Question: Considering the table below what is the ROE and ROA? What's the current and acid test ratios? What's the profit margin And what's the operating

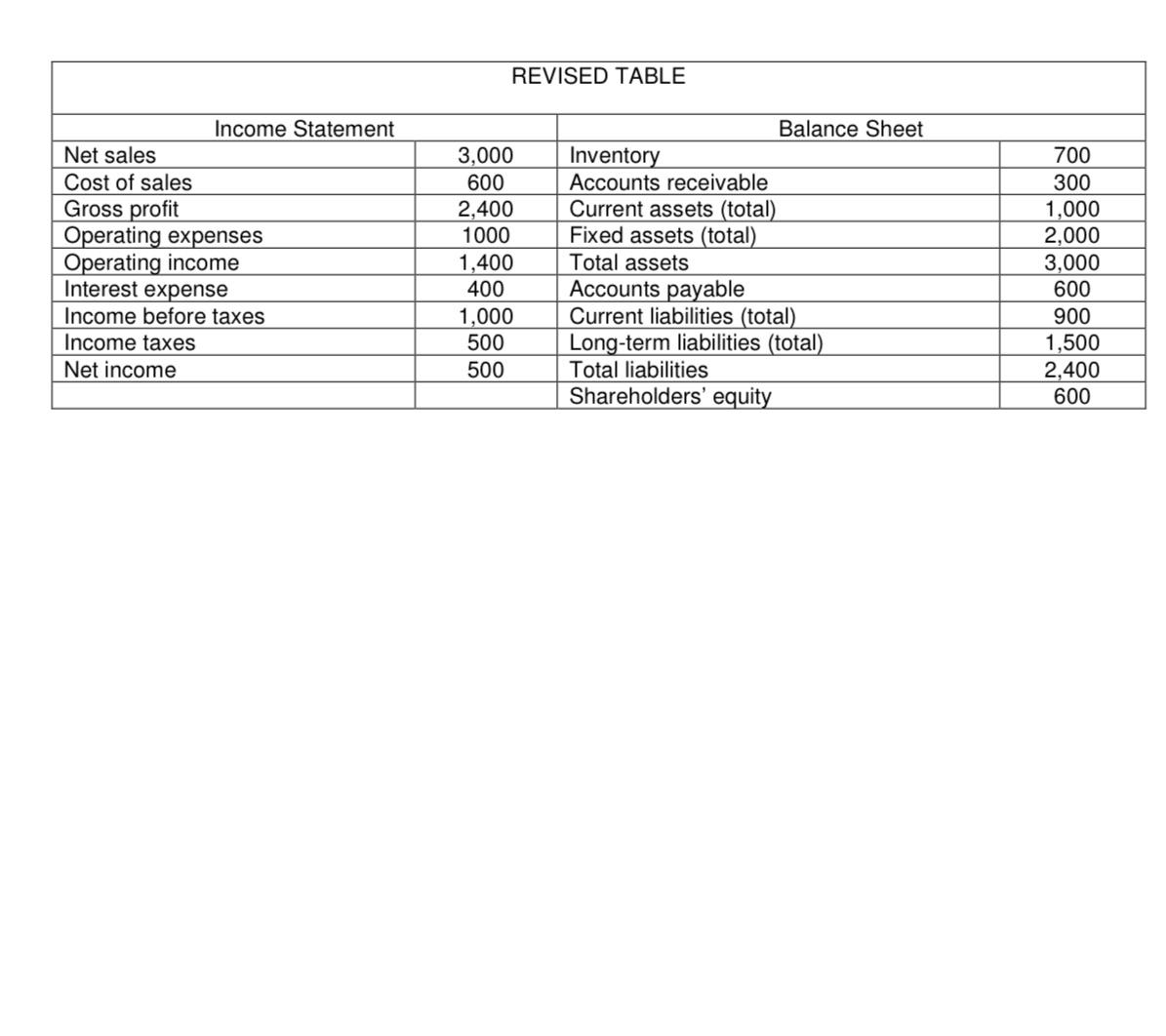

Considering the table below what is the ROE and ROA? What's the current and acid test ratios? What's the profit margin And what's the operating cycle?

Net sales Cost of sales Gross profit Income Statement Operating expenses Operating income Interest expense Income before taxes Income taxes Net income REVISED TABLE 3,000 600 2,400 1000 1,400 400 1,000 500 500 Inventory Accounts receivable Current assets (total) Fixed assets (total) Total assets Balance Sheet Accounts payable Current liabilities (total) Long-term liabilities (total) Total liabilities Shareholders' equity 700 300 1,000 2,000 3,000 600 900 1,500 2,400 600

Step by Step Solution

3.32 Rating (173 Votes )

There are 3 Steps involved in it

Return on Equity ROE ROE Net Income Shareholders Equity ROE 500 600 ROE 083 or 83 ... View full answer

Get step-by-step solutions from verified subject matter experts