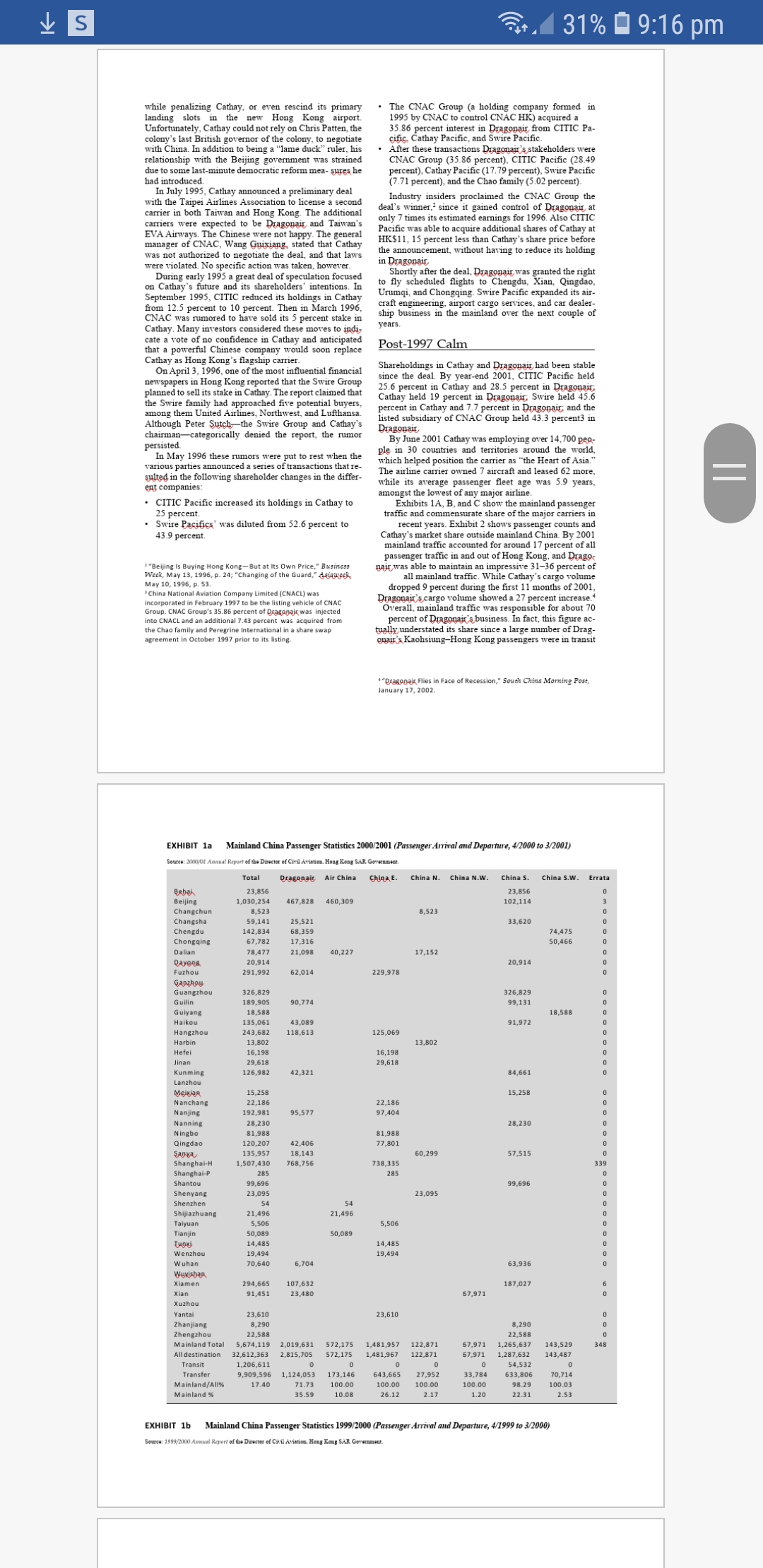

Cit 31% 9:16 pm while penalizing Cathay, or even rescind its primary . The CNAC Group (a holding company formed in landing slots in the new Hong Kong airport. 1995 by CNAC to control CNAC HK) acquired a Unfortunately, Cathay could not rely on Chris Patten, the 35.86 percent interest in Dragonair from CITIC Pa- colony's last British governor of the colony, to negotiate cific, Cathay Pacific, and Swire Pacific. with China. In addition to being a "lame duck" ruler, his relationship with the Beijing government was strained After these transactions Dragonair's stakeholders were CNAC Group (35.86 percent), CITIC Pacific (28.49 due to some last-minute democratic reform mea- sures he percent), Cathay Pacific (17.79 percent), Swire Pacific had introduced. In July 1995, Cathay announced a preliminary deal (7.71 percent), and the Chao family (5.02 percent). with the Taipei Airlines Association to license a second Industry insiders proclaimed the CNAC Group the carrier in both Taiwan and Hong Kong. The additional deal's winner,? since it gained control of Dragonair, at carriers were expected to be Dragonair, and Taiwan's only 7 times its estimated earnings for 1996. Also CITIC EVA Airways. The Chinese were not happy. The general Pacific was able to acquire additional shares of Cathay at manager of CNAC, Wang Guixiang, state HK$11, 15 percent less than Cathay's share price before was not authorized to negotiate the deal, and that laws the announcement, without having to reduce its holding were violated. No specific action was taken, however. in Dragonair, During early 1995 a great deal of speculation focused Shortly after the deal, Dragonair was granted the right on Cathay's future and its shareholders' intentions. In to fly scheduled flights to Chengdu, Xian, Qingdao, September 1995, CITIC reduced its holdings in Cathay Urumqi, and Chongqing. Swire Pacific expanded its air- from 12.5 percent to 10 percent. Then in March 1996, craft engineering, airport cargo services, and car dealer- CNAC was rumored to have sold its 5 percent stake in ship business in the mainland over the next couple of Cathay. Many investors considered these moves to indi years cate a vote of no confidence in Cathay and anticipated that a powerful Chinese company would soon replace Post-1997 Calm Cathay as Hong Kong's flagship carrier. On April 3, 1996, one of the most influential financial Shareholdings in Cathay and Dragonair had been stable newspapers in Hong Kong reported that the Swire Group since the deal. By year-end 2001, CITIC Pacific held planned to sell its stake in Cathay. The report claimed that 25.6 percent in Cathay and 28.5 percent in Dragonair; the Swire family had approached five potential buyers, Cathay held 19 percent in Dragonair, Swire held 45.6 among them United Airlines, Northwest, and Lufthansa. percent in Cathay and 7.7 percent in Dragonair; and the Although Peter Sutch-the Swire Group and Cathay's listed subsidiary of CNAC Group held 43.3 percent3 in chairman-categorically denied the report, the rumor Dragonair, persisted. By June 2001 Cathay was employing over 14,700 peg- In May 1996 these rumors were put to rest when the ple in 30 countries and territories around the world, various parties announced a series of transactions that re- which helped position the carrier as "the Heart of Asia." sulted in the following shareholder changes in the differ- The airline carrier owned 7 aircraft and leased 62 more, ent companies: while its average passenger fleet age was 5.9 years, = CITIC Pacific increased its holdings in Cathay to amongst the lowest of any major airline. Exhibits 1A, B, and C show the mainland passenger 25 percent. traffic and commensurate share of the major carriers in Swire Pacifics' was diluted from $2.6 percent to recent years. Exhibit 2 shows passenger counts and 43.9 percent Cathay's market share outside mainland China. By 2001 mainland traffic accounted for around 17 percent of all passenger traffic in and out of Hong Kong, and Drago- 2 "Beijing Is Buying Hong Kong-But at Its Own Price," Business Week, May 13, 1996, p. 24; "Changing of the Guard," Ajajce pait was able to maintain an impressive 31-36 percent of May 10, 1996, p. 53. all mainland traffic. While Cathay's cargo volume China National Aviation Company Limited (CNACL) was dropped 9 percent during the first 11 months of 2001, incorporated in February 1997 to be the listing vehicle of CNAC Dragonair's cargo volume showed a 27 percent increase.* Group. CNAC Group's 35.86 percent of Dragopak was injected Overall, mainland traffic was responsible for about 70 into CNACL and an additional 7.43 percent was acquired from percent of Dragonair's business. In fact, this figure ac- the Chao family and Peregrine International in a share swap tually understated its share since a large number of Drag- agreement in October 1997 prior to its listing. onair's Kaohsiung-Hong Kong passengers were in transit "Dragopaj Flies in Face of Recession," South China Morning Post, January 17, 2002. EXHIBIT la Mainland China Passenger Statistics 2000/2001 (Passenger Arrival and Departure, 4/2000 to 3/2001) Source: 200401 Annual Report of the Director of Civil Aviation, Hong Kong SAR. Government Total Dragonair, Air China China E. China N. China N.W. China S. China S.W. Errata Bebah 23,856 Beijing 1,030,254 467,828 460,309 102,114 Changchun 8,523 8,523 Changsha 59,141 25,521 33,620 Chengdu 142,834 68,359 Chongqing 67,782 17,316 50,466 Dalian 78,477 21.098 40,227 17,152 20,914 20,914 Fuzhou 291,992 62,014 229,978 Ganzhay Guangzhou 326,829 326,829 Guilin 189,905 90.774 99,131 Guiyang 18,588 Haikou 135,061 43,089 91,972 Hangzhou 243,682 118,613 25,069 Harbin 13,802 13,802 Hefel 16,198 16,198 Jinan 29,618 Kunming 126,982 12,321 84,661 Lanzhou 15,258 Nanchang 22,186 22,186 Nanjing 192,981 95.577 97,404 Nanning 28,230 28,230 Ningb 81,988 81,988 Qingdao 120,207 42,406 135,957 77,801 18,143 60,299 57,515 Shanghai-H 1,507,430 768,756 738,335 Shanghai-P 285 285 Shantou 99,69 99,696 Shenyang 23.095 23,095 Shenzhen 54 Shijiazhuang 1,496 21,496 Taiyuan 5.506 5,506 Tianjin 50.08 50,089 14,485 14,485 Wenzhou 19,494 19,494 Wuhan 70,640 6,704 63,936 wuxisbar Xiamen 294,665 107,632 187,027 Xian 91,451 23,480 57.971 Xuzhou Yantai 23,61 23,610 Zhanjiang 8,290 8,290 Zhengzhou 22,588 Mainland Total 5,674,119 2,019,631 572,175 1,481,957 122,871 57,971 1,265,637 143,529 348 All destination 32,612,363 2,815,705 1,481,967 122,871 57,971 1,287,632 143,487 Transit 1,206,611 C 0 54,532 Transfer 9,909,596 1,124,053 173,14 643,665 27,952 33,78 $33,806 70,714 Mainland/All 17.40 71.73 100.00 100.00 100.00 100.00 98.29 100.03 Mainland % 35.59 10.08 26.12 2.17 1.20 22.31 2.53 EXHIBIT 1b Mainland China Passenger Statistics 1999/2000 (Passenger Arrival and Departure, 4/1999 to 3/2000) Source: 1999/2060S 30% 9:19 pm was the second most popular route in Dragonair's sched- More Turbulence? ule and accounted for 19-20 percent of its total passen- gers, Shanghai-Hong Kong was the most popular route After a few quiet years, there were signs that the status while Beijing-Hong Kong was third. quo might be changing again. It was reported that CNAC might merge with Air China and China Southwest Air- Global Opportunities and Challenges lines.' The resulting group would have total assets of ap- proximately HK$52.9 billion and a fleet of 118 aircraft. Also, the listed arm of CNAC Group swapped its rental Airline industry experts forecasted that by 2020, global property portfolio for a 51 percent stake in Air Macau, airlines would purchase 16,000 aircraft worth US$1,200 which principally provided a transit point for main- land- billion. It was estimated that infrastructure providers- Taiwan traffic until direct cross-strait flights would be airports and air traffic