Question: Can someone help me to perform a cash flow statement for financial analyses from 2000 to 2005: Below is the exhibit that I got from

Can someone help me to perform a cash flow statement for financial analyses from 2000 to 2005:

Below is the exhibit that I got from the case study:

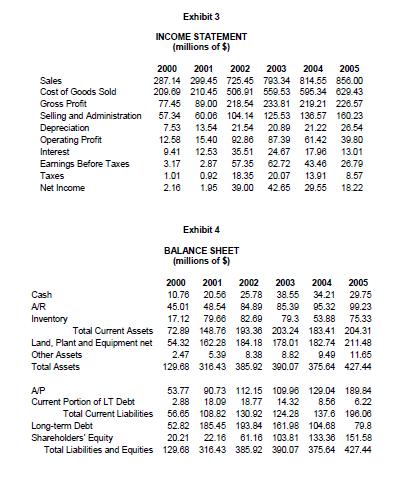

Exhibit 3 INCOME STATEMENT (millions of $) 2000 2001 2002 2003 2004 2005 Sales Cost of Goods Sold 287.14 200.45 725.45 783.34 814.55 856.00 209.60 210.45 506.91 550.53 595.34 629.43 Gross Profit 77.45 89.00 218.54 233.81 219.21 226.57 Selling and Administration Depreciation Operating Profit 57.34 80.06 104.14 125.53 136.57 180.23 7.53 13.54 21.54 20.80 87.30 24.67 21.22 26.54 12.58 15.40 92.88 61.42 30.80 Interest 9.41 12.53 35.51 17.96 13.01 Eamings Before Taxes 3.17 2.87 57.35 62.72 43.46 26.79 es 1.01 0.92 18.35 20.07 13.91 8.57 Net Income 2.18 1.95 39.00 42.65 29.55 18.22 Exhibit 4 BALANCE SHEET (millions of $) 2000 10.76 2001 2002 2003 2004 2005 Cash 20.56 25.78 38.55 34.21 29.75 AR 45.01 48.54 84.89 85.39 95.32 99.23 Inventory 17.12 79.66 82.60 79.3 53.88 75.33 Total Current Assets 72.89 148.76 193.36 203.24 183.41 204.31 Land, Plant and Equipment net 54.32 182.28 184.18 178.01 182.74 211.48 Other Assets 2.47 5.30 8.38 8.82 9.49 11.65 Total Assets 129.88 318.43 385.02 390.07 375.64 427.44 A/P 53.77 90.73 112.15 109.08 129.04 189.84 Current Portion of LT Debt 2.88 18.00 18.77 14.32 8.56 8.22 Total Current Liabilities 56.65 108.82 130.92 124.28 137.6 196.06 Long-term Debt Shareholders' Equity Total Liabilities and Equities 129.88 316.43 385.92 390.07 375.64 427.44 52.82 185.45 193.84 181.98 104.68 79.8 20.2 22.16 61.18 103.81 133.36 151.58

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts