Answered step by step

Verified Expert Solution

Question

1 Approved Answer

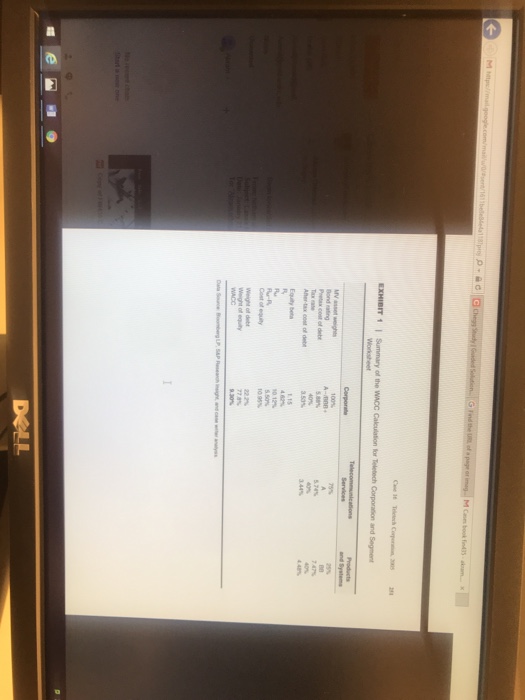

Could u please answer the first question? Case 16- Teletech Corporation As you will recall, Teletech comprises two quite different divisions, housed within one corporate

Could u please answer the first question?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started