Answered step by step

Verified Expert Solution

Question

1 Approved Answer

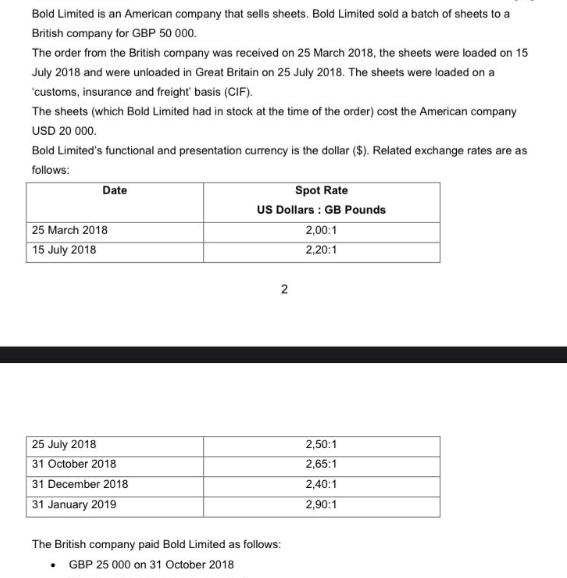

Bold Limited is an American company that sells sheets. Bold Limited sold a batch of sheets to a British company for GBP 50 000.

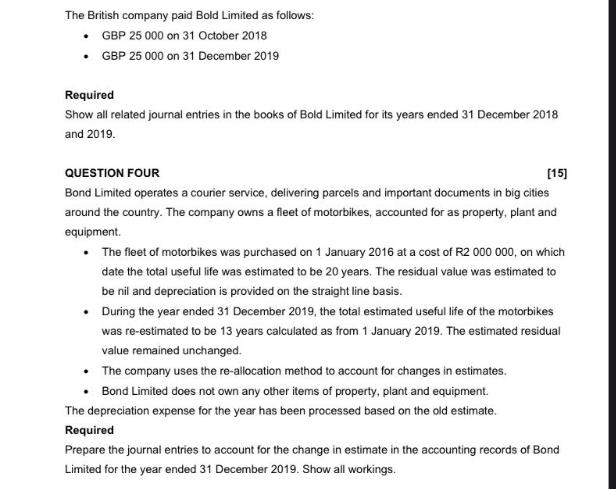

Bold Limited is an American company that sells sheets. Bold Limited sold a batch of sheets to a British company for GBP 50 000. The order from the British company was received on 25 March 2018, the sheets were loaded on 15 July 2018 and were unloaded in Great Britain on 25 July 2018. The sheets were loaded on a 'customs, insurance and freight' basis (CIF). The sheets (which Bold Limited had in stock at the time of the order) cost the American company USD 20 000. Bold Limited's functional and presentation currency is the dollar ($). Related exchange rates are as follows: Date 25 March 2018 15 July 2018 25 July 2018 31 October 2018 31 December 2018 31 January 2019 Spot Rate US Dollars : GB Pounds 2,00:1 2,20:1 2 The British company paid Bold Limited as follows: GBP 25 000 on 31 October 2018 2,50:1 2,65:1 2,40:1 2,90:1 The British company paid Bold Limited as follows: GBP 25 000 on 31 October 2018 GBP 25 000 on 31 December 2019 Required Show all related journal entries in the books of Bold Limited for its years ended 31 December 2018 and 2019. QUESTION FOUR [15] Bond Limited operates a courier service, delivering parcels and important documents in big cities around the country. The company owns a fleet of motorbikes, accounted for as property, plant and equipment. The fleet of motorbikes was purchased on 1 January 2016 at a cost of R2 000 000, on which date the total useful life was estimated to be 20 years. The residual value was estimated to be nil and depreciation is provided on the straight line basis. During the year ended 31 December 2019, the total estimated useful life of the motorbikes was re-estimated to be 13 years calculated as from 1 January 2019. The estimated residual value remained unchanged. The company uses the re-allocation method to account for changes in estimates. Bond Limited does not own any other items of property, plant and equipment. The depreciation expense for the year has been processed based on the old estimate. Required Prepare the journal entries to account for the change in estimate in the accounting records of Bond Limited for the year ended 31 December 2019. Show all workings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

You have provided the details of transactions made by Bold Limited an American company that sold sheets to a British company for GBP 50000 You have also shown the related exchange rates for various da...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started