Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bia Inc. traded its existing rental cars for new cars with better technology. Two-thirds of the existing cars' original cost of $375,000 had been

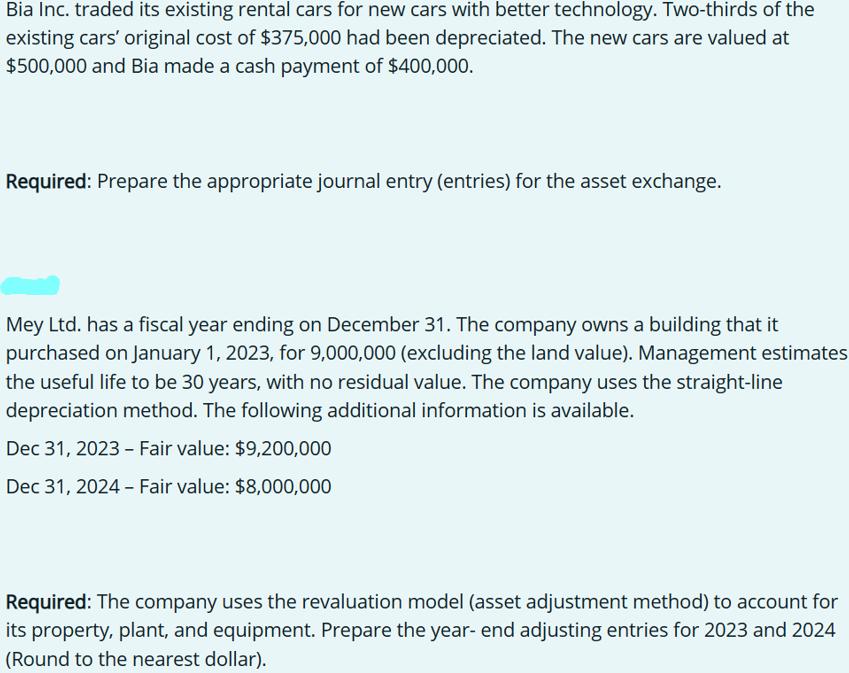

Bia Inc. traded its existing rental cars for new cars with better technology. Two-thirds of the existing cars' original cost of $375,000 had been depreciated. The new cars are valued at $500,000 and Bia made a cash payment of $400,000. Required: Prepare the appropriate journal entry (entries) for the asset exchange. Mey Ltd. has a fiscal year ending on December 31. The company owns a building that it purchased on January 1, 2023, for 9,000,000 (excluding the land value). Management estimates the useful life to be 30 years, with no residual value. The company uses the straight-line depreciation method. The following additional information is available. Dec 31, 2023 - Fair value: $9,200,000 Dec 31, 2024 Fair value: $8,000,000 Required: The company uses the revaluation model (asset adjustment method) to account for its property, plant, and equipment. Prepare the year-end adjusting entries for 2023 and 2024 (Round to the nearest dollar).

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entry for Asset Exchange Debit New Cars 500000 Debit Accumulated Depreciation 250000 Credit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started