Answered step by step

Verified Expert Solution

Question

1 Approved Answer

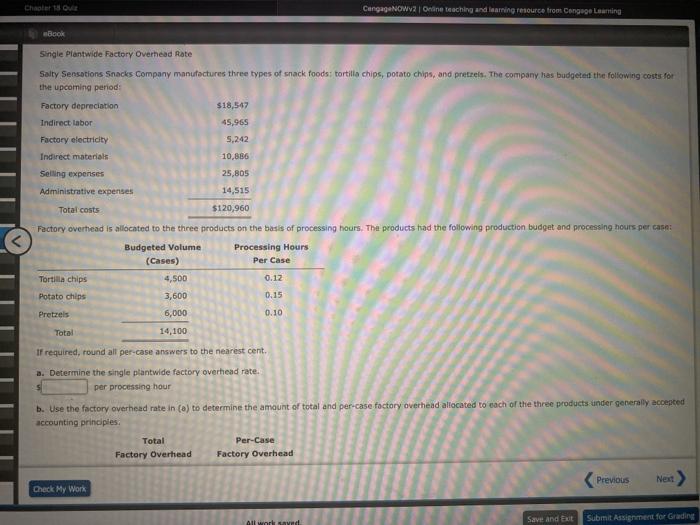

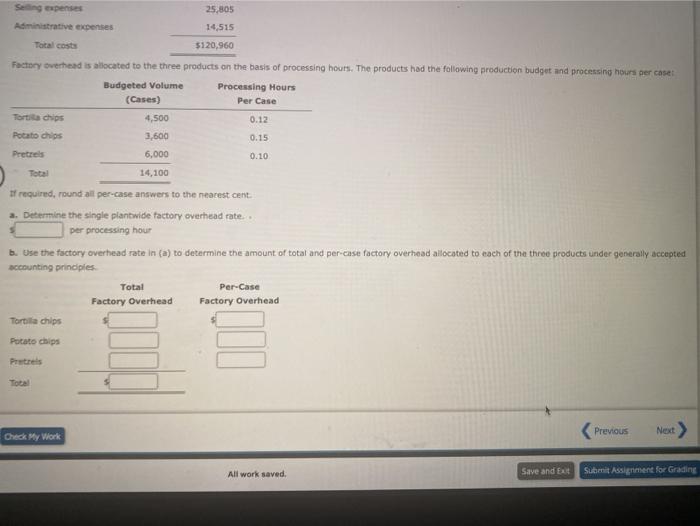

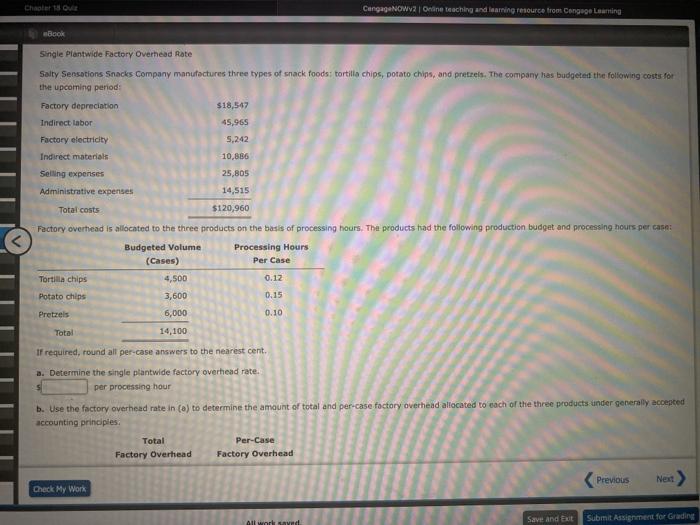

Chapter 1 QUE CengageNOW2 Online Teaching and learning resource from Cangage Learning Book Single Plantwide Factory Overhead Rate Salty Sensations Snacks Company manufactures three types

