Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Depreciation by Two Methods; Sale of Fixed Asset New tire retreading equipment, acquired at a cost of $140,000 at the beginning of a fiscal year,

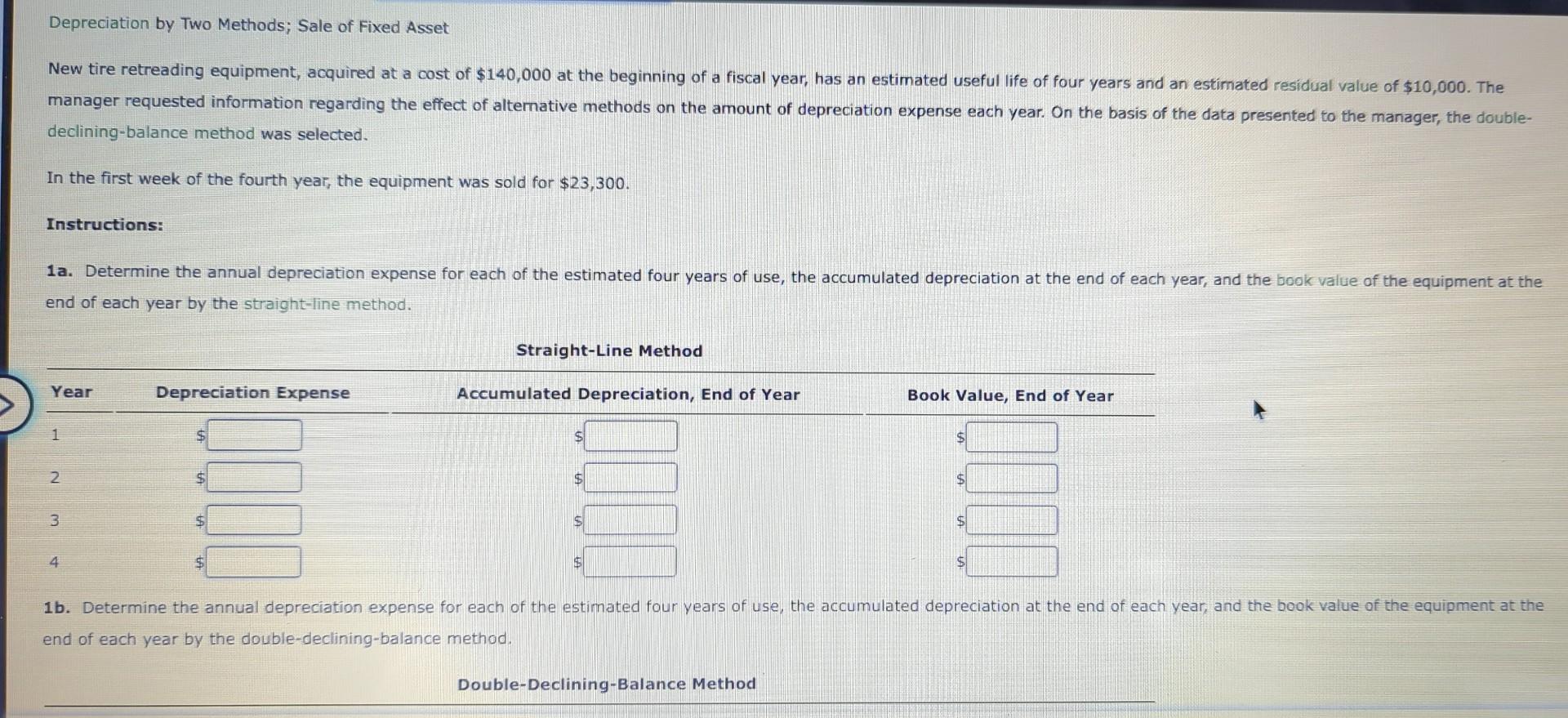

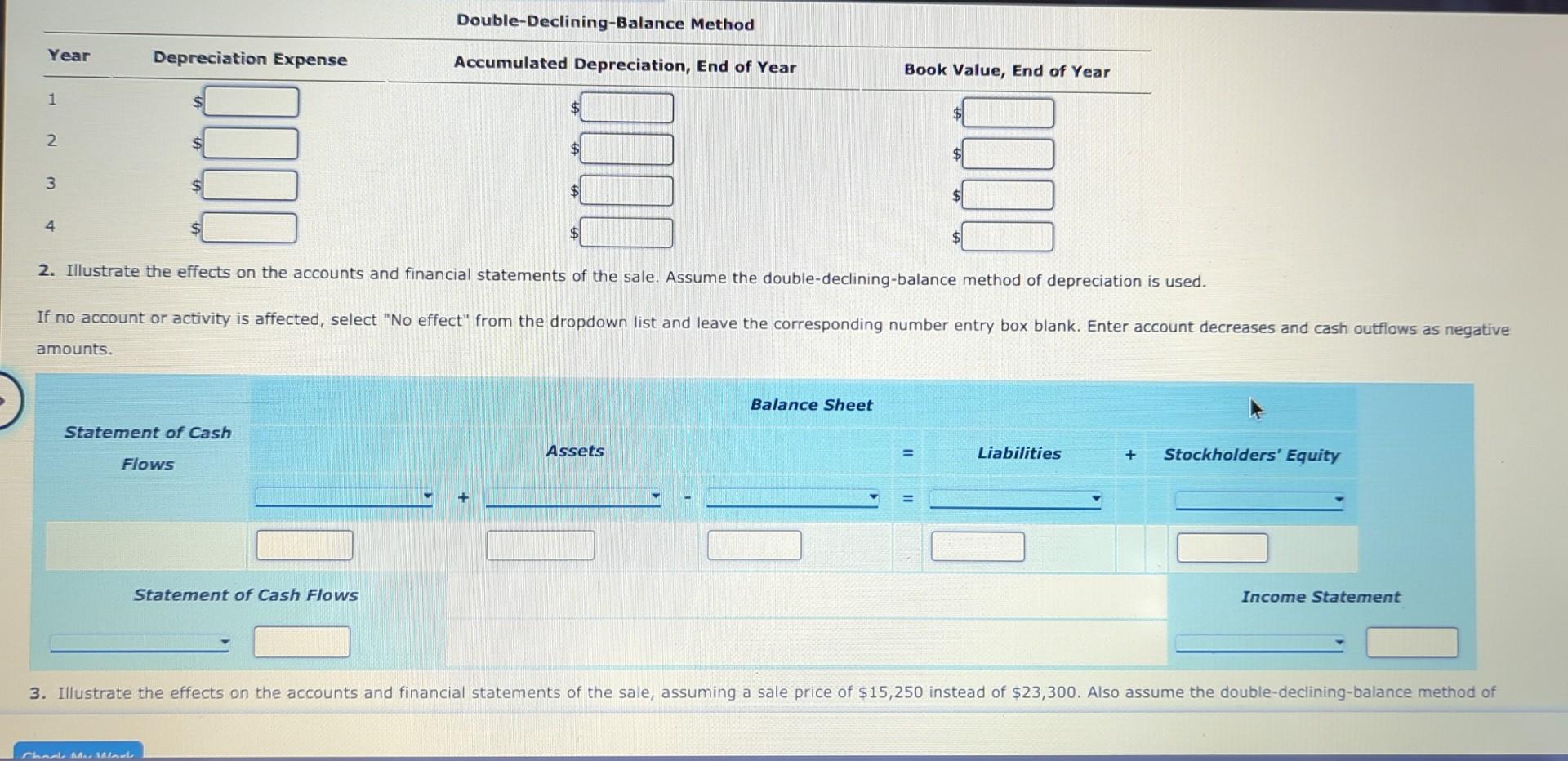

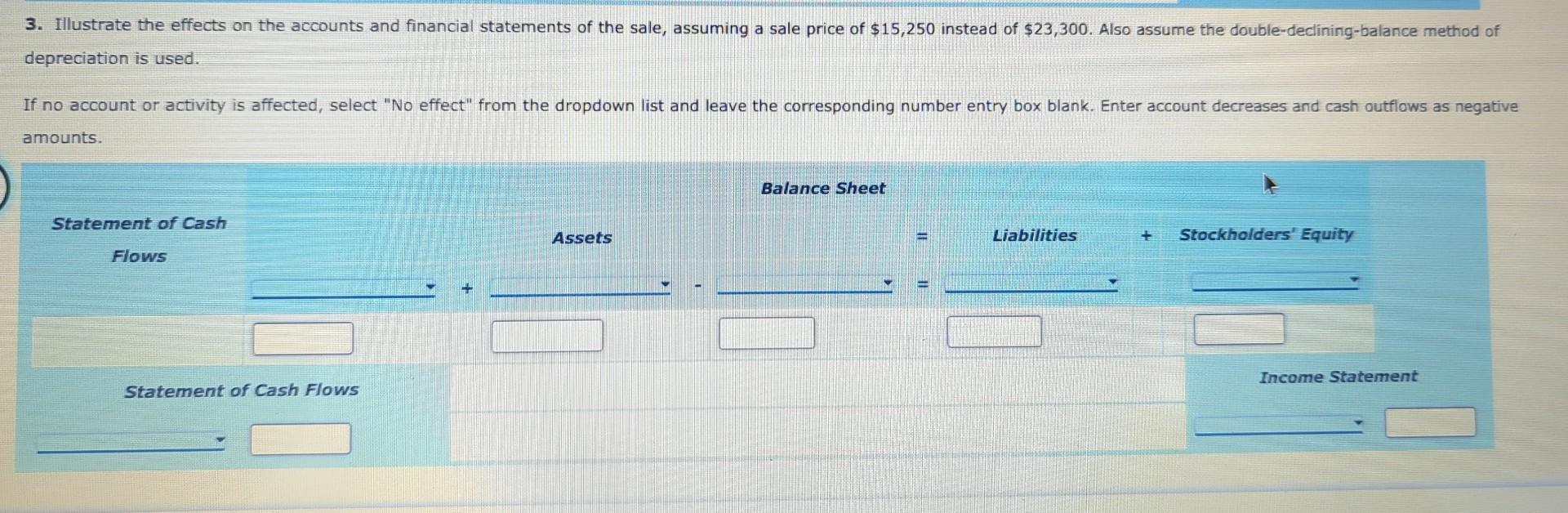

Depreciation by Two Methods; Sale of Fixed Asset New tire retreading equipment, acquired at a cost of $140,000 at the beginning of a fiscal year, has an estimated useful life of four years and an estimated residual value of $10,000. The manager requested information regarding the effect of alternative methods on the amount of depreciation expense each year. On the basis of the data presented to the manager, the doubledeclining-balance method was selected. In the first week of the fourth year, the equipment was sold for $23,300. Instructions: 1a. Determine the annual depreciation expense for each of the estimated four years of use, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by the straight-line method. 1b. Determine the annual depreciation expense for each of the estimated four years of use, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by the double-declining-balance method. Double-Declining-Balance Method 2. Illustrate the effects on the accounts and financial statements of the sale. Assume the double-declining-balance method of depreciation is used. If no account or activity is affected, select "No effect" from the dropdown list and leave the corresponding number entry box blank. Enter account decreases and cash outflows as negative amounts. 3. Illustrate the effects on the accounts and financial statements of the sale, assuming a sale price of $15,250 instead of $23,300. Also assume the double-declining-balance method of depreciation is used. If no account or activity is affected, select "No effect" from the dropdown list and leave the corresponding number entry box blank. Enter account decreases and cash outflows as negative amounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started