash Trade Receivable Merchandise Inventory Furniture, net Equipment, net Building, net Machinery, net Land Copyright, net Investment in Sharp Co. Cost of Goods Sold Loss on sale of machinery Loss on sale of building Expenses Dividends Declared ARKIN COMPANY P3,240,000 1,020,000 2,640,000 720.000 1.140.000 9,060,000 480.000 5,880,000 660.000 4,320,000 6,900,000 60,000 360,000 3.840,000 2.280,000 P42.600,000 SHARP COMPANY P1,800,000 960,000 1,740,000 540,000 660,000 6,540,000 360,000 3,000,000 240,000 2,400,000 180.000 1,440,000 1,620,000 1.920.000 P23,400,000 Liabilities Ordinary Shares Retained Earnings, 01/01/17 Sales Gain on sale of furniture Gain on sale of land Dividend Revenue P3.930,000 11,400,000 7.200.000 16.800.000 90.000 1,200.000 1.980.000 P42.600.000 P2,700,000 5,700,000 4,200,000 9.600.000 120,000 360,000 720.000 D22 400 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started