services-around the world permitted. would spend US$350 billion to accommodate the growth The extent to which this would affect Dragonair's post- in air traffic. Global aviation was the prime en- gine of tion in the merged group was of strategic importance to travel and tourism that at the beginning of the millennium Cathay and Swire. Should Cathay strike out on its own? contributed more than US$3,500 billion to the world economy, or 12 percent of the total. More than 190 Complicating the picture further, in 2001 China Eastern Airline joined the Asia Mile Travel Reward Programme, million jobs were generated by the global aviation which also includes Dragonair, Swissair, Japan Airlines, industry, or 8 percent of the world total. Capital invest- Japan Asia Airways, Asiana Airlines, and Qantas Airways. ment for travel and tourism was at US$733 billion a year, In March 2002 Cathay announced that its net profit more than 11 percent of the world total. This truly for 2001 fell 87 percent from the preceding year. Ac- represented an enormous potential market for all the cording to its chairman, James Hughes-Hallett, Cathay's global airlines. traffic had already been affected by the economic slow- Whether Cathay could repeat its winning formula that down in 2001 and with the sudden drop after September had proven successful in the Asian region depended not 11, 2001, the carrier was forced to cut back several only on the developments in the China market, but also routes. To attract customers back to flying, the airline on how effectively the company could address twomajor then discounted its fares severely. The reported net profit challenges: capitalizing on the benefits of globalization for 2001 was $84.7 million, down from $645 million the and growth without losing Cathay's local/ Asian identity previous year. and individuality; and forging rewarding relationships Adding salt to the wounds, the 2003 SARS (Severe with strong global partners without cannibalizing Acute Respiratory Syndrome) epidemic also hit the Hong Cathay's own market shares. Kong tourist traffic and Cathay Pacific hard. In May, The first challenge was essentially a "think global and with international travel to the mainland restricted and act local" issue. Through networks with global partners, SARS having spread to Taiwan, the airline recorded a Cathay could become connected with a number of major loss of US$5 million a day. markets around the world. However, it remained impor- Once the epidemic was under control toward the sec- tant for Cathay to reinforce "the Heart of Asia" brand im- ond half of 2003, travel resumed as China's rapid eco- age, anchored at Hong Kong city and conveniently linked nomic expansion continued apace. While high fuel prices with all major Asian cities. That image would provide a increased costs and reduced profitability, by March 2004 distinct advantage over other national flag carriers in the airline reported net earnings of US$167 million for Asia, even more than being known as Hong Kong's flag the year, higher than analyst expectations." carrier. During 2003 Cathay Pacific negotiated intensively The second challenge related to leveraging the rela- with Chinese authorities about getting direct access to tionships with Cathay's allied partners. Cathay joined three mainland destinations: Beijing, Shanghai, and Xia- with American Airlines, British Airways, and Qantas to men. Strong opposition came from Dragonair, where found Oneworld in February 1999, and soon the new al- Cathay held a minority stake, and from government-con- liance had doubled in size with the additions of Iberia, trolled airlines including China Eastern Air. In October Aer Lingus, and LanChile. By 2002 Oneworld airlines 2003 Cathay was finally granted a permit for takeoffs served 574 destinations in 134 countries and territories, with more than 8,500 flights every day. Further, the eight