Answered step by step

Verified Expert Solution

Question

1 Approved Answer

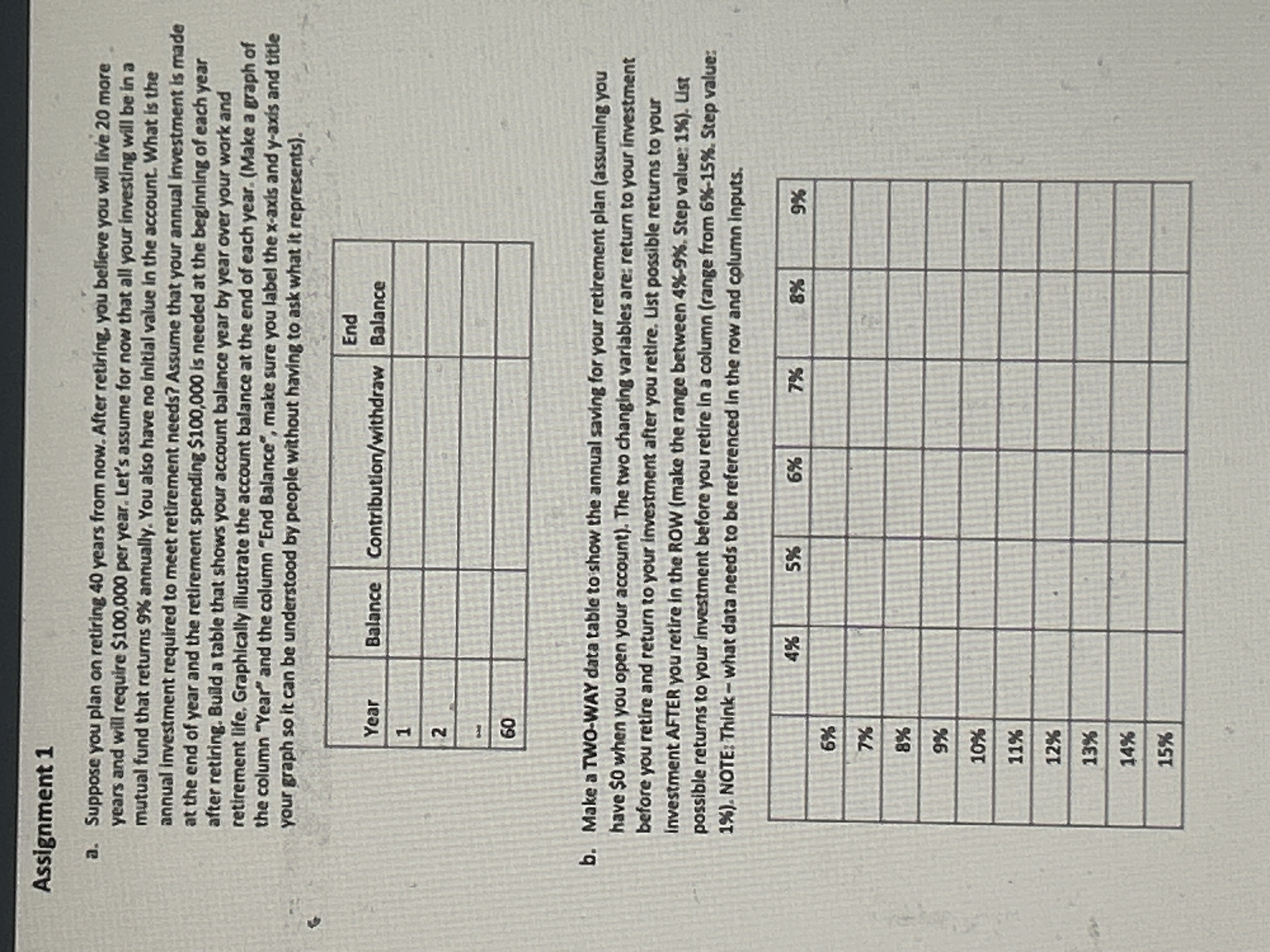

Assignment 1 a . Suppose you plan on retirine 4 0 years from now. After retiring, you believe you will live 2 0 more years

Assignment

a Suppose you plan on retirine years from now. After retiring, you believe you will live more

years and will require $ per year. Let's assume for now that all your investing will be in a

mutual fund that returns annually. You also have no initial value in the account. What is the

annual imvestment required to meet retirement needs? Assume that your annual investment is made

at the end of year and the retirement spending $ is needed at the beginning of each year

after retiring. Build a table that shows your account balance vear by year over your work and

retirement life, Graphically illustrate the account balance at the end of each year. Make a eraph of

the column "Year" and the column "End Balance", make sure you label the axis and axis and title

your graph so it can be understood by people without having to ask what it represents

b Make a TWOWAY data table to show the annual saving for your retirement plan assuming you

have $ when you open your account The two changing variables are: return to your investment

before you retire and return to your investment after you retire. Ust possible returns to your

investment AFTER you retire in the ROW make the range between Step value: Ust

possible returns to your investment before you retire in a column range from Step value:

NOTE: Think what data needs to be referenced in the row and column inputs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started