Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|} hline Land and Building at valuation & 1941413 & 1632300 hline Plant and Equipment at cost less accumulated depreciation & 2528000 & 2143500

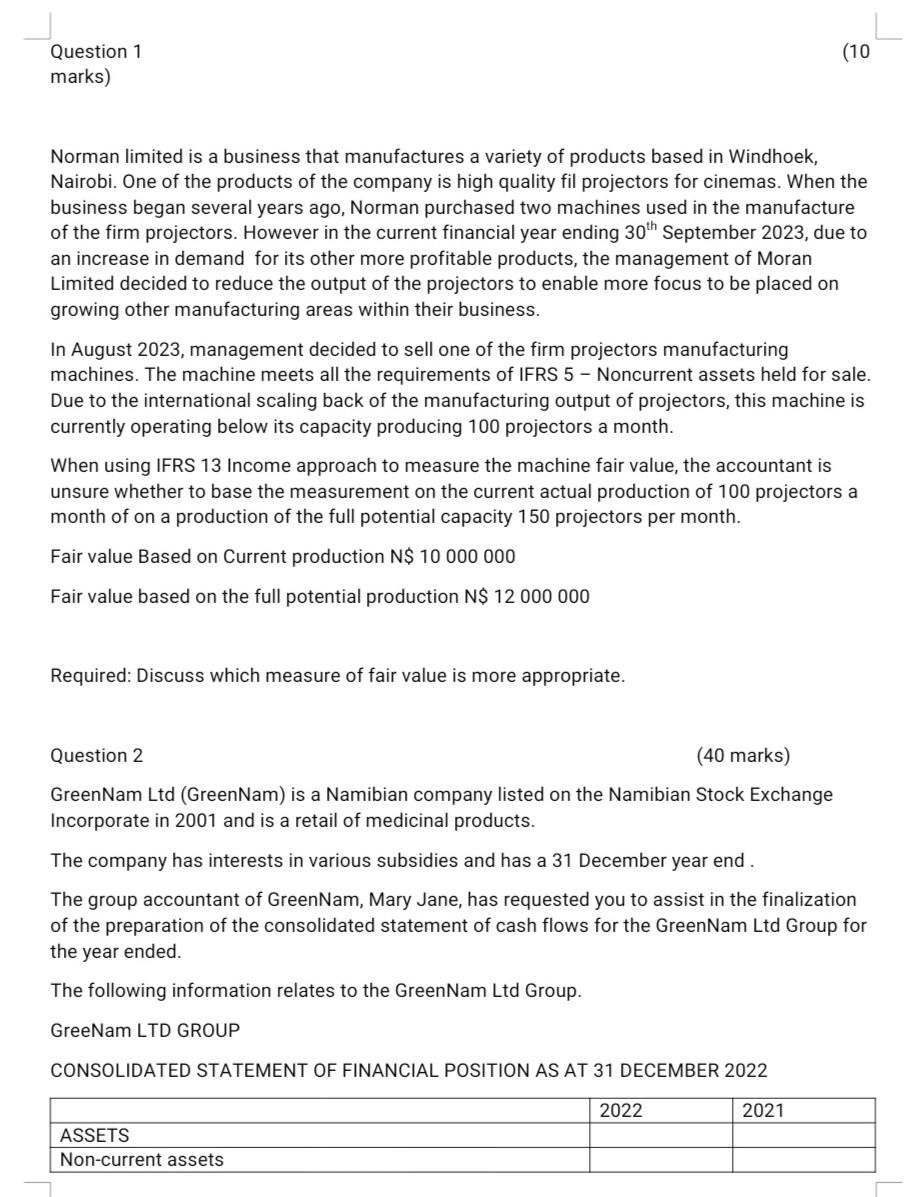

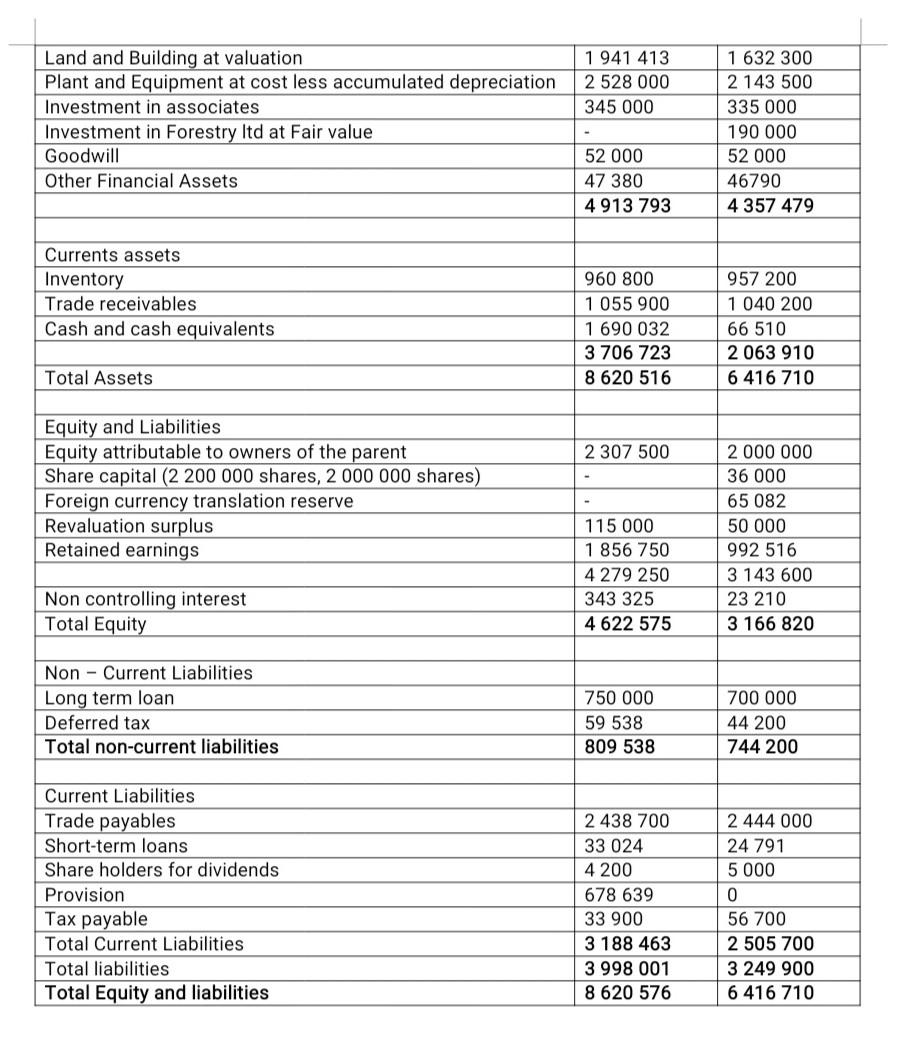

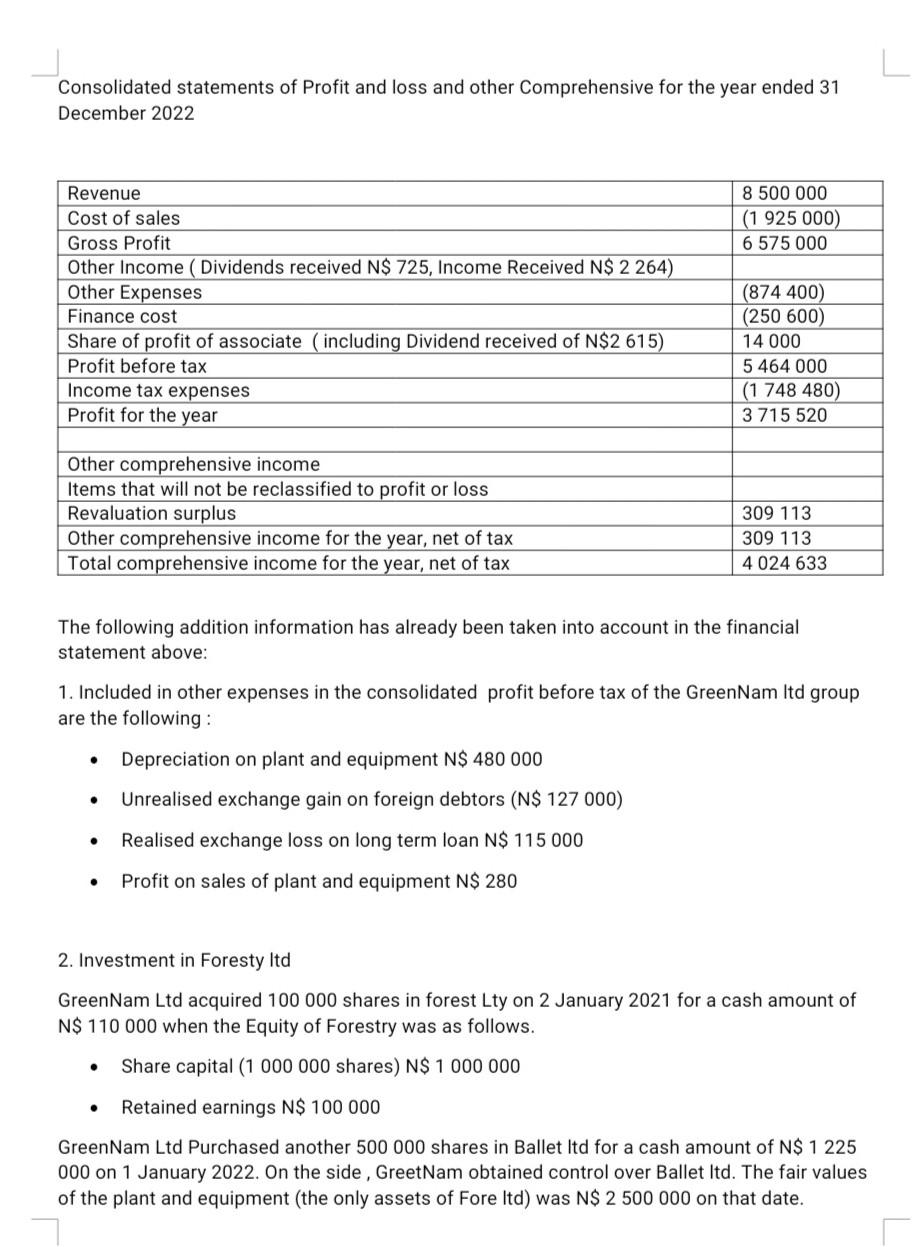

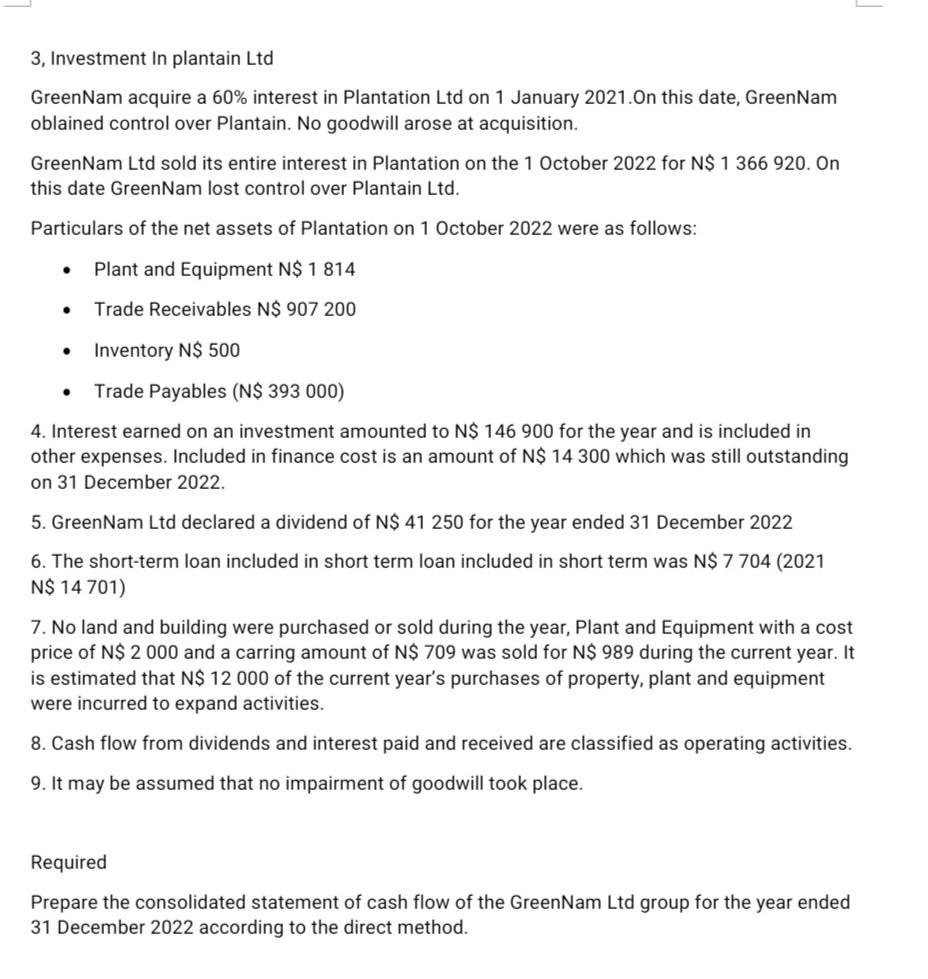

\begin{tabular}{|c|c|c|} \hline Land and Building at valuation & 1941413 & 1632300 \\ \hline Plant and Equipment at cost less accumulated depreciation & 2528000 & 2143500 \\ \hline Investment in associates & 345000 & 335000 \\ \hline Investment in Forestry Itd at Fair value & - & 190000 \\ \hline Goodwill & 52000 & 52000 \\ \hline \multirow[t]{2}{*}{ Other Financial Assets } & 47380 & 46790 \\ \hline & 4913793 & 4357479 \\ \hline \multicolumn{3}{|l|}{ Currents assets } \\ \hline Inventory & 960800 & 957200 \\ \hline Trade receivables & 1055900 & 1040200 \\ \hline \multirow[t]{2}{*}{ Cash and cash equivalents } & 1690032 & 66510 \\ \hline & 3706723 & 2063910 \\ \hline Total Assets & 8620516 & 6416710 \\ \hline \multicolumn{3}{|l|}{ Equity and Liabilities } \\ \hline Equity attributable to owners of the parent & 2307500 & 2000000 \\ \hline Share capital (2 200000 shares, 2000000 shares) & - & 36000 \\ \hline Foreign currency translation reserve & - & 65082 \\ \hline Revaluation surplus & 115000 & 50000 \\ \hline \multirow[t]{2}{*}{ Retained earnings } & 1856750 & 992516 \\ \hline & 4279250 & 3143600 \\ \hline Non controlling interest & 343325 & 23210 \\ \hline Total Equity & 4622575 & 3166820 \\ \hline \multicolumn{3}{|l|}{ Non - Current Liabilities } \\ \hline Long term loan & 750000 & 700000 \\ \hline Deferred tax & 59538 & 44200 \\ \hline Total non-current liabilities & 809538 & 744200 \\ \hline \multicolumn{3}{|l|}{ Current Liabilities } \\ \hline Trade payables & 2438700 & 2444000 \\ \hline Short-term loans & 33024 & 24791 \\ \hline Share holders for dividends & 4200 & 5000 \\ \hline Provision & 678639 & 0 \\ \hline Tax payable & 33900 & 56700 \\ \hline Total Current Liabilities & 3188463 & 2505700 \\ \hline Total liabilities & 3998001 & 3249900 \\ \hline Total Equity and liabilities & 8620576 & 6416710 \\ \hline \end{tabular} Consolidated statements of Profit and loss and other Comprehensive for the year ended 31 December 2022 The following addition information has already been taken into account in the financial statement above: 1. Included in other expenses in the consolidated profit before tax of the GreenNam Itd group are the following : - Depreciation on plant and equipment N\$480000 - Unrealised exchange gain on foreign debtors (N\$127 000) - Realised exchange loss on long term loan N$115000 - Profit on sales of plant and