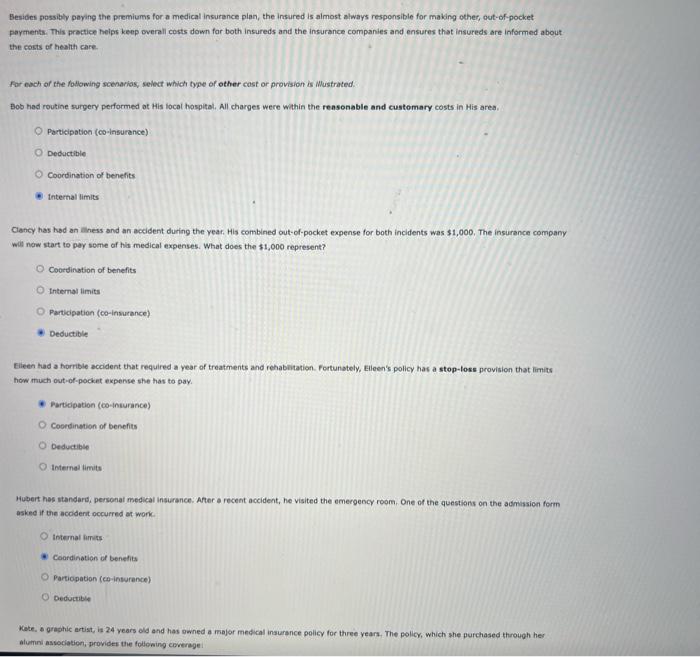

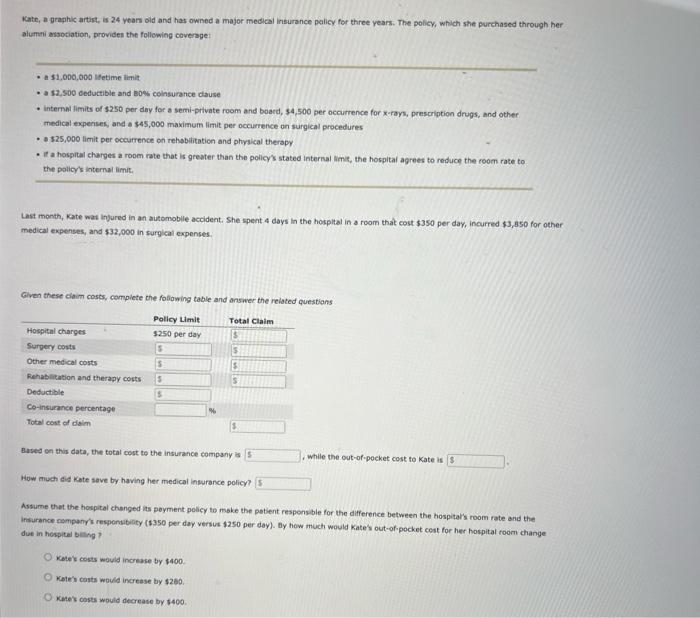

Besides pessibly paying the premiums for a medical insurence plan, the insured is almost always responsible for making other, out-of-pocket payments. This practice heips keep overall costs down for both insureds and the insurance companies and ensures that insureds are informed about. the costs of heahth care. for each of the following scenarios, select which type of other cost or provision is Mustrated. Aob had routine surgery performed at His local hospital. All charges were within the reasonable and customary costs in His area. Perticipation (co-insurence) Deductible Coordination of benefits Internal limits Cancy has had an liness and an aceident during the year. His combined out-of-pocket expense for both incidents was $1,000. The insurance company will now start to pay some of his medical expenses. What does the $1,000 represent? Coordination of benefits Internal limits Participation (co-insurance) Deductible Eileen had a horrible accident that required a year of treatments and rehabitation. Fortunately, Elieen's policy has a stop-loss provision that limits how much out-of-pocket expense she has to pay. Partidpation (co-Iniurance) Coordingtion of benefits Deductible Internal limits Hubert has standard; personal medical insurance. After a recent accident, he visited the emergency room, One of the questions on the admission form asked if the acoldent occurred at work. Internal limits Coardination of benefits Partiopation (co-inturance) Deductible Kete, 4 graphic artist, is 24 years ald and has owned a major medical insurance policy for three years, The policy, which she purchased through her alumini assodation, provides the following coverage. Kate, a graphic artist, is 24 yean old and has owned a major medical insurance pelicy for three years. The policy, which sthe purchased through her alumni association, providen the following coveragei - A 11,000,000 litetime linit - a 12,500 ceductible and eow coinsurance clause - intemal limits of $250 per day for a semi-private room and boacd, 54,500 per occurrence for x-rays, prescription drugs, and other medical expenses, and a $45,000 maximum limit per occurrence on surgical procedures - s s25,000 limit per occurrence ph rehabititation and physical therapy - it a hospital charges a room rate that is greater than the policy's stated internal limit, the hospital agrees to reduce the room rate to the policy's internal limit. Last month, kate wat infored in an automoblle accident. She spent 4 days in the hospltal in a room that cost $350 per day, incurred $3,350 for other medical expenses, and $32,000 in surgical expenses. Given these ciaim costs, compiete the fobiawing table and answer the related questians Based on this data, the total cost to the insurance eompany is while the out-of-pecket cost to Kate is How much did Kate save by having her medical insurance policy? Assume that the hospital changed its poyment policy to make the potient responsble for the difference between the hospital's room rate and the insurance company's responuibility (\$350 per day versut $250 per day). By how much would Kate's out-of-pocket cest for her hospital room change due in hespital biting ? Kate's costs would increase by $400. Kate's costs wauld increase by $260. Kate's costs would decrease by 5400