Question

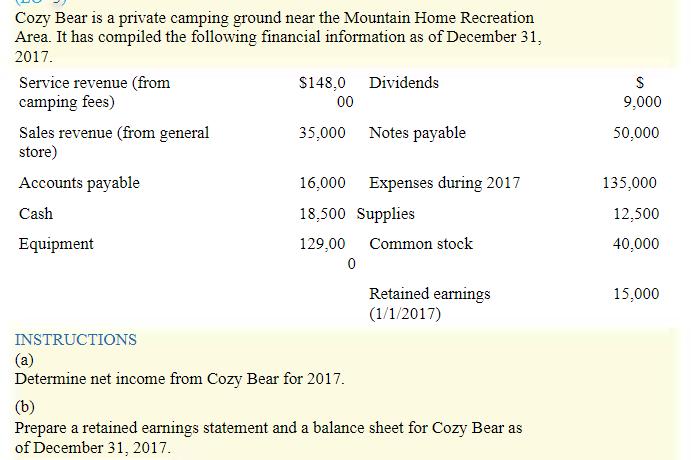

Cozy Bear is a private camping ground near the Mountain Home Recreation Area. It has compiled the following financial information as of December 31,

Cozy Bear is a private camping ground near the Mountain Home Recreation Area. It has compiled the following financial information as of December 31, 2017. Dividends Service revenue (from camping fees) Sales revenue (from general store) Accounts payable Cash Equipment INSTRUCTIONS $148,0 00 35,000 Notes payable 16,000 Expenses during 2017 18,500 Supplies 129,00 (a) Determine net income from Cozy Bear for 2017. 0 Common stock Retained earnings (1/1/2017) (b) Prepare a retained earnings statement and a balance sheet for Cozy Bear as of December 31, 2017. S 9,000 50,000 135,000 12,500 40,000 15,000

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Service revenue from camping fees 148000 Dividends S9000 Sales revenue fro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

6th edition

1118096894, 978-1-11921511, 978-1118096895

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App