(1) Calculate the total cost of SATHU and total cost of DHUA (if the expected number of units is produced) using the traditional costing system.

(1) Calculate the total cost of SATHU and total cost of DHUA (if the expected number of units is produced) using the traditional costing system.

(2)Calculate the total cost of SATHU and total cost of DHUA (if the expected number of units is produced) using the activity-based costing system.

(3)Suppose the company decides to use ABC to set its selling price. What would be the minimum selling price per unit for each product if the company requires a gross profit margin of 35% for all products?

(4) Assume that Tenaga cost increased by 2 0 % and Camputer's cost decreased by $30,000. Calculate the total cost of DHUA only (assuming that the expected no. of units is produced, and the total driver units remain the same) using the activity-based costing system

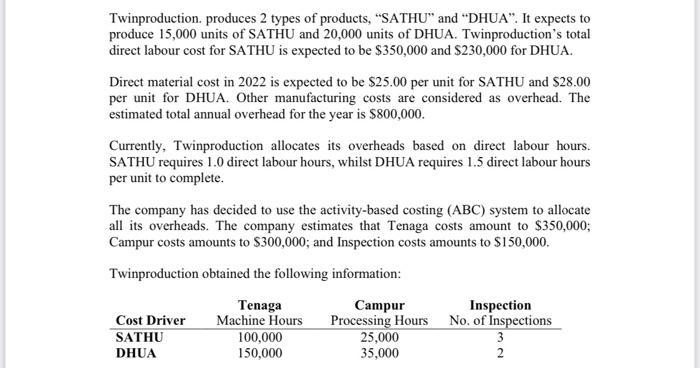

Twinproduction, produces 2 types of products, "SATHU" and "DHUA". It expects to produce 15,000 units of SATHU and 20,000 units of DHUA. Twinproduction's total direct labour cost for SATHU is expected to be $350,000 and $230,000 for DHUA. Direct material cost in 2022 is expected to be $25.00 per unit for SATHU and $28.00 per unit for DHUA. Other manufacturing costs are considered as overhead. The estimated total annual overhead for the year is $800,000. Currently, Twinproduction allocates its overheads based on direct labour hours. SATHU requires 1.0 direct labour hours, whilst DHUA requires 1.5 direct labour hours per unit to complete. The company has decided to use the activity-based costing (ABC) system to allocate all its overheads. The company estimates that Tenaga costs amount to $350,000; Campur costs amounts to $300,000; and Inspection costs amounts to $150,000. Twinproduction obtained the following information: Tenaga Campur Machine Hours Processing Hours 25,000 35,000 Cost Driver SATHU DHUA 100,000 150,000 Inspection No. of Inspections 3 2

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Working notes WN 1 Calculation of Overhead rate in traditional accounting Hours in Sathu 15000 units ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started