Answered step by step

Verified Expert Solution

Question

1 Approved Answer

COMPANY A COMPANY B COMPARE THE LEVERAGE RATIO FOR COMPANY A AND COMPANY B AND WRITE A ANALYSIS. NEED THIS ASAP PLS THANKS IN ADVANCE

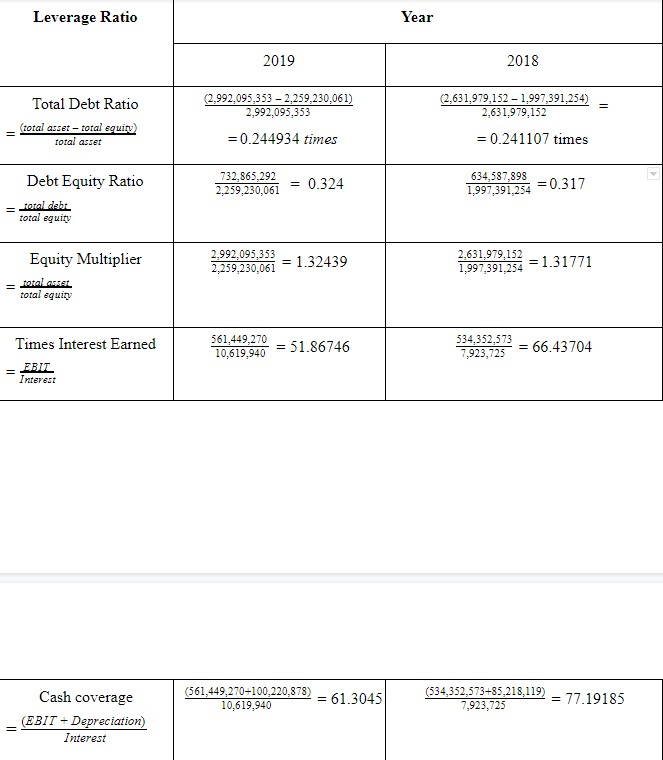

COMPANY A

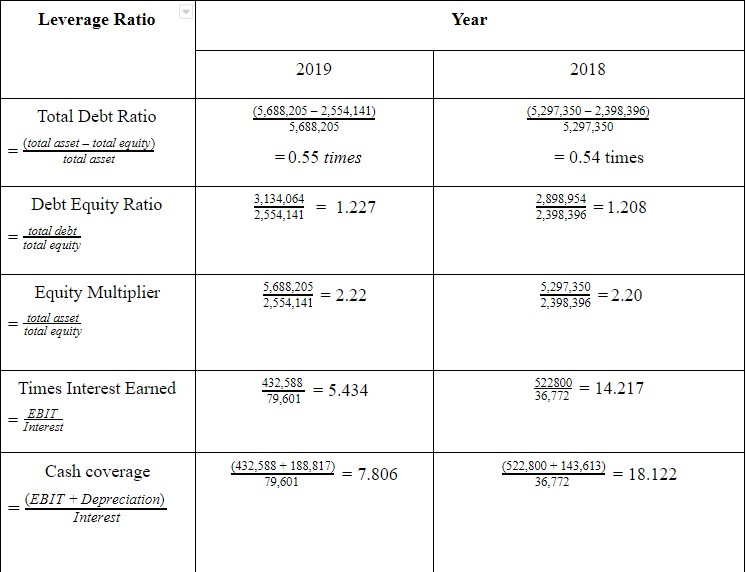

COMPANY B

COMPARE THE LEVERAGE RATIO FOR COMPANY A AND COMPANY B AND WRITE A ANALYSIS. NEED THIS ASAP PLS THANKS IN ADVANCE

Leverage Ratio Year 2019 2018 Total Debt Ratio (total asset total equiru total asset (2.992.095,353 -2.259,230.061) 2,992,095,353 = 0.244934 times (2,631,979,152 - 1,997,391,254) 2.631.979.152 = 0.241107 times Debt Equity Ratio 732.865,292 2,259,230,061 = 0.324 634,587,898 1,997,391,254 = 0.317 total dat total equity 2.992,095,353 2,259,230,061 1.32439 Equity Multiplier = totalment 2,631,979,152 1,997,391,254 = 1.31771 total equity Times Interest Earned EBIT 561,449,270 10,619,940 51.86746 534,352,573 7,923,725 66.43704 = Interest (561,449,270-100,220,878) 10,619,940 = 61.3045 (534,352,573+85,218,119) 7,923,725 = 77.19185 Cash coverage (EBIT + Depreciation) Interest Leverage Ratio Year 2019 2018 5.688,205 - 2,554,141) 5,688,205 (5,297,350 -2,398,396) 5,297,350 Total Debt Ratio (total asset - total equit) total asset =0.55 times = 0.54 times Debt Equity Ratio 3,134,064 2,554,141 = 1.227 2,898,954 2,398,396 = 1.208 total debt total equity 5,688,205 2,554,141 = Equity Multiplier total asset total equity = 2.22 5,297,350 = 2.20 2,398,396 = Times Interest Earned 432,588 79,601 = 5.434 522800 36,772 = - 14.217 EBIT Interest (432,588 - 188.817) = 7.806 79,601 (522.800 + 143,613) 36,772 18.122 Cash coverage (EBIT + Depreciation) InterestStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started