Answered step by step

Verified Expert Solution

Question

1 Approved Answer

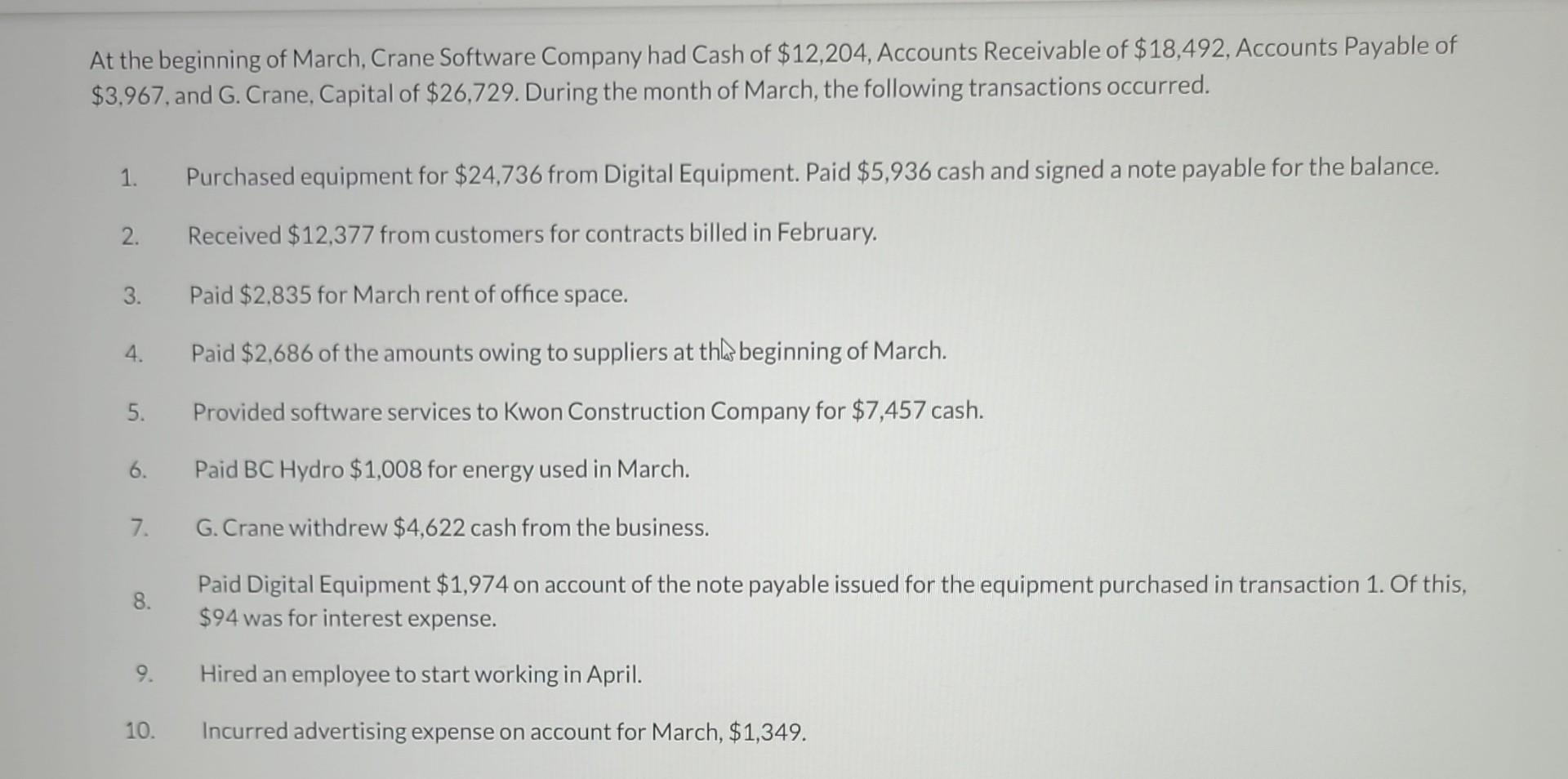

At the beginning of March, Crane Software Company had Cash of $12,204, Accounts Receivable of $18,492, Accounts Payable of $3,967, and G. Crane, Capital of

At the beginning of March, Crane Software Company had Cash of $12,204, Accounts Receivable of $18,492, Accounts Payable of $3,967, and G. Crane, Capital of $26,729. During the month of March, the following transactions occurred. 1. Purchased equipment for $24,736 from Digital Equipment. Paid $5,936 cash and signed a note payable for the balance. 2. Received $12,377 from customers for contracts billed in February. 3. Paid $2,835 for March rent of office space. 4. Paid $2,686 of the amounts owing to suppliers at this beginning of March. 5. Provided software services to Kwon Construction Company for $7,457 cash. 6. Paid BC Hydro $1,008 for energy used in March. 7. G. Crane withdrew $4,622 cash from the business. 8. Paid Digital Equipment $1,974 on account of the note payable issued for the equipment purchased in transaction 1. Of this, $94 was for interest expense. 9. Hired an employee to start working in April. 10. Incurred advertising expense on account for March, $1,349

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started