Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete the IRS tax return for tina's sole proprietorship business. complete form 1040 schedule c, and forms required by schedule c: forms 4562 (depreciation) and

complete the IRS tax return for tina's sole proprietorship business. complete form 1040 schedule c, and forms required by schedule c: forms 4562 (depreciation) and 8829 (home office) for tina's kitchen supplies.

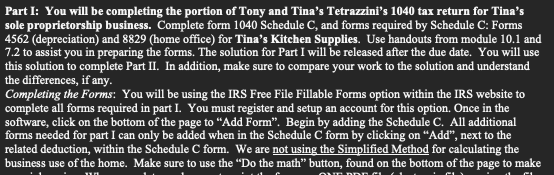

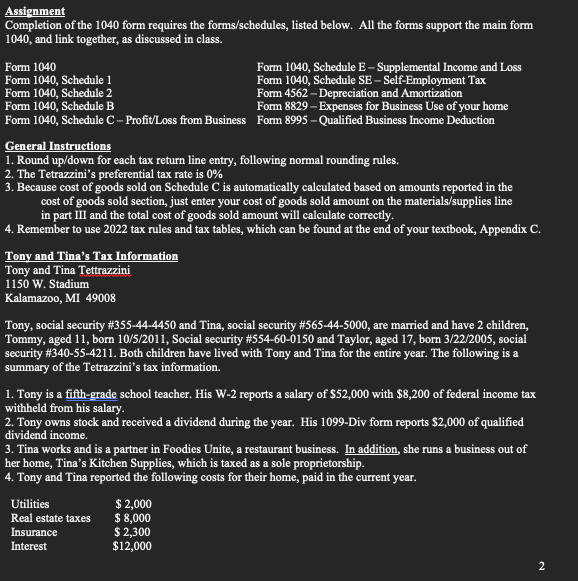

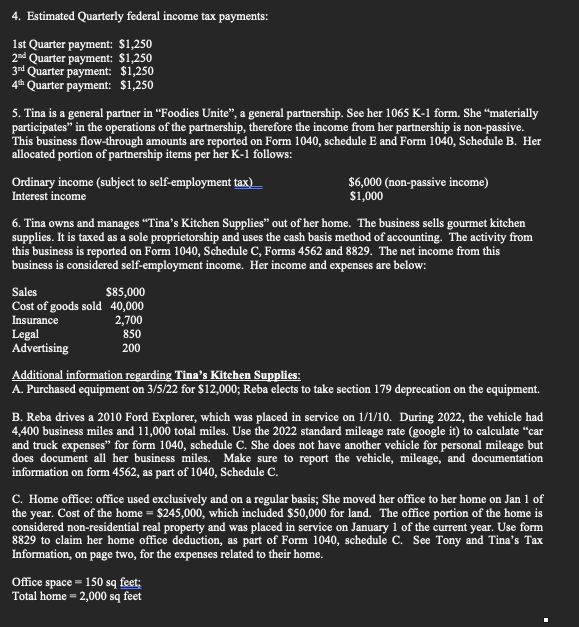

Part I: You will be completing the portion of Tony and Tina's Tetrazzini's 1040 tax return for Tina's sole proprietorship business. Complete form 1040 Schedule C, and forms required by Schedule C: Forms 4562 (depreciation) and 8829 (home office) for Tina's Kitchen Supplies. Use handouts from module 10.1 and 7.2 to assist you in preparing the forms. The solution for Part I will be released after the due date. You will use this solution to complete Part II. In addition, make sure to compare your work to the solution and understand the differences, if any. Completing the Forms: You will be using the IRS Free File Fillable Forms option within the IRS website to complete all forms required in part I. You must register and setup an account for this option. Once in the software, click on the bottom of the page to "Add Form". Begin by adding the Schedule C. All additional forms needed for part I can only be added when in the Schedule C form by clicking on "Add", next to the related deduction, within the Schedule C form. We are not using the Simplified Method for calculating the business use of the home. Make sure to use the "Do the math" button, found on the bottom of the page to make CL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is the completed IRS tax return for Tinas sole proprietorship business Tinas Kitchen Supplies F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started