Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Each Question carries 10 marks) Question 1 a. Explain the similarities and differences between adverse selection and moral hazard (3 marks) b. Discuss the three

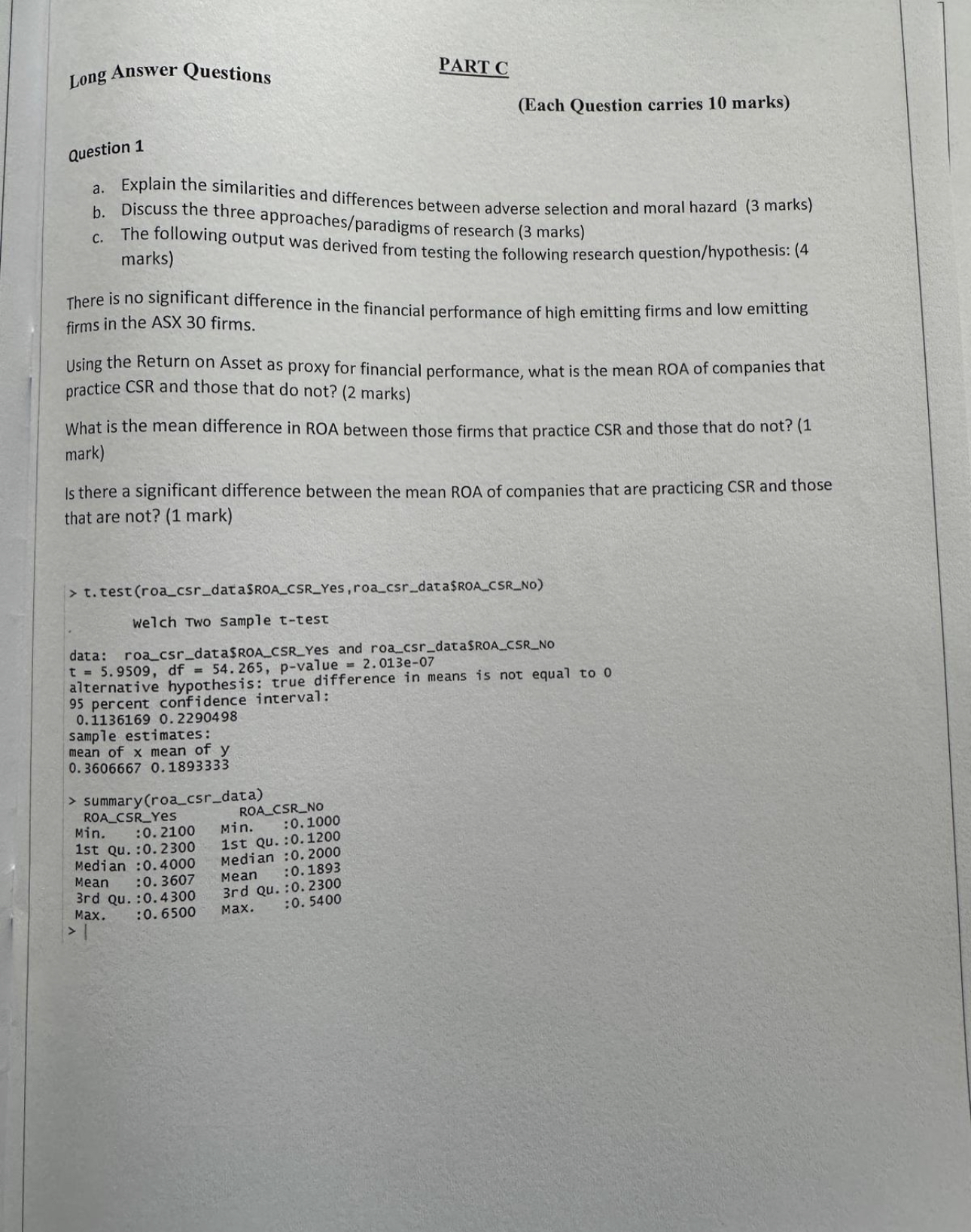

(Each Question carries 10 marks) Question 1 a. Explain the similarities and differences between adverse selection and moral hazard (3 marks) b. Discuss the three approaches/paradigms of research ( 3 marks) c. The following output was derived from testing the following research question/hypothesis: (4 marks) There is no significant difference in the financial performance of high emitting firms and low emitting firms in the ASX 30 firms. Using the Return on Asset as proxy for financial performance, what is the mean ROA of companies that practice CSR and those that do not? (2 marks) What is the mean difference in ROA between those firms that practice CSR and those that do not? (1 mark) Is there a significant difference between the mean ROA of companies that are practicing CSR and those that are not? (1 mark) > t.test(roa_cSr_dataSROA_CSR_Yes,roa_cSr_dataSROA_CSR_NO) welch two sample t-test data: roa_csr_dataSROA_CSR_Yes and roa_csr_dataSROA_CSR_NO t=5.9509,df=54.265,p-value =2.013e07 alternative hypothesis: true difference in means is not equal to 0 95 percent confidence interval: 0.11361690 .2290498 sample estimates: mean of x mean of y 0.36066670 .1893333

(Each Question carries 10 marks) Question 1 a. Explain the similarities and differences between adverse selection and moral hazard (3 marks) b. Discuss the three approaches/paradigms of research ( 3 marks) c. The following output was derived from testing the following research question/hypothesis: (4 marks) There is no significant difference in the financial performance of high emitting firms and low emitting firms in the ASX 30 firms. Using the Return on Asset as proxy for financial performance, what is the mean ROA of companies that practice CSR and those that do not? (2 marks) What is the mean difference in ROA between those firms that practice CSR and those that do not? (1 mark) Is there a significant difference between the mean ROA of companies that are practicing CSR and those that are not? (1 mark) > t.test(roa_cSr_dataSROA_CSR_Yes,roa_cSr_dataSROA_CSR_NO) welch two sample t-test data: roa_csr_dataSROA_CSR_Yes and roa_csr_dataSROA_CSR_NO t=5.9509,df=54.265,p-value =2.013e07 alternative hypothesis: true difference in means is not equal to 0 95 percent confidence interval: 0.11361690 .2290498 sample estimates: mean of x mean of y 0.36066670 .1893333 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started