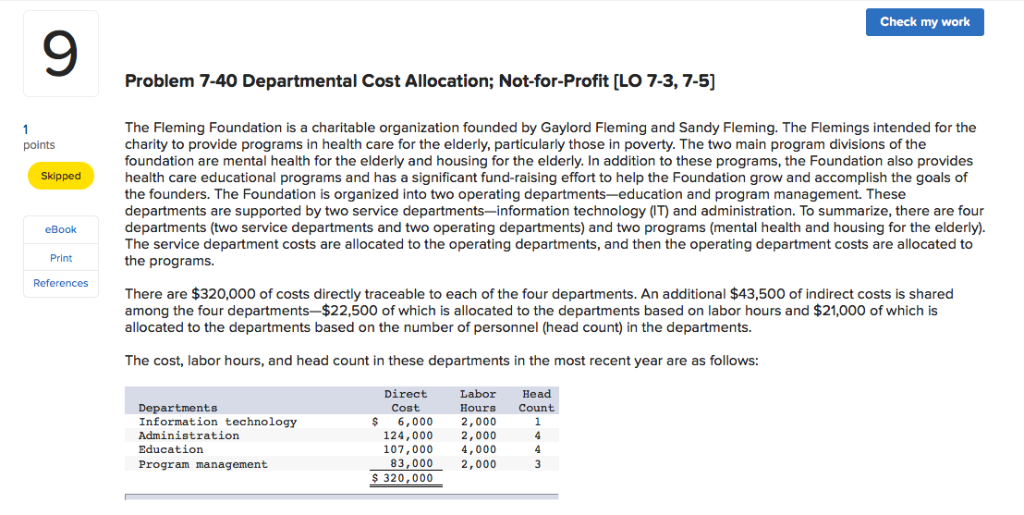

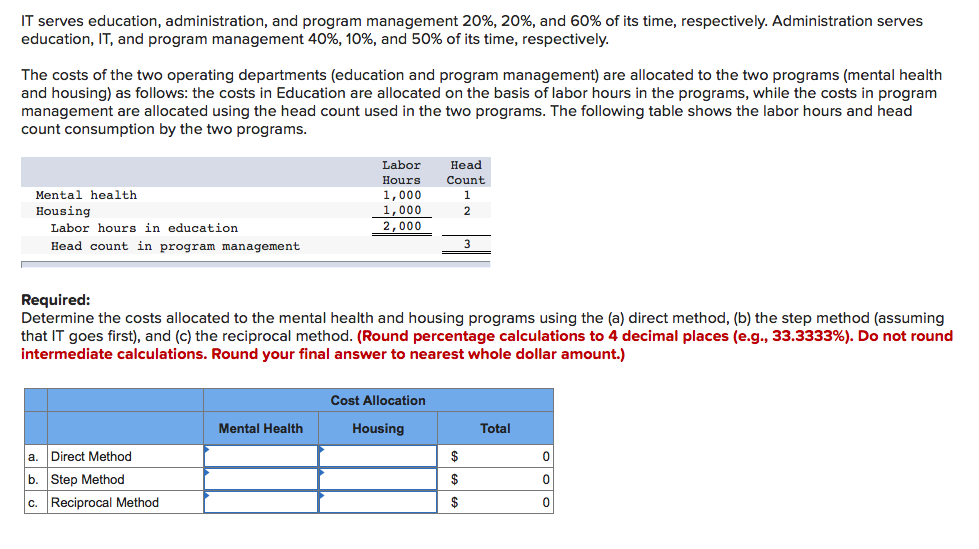

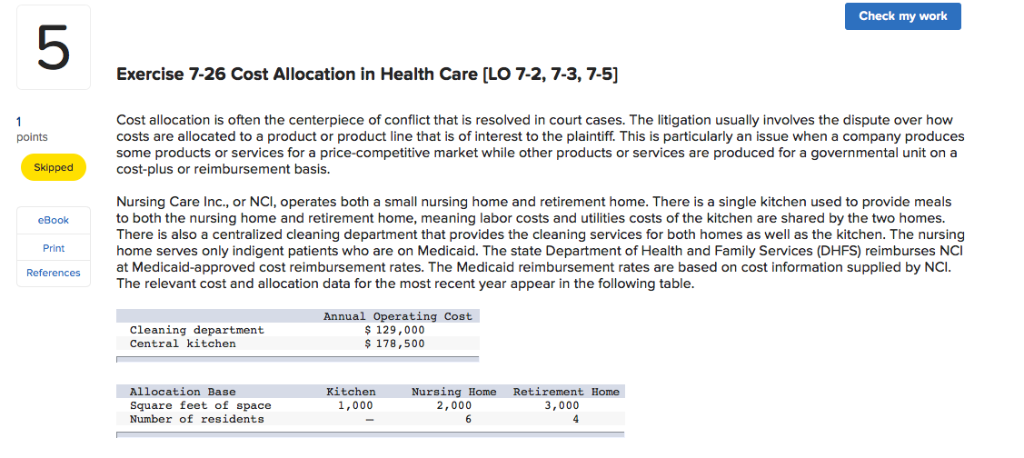

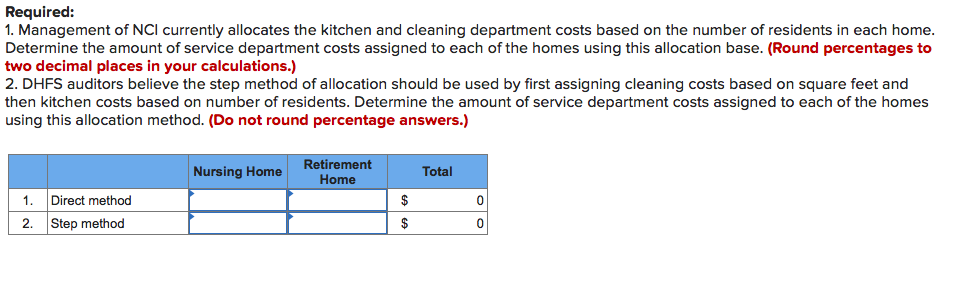

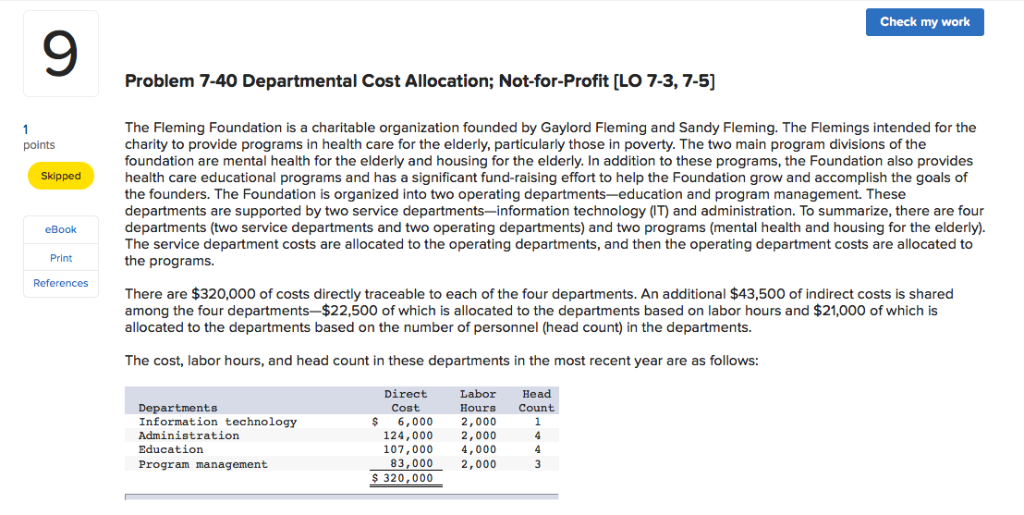

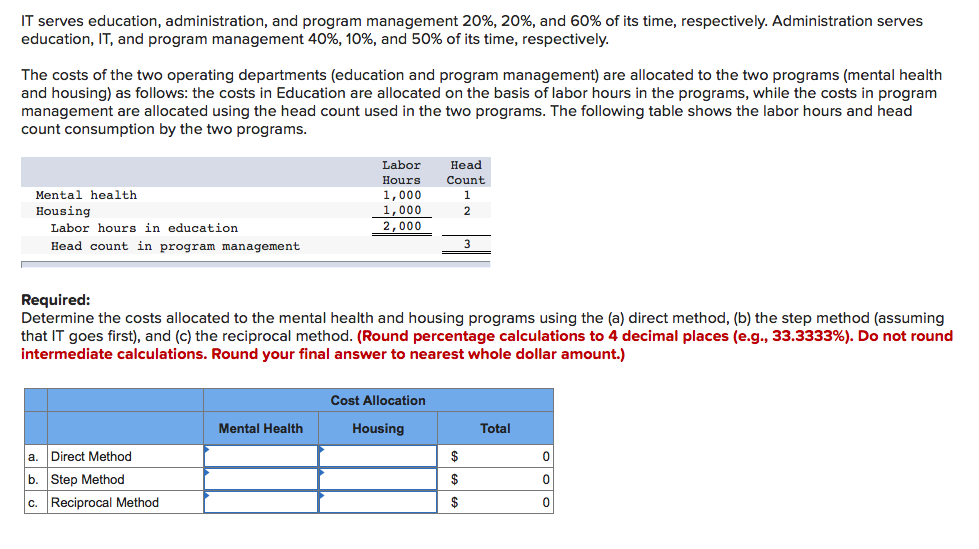

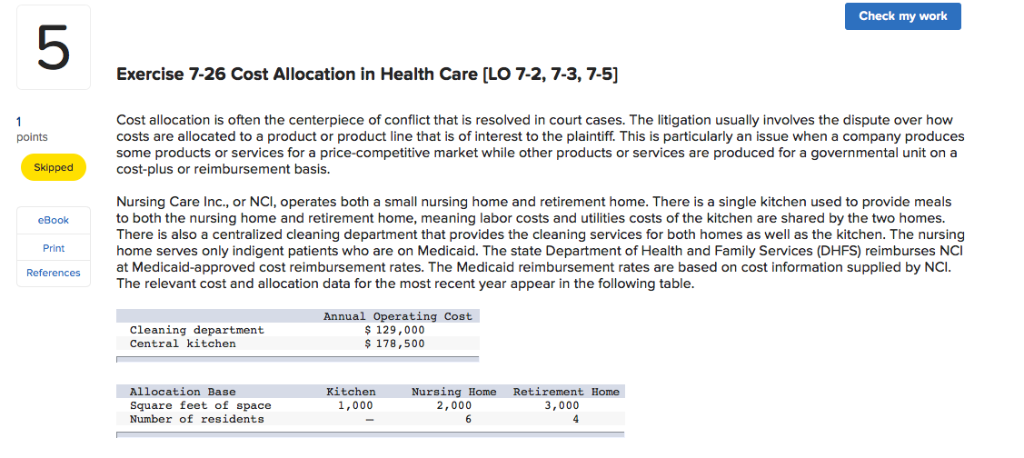

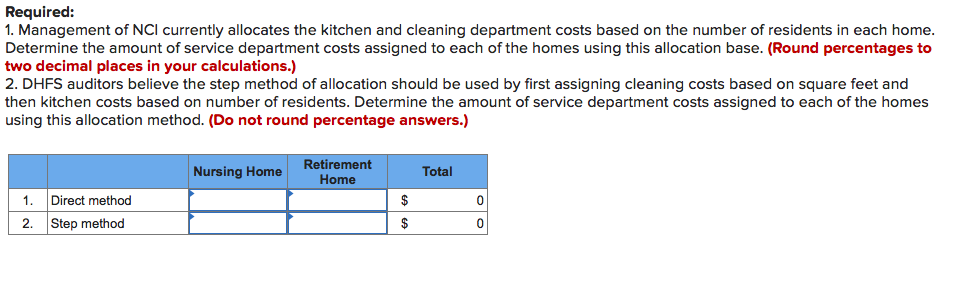

Check my work 9 Problem 7-40 Departmental Cost Allocation; Not-for-Profit LO 7-3,7-5] The Fleming Foundation is a charitable organization founded by Gaylord Fleming and Sandy Fleming. The Flemings intended for the charity to provide programs in health care for the elderly, particularly those in poverty. The two main program divisions of the foundation are mental health for the elderly and housing for the elderly. In addition to these programs, the Foundation also provides health care educational programs and has a significant fund-raising effort to help the Foundation grow and accomplish the goals of the founders. The Foundation is organized into two operating departments-education and program management. These departments are supported by two service departments-information technology (IT) and administration. To summarize, there are four departments (two service departments and two operating departments) and two programs (mental health and housing for the elderly) The service department costs are allocated to the operating