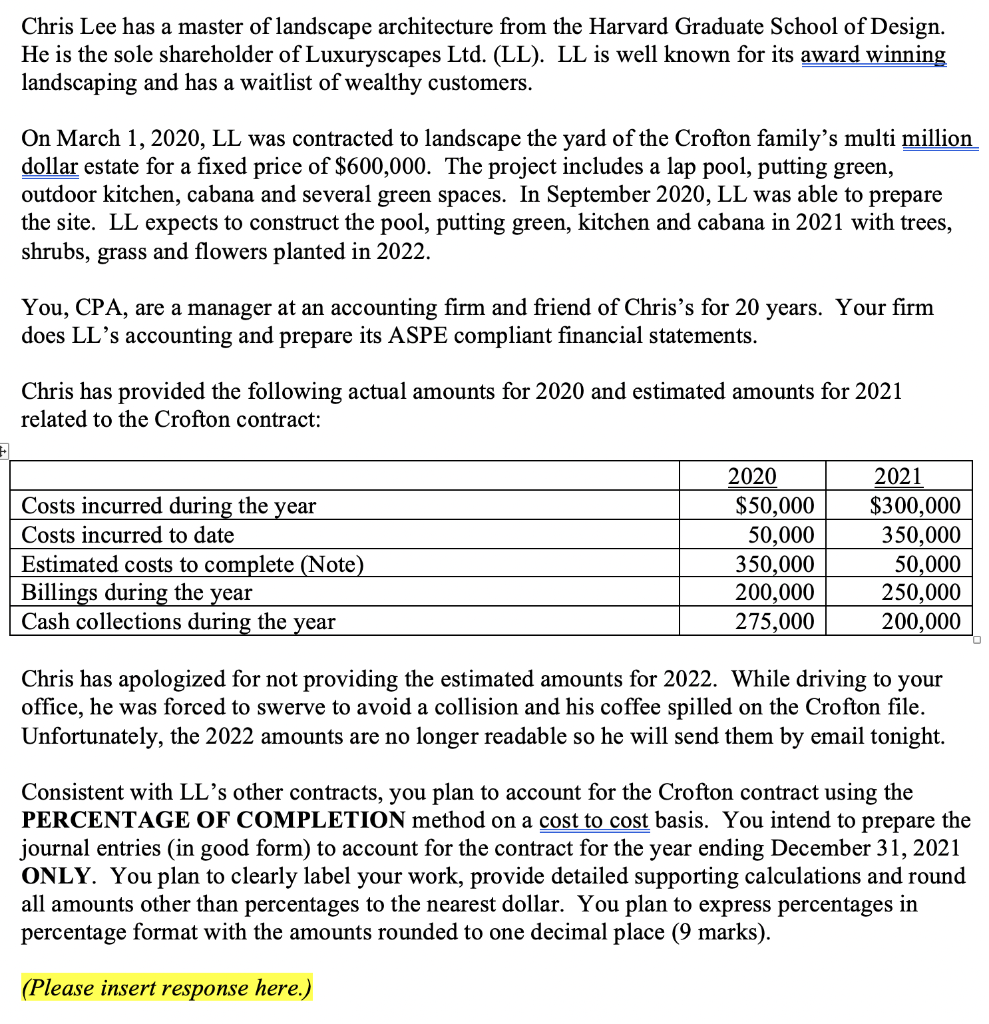

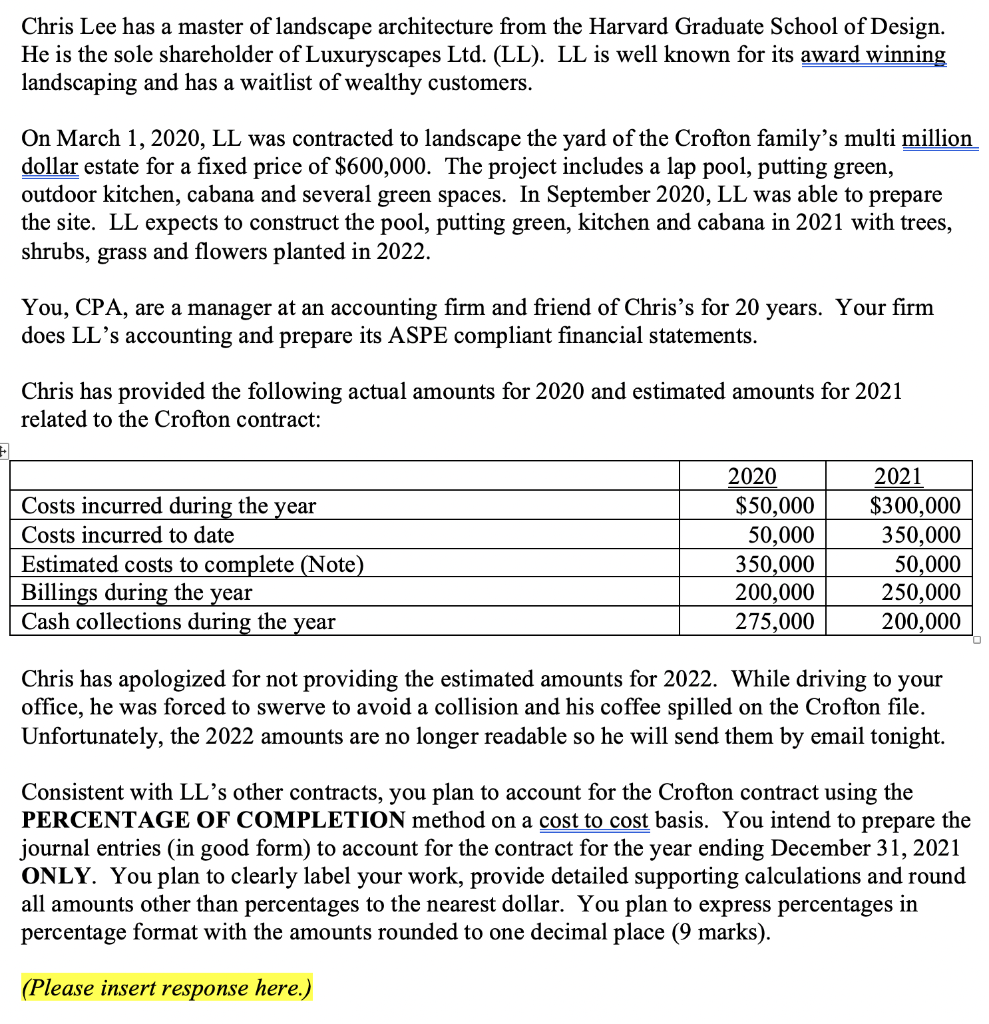

Chris Lee has a master of landscape architecture from the Harvard Graduate School of Design. He is the sole shareholder of Luxuryscapes Ltd. (LL). LL is well known for its award winning landscaping and has a waitlist of wealthy customers. On March 1, 2020, LL was contracted to landscape the yard of the Crofton family's multi million dollar estate for a fixed price of $600,000. The project includes a lap pool, putting green, outdoor kitchen, cabana and several green spaces. In September 2020, LL was able to prepare the site. LL expects to construct the pool, putting green, kitchen and cabana in 2021 with trees, shrubs, grass and flowers planted in 2022. You, CPA, are a manager at an accounting firm and friend of Chris's for 20 years. Your firm does LLs accounting and prepare its ASPE compliant financial statements. Chris has provided the following actual amounts for 2020 and estimated amounts for 2021 related to the Crofton contract: Costs incurred during the year Costs incurred to date Estimated costs to complete (Note) Billings during the year Cash collections during the year 2020 $50,000 50,000 350,000 200,000 275,000 2021 $300,000 350,000 50,000 250,000 200,000 Chris has apologized for not providing the estimated amounts for 2022. While driving to your office, he was forced to swerve to avoid a collision and his coffee spilled on the Crofton file. Unfortunately, the 2022 amounts are no longer readable so he will send them by email tonight. Consistent with LL's other contracts, you plan to account for the Crofton contract using the PERCENTAGE OF COMPLETION method on a cost to cost basis. You intend to prepare the journal entries (in good form) to account for the contract for the year ending December 31, 2021 ONLY. You plan to clearly label your work, provide detailed supporting calculations and round all amounts other than percentages to the nearest dollar. You plan to express percentages in percentage format with the amounts rounded to one decimal place (9 marks). (Please insert response here.) Chris Lee has a master of landscape architecture from the Harvard Graduate School of Design. He is the sole shareholder of Luxuryscapes Ltd. (LL). LL is well known for its award winning landscaping and has a waitlist of wealthy customers. On March 1, 2020, LL was contracted to landscape the yard of the Crofton family's multi million dollar estate for a fixed price of $600,000. The project includes a lap pool, putting green, outdoor kitchen, cabana and several green spaces. In September 2020, LL was able to prepare the site. LL expects to construct the pool, putting green, kitchen and cabana in 2021 with trees, shrubs, grass and flowers planted in 2022. You, CPA, are a manager at an accounting firm and friend of Chris's for 20 years. Your firm does LLs accounting and prepare its ASPE compliant financial statements. Chris has provided the following actual amounts for 2020 and estimated amounts for 2021 related to the Crofton contract: Costs incurred during the year Costs incurred to date Estimated costs to complete (Note) Billings during the year Cash collections during the year 2020 $50,000 50,000 350,000 200,000 275,000 2021 $300,000 350,000 50,000 250,000 200,000 Chris has apologized for not providing the estimated amounts for 2022. While driving to your office, he was forced to swerve to avoid a collision and his coffee spilled on the Crofton file. Unfortunately, the 2022 amounts are no longer readable so he will send them by email tonight. Consistent with LL's other contracts, you plan to account for the Crofton contract using the PERCENTAGE OF COMPLETION method on a cost to cost basis. You intend to prepare the journal entries (in good form) to account for the contract for the year ending December 31, 2021 ONLY. You plan to clearly label your work, provide detailed supporting calculations and round all amounts other than percentages to the nearest dollar. You plan to express percentages in percentage format with the amounts rounded to one decimal place (9 marks). (Please insert response here.)