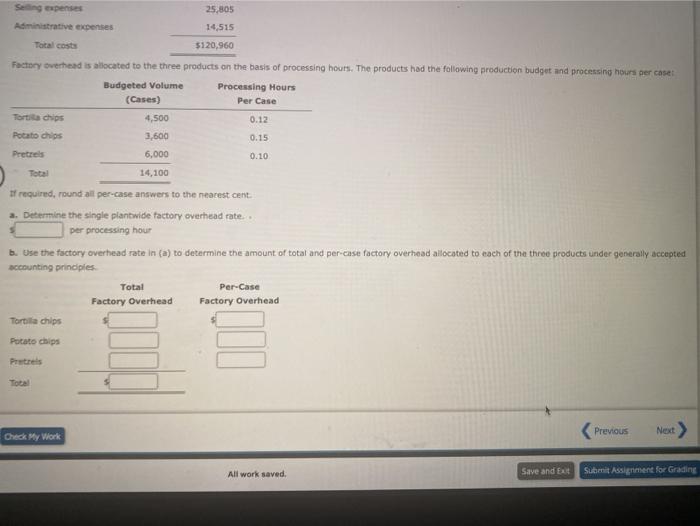

Chapter 1 QUE CengageNOW2 Online Teaching and learning resource from Cangage Learning Book Single Plantwide Factory Overhead Rate Salty Sensations Snacks Company manufactures three types of snack foods: tortilla chips, potato chips, and pretres. The company has budgeted the following costs for the upcoming period Factory depreciation $18,547 Indirect labor 45.965 Factory electricity 5.242 Indirect materials 10,886 Selling expenses 25,805 Administrative expenses 14,515 Total costs $120,960 Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per caso Budgeted Volume (Cases) 4,500 Processing Hours Per Case Tortilla chips 0.12 0.15 Potato chips Pretzels 3,600 6,000 14,100 0.10 Total If required, round all per case answers to the nearest cent. 3. Determine the single plantwide factory overhead rate. per processing hour b. Use the factory overhead rate in (a) to determine the amount of total and per-case factory overhead allocated to each of the three products under generally accepted accounting principles Total Per-Case Factory Overhead Factory Overhead Previous Next Check My Work All work saved Save and Exit Submit Assignment for Grading Sg expenses Administrative expenses 25,805 14,515 $120,960 Factory overhead is located to the three products on the basis of processing hours. The products had the following production budget and processing hours per case Budgeted Volume Processing Hours (Cases) Per Case Tortilla chips 4,500 0.12 Potato chips 3,600 0.15 Pretres 6,000 0.10 14,100 If required, round all per case answers to the nearest cent 2. Determine the single plantwide factory overhead rate. per processing hour b. Use the factory overhead rate in (a) to determine the amount of total and per-case factory overhead allocated to each of the three products under generally accepted accounting principles Total Per-Case Factory Overhead Factory Overhead Tortilla chips Potato chips Previous Next Check My Work All work saved, Save and Submit Assignment for Grading

Chapter 1 QUE CengageNOW2 Online Teaching and learning resource from Cangage Learning Book Single Plantwide Factory Overhead Rate Salty Sensations Snacks Company manufactures three types of snack foods: tortilla chips, potato chips, and pretres. The company has budgeted the following costs for the upcoming period Factory depreciation $18,547 Indirect labor 45.965 Factory electricity 5.242 Indirect materials 10,886 Selling expenses 25,805 Administrative expenses 14,515 Total costs $120,960 Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per caso Budgeted Volume (Cases) 4,500 Processing Hours Per Case Tortilla chips 0.12 0.15 Potato chips Pretzels 3,600 6,000 14,100 0.10 Total If required, round all per case answers to the nearest cent. 3. Determine the single plantwide factory overhead rate. per processing hour b. Use the factory overhead rate in (a) to determine the amount of total and per-case factory overhead allocated to each of the three products under generally accepted accounting principles Total Per-Case Factory Overhead Factory Overhead Previous Next Check My Work All work saved Save and Exit Submit Assignment for Grading Sg expenses Administrative expenses 25,805 14,515 $120,960 Factory overhead is located to the three products on the basis of processing hours. The products had the following production budget and processing hours per case Budgeted Volume Processing Hours (Cases) Per Case Tortilla chips 4,500 0.12 Potato chips 3,600 0.15 Pretres 6,000 0.10 14,100 If required, round all per case answers to the nearest cent 2. Determine the single plantwide factory overhead rate. per processing hour b. Use the factory overhead rate in (a) to determine the amount of total and per-case factory overhead allocated to each of the three products under generally accepted accounting principles Total Per-Case Factory Overhead Factory Overhead Tortilla chips Potato chips Previous Next Check My Work All work saved, Save and Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started