Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CoursHeroTranscribedText: McDougal Company uses a predetermined overhead rate to assign overhead to jobs. Because McDougal's production is machine intensive, overhead is applied on the basis

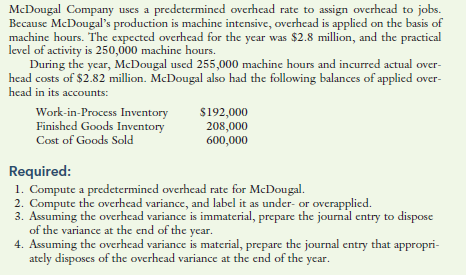

CoursHeroTranscribedText: McDougal Company uses a predetermined overhead rate to assign overhead to jobs. Because McDougal's production is machine intensive, overhead is applied on the basis of machine hours. The expected overhead for the year was $2.8 million, and the practical level of activity is 250,000 machine hours. During the year, McDougal used 255,000 machine hours and incurred actual over- head costs of $2.82 million. McDougal also had the following balances of applied over- head in its accounts: Work-in-Process Inventory $192,000 Finished Goods Inventory 208,000 Cost of Goods Sold 600,000 Required: 1. Compute a predetermined overhead rate for McDougal. 2. Compute the overhead variance, and label it as under- or overapplied. 3. Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at the end of the year. 4. Assuming the overhead variance is material, prepare the journal entry that appropri- ately disposes of the overhead variance at the end of the year

CoursHeroTranscribedText: McDougal Company uses a predetermined overhead rate to assign overhead to jobs. Because McDougal's production is machine intensive, overhead is applied on the basis of machine hours. The expected overhead for the year was $2.8 million, and the practical level of activity is 250,000 machine hours. During the year, McDougal used 255,000 machine hours and incurred actual over- head costs of $2.82 million. McDougal also had the following balances of applied over- head in its accounts: Work-in-Process Inventory $192,000 Finished Goods Inventory 208,000 Cost of Goods Sold 600,000 Required: 1. Compute a predetermined overhead rate for McDougal. 2. Compute the overhead variance, and label it as under- or overapplied. 3. Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at the end of the year. 4. Assuming the overhead variance is material, prepare the journal entry that appropri- ately disposes of the overhead variance at the end of the year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started