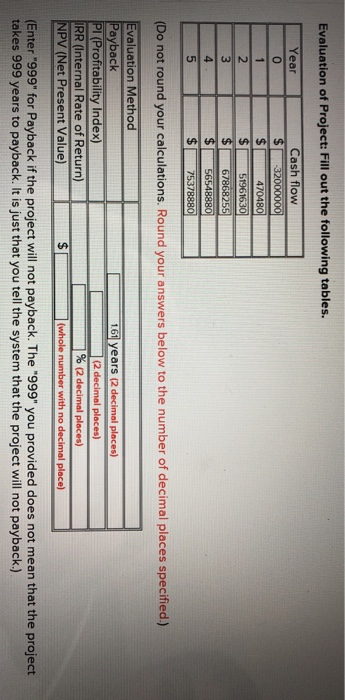

Evaluation of Project: Fill out the following tables. Year Cash flow (Do not round your calculations. Round your answers below to the number of decimal places specified) Payback 161 years (2 decimal places) (Profitability Index) RR (Internal Rate of Return) NPV (Net Present Value)S (Enter "999" for Payback if the project will not payback. The "999" you provided does not mean that the project takes 999 years to payback. It is just that you tell the system that the project will not payback.) (2 decimal places) % (2 decimal places) (whole number with no decimal place h the foreseeable competition from other similar products, S T sp ent $6,000,000 to develop a new lin e of smart upright Itcases (new t cost) that enable users to track easily the model devel nes. The smart suitcase model has of their s using an app on their cell a built-in global tracker which applies the state-of-the-art micro-electroni r telephone technologies The sen to track and report its location. In addition, its digital self scale weighs itself a y once it is filled om sors in the side studs of the suitcase will send the information on the mea sured weight to the acc the user's cell phone for his/her review so as hell is made of polycar to avoid unnecessary overweight c harges e that will certainly provide extra strength and durability to protect the contents inside it. Its fine wheels and eight handle make the suitcase super easy to use by travelers. The s TSA friendly lock provide co and its 360 degree dual wheels enable its user to move the suitcase more smoothly and in a more stable way at the same studying cost) The company had also spent a further $1,200,000 to study the marketability of this new line of smart upright suitcases T h able to produce the smart upright suitcases at a variable cost of $70 each. The total fixed costs for the operation are expected to 3,000,000 suitcases, 2,2 1,800,000 $9,000,000 per year. ST expects to sell 2,500,000 s 00,000 suitcases 00,000 suito of the new model per year over the next five years r The new smart upright suitcases will be selling at a e of $140 each. To launch this new line of production, ST needs to invest $32,000,000 in equipment which will be depreciated on a ear MACRS schedule. The value of the used equipment is expected to be worth $4,000,000 as at the end of the 5 year projedt to stop producing the existing suitcase model entirely in two years. Should ST not introduce the smart upright suitcases, ales per year of the existing model will be 2,000,000 suitcases and 1,250,000 suitcases for the next two years kisting model can be produced at variable costs of $50 each and total fixed costs of $7,500,000 per year. The existing lling for $100 each. If ST nd 1,062,500 suitcases for the year after next. In addition, to promote sales of the existing model alongside with the smart s the smart upright model, sales of existing m I will be eroded by 1,200,000 suitcases for next ht model, ST has to reduce the price of the existing m ill be 15 percent of sales and will vary with the occurrence of the cash flows. As such, there will be no initial NWC required. The first l to $85 each. Net working capital for the smart upright suitcase project in NWC is expected to occur in year 1 according to the sales of the year. ST is currently in the tax bracket of 35 percent and it a 15 nercent returns on all of its projects. The firm also requires a payback of 4 years for all projects u have just been hired by ST as a f ial consultant to advise them on this smart upright suitcase project. You are expected to t by their next meeting which is scheduled sometime next month. e answers to the following questions to their