departments, and then the operating department costs are allocated to the programs. points Skipped eBook Print References There are $320,000 of costs directly traceable to each of the four departments. An additional $43,500 of indirect costs is shared among the four departments-$22,500 of which is allocated to the departments based on labor hours and $21,000 of which is allocated to the departments based on the number of personnel (head count) in the departments. The cost, labor hours, and head count in these departments in the most recent year are as follows: Direct Cost Labor Head Hours Count Departments Information technology Administration Education Program management $ 6,000 2,000 2,000 4,000 83,000 2,000 124,000 107,000 320,000 IT serves education, administration, and program management 20%, 20%, and 60% of its time, respectively. Administration serves education, IT, and program management 40%, 10%, and 50% of its time, respectively The costs of the two operating departments (education and program management) are allocated to the two programs (mental health and housing) as follows: the costs in Education are allocated on the basis of labor hours in the programs, while the costs in program management are allocated using the head count used in the two programs. The following table shows the labor hours and head count consumption by the two programs. Labor Hours Count 1,000 1,000 2,000 Head Mental health Housing Labor hours in education Head count in program management Required: Determine the costs allocated to the mental health and housing programs using the (a) direct method, (b) the step method (assuming that IT goes first), and (c) the reciprocal method. (Round percentage calculations to 4 decimal places (e.g., 33.3333%). Do not round intermediate calculations. Round your final answer to nearest whole dollar amount.) Cost Allocation Mental Health Housing Total a. Direct Method b. Step Method c. Reciprocal Method 0 0 0 Check my work 5 Exercise 7-26 Cost Allocation in Health Care [LO 7-2, 7-3, 7-5] Cost allocation is often the centerpiece of conflict that is resolved in court cases. The litigation usually involves the dispute over how costs are allocated to a product or product line that is of interest to the plaintiff. This is particularly an issue when a company produces some products or services for a price-competitive market while other products or services are produced for a governmental unit on a cost-plus or reimbursement basis. points Skipped Nursing Care Inc., or NCI, operates both a small nursing home and retirement home. There is a single kitchen used to provide meals to both the nursing home and retirement home, meaning labor costs and utilities costs of the kitchen are shared by the two homes. There is also a centralized cleaning department that provides the cleaning services for both homes as well as the kitchen. The nursing home serves only indigent patients who are on Medicaid. The state Department of Health and Family Services (DHFS) reimburses NCI at Medicaid-approved cost reimbursement rates. The Medicaid reimbursement rates are based on cost information supplied by NCI. The relevant cost and allocation data for the most recent year appear in the following table eBook Print Cleaning department Central kitchen Annual Operating Cost 129,000 178,500 Allocation Base Square feet of space Number of residents K tchen 1,000 Nursing Home Retirement Home 2,000 3,000 Required: 1. Management of NCI currently allocates the kitchen and cleaning department costs based on the number of residents in each home. Determine the amount of service department costs assigned to each of the homes using this allocation base. (Round percentages to two decimal places in your calculations.) 2. DHFS auditors believe the step method of allocation should be used by first assigning cleaning costs based on square feet and then kitchen costs based on number of residents. Determine the amount of service department costs assigned to each of the homes using this allocation method. (Do not round percentage answers.) Nursing Home Retirement Total Home 1. Direct method 2. Step method