Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the real property gains tax (if any) payable on the: i. Transfer of land from Allan to Allgood Sdn Bhd on 1 July 2018.

Compute the real property gains tax (if any) payable on the:

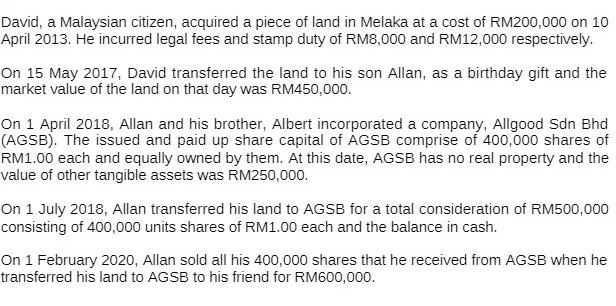

David, a Malaysian citizen, acquired a piece of land in Melaka at a cost of RM200,000 on 10 April 2013. He incurred legal fees and stamp duty of RM8,000 and RM12,000 respectively. On 15 May 2017, David transferred the land to his son Allan, as a birthday gift and the market value of the land on that day was RM450,000. On 1 April 2018, Allan and his brother, Albert incorporated a company, Allgood Sdn Bhd (AGSB). The issued and paid up share capital of AGSB comprise of 400,000 shares of RM1.00 each and equally owned by them. At this date, AGSB has no real property and the value of other tangible assets was RM250,000. On 1 July 2018, Allan transferred his land to AGSB for a total consideration of RM500,000 consisting of 400,000 units shares of RM1.00 each and the balance in cash. On 1 February 2020, Allan sold all his 400,000 shares that he received from AGSB when he transferred his land to AGSB to his friend for RM600,000.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

For the first scenario To compute the real property gains tax RPGT payable on the transfer of land f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started