Expansion Berhad, a Malaysian company that trades internationally, acquired a wholly-owned overseas subsidiary, Foreign Plc on 1 January 2020 for a cash consideration of

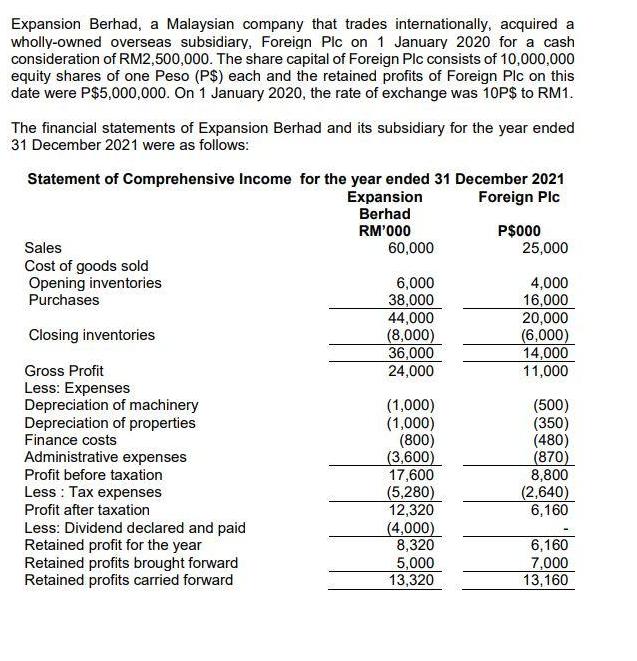

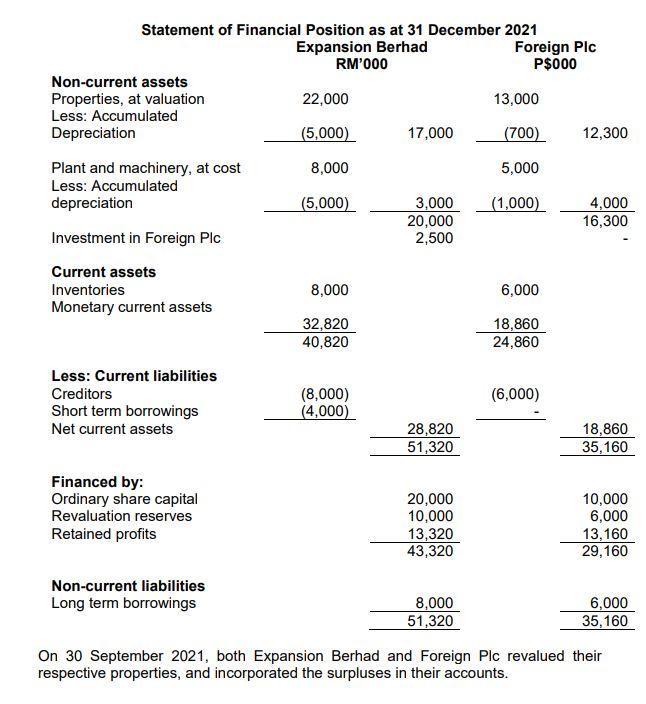

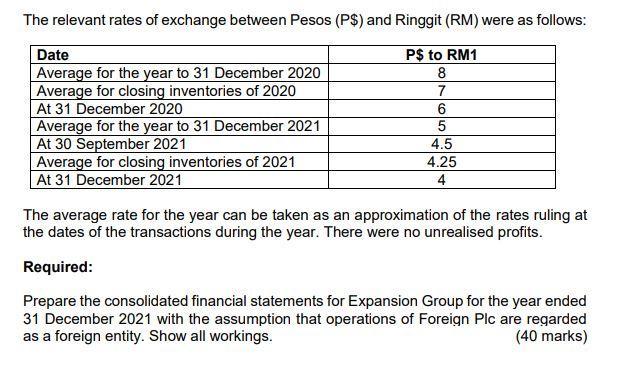

Expansion Berhad, a Malaysian company that trades internationally, acquired a wholly-owned overseas subsidiary, Foreign Plc on 1 January 2020 for a cash consideration of RM2,500,000. The share capital of Foreign Plc consists of 10,000,000 equity shares of one Peso (P$) each and the retained profits of Foreign Plc on this date were P$5,000,000. On 1 January 2020, the rate of exchange was 10P$ to RM1. The financial statements of Expansion Berhad and its subsidiary for the year ended 31 December 2021 were as follows: Statement of Comprehensive Income for the year ended 31 December 2021 Foreign Plc Sales Cost of goods sold Opening inventories Purchases Closing inventories Gross Profit Less: Expenses Depreciation of machinery Depreciation of properties Finance costs Administrative expenses Profit before taxation Less: T : Tax expenses Profit after taxation Less: Dividend declared and paid Retained profit for the year Retained profits brought forward Retained profits carried forward Expansion Berhad RM'000 60,000 6,000 38,000 44,000 (8,000) 36,000 24,000 (1,000) (1,000) (800) (3,600) 17,600 (5,280) 12,320 (4,000) 8,320 5,000 13,320 P$000 25,000 4,000 16,000 20,000 (6,000) 14,000 11,000 (500) (350) (480) (870) 8,800 (2,640) 6,160 6,160 7,000 13,160 Statement of Financial Position as at 31 December 2021 Expansion Berhad RM'000 Non-current assets Properties, at valuation Less: Accumulated Depreciation Plant and machinery, at cost Less: Accumulated depreciation Investment in Foreign Plc Current assets Inventories Monetary current assets Less: Current liabilities Creditors Short term borrowings Net current assets Financed by: Ordinary share capital Revaluation reserves Retained profits Non-current liabilities Long term borrowings 22,000 (5,000) 8,000 (5,000) 8,000 32,820 40,820 (8,000) (4,000) 17,000 3,000 20,000 2,500 28,820 51,320 20,000 10,000 13,320 43,320 8,000 51,320 Foreign Plc P$000 13,000 (700) 5,000 (1,000) 6,000 18,860 24,860 (6,000) 12,300 4,000 16,300 18,860 35,160 10,000 6,000 13,160 29,160 6,000 35,160 On 30 September 2021, both Expansion Berhad and Foreign Plc revalued their respective properties, and incorporated the surpluses in their accounts. The relevant rates of exchange between Pesos (P$) and Ringgit (RM) were as follows: P$ to RM1 8 7 Date Average for the year to 31 December 2020 Average for closing inventories of 2020 At 31 December 2020 Average for the year to 31 December 2021 At 30 September 2021 Average for closing inventories of 2021 At 31 December 2021 6 5 4.5 4.25 4 The average rate for the year can be taken as an approximation of the rates ruling at the dates of the transactions during the year. There were no unrealised profits. Required: Prepare the consolidated financial statements for Expansion Group for the year ended 31 December 2021 with the assumption that operations of Foreign Plc are regarded as a