equipment N$280 2. Investment in Foresty Itd GreenNam Ltd acquired 100000 shares in forest Lty on 2 January 2021 for a cash amount of N\$ 110000 when the Equity of Forestry was as follows. - Share capital (1000 000 shares) N\$1000 000 - Retained earnings N$100000 GreenNam Ltd Purchased another 500000 shares in Ballet Itd for a cash amount of N\$ 1225 000 on 1 January 2022. On the side, GreetNam obtained control over Ballet Itd. The fair values of the plant and equipment (the only assets of Fore Itd) was N\$2500 000 on that date. Norman limited is a business that manufactures a variety of products based in Windhoek, Nairobi. One of the products of the company is high quality fil projectors for cinemas. When the business began several years ago, Norman purchased two machines used in the manufacture of the firm projectors. However in the current financial year ending 30th September 2023 , due to an increase in demand for its other more profitable products, the management of Moran Limited decided to reduce the output of the projectors to enable more focus to be placed on growing other manufacturing areas within their business. In August 2023, management decided to sell one of the firm projectors manufacturing machines. The machine meets all the requirements of IFRS 5 - Noncurrent assets held for sale. Due to the international scaling back of the manufacturing output of projectors, this machine is currently operating below its capacity producing 100 projectors a month. When using IFRS 13 Income approach to measure the machine fair value, the accountant is unsure whether to base the measurement on the current actual production of 100 projectors a month of on a production of the full potential capacity 150 projectors per month. Fair value Based on Current production N\$10000 000 Fair value based on the full potential production N\$12000 000 Required: Discuss which measure of fair value is more appropriate. Question 2 (40 marks) GreenNam Ltd (GreenNam) is a Namibian company listed on the Namibian Stock Exchange Incorporate in 2001 and is a retail of medicinal products. The company has interests in various subsidies and has a 31 December year end . The group accountant of GreenNam, Mary Jane, has requested you to assist in the finalization of the preparation of the consolidated statement of cash flows for the GreenNam Ltd Group for the year ended. The following information relates to the GreenNam Ltd Group. GreeNam LTD GROUP CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 3, Investment In plantain Ltd GreenNam acquire a 60% interest in Plantation Ltd on 1 January 2021. On this date, GreenNam oblained control over Plantain. No goodwill arose at acquisition. GreenNam Ltd sold its entire interest in Plantation on the 1 October 2022 for N\$1366 920. On this date GreenNam lost control over Plantain Ltd. Particulars of the net assets of Plantation on 1 October 2022 were as follows: - Plant and Equipment N$1814 - Trade Receivables N\$907 200 - Inventory N$500 - Trade Payables (N\$393 000) 4. Interest earned on an investment amounted to N$146900 for the year and is included in other expenses. Included in finance cost is an amount of N$14300 which was still outstanding on 31 December 2022. 5. GreenNam Ltd declared a dividend of N\$ 41250 for the year ended 31 December 2022 6. The short-term loan included in short term loan included in short term was N\$7 704 (2021 N\$ 14 701) 7. No land and building were purchased or sold during the year, Plant and Equipment with a cost price of N$2000 and a carring amount of N$709 was sold for N$989 during the current year. It is estimated that N$12000 of the current year's purchases of property, plant and equipment were incurred to expand activities. 8. Cash flow from dividends and interest paid and received are classified as operating activities. 9. It may be assumed that no impairment of goodwill took place. Required Prepare the consolidated statement of cash flow of the GreenNam Ltd group for the year ended 31 December 2022 according to the direct method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started