s "CNAC Looks for Boom after Merger," South China Morning Post, member airlines were expected to benefit by almost March 1, 2002. US$1 billion in 2002 by virtue of the various relation- "Hong Kong: Loss at Airline," New York Times, March 7, 2002, ships amongst them: revenue generation, protection and p. W1. feed, and savings from joint purchasing and shared air- "len Cheng, "Cathay Pacific rebounds, after SARS Outbreak," Financial Times, March 11, 2004, p. 1. port and city facilities. Nicholas lonides, "Dragonair Fights Cathay Pacific China License," Flight International, April 29, 2003, p. 10. three times weekly. Access to Shanghai and Xiamen was economy and a weaker performance in cargo traffic. still denied, however. While the growing business Cathay had in the aviation In September 2004, with important democratic elec- powerhouse of China was a significant plus, some 60 tions in Hong Kong upcoming, the Chinese government percent of its business comes from outside China, expos- further liberalized access to mainland cities from Hong ing it to a global slowdown. Still, the results confirmed Kong, although not directly to Cathay. The main question the benefits of Cathay's acquisitions in China-the 2006 involved the role of a large new airport outside of takeover of Dragon Air, which had an extensive network Guangzhou, just north of Hong Kong. The giant Baiyun of connections between Hong and the mainland, and a International Airport had opened in August about 80 stake in Air China. Those acquisitions, which had now miles up the Pearl River from Hong Kong, in direct com- produced their first full-year contribution to the results, petition with the huge new Chek Lap Kok airport outside were already having a positive impact on the business of Hong Kong, which had opened in July 1998. The move to the Cathay Pacific Group preserve Hong Kong's status as the entry hub into China was seen as a political move by the Chinese authorities to Discussion Questions reduce the pressure for greater democracy in the former British colony." The pact also reaffirmed the limits on in- ternational access to Hong Kong destinations, limiting 1. Given the political complications, how attractive is the foreign competition and solidifying Cathay Pacific's sta- China mainland market? How would you evaluate the us as the Hong Kong flag carrier. threat from Baiyun? What if China's economic expan- In 2007 Cathay Pacific posted a 71.8 percent increase sion slows down? in profit, taking advantage of booming growth in Asia What strategic alternatives are there for Cathay to de- and defying the impact of historically high oil prices. The velop the mainland market? Should it rely on Drago- sharp jump in Cathay's profit during the year, well be- pair, develop new alliances, or continue to go it alone? yond the expectations of analysts of more than HK$7 bil- 3. How should Cathay develop and market its global im- lion, or US$900 million, followed similar performances age without diminishing its local/regional identity as from other major regional carriers including Qantas and the Hong Kong (and China) carrier? Singapore Airlines. Driving the good times of the airline 4. Should Cathay focus on China by attempting to develop industry was a leap in passenger volume, in particular it further or instead focus on the overall global market? business travelers, as Asian economies enjoyed robust economic growth. Demand from business and first-class " Keith Bradsher, "Deal Preserves Hong Kong's Hub Status," New York Times, September 9, 2004, p. W1,7. passengers was particularly strong. But industry executives and analysts were concerned about dark clouds on the horizon from a softening U.S. Source: This case was prepared by Eddie Yu, associate professor at the City University of Hong Kong, and Anthony Ko, associate profes- sor at the Open University of Hong Kong, and revised by Paul Kolesa