foreign entity. Show all workings. (40 marks) Expansion Berhad, a Malaysian company that trades internationally, acquired a wholly-owned overseas subsidiary, Foreign Plc on 1 January 2020 for a cash consideration of RM2,500,000. The share capital of Foreign Plc consists of 10,000,000 equity shares of one Peso (P$) each and the retained profits of Foreign Plc on this date were P$5,000,000. On 1 January 2020, the rate of exchange was 10P$ to RM1. The financial statements of Expansion Berhad and its subsidiary for the year ended 31 December 2021 were as follows: Statement of Comprehensive Income for the year ended 31 December 2021 Foreign Plc Sales Cost of goods sold Opening inventories Purchases Closing inventories Gross Profit Less: Expenses Depreciation of machinery Depreciation of properties Finance costs Administrative expenses Profit before taxation Less: T : Tax expenses Profit after taxation Less: Dividend declared and paid Retained profit for the year Retained profits brought forward Retained profits carried forward Expansion Berhad RM'000 60,000 6,000 38,000 44,000 (8,000) 36,000 24,000 (1,000) (1,000) (800) (3,600) 17,600 (5,280) 12,320 (4,000) 8,320 5,000 13,320 P$000 25,000 4,000 16,000 20,000 (6,000) 14,000 11,000 (500) (350) (480) (870) 8,800 (2,640) 6,160 6,160 7,000 13,160 Statement of Financial Position as at 31 December 2021 Expansion Berhad RM'000 Non-current assets Properties, at valuation Less: Accumulated Depreciation Plant and machinery, at cost Less: Accumulated depreciation Investment in Foreign Plc Current assets Inventories Monetary current assets Less: Current liabilities Creditors Short term borrowings Net current assets Financed by: Ordinary share capital Revaluation reserves Retained profits Non-current liabilities Long term borrowings 22,000 (5,000) 8,000 (5,000) 8,000 32,820 40,820 (8,000) (4,000) 17,000 3,000 20,000 2,500 28,820 51,320 20,000 10,000 13,320 43,320 8,000 51,320 Foreign Plc P$000 13,000 (700) 5,000 (1,000) 6,000 18,860 24,860 (6,000) 12,300 4,000 16,300 18,860 35,160 10,000 6,000 13,160 29,160 6,000 35,160 On 30 September 2021, both Expansion Berhad and Foreign Plc revalued their respective properties, and incorporated the surpluses in their accounts. The relevant rates of exchange between Pesos (P$) and Ringgit (RM) were as follows: P$ to RM1 8 7 Date Average for the year to 31 December 2020 Average for closing inventories of 2020 At 31 December 2020 Average for the year to 31 December 2021 At 30 September 2021 Average for closing inventories of 2021 At 31 December 2021 6 5 4.5 4.25 4 The average rate for the year can be taken as an approximation of the rates ruling at the dates of the transactions during the year. There were no unrealised profits. Required: Prepare the consolidated financial statements for Expansion Group for the year ended 31 December 2021 with the assumption that operations of Foreign Plc are regarded as a foreign entity. Show all workings. (40 marks)

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

For assets and liabilities the exchange rate at the balance sheet date should be used For inc...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started