Question

E4-16 through E4-18 (Static) Recording Four Adjusting Journal Entries, Preparing an Adjusted Trial Balance, Reporting an Income Statement, Statement of Retained Earnings, Balance Sheet and

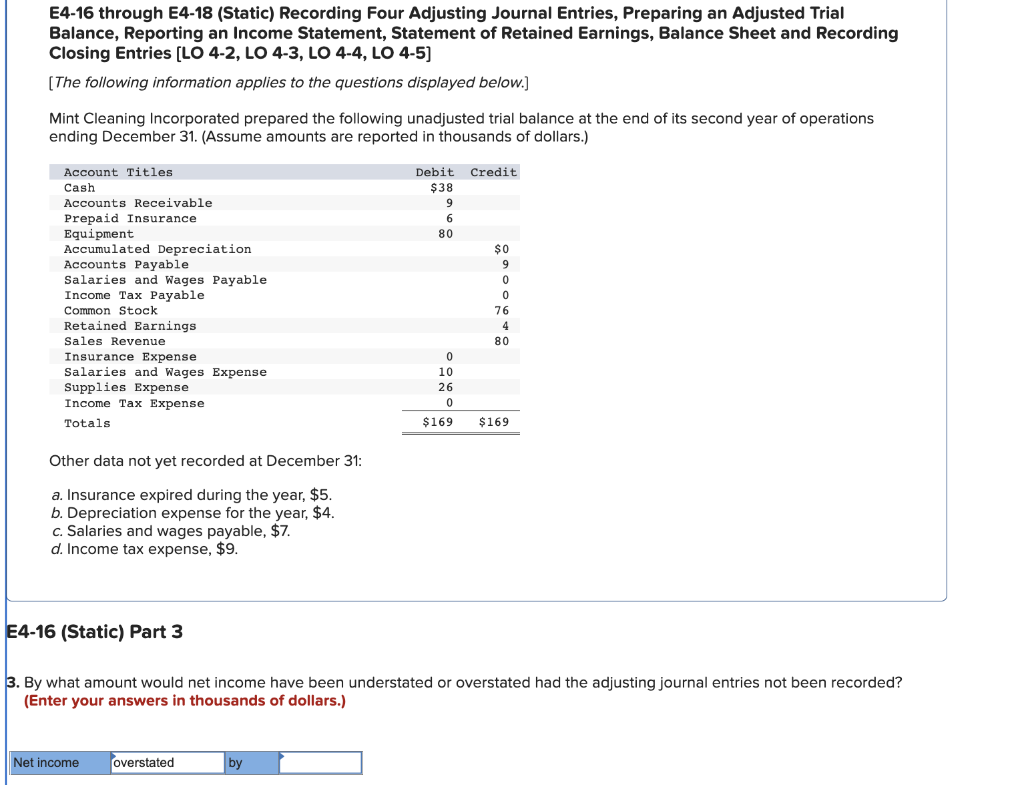

E4-16 through E4-18 (Static) Recording Four Adjusting Journal Entries, Preparing an Adjusted Trial Balance, Reporting an Income Statement, Statement of Retained Earnings, Balance Sheet and Recording Closing Entries [LO 4-2, LO 4-3, LO 4-4, LO 4-5]

Skip to question

[The following information applies to the questions displayed below.]

Mint Cleaning Incorporated prepared the following unadjusted trial balance at the end of its second year of operations ending December 31. (Assume amounts are reported in thousands of dollars.)

| Account Titles | Debit | Credit |

|---|---|---|

| Cash | $38 | |

| Accounts Receivable | 9 | |

| Prepaid Insurance | 6 | |

| Equipment | 80 | |

| Accumulated Depreciation | $0 | |

| Accounts Payable | 9 | |

| Salaries and Wages Payable | 0 | |

| Income Tax Payable | 0 | |

| Common Stock | 76 | |

| Retained Earnings | 4 | |

| Sales Revenue | 80 | |

| Insurance Expense | 0 | |

| Salaries and Wages Expense | 10 | |

| Supplies Expense | 26 | |

| Income Tax Expense | 0 | |

| Totals | $169 | $169 |

Other data not yet recorded at December 31:

- Insurance expired during the year, $5.

- Depreciation expense for the year, $4.

- Salaries and wages payable, $7.

- Income tax expense, $9.

E4-16 (Static) Part 3

-

By what amount would net income have been understated or overstated had the adjusting journal entries not been recorded? (Enter your answers in thousands of dollars.)

How do I find if net income will be over or understated and by what amount? How do I calculate this?

E4-16 through E4-18 (Static) Recording Four Adjusting Journal Entries, Preparing an Adjusted Trial Balance, Reporting an Income Statement, Statement of Retained Earnings, Balance Sheet and Recording Closing Entries [LO 4-2, LO 4-3, LO 4-4, LO 4-5] [The following information applies to the questions displayed below.] Mint Cleaning Incorporated prepared the following unadjusted trial balance at the end of its second year of operations ending December 31. (Assume amounts are reported in thousands of dollars.) Other data not yet recorded at December 31: a. Insurance expired during the year, $5. b. Depreciation expense for the year, $4. c. Salaries and wages payable, $7. d. Income tax expense, $9. 16 (Static) Part 3 By what amount would net income have been understated or overstated had the adjusting journal entries not been recorded? Enter your answers in thousands of dollars.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started